This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back. In today’s newsletter:

Western groups warn over US-China rare earths fight

Bonanza for US and UK immigration lawyers

Germany offers incentive to keep retirees working

No more VIPs at Art Basel

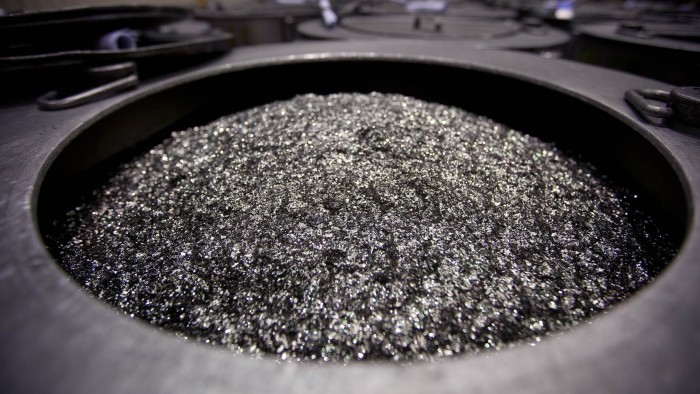

We begin with rare earths. Western companies have warned that the renewed US-China dispute over the critical minerals will lead to “broken” supply chains and higher prices for chips, cars and weapons.

Trade war escalation: China first introduced rare-earth export restrictions in April in retaliation to tariffs imposed by the Trump administration. Last week, Beijing tightened those rules further, requiring foreign companies to get approval to export magnets that contain even trace amounts of the materials sourced from China.

In response, US President Donald Trump threatened to impose an additional 100 per cent tariff on Chinese imports.

Dire warnings: Industry executives are pleading for the two trading powers to reduce tensions, pointing out the negative impact from the export curbs.

The Chinese commerce ministry’s new rules “are expected to have far-reaching consequences for deliveries of the affected products to Germany and Europe”, the German car industry group VDA said. Defence executives and other industry stakeholders also warned that the curbs could delay production of some weapon components.

Read more on how companies are responding to China’s rare-earth restrictions.

Here’s what else we’re keeping tabs on today:

Central banks: US Federal Reserve Chair Jay Powell speaks on the economic outlook at a National Association for Business Economics event in Philadelphia.

Economic data: IEA monthly oil market report. Germany releases inflation rate data for September while the UK has labour market figures for October. ZEW publishes its report on German economic sentiment.

Global economy: The IMF publishes its latest World Economic Outlook report.

Results: BlackRock, Citigroup, Goldman Sachs, Johnson & Johnson, JPMorgan Chase, LVMH, Publicis Groupe, Wells Fargo and YouGov report earnings.

Five more top stories

1. Traders betting against runaway US stocks are blaming indiscriminate retail investors for their worst year of returns in half a decade. A basket of the 250 US stocks most popular with short sellers has surged 57 per cent this year, hurting the traders betting on those shares’ decline. Read the full story.

2. Exclusive: Immigration lawyers in the UK and US say they are the busiest they have been in years, as the countries clamp down on new arrivals and President Trump’s administration steps up deportations. Read more on the immigration specialists boom.

3. Exclusive: Germans who choose to work beyond the retirement age will be able to earn up to €2,000 a month tax-free, as part of Chancellor Friedrich Merz’s push to tackle labour shortages and revive Europe’s largest economy. Read details of the active pension plan.

4. Exclusive: Revolut’s full UK banking licence is being held up by regulators’ concerns over whether its risk controls can keep pace with the rapid growth of its overseas operations. Read the full report.

5. Exclusive: Art Basel is ditching the “empty” VIP title from its operations. The Swiss group behind art fairs spanning from Hong Kong to Miami Beach said the term distracts focus from its core audience.

Analysis © Kenny Holston/Getty Images

© Kenny Holston/Getty Images

Israel is celebrating the release of hostages from Gaza. But for Prime Minister Benjamin Netanyahu the question is: can he gain political redemption?

We’re also reading . . .

Age of leisure: Some investors are betting artificial intelligence will usher in an era in which we only work three days a week. Is that likely, asks Sarah O’Connor.

European defence tech: Investors are concerned that hype over European defence start-ups is not matching reality.

Madagascar turmoil: President Andry Rajoelina’s whereabouts remain unclear even as the opposition said he had fled the country after weeks of protests.

Jesper Brodin: Sweden has nominated Ikea’s outgoing boss to head the UN’s refugee agency in a rare case of a business leader being backed for a top international policy job.

Chart of the day

Professional and retail investors are swarming to buy gold, pushing prices to record highs. Bullion is up more than 50 per cent this year to surpass $4,000 a troy ounce, putting it on track for its best year since 1979. But as the rally builds, a growing chorus is starting to ask — when will it stop?

Take a break from the news . . .

Take a break from the news . . .

From Singapore to Los Angeles, a new generation of restaurants has set out in the footsteps of Nobu and Zuma. FT critic Jay Rayner examines the rise of “luxe” food chains — and whether it has come at a cost.