(Bloomberg) — ASML Holding NV Chief Executive Officer Christophe Fouquet walked back his forecast that sales will grow next year, blaming trade disputes and global tensions.

Most Read from Bloomberg

Fouquet, who in October told investors he expected 2026 to be a growth year for the semiconductor industry and ASML, took a more cautious stance on Wednesday when the company reported its second-quarter results.

“We continue to see increasing uncertainty driven by macro-economic and geopolitical developments,” Fouquet said in a statement. “Therefore, while we still prepare for growth in 2026, we cannot confirm it at this stage.”

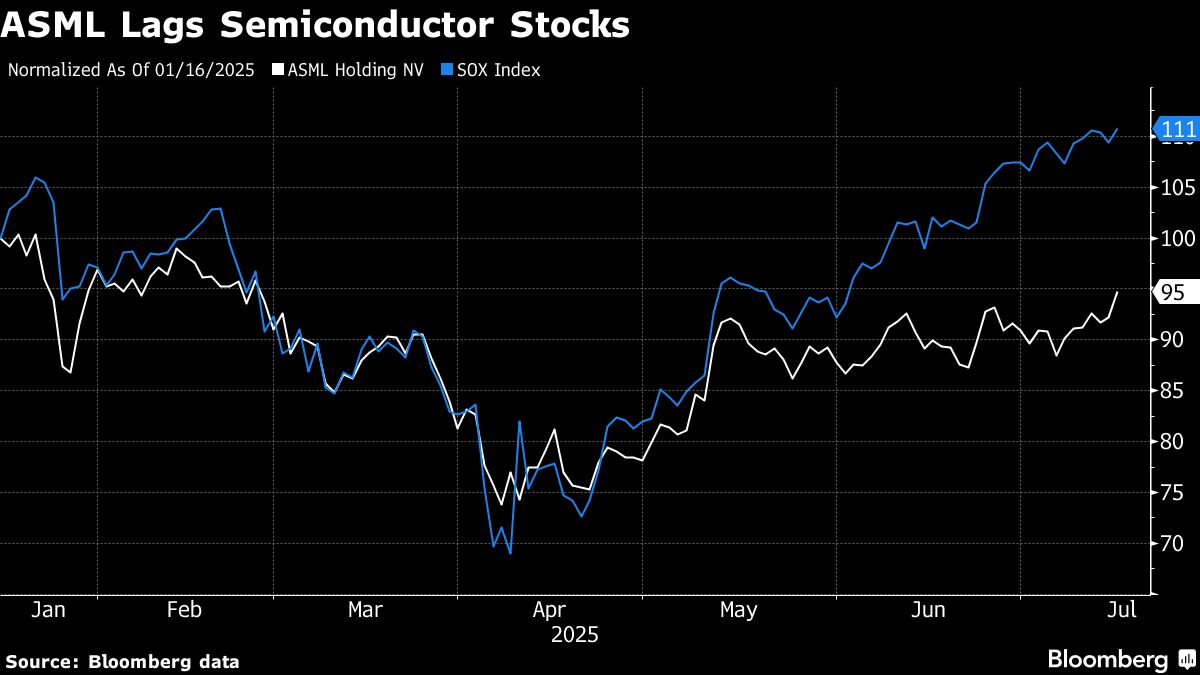

The Dutch firm’s shares fell as much as 11% to €630.70 in Amsterdam on Wednesday, the biggest intraday decline since Jan. 27. It has shed about €140 billion ($155 billion) in value over the last year.

ASML is the only company that makes the type of cutting-edge lithography machines needed to manufacture chips used in everything from Apple Inc.’s smartphones to Nvidia Corp.’s artificial intelligence accelerators. The firm has been caught in between the US and China — its biggest market last year — as their relationship deteriorates.

While tensions between the two nations have eased in recent days, Fouquet’s comments reflect how mixed messages from Washington on trade and foreign relations are weighing on the semiconductor industry.

ASML forecast third-quarter net sales between €7.4 billion and €7.9 billion. That’s below the €8.2 billion average analyst estimate, according to data compiled by Bloomberg. It expects 15% revenue growth for the year.

Chief Financial Officer Roger Dassen said ASML’s clients are more worried about the global trade war now than they were in April.

“Our customers are more concerned about the tariffs discussion today than they were three months ago,” Dassen said on a call with analysts Wednesday. “Countries are in full battle mode again when it comes to tariffs.”

Washington’s chaotic trade policy rollout has roiled markets and made planning major spending difficult. While chips are currently exempt from the US reciprocal tariffs set to take effect on Aug. 1, President Donald Trump has said sector-specific levies on semiconductors could also be in the cards.

Despite ASML’s downgraded outlook for next year, Fouquet said the company’s “AI customers’ fundamentals remain strong.”

Story Continues

There are also signs that tensions between the Trump administration and Beijing are easing. On Tuesday, Nvidia and Advanced Micro Devices Inc. said they would restart sales of some AI processors to China that had previously been blocked, after gaining assurances from the Trump administration that the shipments would be approved.

While dropping the ban would be good for the industry, the direct impact on ASML’s business is limited, according to Dassen. “Are we going to sell 20 more tools as a result of that? Probably not,” he said.

ASML is poised to benefit from hundreds of billions of dollars of investment pouring into AI data centers. Its extreme ultraviolet lithography machines are needed to produce Nvidia’s most cutting-edge chips, which are the backbone of much of the planned AI infrastructure.

ASML reported bookings of €5.5 billion in the second quarter, beating estimates. ASML plans to stop reporting the figure next year, arguing orders don’t always reflect its business momentum.

The company still faces a number of restrictions on its sales to China, which accounted for 27% of system sales last quarter. It has never been able to sell its most-advanced EUV machines to the country because of US-led restrictions.

Last year, the Dutch government also blocked immersion deep ultraviolet lithography systems — the company’s second-most capable machines — to China after pressure from the US.

The threat of more tariffs also loom. The US government is expected to finish an investigation into the trade of semiconductors and semiconductor manufacturing soon, and that could lead to chip-specific levies.

–With assistance from Sarah Jacob.

(Updates shares, adds fresh CFO comments.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.