Bechtle (XTRA:BC8) has delivered steady single-digit growth in both revenue and net income over the past year, with the stock climbing 24% for investors in the past 12 months. These numbers highlight its long-term performance.

See our latest analysis for Bechtle.

Bechtle’s share price has surged nearly 15% in a single day and is up over 27% year-to-date, signaling growing momentum and renewed optimism from investors. The stock’s one-year total shareholder return of 24% highlights steady performance, while the lift in recent weeks suggests the market sees potential for further gains.

If you’re interested in other companies gaining traction, now is a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

But after such a strong rally, the key question is whether Bechtle remains undervalued given its fundamentals, or if the market has already priced in all the company’s future growth potential. Is there still a buying opportunity?

Most Popular Narrative: 7.1% Undervalued

With Bechtle’s last close at €40.10 and the most widely followed narrative setting fair value at €43.17, the stock is trading below what analysts believe it’s worth. This difference suggests there may still be room for upside, depending on how key assumptions play out.

Bechtle’s emphasis on internationalization and M&A strategy, particularly in the European market, is expected to bolster revenue through geographic diversification and market penetration. This approach may help mitigate challenges faced in domestic markets. The reorganization of the Executive Board to focus on expanding multichannel offerings and further internationalization aims to improve process efficiency, which could lead to better net margins.

Want to know why this upgrade isn’t just about surface-level optimism? The core of this valuation is built on a major shift in expansion strategy and a bold earnings forecast. Wondering what growth bets and profit assumptions drive the narrative’s target? Uncover the big calls that could shape Bechtle’s next five years.

Result: Fair Value of €43.17 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent caution remains, as weaker IT investment from SMEs and shifting partner incentive structures in core markets could slow Bechtle’s growth trajectory.

Find out about the key risks to this Bechtle narrative.

Another View: Discounted Cash Flow Challenges

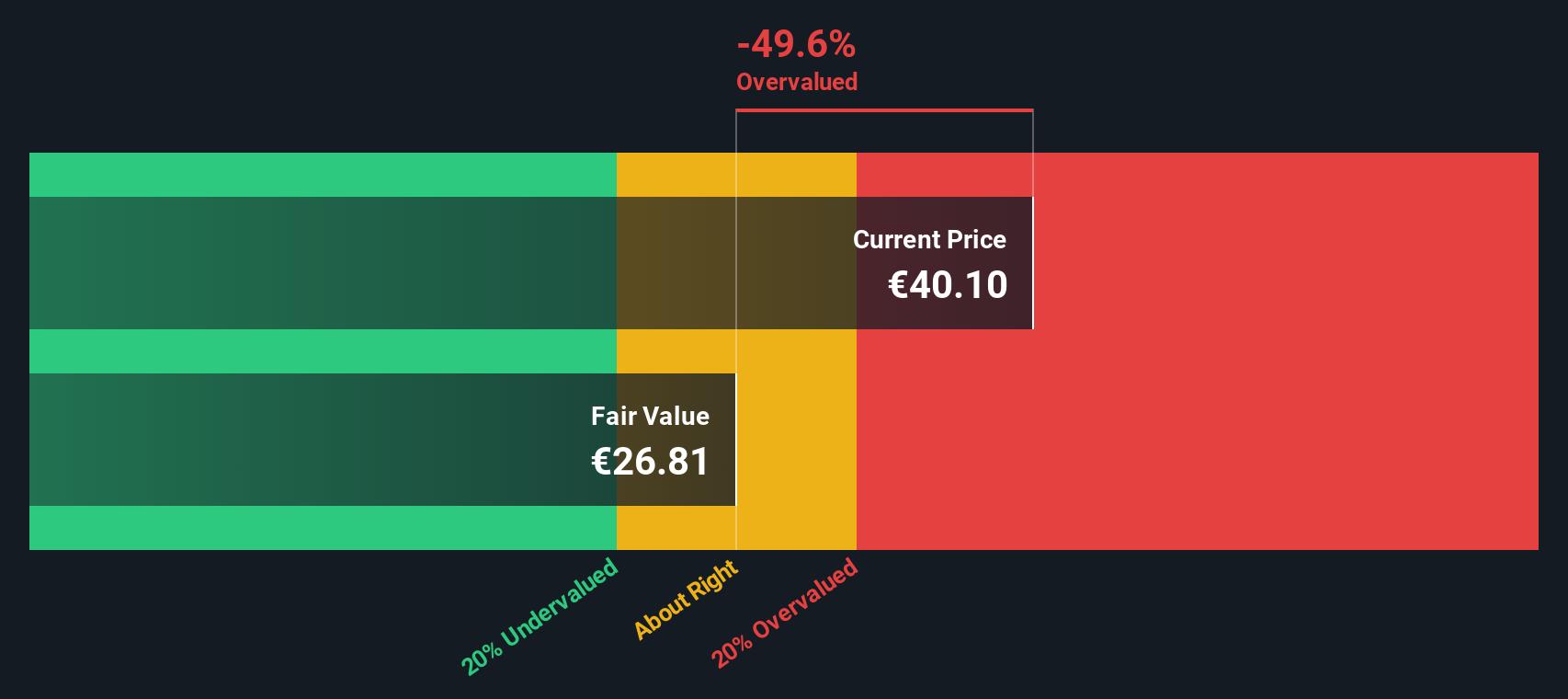

Looking at Bechtle through our DCF model provides a more cautious perspective. The SWS DCF suggests the current share price of €40.10 is above the estimated fair value of €26.81, which indicates the stock may be overvalued based on projected future cash flows. Could recent optimism be ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

BC8 Discounted Cash Flow as at Nov 2025

BC8 Discounted Cash Flow as at Nov 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bechtle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Bechtle Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Bechtle.

Looking for more investment ideas?

Take control of your investing journey by checking out other exceptional stocks picked for their innovation, value, and long-term potential. Make your next move count and don’t let great opportunities pass by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bechtle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com