1h agoWed 13 Aug 2025 at 3:55amMarket snapshotASX 200: -0.5% to 8,836 points (live values below)

Australian dollar: flat at 65.27 US centsNikkei 225: +1.4% to 43,297 pointsHang Seng: +1.8% to 25,420 pointsWall Street: Dow Jones (+1.1%), S&P 500 (+1.1%), Nasdaq (+1.4%)Europe: FTSE (+0.2%), DAX (-0.2%), Stoxx 600 (+0.2%)Spot gold: +0.2% to $US3,350/ounceBrent crude: +0.1% to $US66.18/barrelIron ore: flat at $US103.30/tonneBitcoin: -0.6% to $US119,503

Prices current around 1:55pm AEST

Live updates on the major ASX indices:

3m agoWed 13 Aug 2025 at 5:01amAsian markets rally, Shanghai hits 3.5 year high

Asian stock markets are rallying, with the Shanghai Composite hitting its highest level in more than three and a half years.

Here’s how the major indices currently stand:

Shanghai Composite: +0.6%Shenzen Component: +1.5%Tokyo’s Nikkei 225: +1.6%Seoul’s Kospi 200: +0.9%

22m agoWed 13 Aug 2025 at 4:42am

CBA’s billions profit sparks criticism

CHOICE’s head of policy Morgan Campbell has slammed the Commonwealth Bank on its $10.25 billion yearly profit announcement.

“By announcing another record profit today, the Commonwealth Bank have shown disdain for more than 2.2 million low-income customers waiting for refunds on fees they should never have been charged,” Mr Campbell said.

“Commonwealth Bank unfairly stuck their hands into the pockets of low-income Australians and refused to make it right. We’re calling on the CBA to refund the fees, and our petition has already received 21,000 signatures.”

In July, ABC News reported that the CBA and its Bankwest subsidiary refused to pay its 2.2 million customers in refunds after they were found to be charged a total of $270 million in avoidable fees.

More details can be found in my colleague Esse Deves’s reporting.

