Disseminated on behalf of Sierra Madre Gold & Silver Ltd.

Silver is prized for its beauty and use in jewellery, but its true value today lies in technology. Silver is now a key material as the world shifts to renewable energy, electric vehicles, and advanced electronics. Its high conductivity and reflectivity make it essential for solar panels, EV batteries, and 5G networks.

For investors, this shift marks a new chapter for the silver market – one driven less by fashion and more by function. Companies like Sierra Madre Gold & Silver are ready to meet this growing demand for industrial and investment needs.

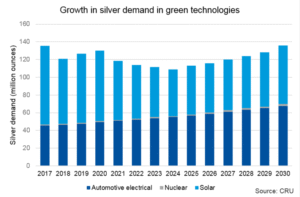

Rising Demand from the Green Transition

The clean energy transition is rapidly changing how silver is used. The Silver Institute reports that global silver demand hit a record 1.2 billion ounces in 2024. More than 30 percent of this was for industrial uses, mainly in solar power and electronics. That figure is set to rise as countries expand renewable energy capacity.

In 2024, industrial silver use hit an all-time high of 680.5 million ounces, driven by solar manufacturing, electric vehicles, and electronics. Solar energy alone now accounts for more than 30 percent of industrial demand.

Each photovoltaic (PV) panel has 15–25 grams of silver. By 2030, solar installations may top 500 gigawatts each year. This could mean the sector needs 250 million ounces of silver annually.

Electric vehicles are another major source of growth. A single EV uses up to 50 grams of silver, roughly twice that of a traditional car. As production expands, the automotive sector’s silver demand could triple by 2030.

These trends are tightening the global silver market. Inventories are falling, and analysts warn of persistent supply deficits through the end of the decade.

The Supply Challenge: Falling Mine Output

While demand surges, mine output is not keeping pace. The Silver Institute estimates global silver production at about 819.7 million ounces in 2024, up less than 1 percent from the previous year.

Even with this small rise, the world will have a 117.6 million-ounce supply deficit in 2025. This shows ongoing long-term shortages.

Mexico remains the world’s largest silver producer, contributing about 23 percent of global output. But much of this comes from aging or polymetallic mines, where silver is a by-product. New producers like Sierra Madre Gold & Silver attract investors. They blend modern exploration with production. This is happening in one of the richest silver belts on Earth.

Sierra Madre’s Portfolio: Reviving Proven Silver Assets

Sierra Madre Gold & Silver Ltd. (TSXV: SM, OTCQX: SMDRF) is advancing two key projects in Mexico’s Sierra Madre mineral belt: La Guitarra and Tepic. Together, they represent a blend of production and exploration upside.

La Guitarra Mine (State of Mexico):

La Guitarra, acquired from First Majestic Silver Corp., is a fully permitted and producing underground operation. It already has processing infrastructure in place. The company reached commercial production at 500 tonnes per day in January 2025, with plans to expand to up to 1,500 tonnes per day by 2027. La Guitarra could restore one of Mexico’s best-known silver mines to its former prominence.

Tepic Project (Nayarit):

Tepic is a high-grade epithermal gold-silver deposit. It has near-surface mineralization, which means there’s great exploration potential. This also allows for options for future growth.

Sierra Madre cuts costs and timeline risks by targeting assets with established infrastructure and clear development paths. This approach is safer than working with early-stage explorers.

Positioned for the New Industrial Cycle

The global shift to cleaner energy sources is reshaping the silver market into something closer to a strategic commodity. Governments and industries now view silver as vital to achieving energy-transition goals. As demand outpaces supply, producers with near-term restart potential stand to benefit most.

Sierra Madre fits neatly into that narrative. The La Guitarra project has restarted production much quicker than greenfield developments. Those often need years for permits and construction. At the same time, its exploration project adds scalability and long-term growth potential.

Mexico has a strong mining infrastructure and a skilled workforce. It’s also close to North American industrial hubs. This gives Sierra Madre a big logistical advantage. The U.S. is putting policies in place to secure supply chains for key materials. This makes Mexico a more important and reliable supplier.

