One of Australia’s leading travel businesses, Corporate Travel Management, is embroiled in an overcharging scandal potentially worth more than $100 million.

Brisbane-based Corporate Travel, a sharemarket listed business valued at more than $2 billion, was founded by enthusiastic multimillionaire entrepreneur Jamie Pherous, who once had Jimmy Barnes sing at his 50th birthday party on Queensland’s Hamilton Island.

Mr Pherous once had Jimmy Barnes sing at his 50th birthday party on Queensland’s Hamilton Island. (Facebook: Corporate Travel Management)

The company helps arrange travel bookings for clients ranging from Wesfarmers to the Australian government to managing refugee barges for UK authorities.

But its shares have been suspended since August as it initiated a review into accounting — before dropping a massive bomb on investors on Friday.

Following a review, it would have to backtrack on revenues recorded in the UK for the past three financial years. That includes 58.2 million pounds ($117.8 million) for the 2023 and 2024 financial years.

Another 19.4 million pounds it had planned to book in the 2025 financial year was also under review.

Corporate Travel Management’s client list includes the federal government. (Corporate Travel Management)

The company flagged that customers would have to be refunded but has not spelled out how much cash is required. The matter was serious enough that the head of European operations has been stood down.

It refused to answer what the nature of the problem was, leading to speculation that it could involve ticket refunds not being passed back to customers.

Possible refunds could lead to ‘significant cash impacts’

Corporate Travel has been targeted for years by short sellers — who make money from share prices falling — who had doubts about its accounting.

It always rejected the accusations.

Corporate Travel was adamant on an analyst call on Friday morning that the problem was not affecting other operations, stretching from the US to Australia.

Mr Pherous said the issue was “isolated to a small number of UK customers only”. (Corporate Travel Management)

“I just want to reassure you that this point is isolated to a small number of UK customers only … we’re committed to the remediation process,” its managing director Mr Pherous said.

“For the rest of the world … we continue to offer great service.”

The problem’s scale shocked many in the market — partly because the company had in August indicated that the problem would actually be the reverse.

“Prior messaging indicated no impact on cash would be recorded,” UBS equity analyst Tim Plumbe told clients.

The company’s shares have been suspended since August as it initiated a review into accounting. (Corporate Travel Management)

RBC Capital Markets analyst Wei-Weng Chen said the impact was worse than initially expected, and up to a third of European revenues may need to be restated.

Possible refunds could “could lead to significant cash impacts”, he wrote.

Corporate Travel said it was holding $143 million in cash and had not drawn down debt, but questions remained about the willingness of banks to lend to a company that has not published accounts.

Reputational fallout could be ‘substantial’

Tony O’Connor, managing director at business travel advisory Butler Caroye, tried to clarify on the analyst call whether the problem was due to fees charged or commissions retained, but the company did not clarify.

He told the ABC that a possible explanation for the refunds was where a travel management company acquired travel tickets for a client. The travel was then cancelled, the refund given to the travel management company, but not passed back to the customer.

“The figure is too big to be anything else,” Mr O’Connor said.

He said the reputational fallout for a travel management company with the refunds could be “substantial”.

