Key takeaways

Bitcoin’s realized cap has hit a record $1 trillion, while billions in short positions could trigger a sharp rally if BTC climbs toward $120K.

Bitcoin’s [BTC] catching its breath, but the market is anything but quiet.

The king coin is at a calmer phase after weeks of frenzied trading, even as realized capital just notched an unprecedented $1 trillion milestone.

Add in nearly $2 billion in shorts stacked for liquidation at the $120K mark — Bitcoin’s next move will not be far away.

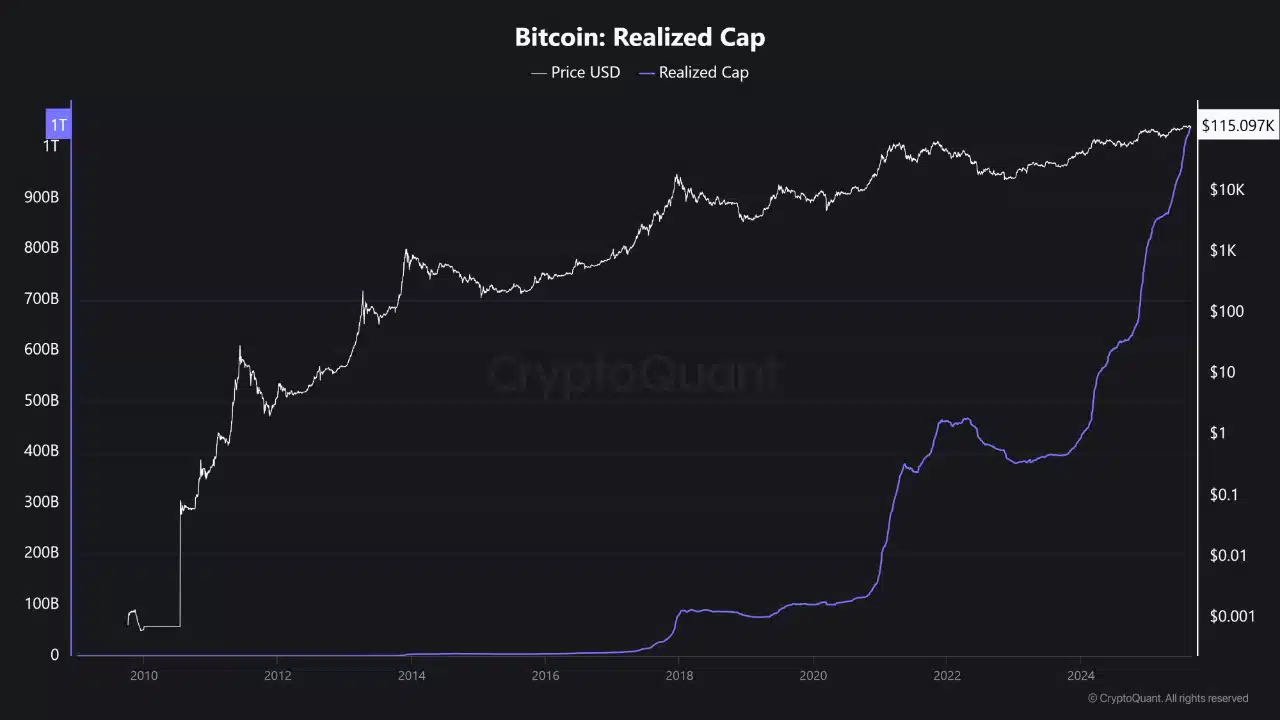

A milestone beyond price

Bitcoin’s realized cap has officially crossed the $1 trillion mark, a first in its history!

Realized cap measures the value of coins based on the last time they moved, capturing actual capital that has entered the network.

Source: CryptoQuant

This milestone proves that Bitcoin’s latest rally is about real money flowing in at record levels. It is a sign of confidence among investors, as more coins are being bought and held at these elevated valuations.

If momentum continues, the path to a $2 trillion realized cap could redefine Bitcoin’s standing in global markets.

