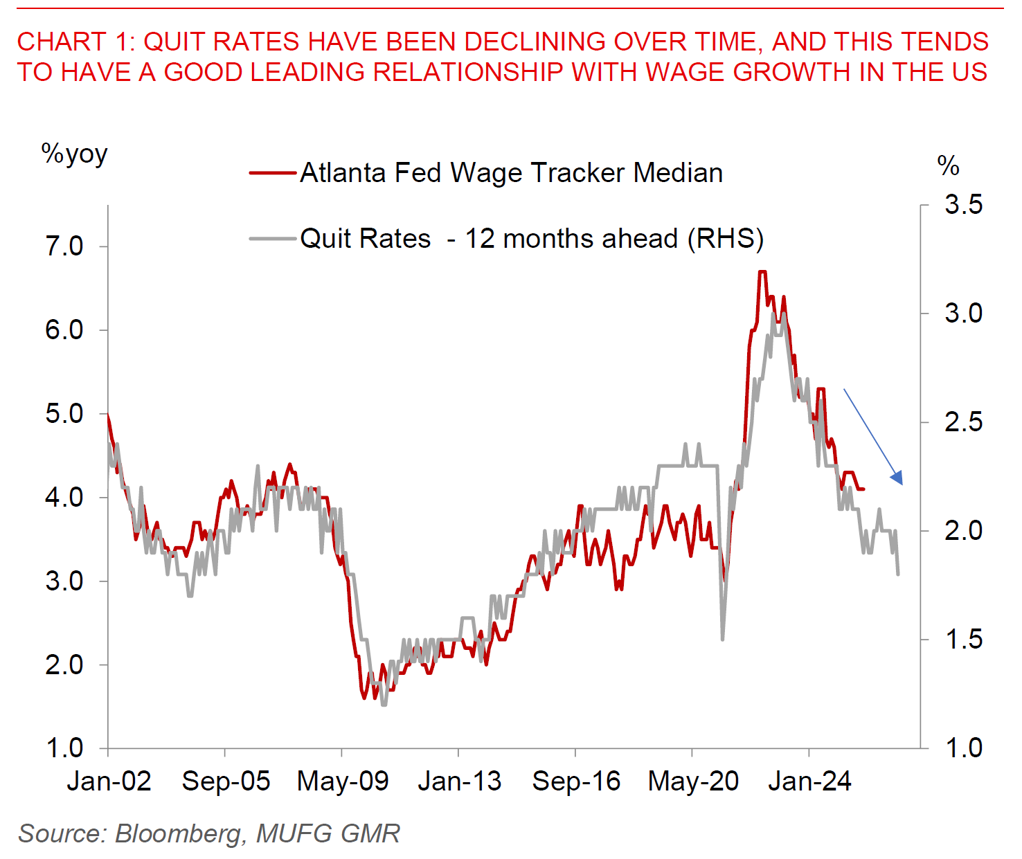

US yields increased and the Dollar strengthened modestly as US JOLTS jobs openings picked up and small business sentiment improved. Nonetheless details such as declining hiring rates and rising layoffs point to labour market softness. Meanwhile, Taiwan’s exports continued to defy gravity with strong electronics and AI demand. In particular, US jobs openings rose by 7658k in September, from 7227k the previous month, and with the jobs opening rates holding steady at 4.6%. We saw some modest deterioration in some of the other labour market indicators such as quit rates, which fell to 1.8% from 2.0% previously, and layoff rates, which rose to 1.2% from 1.1%. We find that quit rates have a very good leading relationship with wage growth, and if this historical correlation holds, could imply wage growth moderates further over the next 6-12 months. Meanwhile, the NFIB Small business index improved to 99.0 from 98.2 previously, with a pickup in hiring plans with a net 19% of owners planning to create new jobs in the next three months, while the proportion of owners raising average selling prices rising to 34%.