The treasurer has given the green light for the South Korean defence conglomerate Hanwha to take a larger stake in the Australian shipbuilder Austal, after months of protracted deliberations that saw the government consult national security agencies while walking a diplomatic tightrope with Japan.

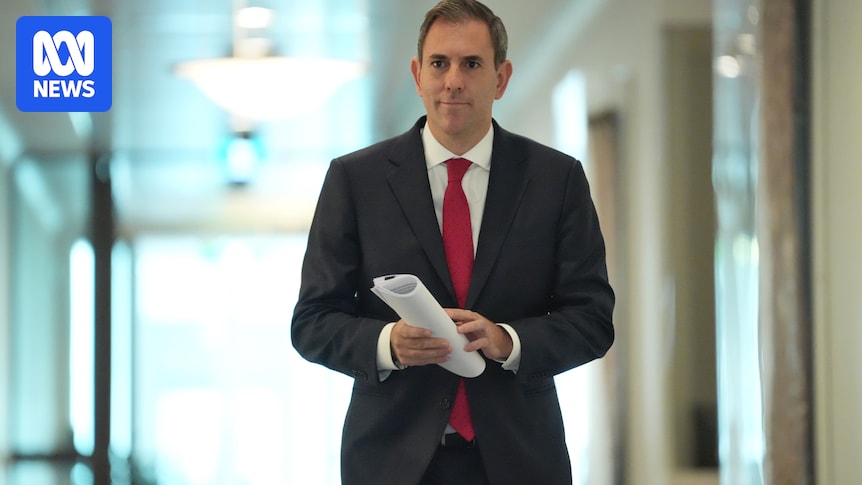

But Jim Chalmers said there will be “strict conditions” on Hanwha’s stake in the strategic shipbuilder, in a nod to the diplomatic and security sensitivities surrounding the bid.

The Foreign Investment Review Board (FIRB) spent more than 10 months scrutinising Hanwha’s pitch to lift its stake in Austal from 9.9 per cent to 19.9 per cent after the Australian shipbuilder rejected an earlier takeover bid from the company.

While the decision could help lift Australia’s shipbuilding capacities and expertise, Japan — which has a sometimes-fraught relationship with South Korea — has reportedly raised concerns over the bid.

Austal is set to play an important role in AUKUS and also to help build the Japanese Mogami frigates at the Henderson shipyard from the 2030s, raising the risk that Hanwha might be able to access technology owned by its Japanese rival Mitsubishi Heavy Industries.

In a statement, Mr Chalmers said the decision “was not taken lightly and comes after extensive consultation and long and careful deliberation”.

“It follows a thorough and robust process that took account of all the relevant economic, national security and other national interest issues,” he said.

The treasurer also said FIRB had reached the same conclusion, and that his decision was “entirely consistent with FIRB’s unequivocal advice not to object to the proposal, subject to conditions”.

Japan raised concerns about bid

Under the move, Hanwha would remain a minority shareholder and would not be able to increase its shareholding above 19.9 per cent.

Limits would also be placed on Hanwha’s access to “sensitive information” and possible board appointments to Austal.

Earlier this year, the Nightly reported that Japanese officials had twice written to the Department of Defence to raise concerns about the Hanwha bid.

But one diplomatic source, speaking on the condition of anonymity, said Australia had calmed Japan’s nerves by reassuring Tokyo that sufficient protections had been put in place to protect Japanese intellectual property.

Mr Chalmers said Austal was a “key pillar of our plan to boost local manufacturing and industry capabilities”.

“This decision and associated conditions will protect our sovereign interests in this capability and ensure the company can continue to grow, invest, and deliver continuous shipbuilding in Western Australia,” he said.

“Australia welcomes foreign investment and operates a non-discriminatory foreign investment framework to ensure foreign investment is in our national interest.”

Decision provides ‘clarity’

In a statement, Austal chief executive Paddy Gregg said the company “respected” the Treasurer’s decision and that it provided “clarity” to the company.

The company also said it would “closely review the opportunities and risks” associated with any pitches from Hanwha for additional partnerships on shipbuilding opportunities.

“Relevant factors which would need to be assessed would include feedback from design partners, the efficient running of the board and its meetings, given discussion of sensitive national security topics”, as well as “potential additional governance and security measures required of the company.”

The CEO and President of Hanwha Aerospace Jae-il Son said the company was “pleased” by the decision, which he said would create opportunities for the two companies “to strategically collaborate on global defence shipbuilding business.”

“Today’s decision follows a robust and thorough review process by FIRB and the treasurer, and we are pleased that we have been able to meet the Australian government’s expectation,” he said.

“We also respect conditions for the approval and Hanwha will maintain full compliance.

“We have always been confident of the benefits our investment will bring, and we will leverage our capabilities and insights for the benefit of the company and its stakeholders.”