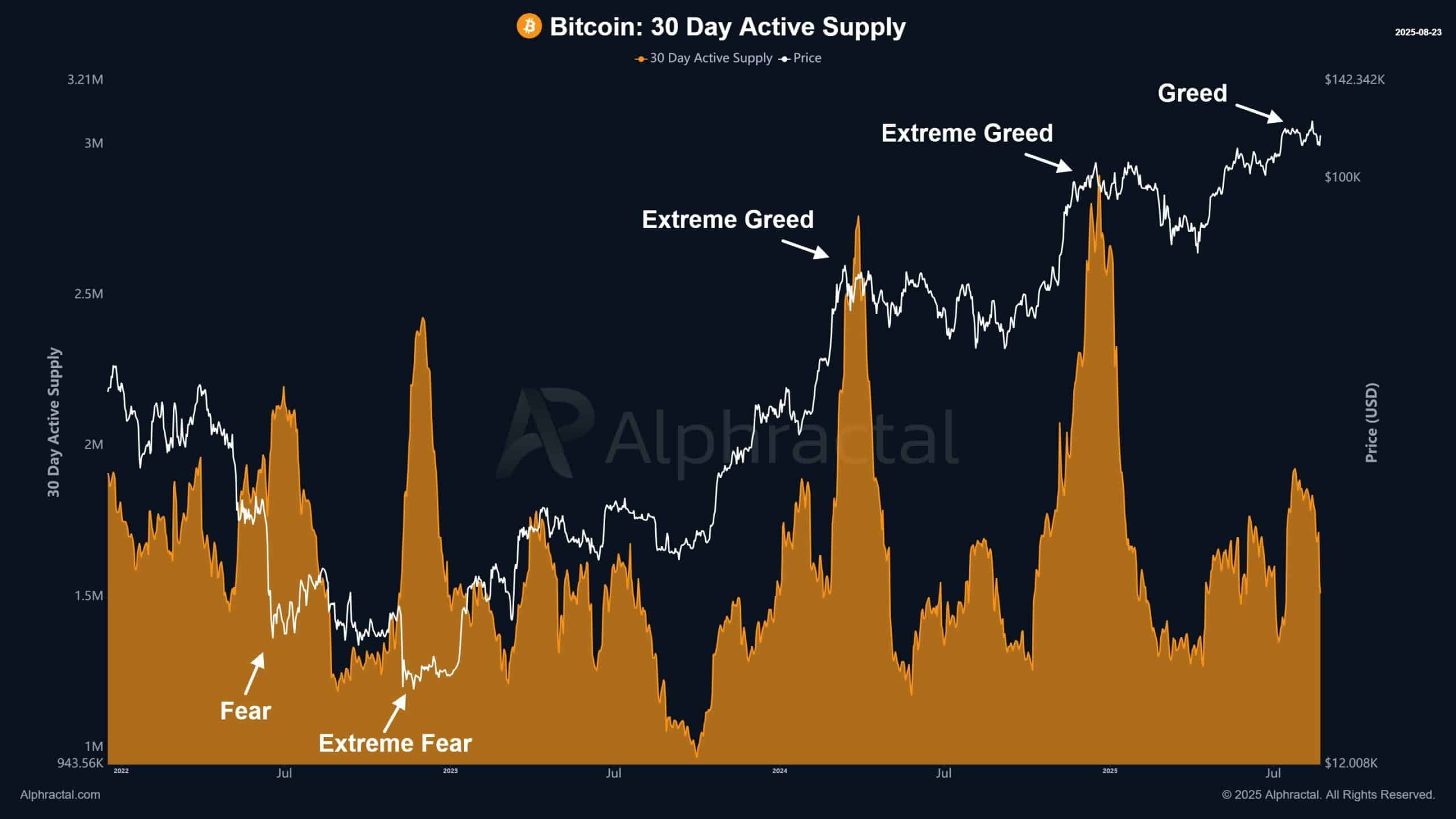

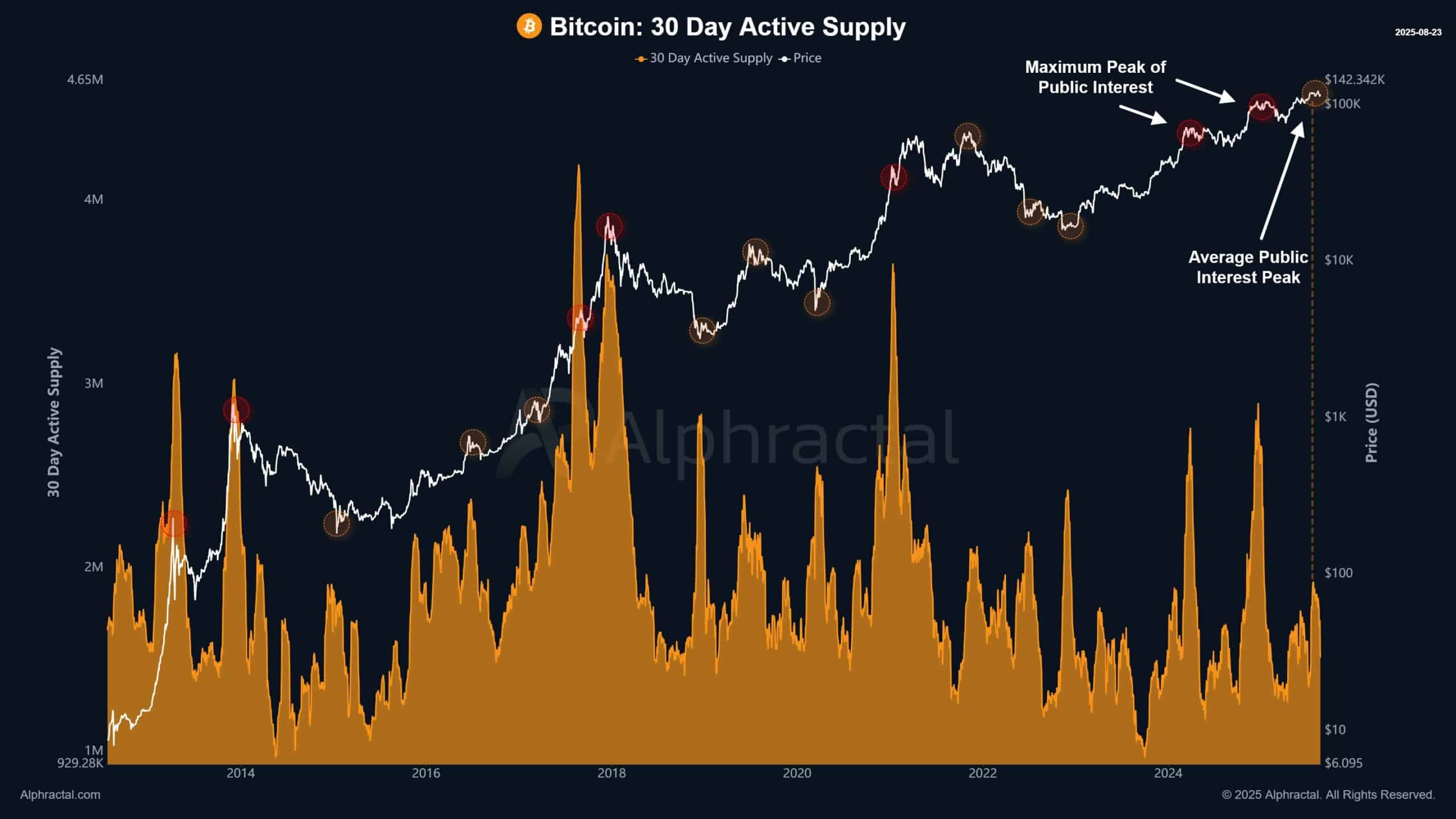

Active supply cools

Bitcoin’s 30-Day Active Supply acts like a pulse check for investor sentiment.

