Stay informed with free updates

Simply sign up to the US equities myFT Digest — delivered directly to your inbox.

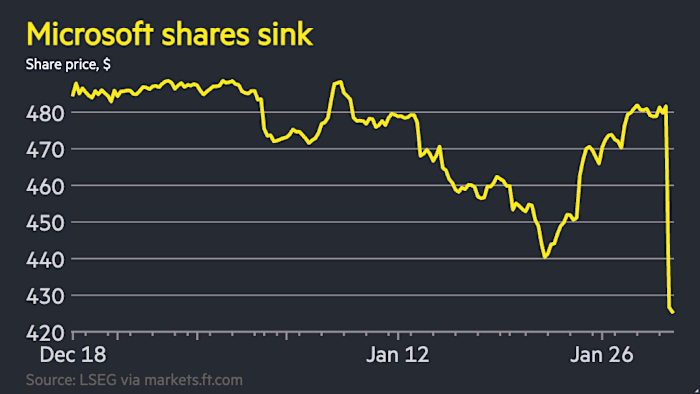

Microsoft’s market value tumbled by $360bn after the US tech behemoth reported a surge in data centre spending, reigniting worries about Silicon Valley’s vast investment in AI infrastructure.

The software group’s shares slid 10 per cent on Thursday, its worst day since the height of the coronavirus pandemic in 2020 and bringing Microsoft’s market capitalisation to $3.2tn.

Thursday’s fall came after Microsoft reported a 66 per cent year-on-year surge in its data centre spending, taking its capital expenditure to $37.5bn in the three months to December.

Microsoft also reported slower than expected cloud growth, although adjusted net income and revenue both exceeded analysts’ expectations.

The sell-off underscores how investors remain nervous about the bumper spending by Big Tech companies to provide the computing power necessary to train and run large AI models. While Wall Street is enthusiastic about the potential for AI to transform many industries, it remains unclear how long it will take for the large costs to pay off.

“The scale of spending is so high that there’s a laser focus on the monetisation of it,” said Venu Krishna, head of US equities strategy at Barclays.

The broader market also pulled back on Thursday, tracking the fall in Microsoft shares.

The tech-heavy Nasdaq Composite fell as much as 2.6 per cent on Thursday morning, before trimming losses to trade 1.3 per cent lower by early afternoon. The broader S&P 500 was 0.6 per cent lower.

Investors expressed nervousness about Microsoft’s over-reliance on OpenAI, with Wednesday’s results revealing that 45 per cent of Microsoft’s $625bn book of future cloud contracts came from the ChatGPT maker.

“The market is watching the exposure of Microsoft on OpenAI,” said Manish Kabra, head of US equity strategy at Société Générale.

The FT reported on Wednesday that OpenAI was in talks to raise close to $40bn in its upcoming funding round from Nvidia, Microsoft and Amazon — three of its largest infrastructure providers — reigniting fears about circular financing in the AI sector.

Oracle, which has signed a $300bn data centre deal with OpenAI, fell 4.5 per cent on Thursday, while Nvidia slipped 0.1 per cent.

Meta, by contrast, climbed 10.2 per cent after its results exceeded expectations, highlighting a growing dispersion between Silicon Valley’s giants.

Correlations between megacap tech stocks “have declined to historic lows”, said Barclays’ Krishna.

“We have entered a new stage in the AI narrative,” he added. “We’ve moved from a ‘rising tide’ concept to a winners and losers phase, as the market tries to assess which business model has the edge.”

Recommended

Adding to the downbeat sentiment on Thursday, expectations of bumper US growth in the fourth quarter of 2025 cooled after data showed a widening trade deficit in November.

The Atlanta Federal Reserve’s GDPNow forecast for fourth-quarter growth fell from an annualised 5.4 per cent to 4.2 per cent following a trade report that showed imports rising and exports sliding in November, sending the deficit sharply higher to $57bn after months of declines.

The Trump administration has touted the economy’s rapid growth in the second half of 2025 as evidence of the success of its fiscal policies. Data released this month put growth at 4.4 per cent in the third quarter of 2025, prompting US President Donald Trump to describe the US as “the hottest country anywhere in the world”.