36m agoWed 13 Aug 2025 at 4:28am

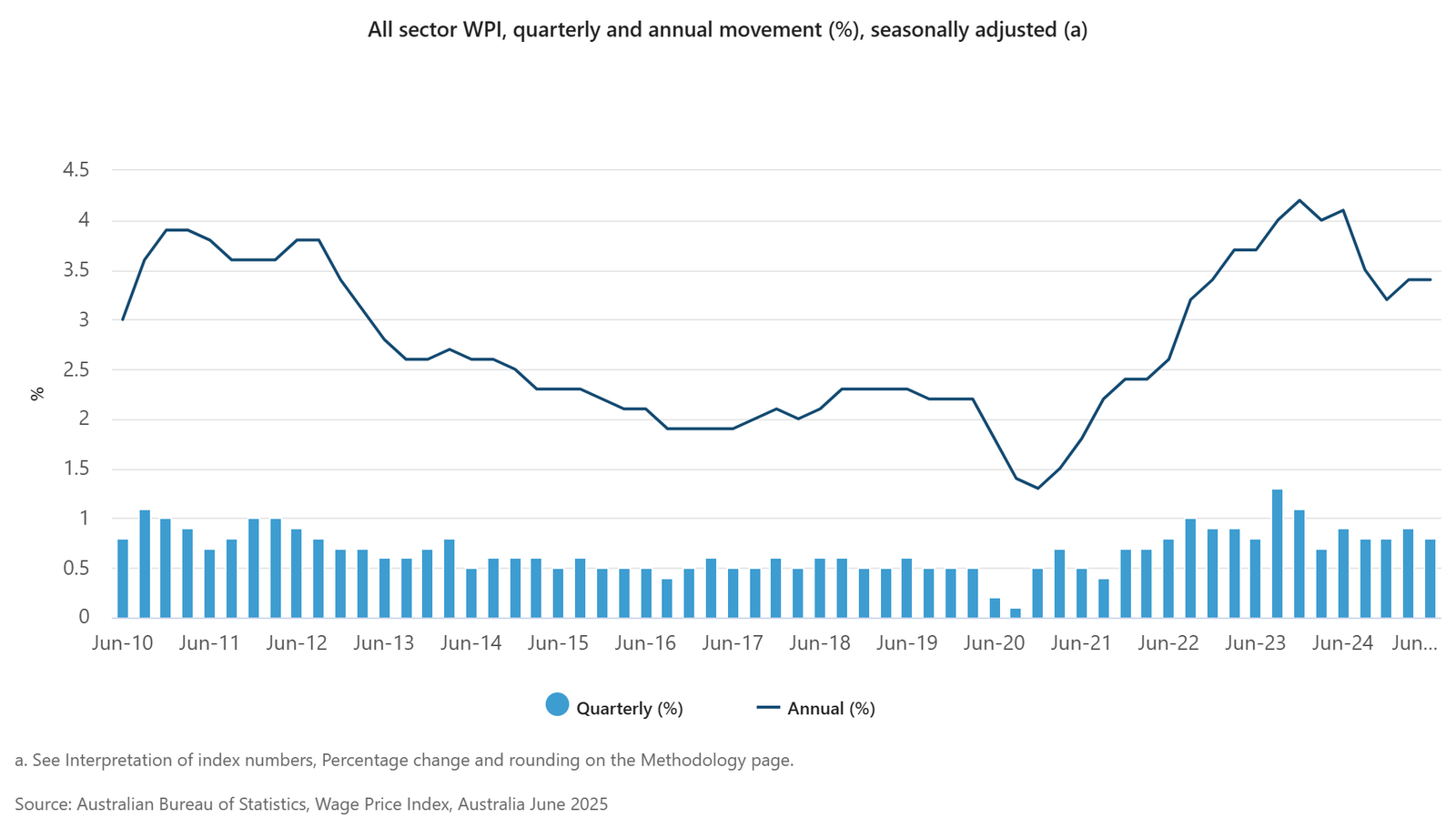

Can current wages growth last?

Earlier today we reported the June quarter Wage Price Index (WPI) as measured by the ABS.

Private sector wages rose 0.8 per cent in the quarter, and 3.4 per cent over the year, seasonally adjusted.

Public sector wages rose 1.0 per cent in the quarter and 3.7 per cent over the year.

Wage increases were driven by backdated increases from newly approved state-based enterprise agreements and, to a lesser extent, aged care wage rises.

Accounting firm, KPMG, says further increases to wage growth needs to coincide with improved productivity growth.

“Sustained real wage growth is a welcome relief for households struggling with cost-of-living pressures,” KPMG Chief Economist Brendan Rynne said.

“However, without improvements in labour productivity, these gains can only go so far.

“Productivity growth is essential for ensuring continued real wage increases and easing pressure on businesses.”

And AMP notes:

“… all industries are now seeing wages growth above headline inflation rate.”

“As a result, household real incomes (take home pay minus inflation) have continued to rise at roughly 1.3 per cent per annum,” AMP’s My Bui wrote.

Note that these wages figures haven’t reflected the 3.5 per cent increase in minimum and award rates from July 1, and they also don’t take into account the latest increase in super guarantee.

47m agoWed 13 Aug 2025 at 4:18am

Billions wiped off CBA’s share price after reporting over $10bn profit for FY2025

Australia’s biggest company, the Commonwealth Bank, has posted a $10.13 billion net profit, but billions were wiped off the bank’s share price, as analysts say the stock was “priced for perfection”.

The nation’s largest lender reported a 7 per cent rise in statutory profit over the past financial year. Its preferred measure of cash profit rose 4 per cent to a record $10.25 billion.

CBA shareholders will receive a final dividend of $2.60 per share, taking the total dividend payout for the year to $4.85, up 4 per cent from a year earlier and its highest on record.

