Oil giant BP has continued its dramatic retreat from green energy projects around the world, announcing it will quit its majority and controlling stake in a proposed $55 billion renewable and green hydrogen project in the Pilbara region of Western Australia.

BP has advised its partners in the Australian Renewable Energy Hub, originally conceived as a monster 26 gigawatt wind and solar project that would produce green hydrogen and ammonia for the domestic and export markets, that it no longer fits with its global strategy.

“This decision reflects BP’s recent strategy reset, which will see BP grow its upstream oil and gas business, focus its downstream business, and invest with increasing discipline into the transition,” a spokesperson said in a media statement.

The move is not surprising given that earlier this year, as Renew Economy reported at the time, that BP had slashed its spend on “low carbon energy” from a planned $US30 billion out to 2030, to around $4 billion, and redirected investment to fossil fuels, which it says are its “highest return opportunities.”

The major scale-back on renewables meant no new investments in “transition” projects over the coming three years, an exit from onshore wind, and a culling of major hydrogen and carbon capture and storage (CCS) from around 30 projects to between just five and seven “prioritised projects” – none of which appeared to be in Australia.

BP has a 63.57 per cent stake in the AREH project, and was its operator, after buying into the project in 2022 after the exist of Macquarie Bank.

On its website, BP describes AREH as one of the largest renewable energy hubs in the world, although its partners, Intercontinental and CWP are also involved in the proposed 50 GW Western renewable energy hub in the south-east of the state.

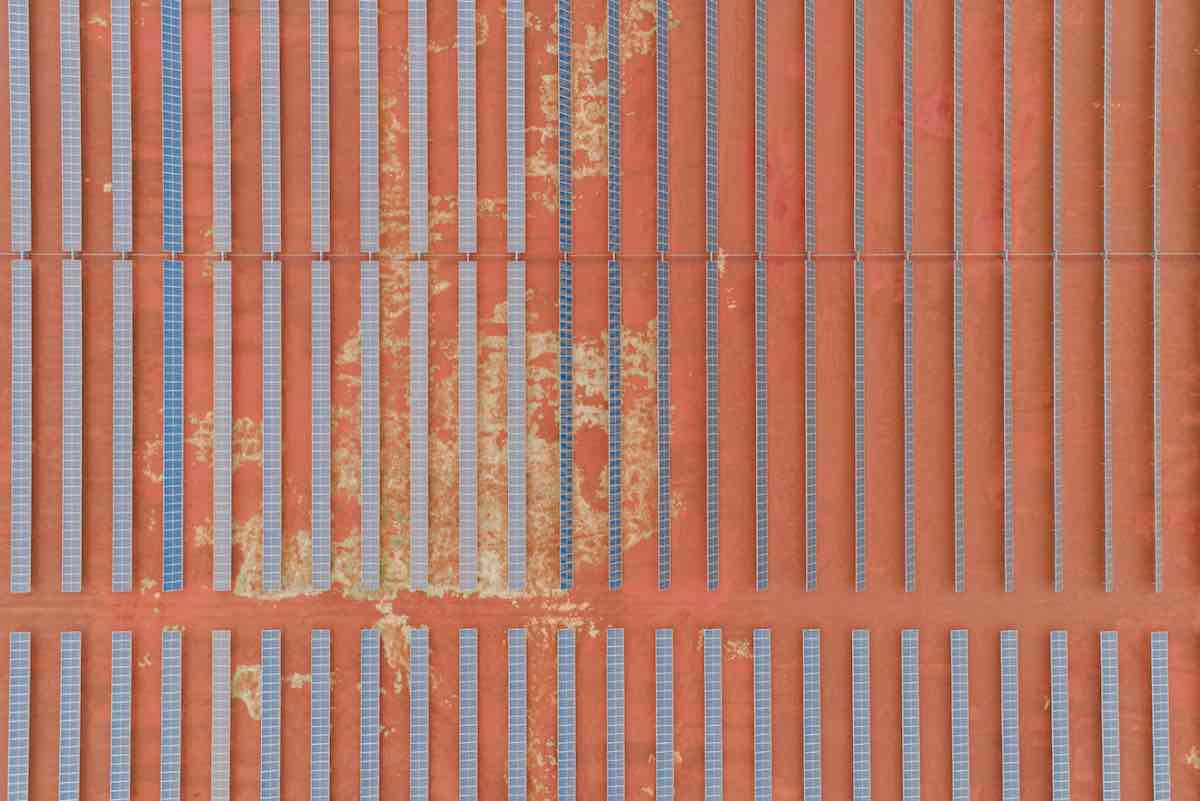

The project covered an area of more than 6,000 hectares and was to combine some 14 GW of hydrogen electrolysers, powered by around 16 GW of wind turbines and another 10 GW of large scale solar.

The plan was to tap in to the huge demand from the regions iron ore miners to decarbonise their operations, and to grow a domestic and export market for green hydrogen and green ammonia. A plan for a cable to south-east Asia had been abandoned some years ago.

The Pilbara decarbonisation plan is still going ahead. However, Fortescue, which intends to reach “real zero” emissions by 2030, appears likely to do that with its own wind, solar and battery projects.

The rollout of green hydrogen, however, have been put on the backburner, largely because of the lack of strong demand and the struggle with costs, and the competition from competing technologies such as EVs, battery storage and electrification that has eliminated some of its anticipated markets.

Green hydrogen will still play a key role in some hard to abate industries, such as green iron, but those projects are still in their pilot stage and not likely to be developed at the scale and speed once touted by the likes of Fortescue boss Andrew Forrest.

Fortescue itself announced this week it had taken a $150 million hit from the write down of two green hydrogen projects, although it is working on a tiny green hydrogen, green iron pilot in the Pilbara. That project, however, is measured in the kilowatts rather than the gigawatts, at least at this stage.

BP has thrown its green energy ambitions in reverse, like other oil majors, and earlier this week sold another large wind portfolio in the US, and is also winding down investments in other green hydrogen projects in Australia, including at Kwinana south of Perth.

It is reported that InterContinental Energy, which owns a 26 per cent stake in AREH, will take control of the project, and still intends to advance the project, at least in stages.

Renew Economy has reached out to Intercontinental Energy for further comment.

Giles Parkinson is founder and editor-in-chief of Renew Economy, and founder and editor of its EV-focused sister site The Driven. He is the co-host of the weekly Energy Insiders Podcast. Giles has been a journalist for more than 40 years and is a former deputy editor of the Australian Financial Review. You can find him on LinkedIn and on Twitter.