– House values in Meadowbank dropped 7.1% in three months, with the average now $1.567m.

– Other suburbs like Kingsland and Mount Albert also saw significant declines in property values.

– Agents expect prices to rise in spring and summer despite current market fluctuations.

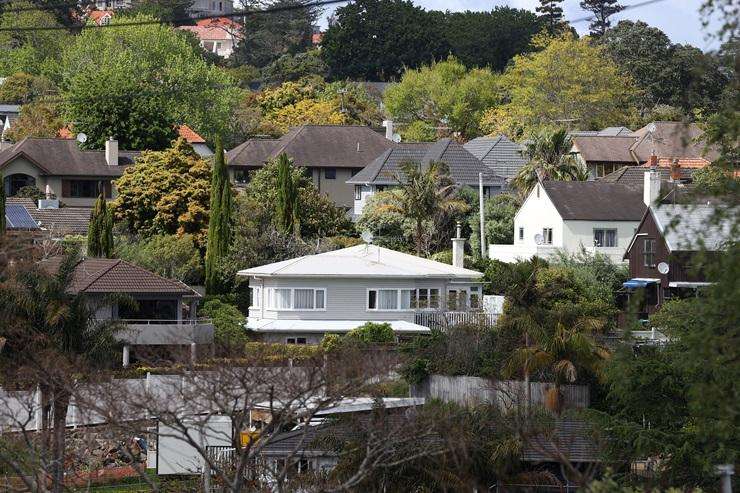

House prices in some of Auckland’s most popular inner-city suburbs have taken a hit over the past three months, according to OneRoof data.

The country’s steepest quarterly drop was, surprisingly, in Meadowbank, home to a swathe of middle-class Aucklanders.

House prices in Meadowbank have long benefited from the suburb’s proximity to Remuera and, as such, they are seen as a barometer for the heat – or lack of heat – in the city’s housing market.

Meadowbank’s average property value has fallen from a peak of just over $2 million in January 2022 to $1.567m at the end of August. The value slide in the suburb shows no sign of slowing. In the last three months, prices fell by 7.1% ($120,000).

The average property value in Remuera, by contrast, rose by 0.8% to $2.64m over the same period.

Also suffering steep drops, according to the latest OneRoof property value figures, are Kingsland (-6.5%), Mount Albert (-6.4%), Glen Innes (-5.9%), Campbells Bay (-5.1%), and Point Chevalier (-5%).

Agents surveyed by OneRoof said values could have been pulled downwards because of a shortage of higher end homes on the market, with more affordable terrace homes and apartments selling instead.

Some pointed to the new council CVs being a factor as they are lower overall, saying this affected what buyers thought a property was worth, even though the property itself had not changed.

However, most of the agents OneRoof talked to expect an uptick in prices over spring and summer.

Discover more:

– First-time buyers target Ōtara as prices fall hard from $1m peak

– Families prepared to pay extra half a million for these homes

– Mike King is selling his home and stepping back from charity role

Barfoot & Thompson agent Denise Michl told OneRoof that few large standalone family homes had been listed in Meadowbank over the autumn and winter, but new builds, like those at the Rislan Meadowbank, had been selling like hot cakes.

The development, which comprises 77 apartments and 13 townhouses, offered an affordable pathway into the suburb, she said.

“The townhouses, for example, appeal to families who want to get their kids into the regarded Meadowbank Primary for a reasonable price. They are selling for around $1.2m to $1.3m – and that’s for four bedrooms.”

Barfoot & Thompson colleague Rawdon Christie, who sells in Meadowbank and neighbouring Ellerslie with Steve Hood, said both suburbs were family-friendly and in zone for good schools, so values would eventually rebound.

Townhouses in the Rislan Meadowbank development have been selling quickly. Photo / Supplied

“It may just be that those who are buying at the moment don’t have as much buying power,” he told OneRoof.

The reality was that prices were flat everywhere, but there were surprises.

“We had a listing in Remuera that attracted nine bidders and sold way higher than we expected. Another one which we thought would sell really easily took us 155 days to sell.”

Christie also highlighted the lack of $3m to $4m listings in Meadowbank right now. “People with higher-value homes are holding onto them. They see no real urgency to sell. Although some would love to downsize and go skiing or go to the beach and cash in, they are not going to do it when the prices are so compromised at the moment.”

However, come spring and summer, those homeowners would probably grow tired of waiting and potentially come to market, he said.