Despite the bumper profit result, the stock price took a heavy hit and dragged the broader ASX 200 index down with it, after trading at a premium difficult to justify.

At 12:30pm AEST, Commonwealth Bank shares had fallen 4.4 per cent, to $170.91.

That still leaves the stock just shy of 30 per cent higher over the past 12 months.

Michael Haynes, an equities analyst at Atlas Funds Management (which is a CBA investor) said shareholders were likely taking profit following the result.

“The underlying business has been operating soundly, but the shares remain very expensive and are priced for perfection,” he told Reuters.

Follow more here.

56m agoWed 13 Aug 2025 at 4:09am

Jumbo loan sizes

The average new loan size for owner-occupiers has hit a record high of $678,000, ABS data show.

The ABS Lending Indicators for the June 2025 quarter show the average new loan size for owner-occupiers in Australia rose by roughly $18,000 between the March and June quarters.

Financial comparison service, Canstar, said, “That’s an estimated increase of $198 a day.

NSW has the largest average new loan size for owner-occupiers at $816,000.

Western Australia hit a record high of $620,000.

Canstar analysis shows that a single person earning the average full-time wage, as recorded by the ABS, could potentially borrow an additional $12,000 from the bank, as a result of Tuesday’s cash rate cut.

1h agoWed 13 Aug 2025 at 3:54am

CBA stock price traded at ‘extreme premium’: analyst

The Commonwealth Bank’s bumper profit has been today’s key business event.

Analysts have been generally positive about the result.

Here’s what Marcus Today portfolio manager Henry Jennings had to say about the result.

“[It was] a solid result,” he said.

“[It was] in line with expectations.

“But it has run hard and is trading at a extreme premium to other banks.

“An extreme P/E ratio for any bank.”

The price-to-earnings (P/E) ratio compares a company’s share price with its earnings per share (EPS).

Analysts and investors use this to determine the relative value of a company’s shares, compared to another similar company.

The CBA has been trading at a P/E north of 30.

Westpac’s P/E for example is 17.5.

“Some of that is being unwound [today],” Henry Jennings said.

1h agoWed 13 Aug 2025 at 3:40am

Update

So does the Aussie share market today indicate a level of mistrust for the numbers coming out of the US? After all, if Trump will fire the economists because he doesn’t like the numbers, can we really trust the numbers?

– Skeptic

Hi,

Thanks for the comment.

Last night’s US CPI data was well received by Wall Street because it was basically in line or a little bit better than was the market had feared.

It seems Donald Trump’s tariffs are not, at this stage, leading to a widespread lift in US inflation.

Today’s decline on the ASX 200 is more related to CBA’s profit result disappointing the market — despite it being a very solid earnings report.

Can we trust the US data? At this point, we have no evidence to suggest we shouldn’t trust it.

1h agoWed 13 Aug 2025 at 3:27am

Interest rates cuts to boost property demand: Oxford Economics

Earlier today the Bureau of Statistics published lending data showing investors were driving growth in the mortgage market.

There were 49,065 new investment loans approved in the June quarter 2025, a 3.5 per cent increase compared to the previous quarter.

Here’s some of what Oxford Economics Australia had to say about it:

“Following yesterday’s cash rate cut, we anticipate a further boost in sentiment and buyer confidence, continuing the positive momentum observed in recent months.”

“Auction clearance rates are running above 70 per cent and mortgage pre-approvals have jumped on the anticipation of further rate cuts.

“The near-term outlook for property price growth and turnover has brightened moving into the spring selling season,” Oxford Economics Australia Lead Economist Maree Kilroy wrote.

1h agoWed 13 Aug 2025 at 3:19am

Billions of dollars wiped off CBA value

The Commonwealth Bank’s (CBA) stock price peaked in June this year at $192.

At 1:15 AEST, it’s trading just north of $170, down roughly 5 per cent on the day.

Since the stock market opened at 10am $14 billion has been wiped off CBA’s market value.

