Yesterday, 5:25amThu 13 Nov 2025 at 5:25amMarket snapshotASX 200: -0.5% to 8,753 points

Australian dollar: +0.3% to 65.58 US centsNikkei 225: +0.5% to 51,299 pointsWall Street: Dow Jones (+0.7%), S&P 500 (+0.1%), Nasdaq (-0.3%)Europe: FTSE (+0.1%)Spot gold: +0.4% to $US4,214/ounce

Brent crude: flat to $US62.67/barrelIron ore: flat to $US103.7/tonne

Bitcoin: +0.1% to $US102,015

Prices current around 4:23pm AEDT

Live updates on the major ASX indices:

Yesterday, 6:15amThu 13 Nov 2025 at 6:15am

One last note (I promise) from DroneShield

DroneShield has just released an ASX statement.

Here’s it in full:

“Drone Shield Limited acknowledges today’s share price movement following the lodgment of change of directors’ interest notices yesterday.

“A substantial number of key DroneShield team members receive performance options as part of

their compensation.

“Yesterday’s change of directors’ interest notices are unrelated to the growth

trajectory of the Company, which remains strong, as highlighted in the recent quarterly market

update reflecting record QoQ revenue growth and positive operating cashflow.

“Directors have retained a stake in the Company through vested options as they have done in the

past when disposing of shares acquired on exercise of options.

“The Board and executives remain

fully committed to the success of the Company.”

Yesterday, 5:38amThu 13 Nov 2025 at 5:38amThat’s it from us

Thanks for joining us today as we’re wrapping up our markets live blog.

Don’t forget to catch The Business on ABC News at 8:44pm, after the late news on ABC TV, and any time on ABC iview.

We’ll be back tomorrow morning with more financial news and insights.

Until then, take care!

LoadingYesterday, 5:21amThu 13 Nov 2025 at 5:21amMarket closes down

The Australian share market has finished the day lower, dropping 0.5% to 8,753.40 and setting a new 50-day low.

Overall, the market had 66 stocks gaining, 8 unchanged and 126 stocks in the red.

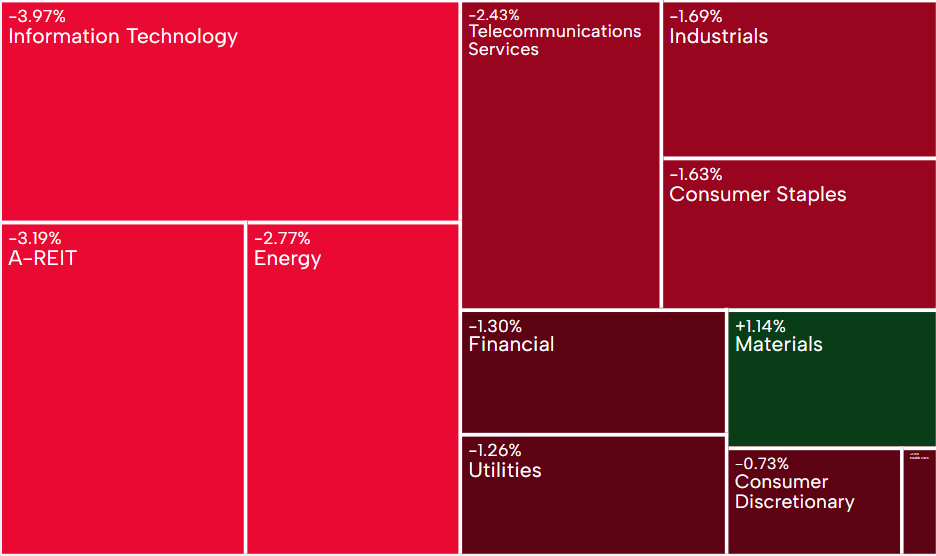

When looking at the sectors, Materials is the only one gaining, up 1.4%.

Information Technology finished at the bottom; down 4%, followed by Telecommunications Services; down 2.4%, and then Energy; down 2.3%.

Among companies, the top mover was IGO, up 15.4%, followed by Liontown Resources, up 11.2%.

It wasn’t a good day for DroneShield, down 32.2%, followed by GrainCorp, down 10.8%.

