It is still early days since the start of the federal government’s new battery rebate scheme, but it already appears clear that it will be far more effective than anyone anticipated.

The first few weeks of the battery rebate have seen around 1,000 registrations for new household batteries per day, with an average size of 18 kilowatt hours (kWh). Both the registration numbers and the battery sizes are far higher than expected, and we can probably thank lower battery prices, and soaring customer bills, for that.

If this rate of registrations continues for the whole year, it could deliver around 250,000 battery systems, and 4,500 megawatt hours (MWh) of storage by next June.

If that rate continues until 2030, and these batteries are cycled once a day, that would deliver almost twice the energy that is currently provided by the federal government’s existing Snowy Hydro power system on average across the year.

Bigger than forecast

Back in November 2021, Green Energy Markets’ managing director Ric Brazzale and myself proposed that the Small Scale Renewable Energy Scheme’s (SRES) should be modified to provide an incentive for batteries to be installed in conjunction with a solar system.

At that time, based on the policy design we put forward, we estimated that within its first three years of operation it might induce half a million battery systems equal to 6,250 MWh in storage capable of 2,500 MW of instantaneous output (inverter capacity).

In later economic modelling work we prepared for the Australian Energy Market Operator in 2024 we examined the potential impact of introducing a government incentive for batteries equal to between 25% to 33% of the fully installed price of a battery system (25% under Step Change Scenario and 33% under Green Energy Exports Scenario).

This is not too far off what the government has ultimately implemented, although we’d assumed it wouldn’t be introduced until 2026-27 financial year.

Under the most optimistic scenario of Green Energy Exports we projected that in the first year of the rebate battery installations would be just under 80,000 systems across the NEM states plus the WA South-West Grid. This would grow to a bit above 200,000 systems installed in each of the years 2028-29 and 2029-30.

The aggregate amount of energy storage capacity we projected to be installed over 2025-26 to 2029-30 was around 8,300 MWh, coupled with about 3,300 MW of inverter capacity in the residential and small commercial sector.

What appears to be actually unfolding is far greater than anything we contemplated. Based on the last few days of STC registration data which we collect for Green Energy Markets’ Solar Report subscribers, around 1,000 battery systems are being registered per working day and the average capacity per system is around 18kWh.

We would caution that there are some areas of uncertainty around whether this rate will continue. There are some plausible arguments for why it might fall but also potentially rise.

However, what is very clear from our discussions with industry participants is that the demand they are seeing from customers for battery systems since the election is very strong and they expect it to keep them busy for months to come.

We would point out that solar system installations for the past five years have tracked at levels comfortably above 1,000 per working day and a solar installation is more labour intensive than a battery, so this level of battery installations shouldn’t be too challenging to achieve over the longer term.

However, in the shorter-term the number of installers accredited to install batteries is far lower than those accredited to install solar. Also there have been challenges with obtaining sufficient stock of battery equipment from suppliers.

But putting those important caveats to one side – let’s consider what this current rate of registration could mean by the end of this financial year.

More energy than Snowy Hydro

As of yesterday – 22 July – we had around 10,000 battery systems registered for STCs. If we managed to maintain 1,000 systems per working day at 18kWh per system up until the end of the current financial year (with two weeks off around Christmas) should land us with a bit over 240,000 battery systems.

Given some systems are also registered over weekends we could probably round this up to around 250,000 battery systems. Multiply that by 18 kWh and you’ve got 4,500 MWh of storage.

In terms of what this might mean in megawatts of instantaneous output this is highly uncertain because there is considerable variation in supplier practices around the size of inverter they use per kWh of storage (with some potential problems emerging which I’ll explain further down).

If we use a rule of thumb ratio of 2.5kWh of storage to 1kW of inverter capacity, then we could expect 1,800 megawatts to be installed by the end of June 2026. Let’s then assume we keep going at 250,000 systems per annum until the end of the 2029-30 financial year we’ll have 22,500 MWh and 9,000 MW of small scale battery storage in place.

To put that into perspective Australia has around 8,000 MW of hydro and a bit under 15,000 MW of gas power station capacity. In overall energy terms if this battery capacity was cycled fully each day it will deliver almost twice the energy provided by the Snowy Hydro system on average across the year.

While that’s a simplistic extrapolation from not many days of data, we’re pretty sure that our prior forecasts have underestimated battery uptake.

Where did we go wrong?

1. System size

In our initial forecasts we had assumed a battery size similar to what the market had done historically of 10kWh. It seemed reasonable to keep it at that level in the short term because that sized battery is typically enough to take care of the average household’s electricity needs not take care of by the solar system.

However, as illustrated in this SolarQuotes video there are substantial labour productivity benefits for suppliers as they add additional battery module capacity to a system, particularly where battery systems have been designed with easy to add stackable modules.

This makes larger capacity systems either far more profitable for the supplier or far cheaper per kilowatt-hour of capacity for the end consumer. This is especially true taking into account that the STC rebate is, very sensibly, provided per unit of capacity rather than a fixed value per system.

And that has meant suppliers have lured consumers towards much larger sized systems than we expected by offering them at quite attractive prices.

