Dublin, Oct. 30, 2025 (GLOBE NEWSWIRE) — The “Spectator Sports Global Market Report by Sports Type, Revenue Stream, Countries and Company Analysis, 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

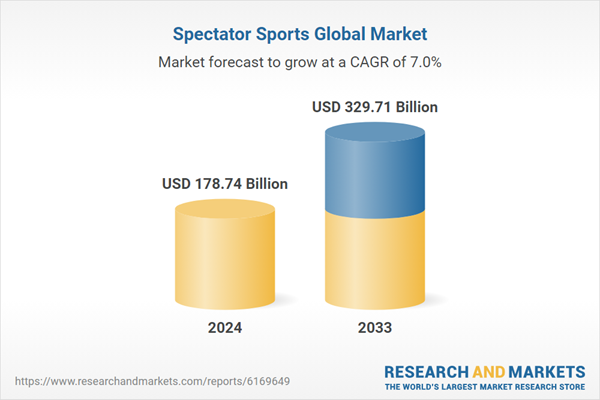

Spectator Sports Market is expected to reach US$ 329.71 billion by 2033 from US$ 178.74 billion in 2024, with a CAGR of 7.04% from 2025 to 2033

A number of significant market factors have impacted the spectator sport industry, such as the growing appeal of sports across a range of demographics and the expanding accessibility of cutting-edge technology. With robust league systems and substantial income, North America leads the spectator sports market, followed by Europe and Asia-Pacific. Due to government investment and efforts to host major events, the Middle East is developing quickly.

Professional leagues, competitions, and live sporting events that spectators attend or watch in person or on digital platforms are all included in the worldwide spectator sports sector. This category covers both individual sports like tennis and athletics as well as team sports like cricket, basketball, and football. With billions of supporters worldwide, spectator sports make money via merchandise, sponsorship agreements, television rights, and ticket sales. In many nations, the sector contributes to employment, tourism, and urban growth, playing a vital cultural and economic role.

Sports fans’ interactions are changing as a result of technological breakthroughs. Digital platforms are increasing the number of viewers outside of stadiums through engaging mobile apps, virtual reality experiences, and high-definition live streaming. Additionally, social media is essential for increasing athlete branding, marketing events, and improving fan connection. By reaching out to younger audiences and international markets, this digitization has given rights holders access to a variety of revenue streams. In addition, the panorama of spectator sports is expanding due to the rising popularity of esports and women’s sports.

Notwithstanding its expansion, the sector still has to contend with issues like event security, infrastructure expenses, and shifting economic conditions that may affect consumers’ discretionary spending. Furthermore, the competition from alternative entertainment options and changes in media consumption necessitate ongoing innovation. Nonetheless, the industry is positioned for long-term growth thanks to strategic investments, international alliances, and a renewed emphasis on sustainability and diversity. While the Middle East is quickly becoming a center for international investments and athletic events, regions like North America, Europe, and Asia-Pacific still hold the top spots.

Key Factors Driving the Spectator Sports Market Growth

Legalizing sports betting increases participation:

Following the Supreme Court’s 2018 decision, the legalization of sports betting in 38 U.S. states and the District of Columbia sped up the acceptance of wagering, resulting in handles that significantly increased game-day viewership by early 2025. According to internal league assessments, bettors watch games for longer periods of time than non-bettors, demonstrating more engagement.

Higher advertising premiums are also being driven by gaming integrations, including live odds tickers. According to the American Gaming Association, the combined revenue from regulated betting platforms from the NBA and MLB could reach USD 1.7 billion annually. Early data also shows a potential risk: clubs are embedding responsible-gaming reminders in apps since losing bets on a home team might reduce long-term participation.

Making new Asia-Pacific leagues commercial:

The Indian Premier League (IPL) saw a 6.50% increase in valuation in 2024, hitting USD 16.4 billion (about Rs 1,34,858 crore). JioCinema’s live streaming attracted 620 million unique viewers in 2024, demonstrating that data-affordable markets can surpass the reach of traditional television.