Market Dynamics: Silver as a Strategic Metal

Silver’s 2025 price action underscores profound shifts in its role within both industrial and investment spheres. After climbing nearly 25 percent year-to-date, silver shattered previous records by reaching its all-time high of $54.24 per ounce in October before correcting and settling in the high-$40 range.

Major analysts such as Metals Focus project that prices could breach the US$60 mark by late 2026 if current supply deficits and clean energy demand trends persist, citing strong industrial momentum – particularly in solar and electronics – as critical drivers.

Supporting this rally, silver exchange-traded products (ETPs) absorbed 95 million ounces in the first half of 2025, pushing global holdings to 1.13 billion ounces – just 7 percent below their all-time peak.

According to data from the World Silver Survey 2025, industrial fabrication demand reached a new record of 680.5 million ounces in 2024, maintaining upward momentum through 2025. The supply side remains structurally tight: analysts project a market deficit of roughly 149 million ounces this year, marking five consecutive years where demand has outpaced annual mine production.

Why Sierra Madre Stands Out

Production: La Guitarra restart completed, targeting output ramp-up in 2026 and 2027.

High-Quality Assets: Two projects in Mexico’s most productive silver-gold belt.

Operational Readiness: A fully permitted plant and infrastructure at La Guitarra reduced start-up costs.

Strong Market Tailwinds: Silver demand from solar, EVs, and electronics continues to set records.

Experienced Leadership: Proven management team with expertise in Mexican mining operations.

These factors make Sierra Madre a unique mix of production, exploration, and expansion potential, and access to one of the fastest-growing industrial metals globally.

A New Chapter for Silver – and for Sierra Madre

Silver’s growing role in the clean-energy transition marks a turning point for the mining industry. Once seen mainly as a precious metal, it is now a cornerstone of the technologies driving global decarbonization.

Sierra Madre Gold & Silver is one of the few junior miners that successfully restarted a permitted mine in Mexico’s silver heartland and is planning a near-term expansion. This positions them well to benefit from the current structural shift. With rising demand and limited supply, the company is ready to continue with its strategy for La Guitarra. This move connects Mexico’s rich mining history with a clean-energy future.

DISCLAIMER

New Era Publishing Inc. and/or CarbonCredits.com (“We” or “Us”) are not securities dealers or brokers, investment advisers, or financial advisers, and you should not rely on the information herein as investment advice. Sierra Madre Gold and Silver Ltd. (“Company”) made a one-time payment of $25,000 to provide marketing services for a term of one month. None of the owners, members, directors, or employees of New Era Publishing Inc. and/or CarbonCredits.com currently hold, or have any beneficial ownership in, any shares, stocks, or options of the companies mentioned.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. It does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular issuer from one referenced date to another represent arbitrarily chosen time periods and are no indication whatsoever of future stock prices for that issuer and are of no predictive value.

Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high-risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reviewing the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures.

It is our policy that the information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable, but we cannot guarantee them.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate,” “expect,” “estimate,” “forecast,” “plan,” and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those anticipated.

These factors include, without limitation, statements relating to the Company’s exploration and development plans, the potential of its mineral projects, financing activities, regulatory approvals, market conditions, and future objectives. Forward-looking information involves numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility, the state of financial markets for the Company’s securities, fluctuations in commodity prices, operational challenges, and changes in business plans.

Forward-looking information is based on several key expectations and assumptions, including, without limitation, that the Company will continue with its stated business objectives and will be able to raise additional capital as required. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, or intended.

There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially. Accordingly, readers should not place undue reliance on forward-looking information. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis and annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise such information to reflect new events or circumstances except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings available on SEDAR+ at www.sedarplus.ca.

Disclosure: Owners, members, directors, and employees of carboncredits.com have/may have stock or option positions in any of the companies mentioned: None.

Carboncredits.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article.

Additional disclosure: This communication serves the sole purpose of adding value to the research process and is for information only. Please do your own due diligence. Every investment in securities mentioned in publications of carboncredits.com involves risks that could lead to a total loss of the invested capital.