Thursday’s bleak GDP figures prompted a weekend of hard questions about whether the government has what it takes to get NZ growing again, writes Catherine McGregor in today’s extract from The Bulletin.

To receive The Bulletin in full each weekday, sign up here.

Commentators react to grim GDP numbers

The weekend’s papers were dominated by reaction to Thursday’s GDP numbers and renewed scrutiny of where the government has gone wrong. Domestic output shrunk 0.9% in the June quarter, a dramatic fall after a promising, if small, uptick in March. In the Sunday Star-Times, Vernon Small noted the result was “three times as bad as the central bank had expected and twice as bad as the broad consensus of bank economists”.

Across the commentariat, a common thread emerged: the government looks adrift, unable to settle on a clear economic plan or find a message that instils confidence that it can turn the ship around. As Matthew Hooton acidly put it in the Herald (paywalled), “this Government … claimed to be led by a global expert in turnaround jobs, promised to get New Zealand back on track and believed its mere election would rebuild business confidence to prompt an immediate economic boom to pay for its promises. In fact, the economy has now completely crashed off the track.”

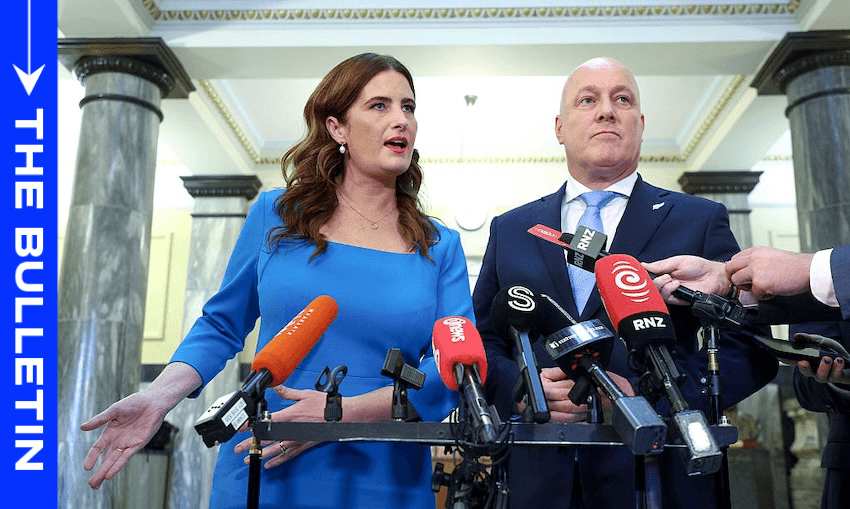

Luxon’s messaging under fire

In the Weekend Post, Luke Malpass argued that Luxon’s one-note rhetorical style is compounding government’s problems: “His preternatural, American-style enthusiasm for basically everything means that he fundamentally oversells what his Government can do, or indeed, what governments are capable of doing in general.” Hooton, as ever, was even blunter: Luxon “has no overarching story of where he wants to take New Zealand, except to put more money in the median voter’s pocket”, and everything he says in support of that overly modest aim “is shallow and trite”. Hooton’s conclusion was stark: Luxon, he said, “needs to go”.

The stimulus bind

On what to do next, Small said the economy is “crying out for greater stimulus”, while acknowledging that the risk of inflation and ballooning deficits made borrowing to spend a non-starter. Most commentators thought the government was boxed in, with no good options other than to hope interest rate cuts would get the economy moving.

Speaking to reporters on Thursday, Nicola Willis stressed that the government “is borrowing at very high levels right now – we are running an annualised deficit bigger than many countries around the world”. That’s an unusual comment from a centre-right finance minister, noted the Herald’s Thomas Coughlan (paywalled), and a marked change from Willis’s first year in office. Then, her “great economic test was whether her tax cuts would be excessively stimulatory – now the great debate is over whether they’re stimulatory enough.”

Austerity, and the case against it

While Small favoured stimulus, Hooton argued the opposite. He said the government erred by allowing Willis’s “heroic” savings to be spent on health, education and welfare “rather than used to stop or even reduce borrowing”. On Newstalk ZB, former National finance minister Ruth Richardson went further, urging Willis to make a UK-style spring statement – a mini-budget – featuring a set of sharp spending cuts to balance the budget.

“Willis would do well to ignore her,” wrote Dan Brunskill at interest.co.nz. “Doctor (honorary) Richardson made up her mind 35 years ago and would prescribe the same medicine regardless of the symptoms.” In his view, spending cuts now wouldn’t rebuild confidence or attract capital, but only prolong the economic downturn. Worse for the government, cuts would increase the chances of Labour winning the next election “and immediately reversing the austerity measures anyway”.

Read more:

Subscribe to +Subscribe