The artificial intelligence (AI) buildout is far from over.

Checking up on what billionaire hedge fund managers have in their portfolios can be a smart idea for investors. This information is publicly released 45 days after a quarter ends through a Form 13F. While this doesn’t give up-to-date information on what these hedge fund managers are doing, it at least informs investors on some potential solid stock picks.

One billionaire I follow is Philippe Laffont of Coatue Management. He has had some incredible success, and after examining some of his top portfolio holdings, it’s clear he’s bullish on artificial intelligence (AI). About a third of his portfolio is invested in six monster AI stocks, and I think each of these should be owned by individual investors in 2026.

Image source: Getty Images.

All six stocks look primed to excel in 2026

The six AI-focused holdings Coatue Management has are:

Meta Platforms (META 0.56%) (7.3% of portfolio)

Microsoft (MSFT 0.06%) (5.9% of portfolio)

Taiwan Semiconductor Manucturing (TSM +1.35%) (5.5% of portfolio)

Amazon (AMZN +0.06%) (4.7% of portfolio)

Nvidia (NVDA +1.09%) (4.5% of portfolio)

Alphabet (GOOG 0.23%) (GOOGL 0.20%) (4.3% of portfolio)

Altogether, that adds up to 32.2%, or about a third of total portfolio assets. However, he also has exposure to other AI investments in his portfolio; these are just some of the largest ones. It’s clear that this billionaire believes that these six will do well in 2026, and I think he’s right on track.

The AI buildout is far from over

Infrastructure players like Nvidia are set to do well in 2026. The demand for graphics processing units (GPUs) is insatiable, as the AI hyperscalers are looking to get as much computing power online as fast as possible. Nvidia told investors during its Q3 earnings release that it is “sold out” of cloud GPUs because demand is so high. This bodes well for anyone in this industry, including Taiwan Semiconductor, which is a major chip supplier to Nvidia.

Today’s Change

(1.09%) $2.05

Current Price

$190.66

Key Data Points

Market Cap

$4.6T

Day’s Range

$189.63 – $192.69

52wk Range

$86.62 – $212.19

Volume

5.5M

Avg Vol

189M

Gross Margin

70.05%

Dividend Yield

0.02%

AI buildouts are expected to persist for many years. Nvidia expects global 2025 data center capital expenditures to reach $600 billion. However, that figure is expected to rise to $3 trillion to $4 trillion by 2030.

If that pans out, businesses like Taiwan Semiconductor and Nvidia make for incredible purchases right now. Combine that with the fact that each of these stocks is down a bit from its all-time high, and each seems like a smart purchase.

Moving to the AI hyperscalers, companies like Meta, Microsoft, Amazon, and Alphabet are all spending a ton of money on AI computing capacity. While investors may be getting a bit fed up with these expensive capital expenditures, all four believe that this investment is necessary to stay relevant in the future.

Of these four, Meta may be the most intriguing. Meta’s stock fell hard after Q3 earnings. While its growth and profitability were great, investors took issue with management’s spending plans for 2026. As a result, the stock plummeted, and it’s now the cheapest of these six when valued using next year’s earnings.

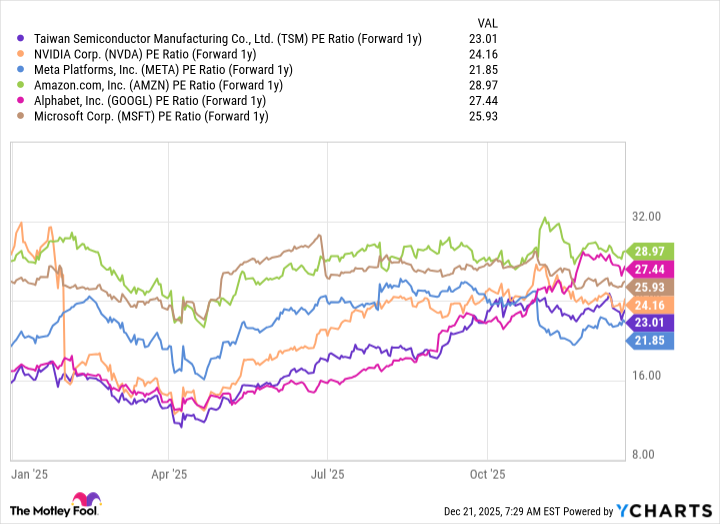

TSM PE Ratio (Forward 1y) data by YCharts

At 21.8 times next year’s earnings, Meta is priced about the same level as the S&P 500 index. With Meta expected to deliver market-beating growth, it seems like a no-brainer investment.

Amazon, Alphabet, and Microsoft all operate leading cloud computing platforms. These will be long-term winners, as clients continue to need more and more computing capacity as generative AI workloads become more common. Furthermore, each of these companies also has its own generative AI model or has deep partnerships with one of the major players. This places them in a great position to succeed not only in 2026, but also in the years after.

Today’s Change

(-0.20%) $-0.62

Current Price

$313.47

Key Data Points

Market Cap

$3.8T

Day’s Range

$312.27 – $315.10

52wk Range

$140.53 – $328.83

Volume

475K

Avg Vol

36M

Gross Margin

59.18%

Dividend Yield

0.26%

Billionaire Philippe Laffont has positioned his portfolio wisely to take advantage of the massive AI buildout. I think investors should do the same, and these six are a great place to start.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.