Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

The US currency rebounded on Wednesday after US Treasury secretary Scott Bessent said Washington was still pursuing a “strong dollar policy” and was not planning an intervention to boost the Japanese yen.

The dollar jumped as much as 0.9 per cent against the euro and 1 per cent against the yen after Bessent said in an interview with CNBC that he expected the US currency to appreciate.

“The US always has a strong dollar policy, but a strong dollar policy means setting the right fundamentals,” Bessent said, adding that the administration’s policies were making the US “the best place to come”.

“If we have sound policies, the money will flow in and we are bringing down our trade deficit, so automatically that should lead to more dollar strength over time,” Bessent said.

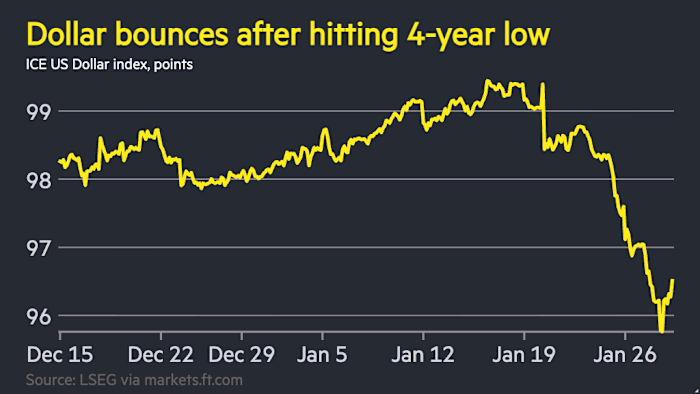

The remarks come after US President Donald Trump said on Tuesday evening that the recent fall in the US currency was a “great” development, pushing the dollar to its lowest level in four years against a basket of peers.

The dollar has fallen almost 2 per cent since last week amid speculation that the US Treasury was considering intervention in foreign exchange markets after it emerged that the New York Federal Reserve had conducted a check on the dollar-yen exchange rate on behalf of the administration on Friday. Rate checks are often seen as a precursor to foreign exchange intervention.

Asked if the US Treasury was intervening in foreign exchange markets to prop up currencies against the dollar, Bessent replied “absolutely not”.

The speculation around a potential joint US-Japan intervention in currency markets, combined with Trump’s comments, had been taken by some investors as a sign that the administration was shifting its stance to welcome a broadly weaker dollar.

Meera Chandan, co-head of global FX strategy at JPMorgan, said the clarification from Bessent dispelled speculation that there is “a massive plot to weaken the dollar”, and assured investors that “it is going to be the usual market forces that are driving it stronger or weaker”.

The Japanese yen weakened back to ¥153.46 per dollar after the remarks, as hopes of a joint intervention faded. It had weakened to almost ¥160 before the New York Fed’s rate check.

Chandan said pressure on the yen “is going to remain and the market is going to test that”. Concrete US interventions in foreign exchange markets are rare. Since 1996, after then-Treasury secretary Robert Rubin initiated a “strong dollar policy”, the US has only intervened three times.

“The market clearly believes that there were rate checks last week. There was no actual intervention. In that sense it is strictly correct that the US is not intervening in dollar-yen,” said Shahab Jalinoos, head of G10 FX research at UBS.

Jalinoos noted that he believes that if the exchange rate were to move up to ¥160, the market would be expecting another “soft” intervention.