The Australian dollar is up 0.3% at 65.57 US cents.

Yesterday, 5:17amThu 13 Nov 2025 at 5:17amDroneShield: ‘$50 million worth of conviction heading straight for the exit’

I’ve been doing a bit of digging around DroneShield’s ASX announcements page to try and piece together what happened with its director share sale, which has resulted in a precipitous 30% plunge in its share price today.

On Tuesday last week (November 4), DroneShield announced that its latest tranche of performance options would vest due to hitting a target of $200 million in cash receipts over a 12-month period.

On November 5, three directors — Jethro Marks, Peter James and CEO Oleg Vornik — announced to the market that they’d taken up shares under this scheme.

Last night (November 12), after the market closed, DroneShield announced that all three of these directors had sold shares between November 6 and 12.

The thing that has really unsettled DroneShield investors is that all three sold all their shares in the company.

According to the latest ASX declarations, the only interest any of the three have left is currently unlisted and unvested performance-based share options.

As one professional investor quipped in an email seen by the ABC:

“From ‘run towards fires’ to running for the exit!”

Adding:

“The CEO just sold every single one of his 14.8 million shares between November 6-12. That’s about $50 million worth of conviction … heading straight for the exit.

“Not to be outdone, the chairman and another director also hit the eject button, selling 100% of their stock.”

As flagged earlier, ABC News has attempted to contact DroneShield CEO Oleg Vornik by email and mobile phone, with no response yet.

Yesterday, 5:02amThu 13 Nov 2025 at 5:02am

Iron ore seesaws amid softening near-term demand in China

Iron ore futures prices have seesawed with market players weighing softening near-term demand in top consumer China and prospects of increasing supply against possible restocking by steelmakers.

The most-traded January iron ore contract on China’s Dalian Commodity Exchange advanced 0.26% to 772.5 yuan ($US108.45) a metric tonne by 1:10pm AEDT.

The benchmark December iron ore on the Singapore Exchange was 0.32% lower at $US102.45 a tonne, as of 1pm AEDT.

Traders shifted their focus back to fundamentals, which are skewed to the weak side, analysts at broker Shengda Futures said in a note.

Expectations of growing supply and softening demand during the remainder of the year had pressured prices earlier in the month.

Some steelmakers increased equipment maintenance amid shrinking margins, analysts at broker Jinyuan Futures said in a note.

But the market had already digested some of the bearish expectations, resulting in some restoration of valuation, Shengda analysts said.

Also, supporting prices were hopes that Chinese steel mills might start restocking seaborne cargoes in their preparation to meet needs during the Chinese New Year holiday in February, said analysts.

Additionally, the momentum to narrow basis, the difference between spot and futures prices, aided resilience in futures prices, said analysts.

Futures prices slid at a more rapid pace than the spot market earlier in the month, said a Shanghai-based analyst on condition of anonymity as he is not authorised to speak to media.

Coking coal and coke, other steelmaking ingredients, fell 0.33% and 0.38%, respectively.

Steel benchmarks on the Shanghai Futures Exchange traded in a tight range. Rebar and hot-rolled coil were little changed, and stainless steel SHSScv1 edged 0.12% lower.

Reporting with Reuters

Yesterday, 4:50amThu 13 Nov 2025 at 4:50amSequoia shares down more than 12pc

The shares of Sequoia Financial Group (Sequoia) have plunged 12.3% after it told the market that its wholly owned subsidiary, InterPrac, intends to defend ASIC proceedings.

“We do recognise the impact on clients affected

by the external investment product failure, confirming InterPrac has cooperated fully with ASIC’s

investigation,” managing director and CEO Garry Crole said.

Yesterday, 4:46amThu 13 Nov 2025 at 4:46amInterprac says it will ‘vigorously defend’ ASIC’s allegations

The company that a number of Shield and First Guardian financial advisers sat under, Interprac, has responded to ASIC’s allegations.

The corporate watchdog alleges thousands of Australians were exposed to poor financial advice and significant risks from the Shield and First Guardian schemes through critical oversight and compliance failures.

Interprac sits under ASX-listed Sequoia, which on Thursday entered a trading halt after the ASIC announcement.