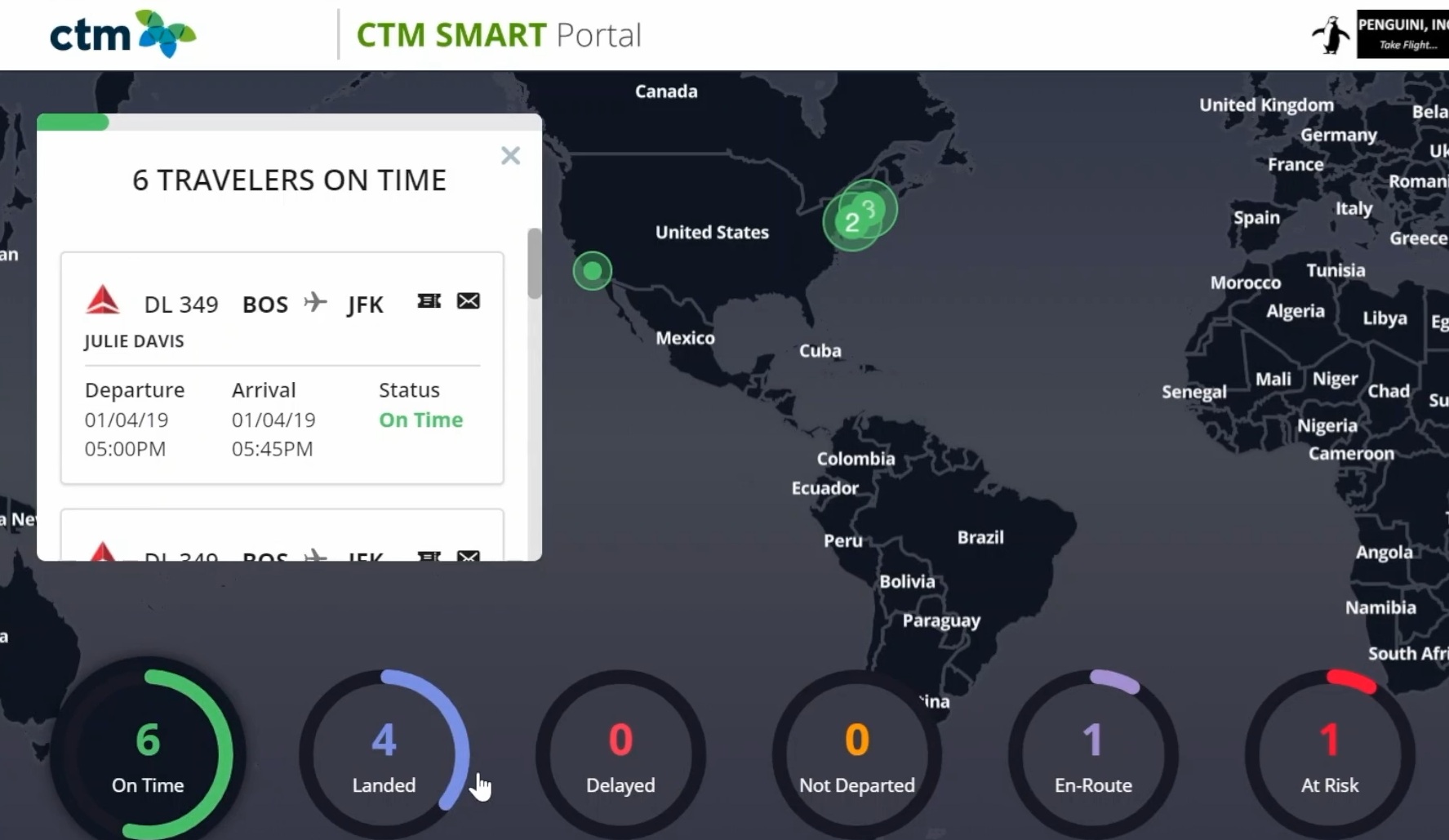

A promotional video for Corporate Travel Management, which helps arrange travel bookings for clients ranging from Wesfarmers to the Australian government. (Corporate Travel Management)

Analysts were frustrated on the conference call, such as when the company — asked if the UK government was one of the overcharged customers — refused to comment.

“Can I just ask why not? Cause’ it’s [a] sort of factual yes-no response if you’ve spoken to them in the last week,” Ord Minnett’s head of institutional research, Alastair Hunter, said.

“It’s somewhat significant as to whether they are government or not entities.”

Corporate Travel cited confidentiality in refusing to identify customers.

Market speculation was the UK government was involved — Corporate Travel has won some major government contracts, including helping repatriate UK residents during the COVID-19 pandemic.

Most controversially, it also ran a project in which asylum seekers were housed on floating barges for the UK government.

The company had initially told analysts the contract’s sustainable margins would be “low”, but a subsequent earnings downgrade revealed it had planned on earning margins of at least 50 per cent.

A major contract in Australia is the whole of government deal, which it won in 2023 and was scheduled to run for at least four years.

The company also warned of taking an additional $13.9 million hit from outstanding money in the Australia-New Zealand region which might not be recovered, stressing this was unrelated to the UK problem.

Corporate Travel did not expect to file its accounts for the 2025 financial year by this year and its shares would remain suspended.