1h agoMon 22 Dec 2025 at 8:54pmMarket snapshotASX Futures: +0.1% to 8,684 points

Australian dollar: +0.7% to 66.55 US centsWall Street: Dow Jones (+0.5%), S&P 500 (+0.7%), Nasdaq (+0.5%) Europe: DAX (+0.02%), FTSE (-0.3%), Stoxx 600 (-0.1%)Spot gold: +2.3% to $US4,437/ounceOil (Brent crude): +2.8% to $US62.16/barrelIron ore: +0.2% to $US104.90/tonneBitcoin: +0.02% at $US88,177

Prices current around 7:50am AEDT

7m agoMon 22 Dec 2025 at 10:15pmOil update

Brent crude is up +2.6% to $US62.02.

Here is a look back at its movements this year:

Brent crude from July 2025 until December 2025 (Refinitiv)22m agoMon 22 Dec 2025 at 10:00pmUS markets update

Brent crude from July 2025 until December 2025 (Refinitiv)22m agoMon 22 Dec 2025 at 10:00pmUS markets update

All of the US markets have closed in the green.

S&P 500 up +0.6%Dow Jones up +0.5%Nasdaq Composite up +0.5%38m agoMon 22 Dec 2025 at 9:43pmLarry Ellison personally steps in on streaming deal

The Oracle co-founder Larry Ellison is personally promising a cheque of $US40.4 billion in Paramount Skydance’s latest push to convince Warner Bros to move away from selling its film assets to competitor Netflix.

Mr Ellison is hoping to shatter any doubts the Warner Bros board has about Paramount’s financing and the lack of full Ellison family backing.

Initially, Warner Bros asked shareholders to reject the $US108.4 billion offer Paramount put forward for the whole company, due to financial doubts and a lack of confidence from the Ellison family.

According to Reuters, Paramount said the amended terms do not change the $US30-per-share all-cash offer even as the fight for Hollywood’s sought-after assets heats up, with control of Warner Bros’ vast library offering a decisive edge in the streaming wars.

But now, many of the Warner Bros investors say they are open to a revised offer from Paramount, as long as its a superior bid and addresses issues with deal terms.

If this happens, Warner Bros would owe Netflix $US2.8 billion as break-up fee.

52m agoMon 22 Dec 2025 at 9:30pm

Finance report with Dan Ziffer

The competition regulator is telling consumers to shop around when it comes to electricity prices as its report demonstrates a “loyalty tax” on long-term plans.

Here is Monday’s finance report.

52m agoMon 22 Dec 2025 at 9:30pmEconomic hits and misses of the year

Our colleague Dan Ziffer spent the past few weeks quizzing some of the country’s most prominent economists about four intertwined elements that helped to define the year.

They include:

Trump’s tariff regime ripping up the rule book that had governed world trade for decadesThe Reserve Bank’s interest rate cutsMarkets in Australia, the US, UK, Japan and elsewhere hitting record highsExplosive growth in artificial intelligence (AI).

You can read his report below:

1h agoMon 22 Dec 2025 at 9:14pm

Better late than never: The gas fix to a problem that should never have beenThat’s the title to chief business correspondent Ian Verrender’s latest piece of analysis.

It talks about the gas export industry costing the nation dearly. You can read it here:

1h agoMon 22 Dec 2025 at 9:00pmThe details on Wall St

The Wall Street market is looking strong as it finishes its final hour of trading.

