News Corp shareholders are being told by Institutional Shareholder Services, a leading proxy adviser, to withhold their votes for four board members, including chairman Lachlan Murdoch.

ISS cited Murdoch’s “substantial” pledge of company shares as collateral for a loan and the company’s dual class of shares with unequal voting rights.

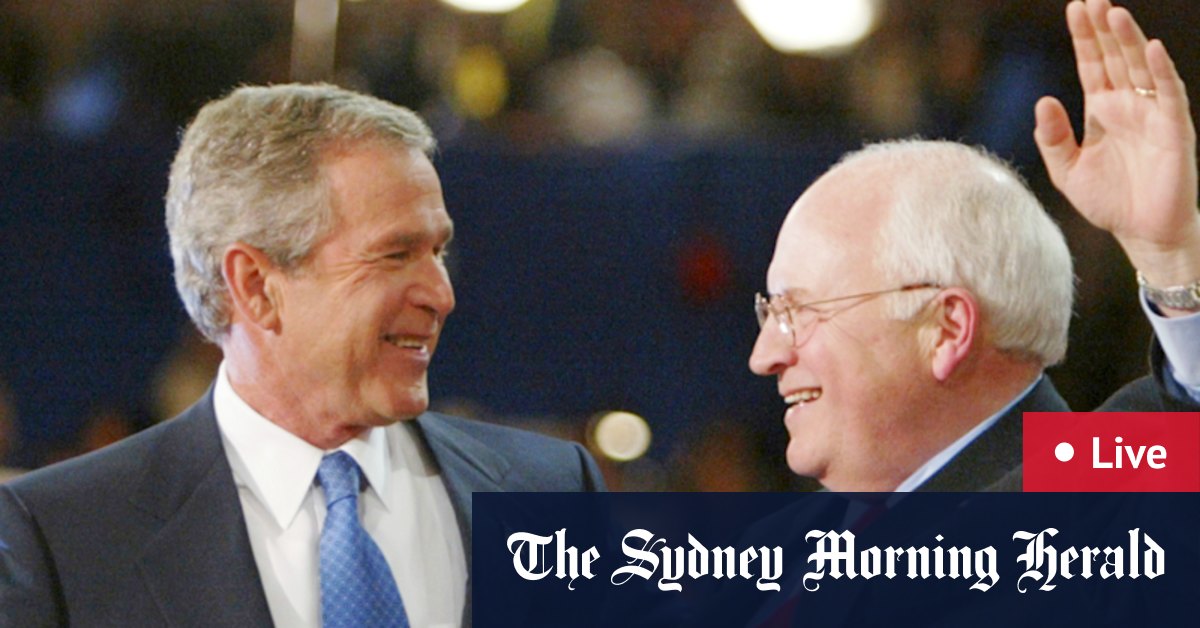

News Corp chairman Lachlan Murdoch at the MotoGP held at Phillip Island last month.Credit: Getty Images

Murdoch recently bought out shares held by three siblings in a deal that settled a family dispute over who controls the company.

The transaction involved borrowing $AU1.5 billion, with shares of News Corp and Fox Corp, another family holding, used as collateral.

Loading

“Pledging of company stock by directors or executive officers can pose a risk to the investments of outside shareholders,” ISS said in an October 30 report, which noted investors with margin loans may be forced to sell, putting pressure on a stock.

The proxy adviser also said dual-class shares “create a misalignment between economic interest and voting rights, which can disenfranchise shareholders holding stock with inferior voting rights”.

News Corp has two classes of common stock. The Murdochs own 33 per cent of the “B” shares that have voting rights. The “A” shares have no such rights.

News Corp disputed ISS’s position in a separate filing, saying the pledge doesn’t present a significant risk and was being done to increase Murdoch’s ownership.

It said a holding company tied to Murdoch and his two younger sisters has the capacity to repay the loan without selling shares.

Bloomberg