The company later released a statement to the ASX saying it intended to “defend the allegations vigorously” and that “Interprac believes it has acted in accordance with its obligations under the Corporations Act”.

ASIC is seeking declarations, civil penalties, and orders to restrain Interprac from carrying on a financial services business.

Interprac said ASIC’s Statement of Claim filed with the Federal Court “concerns historical conduct involving certain former authorised representatives and their recommendations for clients to invest” in the two funds via approved superannuation platforms.

It noted that these representatives ceased to be authorised by Interprac during 2025.

“The Interprac board and support staff are committed to continue to act in clients’ best interests and take our compliance and governance obligations seriously,” its managing director Garry Crole said in a statement to the ASX.

He said the company had cooperated with ASIC during its investigation, and Sequoia would keep the market informed in accordance with its continuous disclosure obligations.

I did an interview with Mr Crole earlier this year on the issue, where he said ‘maybe we could have done more’ to prevent First Guardian and Shield losses. Watch that here:

Yesterday, 4:44amThu 13 Nov 2025 at 4:44amStronger labour market result in October broadly offsets September weaker result: Westpac

While October’s data was solid, it largely offsets a weaker-than-expected read in September, according to a Westpac economist Ryan Wells.

He said, “The underlying narrative has not changed: the labour market is gradually softening and becoming ‘less tight’.”

“In light of today’s data, though, we think the RBA are more likely to cite the October figures as a reason to dismiss the September signal,” Mr Wells said.

“This would be the expected response from a central bank that is more concerned over the risk of persistent above-target inflation.

“With a labour market not posing any material upside risks to inflation … the RBA can remain squarely focussed on assessing multiple quarterly prints for inflation and regaining confidence that underlying inflation is indeed on track to continue moving toward the mid-point of the target range next year.”

Yesterday, 4:32amThu 13 Nov 2025 at 4:32amASX 200 slips along with most sectors

The ASX 200 has dropped 0.9% to 8,717.90.

The bottom performing stocks in this index are DroneShield and GrainCorp, down 29.4% and 10.6% respectively.

The index has lost 1.3% for the last five days and sits 4.4% below its 52-week high.

10 of 11 sectors are lower today, with Materials the only sector to gain.

(ASX)

(ASX)

Yesterday, 4:23amThu 13 Nov 2025 at 4:23am

Investors pivot to Australian small caps as blue-chip premiums bite

Australian small-cap stocks are having their best run in over a decade due to strong earnings and growth potential, as pricey blue-chip stocks have sent investors seeking value elsewhere, fund managers say.

Powered by robust earnings, easing interest rates and a policy tailwind for critical minerals, the ASX Small Ordinaries Index, which tracks companies valued at between $200 million and $10 billion, has raced ahead with a nearly 21% gain since the start of this year.

That sharply outpaced the ASX 200 benchmark index’s return of about 8%, both as of Wednesday’s close.

By that measure, the small-caps index is headed for its best year since 2009, reflecting an aversion among some parts of the market to blue-chip banking stocks whose prices have skyrocketed since the central bank began its easing cycle earlier this year.

These factors have “prompted investors to look further down the market for value and growth, giving small-caps a relative bid they haven’t enjoyed in years”, said David Tuckwell, chief investment officer at ETF Shares.

“The small end of the ASX has long carried the stigma of being a bit of a ‘dumping ground’, the place companies go once the market loses interest,” he said.

Small-cap inflows surge

A surge of inflows in wealth manager Betashares’ Small Companies Select ETF has seen unit allocations.

Meanwhile, the iShares MSCI Australia ETF, seen as a benchmark for foreign interest in Australian blue-chips, has seen allocations drop 13%.

The small-cap index is trading at a price-to-earnings ratio of about 11, versus almost 20 for the benchmark blue-chip index, according to LSEG data, underscoring the value appeal of small caps.

Hugh Lam, an investment strategist at Betashares, pinned the rally on a supportive macroeconomic environment, marked by robust gross domestic product growth.

“GDP growth … tends to support cyclical areas of the economy such as consumer discretionary and industrials – two sectors where small caps have greater revenue exposure to,” Mr Lam said.