2. Lower prices

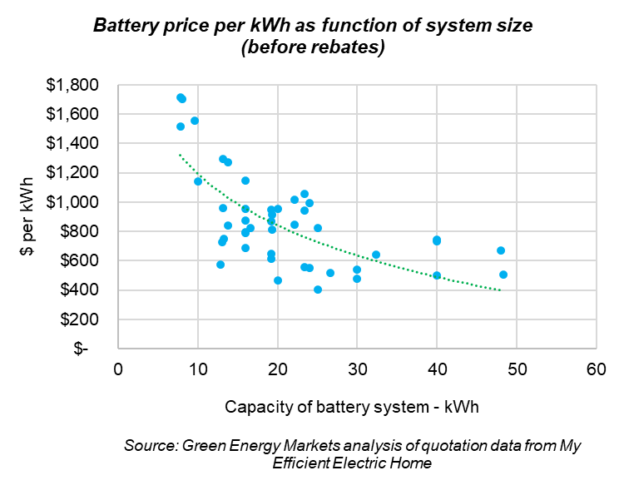

We had expected prices for a fully installed system this year to be around $1,000 per kWh.

The chart below, using quotation data for fully installed systems we’ve obtained from MyEfficientElectricHome, illustrates the relationship between larger systems and cheaper prices per kWh before we’ve applied the rebate.

Most of the systems within this sample are from major brands such as BYD, Sungrow, Tesla, SigEnergy and Alpha ESS although several of the very low priced systems are from lesser known brands that are yet to demonstrate a sound track record of reliability.

This data would suggest that with customers erring towards systems close to 20kWh, most are paying under $1000 per kWh, with the mid point closer to $850 per kWh.

What is really pleasing to see from this data is that prices per kWh of battery storage have noticeably declined compared to where they were 12 to 18 months ago when we prepared our last set of modelling assumptions.

We had hoped that the larger market induced by the rebate would lead to a similar phenomenon as what we saw unfold in the solar market back in the late 2000’s and early 2010’s.

When a market is small it can be hindered by volumes that are insufficient to support enough suppliers that they vigorously compete and ensure enough sales within a geographic area that an installer can keep busy without travelling too far and aren’t installing systems frequently enough that they become adept and efficient.

It can also mean a market is too small for major manufacturers to consider it worth their while to compete for market share. Essentially it is treated as a niche, high margin, low volume market. Thankfully, it appears that home batteries are now moving towards a low margin, high volume product.

Some emerging issues we need to address quickly

However, there are some emerging issues that government will need to tend to. Batteries likely to be big enough to export to the grid, not just serve the household.

Most households in Australia will consume between 10 kWh to 20 kWh of electricity per day. Of that, the solar system will take care of probably 5 kWh leaving them with 10 kWh to 15 kWh that could be satisfied with a battery.

If the market is moving towards an average of 20 kWh per system then many households will be installing batteries that for much of the year will have surplus storage capacity. Indeed even 15 kWh systems are likely to encounter significant parts of the year where their capacity will be greater than a household can use.

That isn’t problem though, provided that these battery systems export surplus energy to the grid during peak demand periods (between around 4pm to 9pm). Encouraging consumers to join VPPs is one option that might address this.

But given consumer wariness about VPPs we’ll also need to look at restructuring electricity network tariffs so customers aren’t deterred from exporting power during the peak period for fear they’ll be caught short later in the night and lose more money importing power than gained from exporting it.

We need to also drive suppliers to incorporate better software into their systems that can predict when a household is likely to have battery capacity to spare and allow that to be exported during the evening peak.

We need inverters and solar systems sized to make good use of the energy storage capacity

The other issue is that some installers can be tempted to sell a customer lots of kilowatt-hours of storage (for which much of the cost might be covered by the STC incentive for the cheaper battery brands) while skimping on the size of the inverter and the solar system.

For a battery to be effectively utilised we really want to be able to charge it up and discharge it at least once per day and ideally charge the system from solar generation that would otherwise be exported to the grid for just a few cents per kWh.

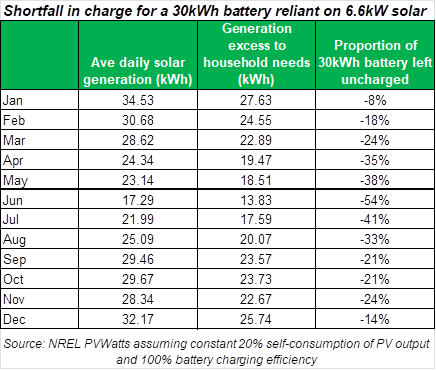

We have seen and heard of retailers encouraging customers to install 30 kWh or even bigger batteries but to cut costs and time suggests the customer needn’t upgrade from a typical 5 kW inverter and 6.6 kW solar system. As shown in the table below that will mean the customer won’t be able fill up that battery with their low cost solar generation.

Yes, there are some electricity retail offers available that could allow the customer to charge up the battery from low cost power from the grid.

But often these are highly constrained in time (e.g. OVO’s free power offer is limited to a 3 hour window) and so it remains important that the inverter capacity is large enough to be able to charge up the battery within a few hours.

Also, some of these retail offers give with one hand while taking from the other. OVO still has to pay fees to the network during the “free” window and you can be sure they’ll be recovering that from customers some other way. So charging up the battery from solar is still likely to be a more reliable option.

Tristan Edis is the Director – Analysis and Advisory at Green Energy Markets. Tristan’s involvement in the clean energy sector and related government climate change and energy policy issues began back in 2000.