1h agoWed 13 Aug 2025 at 3:07amWhy China is becoming the world’s first electrostate

In April this year, China installed more solar power than Australia has in all its history. In one month.

But this transformation is not being driven by a moral obligation to act on climate change.

China’s reasons for this are less about arresting rising temperatures than its desire to stop relying on imported fossil fuels and to fix the pollution caused by them.

The superpower has put its economic might and willpower behind renewable technologies, and by doing so, is accelerating the end of the fossil fuel era and bringing about the age of the electrostate.

For more, here’s the full story by Jo Lauder:

2h agoWed 13 Aug 2025 at 2:50am

Don’t feel too sad for CBA shareholders

At 12:30pm AEST, Commonwealth Bank shares had fallen 4.4 per cent to $170.91.

But here’s how it looks in the context of the last 12 months:

Today’s drop still leaves the stock just shy of 30 per cent higher over the past year.

2h agoWed 13 Aug 2025 at 2:47am

Penalty decision over Qantas illegal outsourcing will be handed down

The Federal Court will hand down its decision next Monday on the penalty Qantas should pay for illegally sacking more than 1,800 workers during the COVID-19 pandemic.

The maximum penalty is $121 million, on top of the $120 million compensation fund that the affected workers are now receiving.

In 2020, Qantas announced it would outsource its entire ground handling workforce, which sparked a four-year legal battle between the carrier and the Transport Workers’ Union (TWU).

The TWU has described the illegal outsourcing, which happened while Alan Joyce was the airline’s CEO, as “the largest case of illegal sackings in Australian history”.

You can read more here.

2h agoWed 13 Aug 2025 at 2:35amProperty investment driving lending growth

Investment activity in the property market has stepped up.

The number of new investment loans rose by 3.5 per cent in the June quarter, according to the Australian Bureau of Statistics (ABS).

“There were 49,065 new investment loans approved in the June quarter 2025,” the ABS noted.

The total value of new investment loans was $32.9 billion, a rise of 1.4 per cent ($443 million).

The average loan size rose by $1,103 to $674,259.

“The 3.5 per cent quarterly growth in the number of investment loans follows two consecutive quarterly falls,” ABS head of finance statistics Dr Mish Tan said.

Data also show new owner occupier loans rose by 0.9 per cent.

“[The] June quarter’s overall rise in home loans followed a fall in the March quarter,”

“That said, lending activity is still at relatively high levels.”

The number of owner occupier first home buyer loans grew by 1.7 per cent (492 loans) to 28,861.

2h agoWed 13 Aug 2025 at 2:17am

Wages growth news and inflation: is it good or bad?

The Wage Price Index (WPI) rose 3.4 per cent over the year to the end of the June quarter.

The largest industry contributors to quarterly wages growth were professional, scientific and technical services (+0.9 per cent) and public administration and safety (+1.1 per cent), according to the ABS.

Private sector wages rose 0.8 per cent and public sector wages rose 1.0 per cent, seasonally adjusted, over the quarter.

The formula economists use to determine if wages growth puts pressure on inflation is:

Inflation + productivity = wages growth (non-inflationary)

We know the CPI (June quarter) was 2.7 per cent (core).

And the Reserve Bank updated its annual productivity growth “assumption” yesterday, for forecasting purposes to 0.7 per cent.

That leaves us with 3.4 per cent.

That happens to be today’s quarterly WPI.

This suggests that current wages growth is non-inflationary.

It also suggests if the nation can boost productivity to 1 per cent or above, Australian workers could receive a non-inflationary pay rise.

3h agoWed 13 Aug 2025 at 1:57am

CBA boss: ‘little appetite’ for ‘retail’ crypto

The CBA boss, Matt Comyn, has been asked to comment on the rise of the crypto currencies.

He was asked pointedly why consumers in the future would put their money with the bank when they could own cryptocurrency instead?

Matt Comyn responded by saying the CBA was “working with” the Reserve Bank (RBA) on digital currencies more broadly but there was, he said, “little appetite” for digital currencies at the retail level.

