Aspiring first home buyers are in the best position they have been in to get into a home of their own for the last four years.

However, those on average incomes will likely still struggle in Auckland and Tauranga.

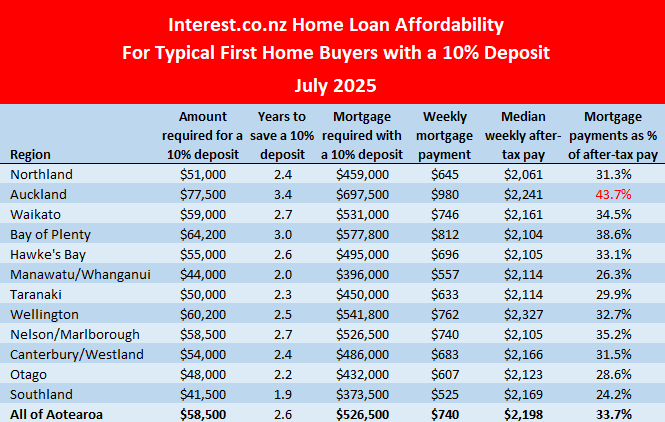

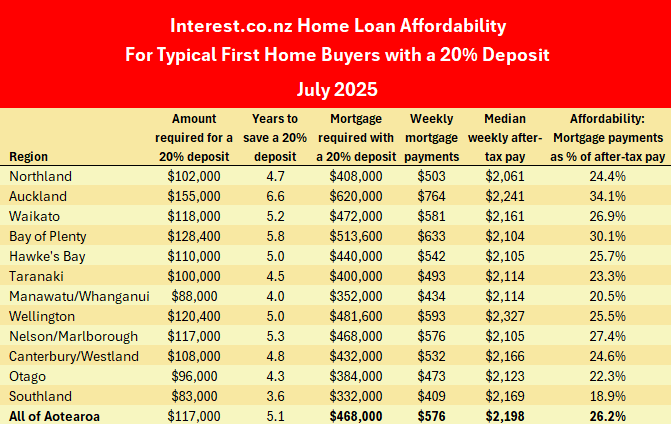

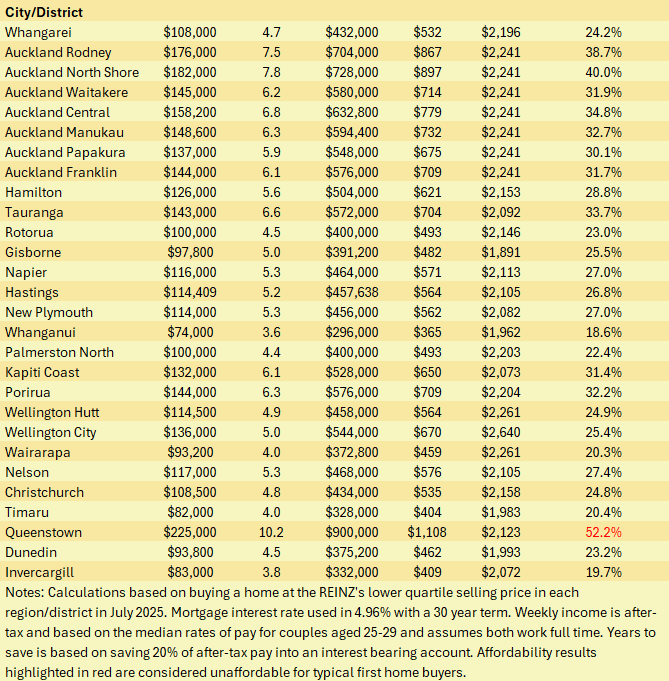

Interest.co.nz measures movements in affordability by tracking changes in the Real Estate Institute of New Zealand’s lower quartile selling prices in all major urban areas, along with movements in mortgage interest rates and after tax incomes for aspiring first home buying couples, based on median wage rates for 25-29 year-olds.

All three of these things feed into overall affordability by determining how much of a deposit first home buyers will need to save, and how much of their income is likely to be eaten up by the mortgage payments on a lower-priced home, which is at its lowest level since July 2021.

No change in mortgage interest rates

There was no change in the average two year fixed mortgage rate, which remained on 4.96% for the second month in a row in July.

That follows 19 months of almost continuous monthly declines, with the average two year fixed rate dropping to 4.96% in June and July this year from 7.04% in November 2023.

House prices flat overall

The REINZ’s national lower quartile selling price also remained unchanged at $585,000 for the second month in a row in July, although there was some movement both up and down at the regional level.

Compared to June, lower quartile prices declined in Waikato, Bay of Plenty, Nelson/Marlborough and Otago. They were unchanged in Auckland, but increased in Northland, Hawke’s Bay, Taranaki, Manawatu/Whanganui, Wellington, Canterbury and Southland.

Overall, the national lower quartile price has declined by 12.7% to $585,000 in June and July this year from its peak of $670,000 in November 2021.

After-tax pay up by $5 a week in July

Based on the median rates of pay for 25-29 year-olds, interest.co.nz estimates a couple working full time would take home $2198 a week in July. That’s up $5 a week compared to June, and up $110 a week compared to July last year.

Saving for a deposit getting easier but still a big ask

The first step aspiring first home buyers need to take is to scrape together a deposit.

For a 10% deposit on a home purchased at the REINZ’s national lower quartile price of $585,000, they would need $58,500.

If they saved 20% of their after-tax pay into an interest bearing account each week, it would take them 2.6 years to save the deposit.

In Auckland, where the regional lower quartile price was $775,000 in July, they would need $77,500 for a 10% deposit, which would take 3.6 years to save.

You can double those figures for a 20% deposit. (The tables below show the 10% and 20% deposit figures for all urban centres around the country).

Although the amount needed for a deposit is still substantial, at the national lower quartile price the amount needed for a 10% deposit has declined by $8500 since lower quartile prices peaked in November 2021. The amount needed for a 20% deposit has declined by $17,000 over the same period.

In Auckland a home buyer would need $77,500 for a 10% deposit on a lower quartile-priced home and $155,000 for a 20% deposit.

Mortgage payments in decline

Falling interest rates and lower house prices have combined to bring mortgage payments down considerably over the last two years.

The mortgage payments on a home purchased at the national lower quartile price with a 10% deposit have remained unchanged at $740 a week for the last three months.

That’s a decline of $195 a week since they peaked at $935 a week in November 2023.

For this home loan affordability report, mortgage payments are judged to move into unaffordable territory when they take up more than 40% of after-tax pay.

By that measure, Auckland and Tauranga are now the only main centres where mortgage payments would be considered unaffordable for first home buyers.

In the Wellington Region, Kapiti Coast and Porirua remain slightly in unaffordable territory while Queenstown is so unaffordable it’s practically off the scale.

Within the Auckland Region, Papakura is the only major district where mortgage payments are still considered affordable.

The average mortgage payment for a home bought at the lower quartile price in Auckland is $980 a week. In Papakura it would $867 a week.

Overall, mortgage payments as a percentage of typical first home buyers’ after-tax income was 33.7% in July, the lowest it has been since July 2021.

So although aspiring first home buyers still face challenges getting into a home of their own, especially in regards to scraping together a deposit, the odds have moved significantly in their favour over the last four years.