REA Group senior economist Angus Moore crunched the numbers on investment suburbs.

Looking to invest in property? There are two states that are full of prime opportunities, according to an exclusive new PropTrack report.

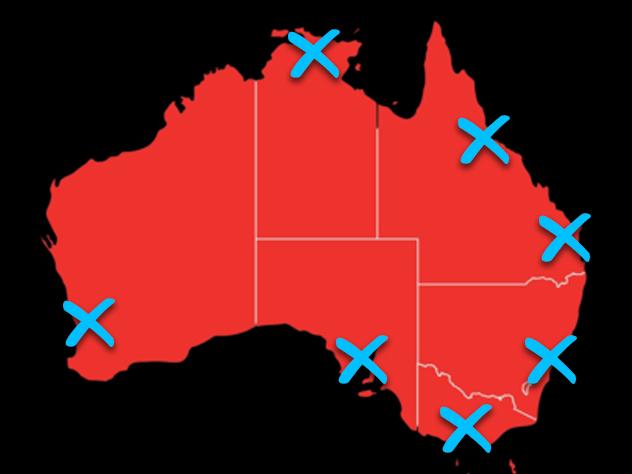

Qld and WA have dominated a list of the 200 best suburbs in Australia for investors, based on rental yield, 12 month value growth and the number of days on average it takes to tenant a vacant rental property.

Qld had nearly half of the suburbs on the list with 98 in total, while WA had 72. It was then daylight in third, followed by South Australia with 17, NSW (seven), the NT (four) and VIC (two).

MORE:Queensland’s top 20 investor suburbs

The number one spot went to Spalding in WA, where a median-priced house cost $398,000, came with a 7 per cent rental yield, had grown in value by 38w per cent over the past year and could be tenanted after an average 22 days on market.

Rockhampton City, Qld was next best, with 35 per cent yearly growth bringing the house median to $375,000, while properties were rented out after 18 days on average and provided a gross yield of 6 per cent.

REA Group senior economist Angus Moore said regional, or outer suburban suburbs featured most strongly in the data.

MORE:South Australia’s top 20 investor suburbs

“It’s not universal, but it is a theme,” Moore said. “One, regional areas often carry higher rental yields. And two, those areas have also seen stronger price growth over the past 12 months, but you could even extend that back to the past five years. Those sort of more affordable, more outlying areas have seen really strong growth on average since 2020, and that’s why they’re showing up in these sorts of lists.”

Western Australia featured prominently on the list.

Moore noted that regional and city fringe suburbs “often have thinner rental markets”.

“There’s just not as much supply and availability as the inner city, where you have a deeper rental market that historically can carry some risk of properties sitting vacant, and so you see higher yields to compensate,” he said.

MORE: NSW’s top 20 investor suburbs

“That hasn’t been true in recent years, where regional rental markets have seen extremely tight conditions. We’ve also seen very strong demand for regional and outer suburban homes, both to rent and to buy, and that’s driven up rents a lot in those areas.”

Why Qld and WA dominate the list

Moore said the growth of Qld and WA markets over the past year contributes to the large number of suburbs on the list.

“Regional Queensland is still solid, even if growth is slower this year and they’re also extremely tight rental markets,” he said. “These areas have seen extraordinarily low rental vacancy rates and commensurately very strong growth in rents over that period. So that continues to make them attractive to investors.”

Moore added that interstate migration had favoured some states, with families priced out of NSW and Victoria largely heading to Qld.

“There’s not a lot of opportunity in NSW and Victoria compared to the other states on this list. That’s not to say there aren’t good opportunities for investors in those states, but certainly relative to those smaller states and smaller capitals, Sydney and Melbourne just haven’t performed as well.”

MORE: Victoria’s top 20 investor suburbs

Angus Moore said regional and outer suburban areas dominated the list.

What the data may not tell you

The PropTrack report is based solely on data and Moore warned that extra diligence would be required before investing in any location.

MORE: Hobart’s top investor suburbs

Some entries on the list, such as Rochester, VIC (which is third) and Lismore, NSW (27th) have been ravaged by flooding or other disasters.

“One other caveat is the regions of WA and Qld that are mining areas,” Moore said. “These can be quite volatile markets, because they do depend on conditions in the mining sector, and that has historically seen some volatility.

“Investors do need to go and dig in and understand the area and what’s been driving that, to figure out whether it’s going to continue, because locally specific factors are going to be very important, such as new builds, whether people are moving to the area from other states, big construction projects, changes in local labour markets and employers.”