The good news keeps getting better for first home buyers, with mortgage payments on lower quartile-priced homes at their lowest point in almost four years.

Interest.co.nz calculates what the likely mortgage payments would be on homes purchased at the Real Estate Institute of New Zealand’s lower quartile selling price each month.

As well as adjusting for changes in house prices, this is also adjusted for movements in mortgage interest rates each month.

In August, the REINZ’s national lower quartile price was $582,000. Interest.co.nz estimates if a property at that price was purchased with a 10% deposit, the likely mortgage payments would be around $722 a week, assuming the mortgage had a 30-year term.

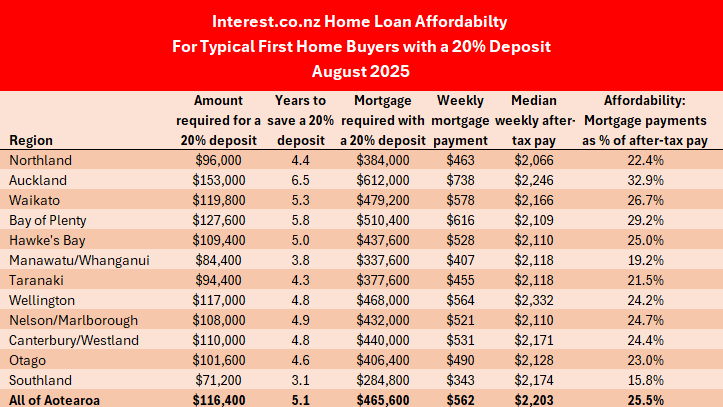

If the home was bought with a 20% deposit, the mortgage payments would reduce to around $562 a week.

That is the lowest both figures have been since October 2021.

For buyers with a 10% deposit the mortgage payments on a lower quartile-priced home hit a record high of $935 a week in November 2023. For those with a 20% deposit the mortgage payments peaked in the same month at $740 a week.

That means mortgage payments on a lower quartile-priced home purchased with a 10% deposit declined by $213 a week between the November 2023 peak and August this year. Mortgage payments on the same home purchased with a 20% deposit declined by $178 a week over the same period.

That drop in mortgage payments is mainly due to a substantial fall in mortgage interest rates, with the average two year fixed rate declining to 4.77% from 7.05% between November 2023 and August 2025. Over the same period there was also a $18,000 drop in the lower quartile house price to $582,000 from $600,000.

What about incomes?

Of course the other side of the affordability coin is what happens with incomes.

Interest.co.nz tracks the pay rates of people aged 25-29 to estimate the likely after-tax pay of people saving for their own home, which allows us to calculate affordability of mortgage payments as a percentage of after-tax pay.

By this measure, a couple who both worked full time home, would have had a combined after-tax income of $2203 a week in August this year, up from $2043 in November 2023.

That’s given an aspiring first home buying couple an extra $160 a week after-tax since lower quartile prices peaked in November 2023.

This means mortgage payments have not only decreased in absolute terms, they have also declined as a percentage of after-tax pay.

At the national level, the mortgage payments on a lower quartile-priced home purchased with a 10% deposit would have eaten up 32.8% of a typical first home buying couple’s after-tax pay in August this year, down from 45.8% at the November 2023 peak.

For buyers with a 20% deposit, affordability has improved to 25.5% from 36.2% over the same period.

Those are substantial improvements in affordability over the last two years.

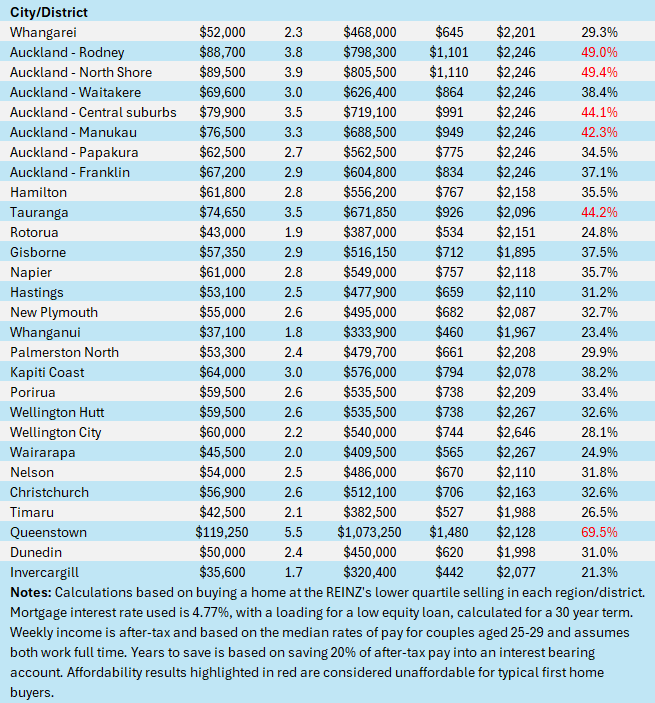

Interest.co.nz considers mortgage payments to be unaffordable when they chew up more than 40% of a couple’s after-tax pay.

By that measure, the only urban districts that could still be regarded as unaffordable for buyers with a 10% deposit are Auckland, Tauranga and Queenstown, while the mortgage payments in all other urban districts round the country are well within affordable limits.

Even within the Auckland region, the districts of Waitakere, Papakura and Franklin are affordable for typical first home buyers, regardless of whether they have a 10% or 20% deposit.

For buyers with a 20% deposit, everywhere except Queenstown is now affordable.

However, while paying off a mortgage has become a lot more affordable for first home buyers, scraping together a deposit remains a major challenge.

Around the regions, a 10% deposit on a lower quartile-priced home ranges from $35,600 in Southland to $76,500 in Auckland and you can double that for a 20% deposit.

If aspiring first home buyers with incomes similar to those used in the examples above saved 20% of their after-tax pay each week into an interest bearing account, it would take them between 1.6 years (Southland) and 3.3 years (Auckland) to save a 10% deposit for a lower quartile-priced home, and double that for a 20% deposit.

So unless they have access to other funds, such as KiwiSaver, assistance from the bank of mum and dad or a large Lotto win, accumulating the deposit is now likely to be the biggest obstacle to home ownership for many.

The tables below show the main affordability measures with either a 10% or 20% deposit, for the main urban areas throughout the country.