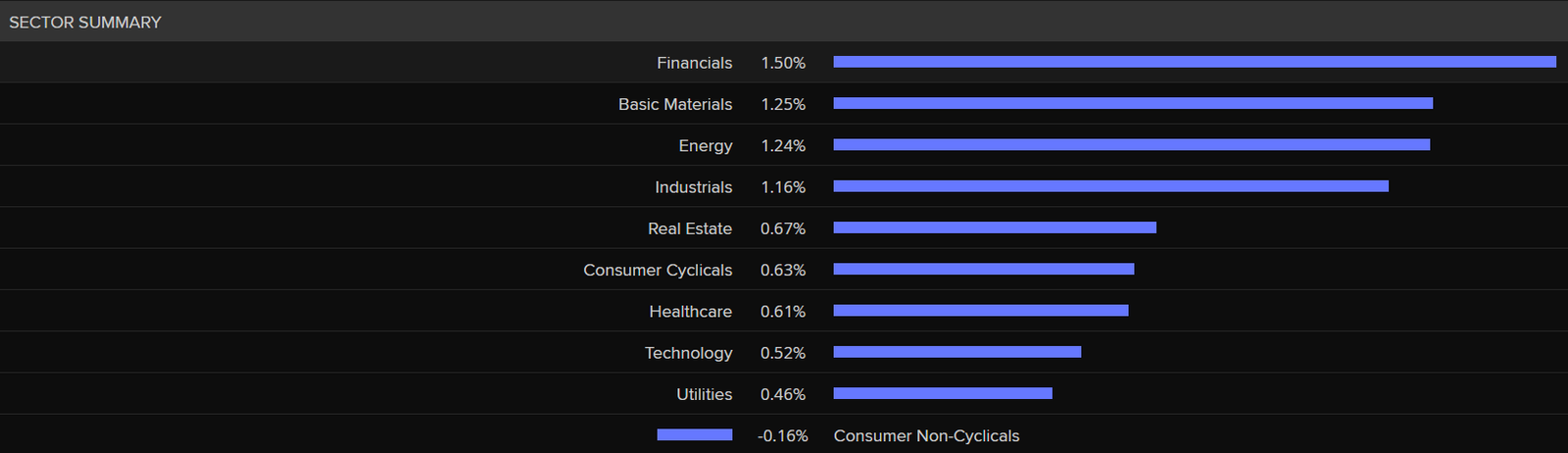

The S&P 500 is making particularly strong gains, up +0.6%, and with nine of its 10 sectors up.

Only Consumer Non-Cyclicals is down -0.2%.

The financial sector is leading the way, up +1.5%.

Here is a closer look at the sectors.

S&P 500 sector summary (Refinitiv)

S&P 500 sector summary (Refinitiv)

Of the stocks, there are 107 stocks in the red, two unchanged, and 394 gaining.

The tech sector comeback is contributing to the overall positive Wall Street results, with Micron Technology up +3.6% and Nvidia Corp up +2.4%.

1h agoMon 22 Dec 2025 at 8:45pmGold snapshot

Here is a graph of gold’s movements over the past 20 months.

It captures its position back in April last year until now — with a little look at where things are positioned to go early next year.

It also includes silver, which has also jumped +2.3% and hit a record high of $US69.44.

Gold movements from April 2024 until now (Reuters)1h agoMon 22 Dec 2025 at 8:30pmGold jumps more than 2pc

Gold movements from April 2024 until now (Reuters)1h agoMon 22 Dec 2025 at 8:30pmGold jumps more than 2pc

Gold has jumped to an all-time high as geopolitical tensions and economic uncertainty continue to grow.

As of 7:20am, gold is up +2.2% to $US4,434.

Because gold is known as a safe-haven (basically an asset that stabilises or increases in value during market turbulence), this move makes sense according to analysts, because of the tensions between the US and Venezuela.

One analyst quoted in Reuters said: “The obvious target for gold bulls is $5,000 next year.”

2h agoMon 22 Dec 2025 at 8:19pmASX to open in the green

Good morning, and welcome to the ABC’s finance blog! Adelaide Miller here — I’ll be your guide for the next few hours.

It’s looking like the Australian share market will start slightly up, with ASX futures up +0.1%.

Wall Street is up as it enters its final hour of trading, with the S&P 500 up +0.6%, the Nasdaq Composite up +0.5%, and the Dow Jones also up +0.5%.

The Australian dollar is slightly up +0.7% at 66.52 US cents.

I’ll bring you more updates shortly, but for now, go grab a coffee!

ASX Futures: +0.1% to 8,684 points

ASX Futures: +0.1% to 8,684 points