Securing the long-term hosting rights for Formula 1 is one of the major financial resources allocated to domestic events by Saudi Arabia as part of its Vision 2030 strategy. This demonstrates how government funds are strategically used to hasten the creation and growth of competitive leagues. Asia-Pacific is the top target for new franchise creation through 2030 since sponsors follow audience momentum.

Growing media-rights values due to competition in streaming:

In 2024, global sports-rights costs exceeded USD 60 billion, demonstrating platforms’ readiness to pay more for live programming that serves as a subscriber retention anchor. As an example of how tech companies view sports as essential engagement tools, Netflix entered the live National Football League market, while Amazon acquired more National Basketball Association bundles.

With an annual worth of almost USD 2 billion, YouTube TV’s NFL Sunday Ticket deal marked the end of single-platform exclusivity and increased bid floors for other high-profile properties. Although viewers traverse a more fragmented world, rights owners now stagger packages to extract numerous revenue sources.

Challenges in the Spectator Sports Market

Changing Preferences for Entertainment and Consumer Behavior:

Adapting to shifting consumer habits is one of the biggest difficulties facing the spectator sports sector. Younger audiences, in particular, are more interested in short-form content, highlights, and interactive forms than they are in attending live events or watching entire games. Sports companies need to fight harder for viewers’ attention as video games, social media, and streaming entertainment become more and more competitive.

Traditional income sources are also under strain from declining in-stadium attendance in some areas. Sports brands must alter their pricing strategies, interaction methods, and content distribution as fans desire value, convenience, and personalization. Long-term audience attrition and a decline in relevance among important demographics may arise from a failure to adapt to these choices.

Risks associated with event management and high operational costs:

There are substantial financial and logistical requirements for planning major athletic events. Increasing operational costs are caused by a number of factors, including staffing, security, infrastructure development, and adherence to safety standards. Unpredictable elements can also cause disruptions and affect profitability, such as severe weather, unstable political environments, or health emergencies like pandemics.

Both public and private organizations are heavily burdened by the cost of maintaining stadiums and training facilities. These costs may be unaffordable for smaller leagues or teams, which would restrict their ability to grow and expand regionally. To overcome these obstacles and guarantee sustainable event execution in a setting that is becoming more complicated, risk management, adaptable planning, and public-private cooperation are crucial.

Key Attributes:

Report AttributeDetailsNo. of Pages200Forecast Period2024 – 2033Estimated Market Value (USD) in 2024$178.74 BillionForecasted Market Value (USD) by 2033$329.71 BillionCompound Annual Growth Rate7.0%Regions CoveredGlobal

Recent Developments in Spectator Sports Industry

In February 2025, TKO Group completed the USD 3.25 billion purchase of Professional Bull Riders, On Location, and IMG, increasing the number of yearly events to 200 and reaching 285 million households.In order to launch a streaming sports bundle targeted at cord-cutting consumers, ESPN, Fox, and Warner Bros. Discovery formed a joint venture in January 2025.In December 2024, Nike reaffirmed their commitment to providing uniforms for all 32 NFL clubs, extending their contract through 2038.

Company Analysis: Overviews, Key Person, Recent Developments, SWOT Analysis, Revenue Analysis

The Walt Disney Company (ESPN)Comcast Corp (NBC Sports & Sky Sports)Liberty Media Corp (Formula 1)DAZN Group LtdMadison Square Garden Sports CorpManchester United PLCReal Madrid CFFC BarcelonaYankees Global EnterprisesDallas Cowboys Football Club Ltd

Market Segmentations

Sports Type

FootballBasketballCricketTennisBaseball

Revenue Stream

Ticket SalesMedia RightsSponsorship & AdvertisingMerchandising & LicensingOther Ancillary Revenues

Regional Outlook

North America

Europe

FranceGermanyItalySpainUnited KingdomBelgiumNetherlandsTurkey

Asia Pacific

ChinaJapanIndiaSouth KoreaThailandMalaysiaIndonesiaAustraliaNew Zealand

Latin America

Middle East & Africa

Saudi ArabiaUnited Arab EmiratesSouth Africa

For more information about this report visit https://www.researchandmarkets.com/r/kxp64m

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Spectator Sports Global Market