Reporting with Reuters

Yesterday, 4:01amThu 13 Nov 2025 at 4:01amTrump signs deal to end longest US government shutdown in history

President Donald Trump has signed legislation ending the longest government shutdown in US history.

The Republican-controlled chamber passed the package by a vote of 222-209, with Trump’s support largely keeping his party together amid vehement opposition from House Democrats.

Trump’s signature on the bill will bring federal workers idled by the 43-day shutdown back to their jobs starting as early as Thursday, although just how quickly full government services and operations will resume is unclear.

It would extend funding through January 30, leaving the federal government on a path to keep adding about $US1.8 trillion a year to its $US38 trillion in debt.

“I feel like I just lived a Seinfeld episode. We just spent 40 days and I still don’t know what the plotline was,” said Republican Representative David Schweikert of Arizona, likening Congress’ handling of the shutdown to the misadventures in a popular 1990s US sitcom.

“I really thought this would be like 48 hours: people will have their piece, they’ll get a moment to have a temper tantrum, and we’ll get back to work.”

The shutdown’s end means the restoration in the coming days of the flow of data on the US economy from key statistical agencies.

The absence of data had left investors, policymakers and households largely in the dark about the health of the job market, the trajectory of inflation and the pace of consumer spending and economic growth overall.

Some data gaps are likely to be permanent, however, with the White House saying employment and Consumer Price Index reports covering the month of October might never be released.

By many economists’ estimates, the shutdown was shaving more than a tenth of a percentage point from gross domestic product over each of the roughly six weeks of the outage, although most of that lost output is expected to be recouped in the months ahead.

Yesterday, 3:39amThu 13 Nov 2025 at 3:39amTop and bottom movers

Let’s take a look at the top five and bottom movers.

Top:

IGO, +15.6%Liontown Resources, +11.2%Pilbara Minerals, +8.6%Domino’s, +7.7%Flight Centre, +5.6%

Bottom:

DroneShield, -32.3%Graincorp, -12.2%Xero, -6.8%Superloop, -6.5%NEXTDC Ltd

, -5.3%

Yesterday, 3:28amThu 13 Nov 2025 at 3:28am

Market snapshotASX 200: -1% to 8,710 points (live values below)

Australian dollar: +0.4% to 65.62 US centsNikkei 225: +0.2% to 51,166 pointsWall Street: Dow Jones (+0.7%), S&P 500 (+0.1%), Nasdaq (-0.3%)Europe: FTSE (+0.1%), DAX (+1.2%), Stoxx 600 (+0.7%)Spot gold: +0.1% to $US4,201/ounce

Brent crude: -0.1% to $US62.62/barrelIron ore: -0.1% to $US103.6/tonne

Bitcoin: +0.1% to $US101,956

Prices current around 2:26pm AEDT

Live updates on the major ASX indices:

Yesterday, 3:26amThu 13 Nov 2025 at 3:26amNAB no longer forecasting rate cut, after strong jobs data

Economists at National Australia Bank have changed their interest rate forecast, now forecasting no further rate cuts this cycle.

“We now see the RBA on hold at 3.6% through to the end of our forecast horizon,” NAB chief economist Sally Auld wrote.

NAB had previously tipped a final 0.25 percentage point cut in May.

The three factors leading the RBA to be on extended hold, the economists note, are:

A shift in the inflation backdrop — “while some of the pick-up is expected to be transitory, underlying inflation is still forecast to remain in the top half of the target band for an extended period”Dynamics around recent growth outcomes — “there is little to no spare capacity in the economy and highlights the risk that price pressures could re-emerge as the ongoing recovery in activity flows through to the labour market”Growing evidence 3.6% cash rate may not be “a little on the restrictive side” — “house price growth is accelerating and the most recent data on lending shows a sharp rise in both the value of new investor loans and the number of new investor loan approvals”

Yesterday, 3:24amThu 13 Nov 2025 at 3:24am

Ansell suspends relationship with Malaysian supplier

Australian glove-maker Ansell has confirmed it has suspended its relationship with Mediceram, a small Malaysian supplier of ceramic formers, over concerns about deteriorating relations between Mediceram and its foreign workers.

The announcement followed repeated strike actions over issues including the renewal of work visas, which remain pending with the relevant Malaysian immigration and labour authorities.

