The strong growth of Hong Kong’s private banking and wealth management sectors will drive increased hiring and leasing of office space in the coming years, according to the chief executive of Hong Kong Monetary Authority (HKMA).

Major private banks’ assets under management (AUM) in the city rose 14 per cent in the first half of the year compared with the end of December, while they hired more than 400 wealth management experts in the last two years, an increase of 12 per cent, said Eddie Yue Wai-man, without naming them.

HSBC and Standard Chartered reported strong growth in their wealth management business in the first half in their interim results last week.

Transactions by the city’s 46 private banks hit HK$4.47 trillion (US$569.4 billion) last year, up 50 per cent from HK$2.97 trillion in 2022, he said, adding that some of them expanded their office space by as much as 50 per cent in recent years.

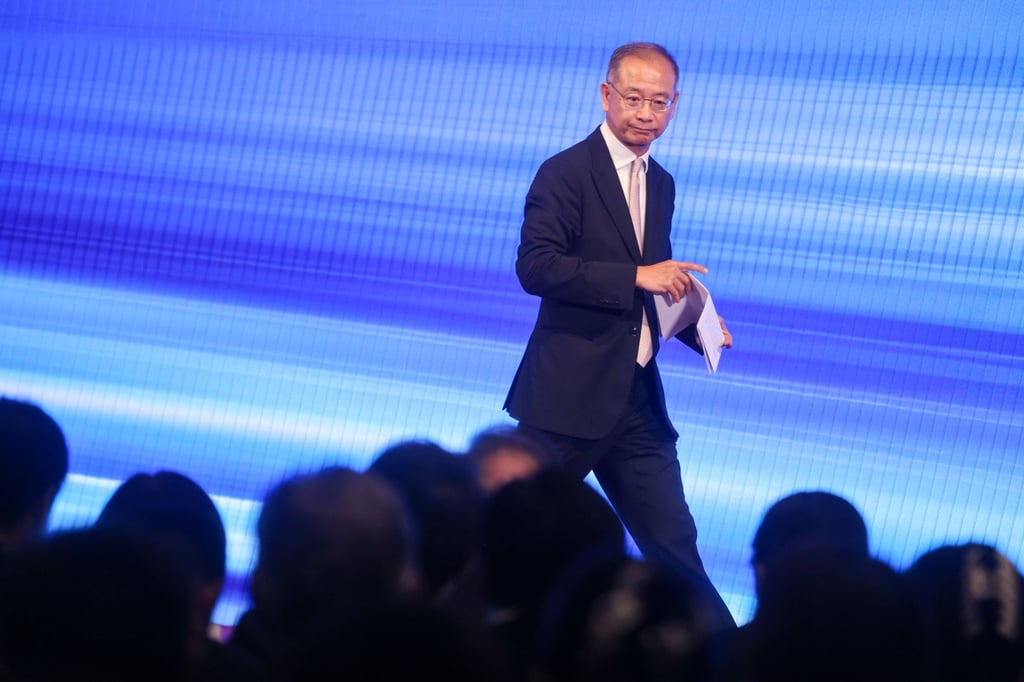

HKMA chief executive Eddie Yue says Hong Kong lenders have benefited from the fast-growing wealth in Asia. Photo: Jonathan Wong

HKMA chief executive Eddie Yue says Hong Kong lenders have benefited from the fast-growing wealth in Asia. Photo: Jonathan Wong

“Recently, a number of international banks and asset management firms have announced plans to further enlarge their operations in the city, with headcount growth projected to range from 10 per cent to 100 per cent in the next few years,” Yue said in an article posted on the HKMA’s website.