The government look set to make things easier for big gas guzzling vehicles with the announcement yesterday that they’re progressing with plans to replace fuel taxes with road user charges.

Cabinet has agreed to a series of important legislative changes to enable the transition of New Zealand’s 3.5 million light vehicles to paying for our roading network through electronic road user charges, rather than petrol tax, says Transport Minister Chris Bishop.

“The abolition of petrol tax, and the move towards all vehicles (whether they be petrol, diesel, electric or hybrid) paying for roads based on distance and weight, is the biggest change to how we fund our roading network in 50 years,” Mr Bishop says.

“Right now, New Zealanders pay Fuel Excise Duty (FED, or petrol tax) of about 70c per litre of petrol every time they fill up at the pump with a petrol car. Diesel, electric, and heavy vehicles pay Road User Charges (RUC) based on distance travelled.

“This revenue is funnelled into the National Land Transport Fund which funds the building of new roads and maintaining our existing ones.

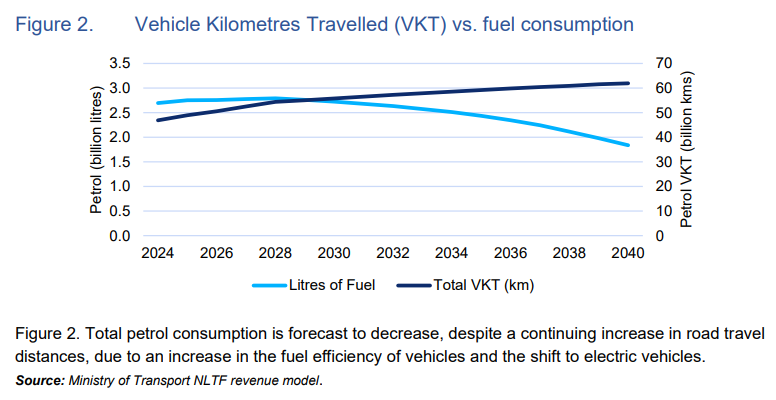

“For decades, petrol tax has acted as a rough proxy for road use, but the relationship between petrol consumption and road usage is fast breaking down. For example, petrol vehicles with better fuel economy contribute less FED per kilometre towards road maintenance, operations, and improvements.

“We are also seeing a fast uptake of fuel-efficient petrol hybrid vehicles. In 2015, there were 12,000 on our roads, while today there are over 350,000.

“As our vehicle fleet changes, so too must the way we fund our roads. It isn’t fair to have Kiwis who drive less and who can’t afford a fuel-efficient car paying more than people who can afford one and drive more often.”

“This is a change that simply has to happen. The government has recognised reality and is getting on with the transition.

That we’ll need to eventually replace fuel taxes as vehicles get more efficient has been known for some time and the government highlighted this work in the (awful) 2024 Government Policy Statement on Land Transport, which included this chart of their predictions on fuel use.

Even before this decline in fuel use occurs, the National Land Transport Fund (NLTF) no longer is sufficient to cover the quickly growing costs of costs of the transport system. This is from the National Land Transport Plan and shows that revenue from the NLTF (pink line – includes both fuel taxes and road user charges) is half to a third that of what the government’s spending intentions are with all of their mega roads they have planned.

Fuel taxes have always had the advantage of being an easy way to raise money for the government because there was very low overheads and was one that no one who drives a petrol vehicle could avoid.

The taxes also had somewhat of an emissions reduction benefit too. By being added to the cost of fuel, the fuel tax also added an incentive to drive a more fuel efficient vehicle. As such, one concern I have with the change is that unless more refined weight classes are introduced for light vehicles, it could help encourage bigger, more polluting vehicles. That’s because someone in a small hatchback would end up paying the same as a giant double-cab ute.

Fuel taxes over the last 50 years

The government do say they’ll make the current RUC system easier but it also looks like most likely you’ll be having to pay a third party to collect RUC.

“The transition will happen in stages, beginning with legislative and regulatory reform to modernise the current RUC system and enable private sector innovation.

“The current RUC system is outdated. It’s largely paper based, means people have to constantly monitor their odometers, and requires people to buy RUC in 1000 km chunks.

“We’re not going to shift millions of drivers from a simple system at the pump to queues at retailers. So instead of expanding a clunky government system, we will reform the rules to allow the market to deliver innovative, user-friendly services for drivers.

“A handful of E-RUC companies already do this for about half of our heavy vehicle fleet and there are several companies, both domestic and international, with innovative technology that could make complying with RUC cheaper and easier.”

Key legislative changes the Government is progressing include:

Removing the requirement to carry or display RUC licences, allowing for digital records instead.Enabling the use of a broader range of electronic RUC devices, including those already built into many modern vehicles.Supporting flexible payment models such as post-pay and monthly billing.Separating NZTA’s roles as both RUC regulator and retailer to foster fairer competition.Allowing bundling of other road charges like tolls and time of used based pricing into a single, easy payment.

“The changes will support a more user-friendly, technology-enabled RUC system, with multiple retail options available for motorists,” Mr Bishop says.

“Eventually, paying for RUC should be like paying a power bill online, or a Netflix subscription. Simple and easy.

“I expect to pass legislation in 2026, followed by an updated Code of Practice for RUC providers. We will also engage with the market in 2026 to assess technological solutions and delivery timelines. In parallel, NZTA and Police will upgrade their systems to support enforcement in a digital environment.

“By 2027, the RUC system will be ‘open for business’, with third-party providers able to offer innovative payment services and a consistent approval process in place.

Share this