Spikes are usually a sign of heightened trading activity during moments of greed or fear, while declines point to calmer phases where fewer coins change hands.

Source: Alphractal

Currently, after weeks of intense movement, Bitcoin has slipped into a quieter mood.

Source: Alphractal

Historically, such cooldowns have preceded sharp market moves, as periods of low activity often reset conditions before the next wave of volatility.

For now, the market seems to be taking a moment.

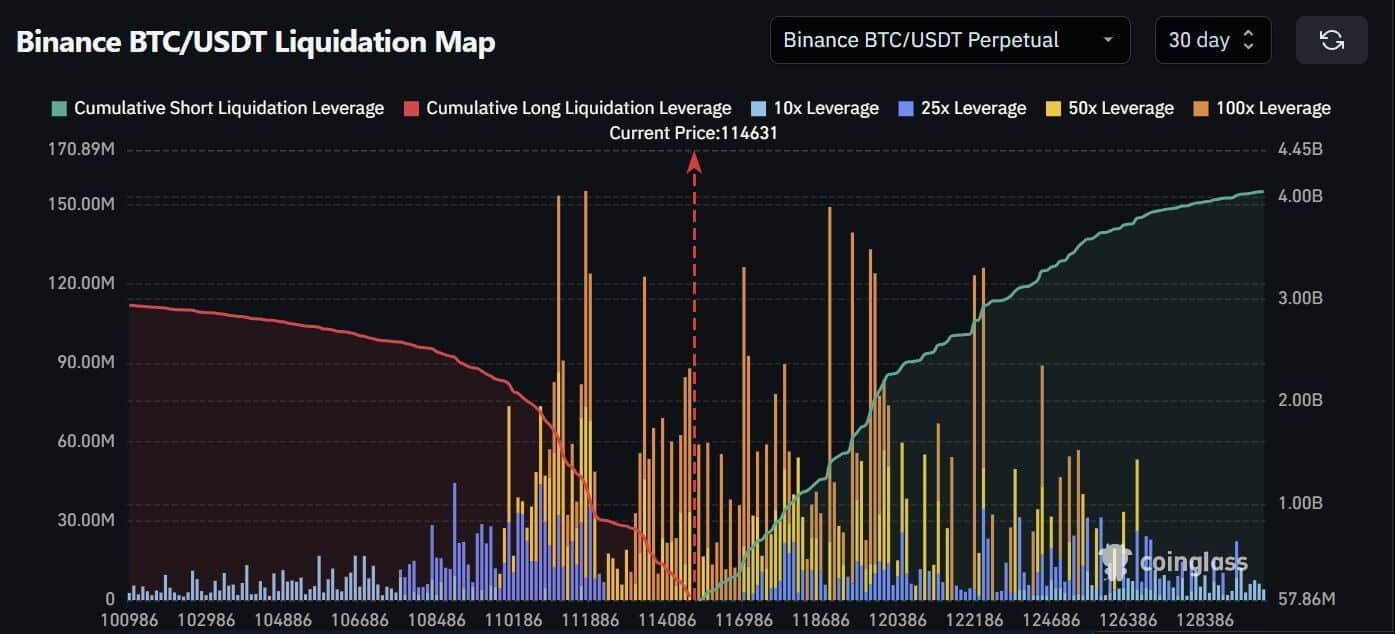

Billions on the line

A big move may not be far away.

Nearly $2 billion in short positions could be wiped out if BTC reaches $120K, potentially triggering a rapid squeeze as traders rush to cover losses.

Source: X

History shows that such liquidations often fuel rallies, turning quiet times into sudden bursts of volatility. In short, today’s calm may not last long.

Bitcoin’s next breakout could come faster and harder than many expect.

Previous: Inside the Aave – WLFI proposal: Rumors, revenue sharing, and governance?

Next: Ethereum: As Wall Street pulls back, is retail keeping ETH alive?