Ahead of Trump-Xi meeting, the Wall Street Journal put out an article saying that the US could roll back some tariffs on China if Beijing cracks down on the export of chemicals that produce fentanyl, under a framework to be discussed during the meeting. In return for China’s efforts, the US could cut its 20% fentanyl-related tariff on Chinese goods by as much as 10%, according to the WSJ report. If this is true, this would likely be good for overall global demand and indirect benefiting other Asian countries. Nonetheless, it would also lower the tariff differential and advantage that other Asian markets have vis-à-vis China right now, and as such it’s not all an unmitigated blessing. Our best sense is that tariff differentials are one reason for companies including from China to invest more in Southeast Asia, but there are other structural factors such as tapping domestic demand, diversifying supply chains and generating goodwill.

Meanwhile, the big mover in the Asia FX space was a weaker PHP, with USD/PHP rising above the psychological 59 level. Post the FX move, the Philippine central bank said it allows the exchange rate to be determined by market forces, and when they do participate in the market, it is largely to dampen inflationary swings in the exchange rate over time rather than to prevent day-to-day volatility. Meanwhile, the BSP said the peso continues to be supported by resilient remittance inflows, still relatively fast economic growth, low inflation, and ongoing structural reforms. Foreign exchange inflows from business process outsourcing and tourism according to the BSP. The central bank also said it continues to maintain robust foreign reserves, which stood at about $109 billion as of September, the most in almost a year.

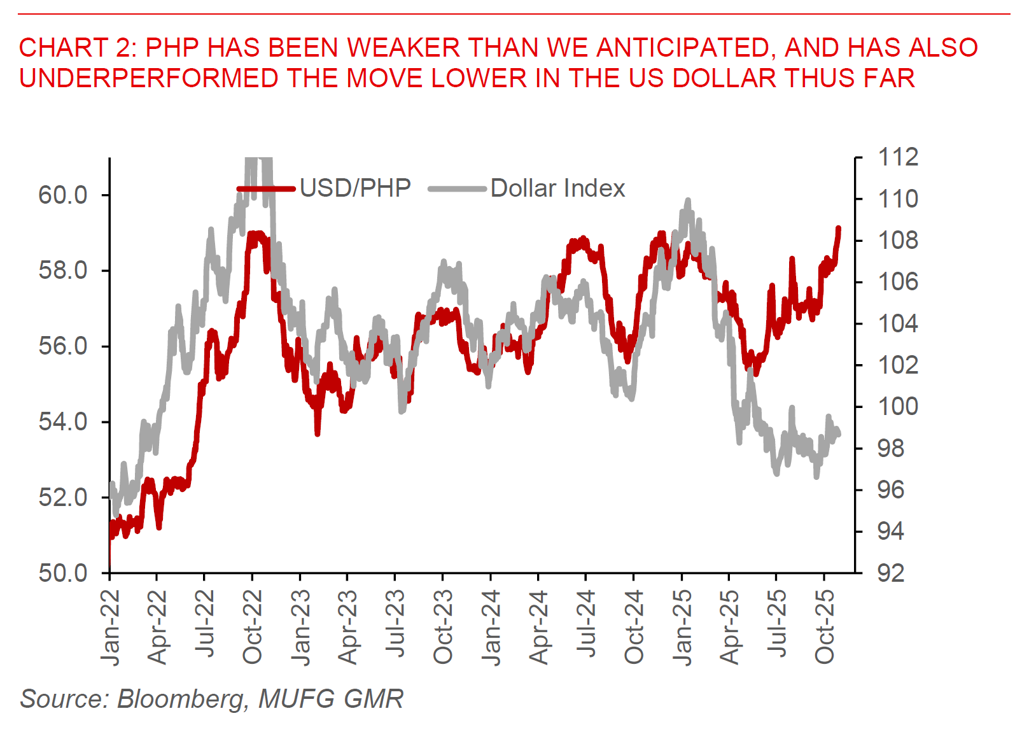

While we had already been anticipating some headwinds to PHP from a more dovish BSP, coupled with the corruption issues arising from flood control projects, the move in PHP has admittedly been weaker than we anticipated (see Philippines – BSP surprise rate cut with dovish tone. Shifting PHP forecasts weaker). We were expecting other offsetting positives such as lower inflation, strong private investment including in renewable energy projects, an expected pick-up in FDI from the past surge in FDI approvals, coupled with seasonal inflows from remittances to boost the PHP. Admittedly this has not happened yet. While we will relook our exact forecasts with our global team in the upcoming Global FX Monthly, we are not entirely comfortable abandoning our views for USD/PHP to move lower directionally, especially after the recent weakness.