08:21 GMT

By Ben Chu, policy and analysis correspondent

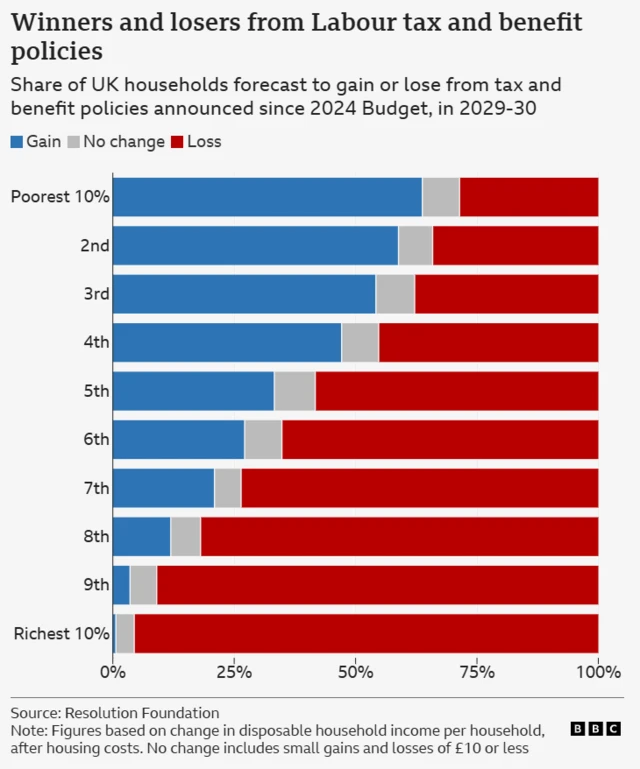

BBC Verify has examined what we know about how the Budget is likely to affect different groups financially.

Do the wealthy bear more of the new tax burden?

The Treasury’s analysis, external suggests that by 2028-29, the tax measures in the Budget will reduce the incomes of the top 10% of earners in the UK population by around £2,000.

In comparison, middle earners will see their incomes fall by about £300, while the bottom 20% of earners will be about £200 worse off.

Do the less well off benefit from other Budget measures?

The Treasury also says people on lower incomes will benefit much more than richer people from measures such as taking costs off electricity bills, freezing fuel duty and scrapping the two child limit. The top 30% of earners will see little cash gain.

What to keep in mind

It’s worth bearing in mind, however, that these calculations only show the impact of the Budget measures.

What actually happens to people’s incomes overall, wherever they are in the UK’s income distribution, will depend on how the wider economy performs.