3h agoWed 13 Aug 2025 at 1:44am

What do analysts make of the CBA result?

The Commonwealth Bank (CBA) is not just Australia’s largest company it also holds the title of the share market’s biggest stock.

So, if you work and you have superannuation, the CBA’s financial performance matters for you and your retirement.

So what do the number crunchers make of it?

“CBA, as is usually the case, has yet again delivered a financial performance that either beat or met analysts’ expectations,” FNArena Editor Rudi-Filapek Vandyck wrote.

“While most experts would see yet more evidence CBA truly is Australia’s pre-eminent lender, also supported by self-created advantages through years of investments in technology, it’s the valuation that most struggle with.

“The key question thus remains the same as this time around last year: are the quality and quantity of the bank’s performance enough to sustain its current premium valuation.

“This is where most analysts struggle,” he said.

While Wilson Asset Management’s Geoff Wilson wrote:

“Overall, a solid result in line with expectations.”

“A lower quality result versus previous ones with a small wins on tax, trading income and bad debt releases.

“The first time they’ve not beaten expectations since first half 2023, so disappointing given the companies astronomical valuation.”

This is perhaps why the share price fell sharply on the announcement of the profit result.

3h agoWed 13 Aug 2025 at 1:37amWPI rises 0.8pc this quarter

Australia’s Wage Price Index (WPI) rose 0.8 per cent this quarter, seasonally adjusted, according to the ABS’s release today.

Private sector wages rose 0.8 per cent and were the main contributor to growth, while public sector wages rose 1.0 per cent.

(Australian Bureau of Statistics)3h agoWed 13 Aug 2025 at 1:26amReality check for CBA share price

(Australian Bureau of Statistics)3h agoWed 13 Aug 2025 at 1:26amReality check for CBA share price

Oliver Twist has turned nasty, especially when it comes to the Commonwealth Bank.

The niceties and the deference have been chucked, replaced by a savage response to what investors clearly believe isn’t enough. They wanted more.

The stock is being jettisoned this morning, down almost 5 per cent since trading opened.

CBA’s supersized $10.25 billion cash profit may have customers feeling as though they’ve been stung. But, even though it was in line with analyst expectations, it was still only a meagre 4 per cent up on last year’s result.

And that kind of growth simply isn’t enough to justify the rocketing price of CBA shares during the past year. They somehow seem to have cut the shackles underpinning ordinary valuation methods and drifted off into outer space.

Its market valuation is more than 30 times its earnings. The broader market is just under 20. And the long-term average for Australian stocks is around 15.

The other three of the big four banks are valued between 14 and 17 times earnings.

Go figure.

In the past 12 months, CBA stock has jumped around 38 per cent. And that’s after its recent declines.

Partly because it was unaffected by global geopolitical tensions — including Donald Trump’s tariff blitz — and partly because the exodus of cash from US markets, global investors went looking for alternatives and CBA took on the mantle as a safe haven.

The end result?

Not only is it the biggest company on the ASX, it now accounts for a whopping 12 per cent of the entire Australian market.

A minor dose of reality this morning.

3h agoWed 13 Aug 2025 at 1:17amCBA boss: Trade ‘disruption’ risk lingers for economy

The CEO of the Commonwealth Bank, Matt Comyn, says the “full impact” of the trade “disruption” that’s developed in the wake of US President Donald Trump’s so-called reciprocal tariffs is yet to be realised.

The RBA governor Michele Bullock touched on this “uncertainty” yesterday in the wake of the bank’s interest rates decision.

“Trade policy developments are nevertheless still expected to have an adverse effect on global economic activity, and there remains a risk that households and firms delay expenditure pending still greater clarity on the outlook,” she said.

Analysts say the financial markets are largely ignoring these risks at present — hence the regular all-time highs achieved by the S&P/ASX 200 index.

ASX 200: -0.5% to 8,836 points (live values below)

ASX 200: -0.5% to 8,836 points (live values below)