Ansell said it was surprised to be informed on October 31 that Mediceram had terminated 177 foreign workers for refusing to work.

“We promptly expressed our clear view to Mediceram that this was not an appropriate course of action in these circumstances,” the company said.

“In the absence of any willingness by Mediceram to reconsider, Ansell informed Mediceram on 4 November 2025 that Ansell is suspending its supplier relationship with the company.”

As we reported previously, Ansell was accused of using an overseas supplier that has allegedly exploited more than 200 factory workers — including through forced labour.

Read more on our investigative reporter Ben Butler’s coverage.

Yesterday, 3:08amThu 13 Nov 2025 at 3:08am

Hundreds of Qantas jobs to come to new innovation centre in Adelaide

The South Australian government has entered into an agreement with Qantas for a Product Innovation Centre that is expected to create more than 420 technology jobs by the end of 2028.

Under the agreement, Qantas will set up a purpose-built centre in the Adelaide CBD.

You can read more here.

Yesterday, 2:48amThu 13 Nov 2025 at 2:48am

It’s important to have right people skilled for right jobs: Employment Minister

The job figures, which Employment Minister Amanda Rishworth called “historically low”, have prompted a question: how does a high level of employment across Australia play into many highly skilled workforce shortages?

“This

historically low unemployment rate means that there are more Australians in jobs,” the minister told the press gallery in Canberra.

“One of the challenges [that] always remains is: How do we make sure that we have the right people skilled for the right jobs?

“That’s critical, how we skill up our workforce to get more jobs.

“So not only is it about creating jobs … but it’s preparing Australians for those jobs.”

Yesterday, 2:31amThu 13 Nov 2025 at 2:31amMost young Australians struggle with financial security, new Monash research says

Financial insecurity is affecting most young Australians, according to new research from Monash University.

The 2025 Australian Youth Barometer report, which surveyed 527 people and interviewed 30 aged 18 to 24, found that 85 per cent experienced financial insecurity in the past year, with one in four reporting it often.

The top issues on young people’s wishlists for urgent government action are affordable housing, youth employment, and climate change, the research says.

Lucas Walsh, the lead author of the study, says policy and decision-makers need to address the challenges facing young people with tailored solutions.

“With young people now making up a historically large share of voters around the country, governments around Australia cannot afford to ignore their pressing concerns,” Professor Walsh says.

“In a cost-of-living crisis, short-term policy debt reductions are welcome, such as lowering student debts like HELP and VET student loans.

“But rising costs of living mean that young people need additional support now, combined with major tax reform to ensure that they have affordable places to live in the future.”

Yesterday, 2:13amThu 13 Nov 2025 at 2:13am’Still some concerns’ about jobs market, despite decline in unemployment

Indeed economist Callam Pickering has a better view of the jobs market than most, with access to data from one of the major employment websites to inform his views.

He says the October ABS data is unambiguously strong, with employment and hours worked both up, and unemployment and underemployment both down.

Many years ago, Pickering used to work as an economist at the RBA, and has no doubt how this data will be received at the central bank.

“Stronger than expected jobs data will offer vindication for the Reserve Bank and guarantees that the next few meetings are unlikely to lead to any change in the cash rate.”

But Pickering adds that there are “still some concerns” around the outlook for the jobs market over the next couple of years.

“Australian employment growth has been sluggish this year. Even after adding another 42,000 people in October, employment has increased by just 160,000 people over the first ten months of the year. That compares to a gain of 325,000 people over the same period last year.”

“The main reason for this slowdown has been reduced hiring in healthcare & social assistance — the industry that drove so much of Australia’s post-pandemic job boom. Thus far the private sector, which has been heavily impacted by a challenging economic environment, hasn’t been able to fill the gap created by reduced hiring elsewhere.”

“Forward-looking measures of labour demand, such as ANZ-Indeed Job Advertisements, remain positive but continue to ease. Job creation continues to be strong enough to keep the unemployment rate relatively low, but each month the number of jobs advertised continues to decline.”

How this all plays out will be a key determinant of whether we see any more rate cuts in 2026 or not.

ASX 200: -0.5% to 8,753 points

ASX 200: -0.5% to 8,753 points