In the neighbouring suburb of Ellerslie, buyers can get a top-floor apartment for $795,000. Photo / Supplied

Christie did highlight some good deals in his patch. He had some “really smart” units in Ellerslie for sale, including a two-bedroom apartment in an art-deco-inspired block for $795,000. He also recently sold with Hood a four-bedroom family home for $1.9m.

Matt Gibson, from Ray White Remuera, thought the drop in Auckland CVs could be impacting values in Meadowbank, saying he recently appraised a property which had dropped by $500,000 yet had been totally renovated.

“There’s a difference between CVs and market value. We’re finding the CVs don’t actually reflect what’s been done to a property. It could be completely done up inside so some people are challenging their CVs. I understand there was something like 10,500 challenges to the new CVS.”

Colleague John Lantz said he was “absolutely baffled” about the drop in council valuations in Meadowbank.

The average property value in Kingsland has dropped by more than 6% over the quarter, but agents say low sales are having an adverse impact. Photo / Ted Baghurst

“A house with a CV of $2.2m that we sold six months ago would still sell for $2.2m today. It’s based on comparable sales out there and what you can get for that money, so there’s no justification that a house that sold for $2.2m now has a new CV of $1.675m.”

Lantz said some buyers were at the start of the year holding off buying because they wanted to see the new council valuations.

“My conversation was, ‘OK, let’s say the CV is $2m. If the CV drops to $1.8m, does that make the property worth $1.8m just because it’s come down?’ And they would say ‘yes’.

“Then I would say, ‘Let’s say that CV went to $2.2m, based on other sales and properties. Would you pay $2.2m just because the CV went up?’ They’d say, ‘Of course not.’ Well, you can’t have it both ways.”

Lantz noted that lending was often based on the CV. “That means buyers have to pony up the $1500 to $2000 fee for a registered valuation before they bid at an auction or pay more than CV for a property,” he said.

A Kingsland recently sold for close to $2m after attracting more than 70 groups to the open homes. Photo / Supplied

“Just this month we took a property to auction where there was a discrepancy in the CV. It was too low. We had to have three valuations done on the property, and they all came in around my estimate and the actual sale price, not the CV,” he said.

A few suburbs over in Mount Albert, Bryce Taylor and Josh Lowe, from Harcourts JK Realty, the lack of higher-value stock was also having an impact.

There were only two sales of properties worth more than $2m in July and only three in June, they said, whereas in July last year there were five in the one month.

One reason higher value properties were scarce was that they may have dropped in value since the owners purchased them, so they would not fetch the owners’ dream price, but would-be sellers were also hesitating because they could not find their next property to move into.

“Obviously, if you’re in that $1.8m to $2.5 million bracket, your next bracket up is $2.5m to $3.5m, and there’s even less of those on the market. When you do have a property like that, it’s really sought-after,” Lowe said.

Taylor said as soon as the larger properties came forward, the market would shift shift.

In Te Atatu Peninsula, where the average property value has dropped 6.4% over the last three months, John Diprose, Harcourts branch manager, said townhouses had been selling from the $600,000s, which may have skewed the market.

Properties in the $2m-plus bracket had been a bit slower to sell, but houses around $1m were snapped up. “In our office, we sell a lot of stuff outside of Te Atatu Peninsula – a lot of new subdivision stuff around Massey.

“When times are good, then there are some expensive properties there as well. There’s probably not so many of those for sale at the moment and that’s probably the case around the northwest to a degree.”

In Kingsland, Ray White business owner Tim Hawes said the suburb had a broad spectrum of properties from one-bedroom units to standalone villas, but there had been few sales, which had led to a “massive” fluctuation in average values.

In the last three months, the average sale price for a home was $1.585m, and $870,000 for an apartment or a townhouse. “If we go back to the same quarter last year, there were eight sales, five homes with an average of $1.6m and three apartments/units/townhouses with an average of around $1m.

“Compare this overall to the last 12 months, where we’ve had 50 sales. There have been 24 apartments/units/townhouses with an average price of around $775,000.”

Hawes said when sales volumes were low, it only took one or two sales to move the average significantly, but that wasn’t a reflection of the real world.

The average house price had not really changed, he said: “This is probably the longest period of stable prices in our hood since 2019.”

Open home numbers were up compared to this time last year, he said, so in terms of buyer activity, it was “night and day different”.

A villa on Kingsland Avenue had attracted 70 groups to the open homes and five bidders at auction, resulting in a sale of $1.93m – above the $1.775m CV.