Crude oil prices snapped a two-day rising streak to register a decline on Friday, pressured by slowing summer demand in the United States—the world’s largest producer and consumer—and projections of a worsening supply glut as the Organisation of the Petroleum Exporting Countries and allies (OPEC+) pump out fresh barrels. Although no peace deal is in sight in the three-and-a-half-year Russia-Ukraine war, with the European Union considering secondary sanctions on Russian crude buyers, Moscow’s strong ties with India, China, and Brazil continue to neutralize much of the impact.

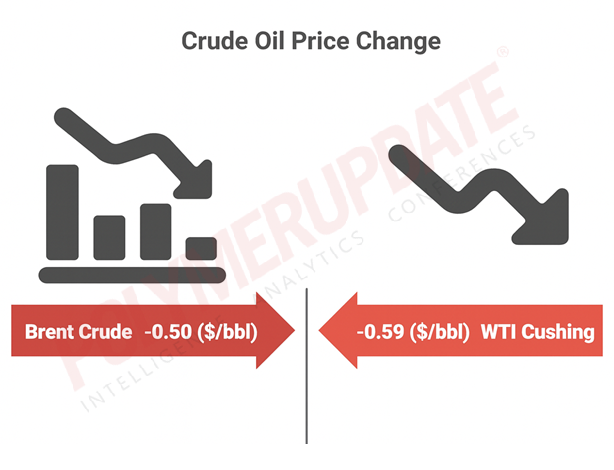

According to Polymerupdate Research, benchmark Brent crude futures for October delivery, which expired on Friday on the InterContinental Exchange (ICE), settled down 0.73 percent, or US$ 0.50 a barrel, at US$ 68.12 a barrel, compared to US$ 68.62 a barrel on Thursday. The most active November contract closed 0.78 percent, or US$ 0.53 a barrel, lower at US$ 67.45 a barrel, against US$ 67.98 a barrel the previous day. The fall marked a retreat for Brent crude prices after two consecutive days of gains.

According to Polymerupdate Research, benchmark Brent crude futures for October delivery, which expired on Friday on the InterContinental Exchange (ICE), settled down 0.73 percent, or US$ 0.50 a barrel, at US$ 68.12 a barrel, compared to US$ 68.62 a barrel on Thursday. The most active November contract closed 0.78 percent, or US$ 0.53 a barrel, lower at US$ 67.45 a barrel, against US$ 67.98 a barrel the previous day. The fall marked a retreat for Brent crude prices after two consecutive days of gains.

Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) dropped 0.91 percent, or US$ 0.59 a barrel, to US$ 64.01 a barrel on Friday, from US$ 64.60 a barrel at the previous close. Crude oil prices have largely traded within a tight range for the past three weeks, moving on mixed fundamentals.

An analyst from AnandRathi Investment Services Ltd commented, “Crude prices declined on Friday amid expectations of softer U.S. fuel demand after the Labour Day weekend, rising OPEC+ output of 547,000 bpd in September, and the restart of Russian crude flows to Hungary and Slovakia via the Druzhba pipeline. Markets are also monitoring U.S. pressure on India to cut Russian oil purchases after Trump doubled tariffs on Indian imports, though Indian buyers are expected to increase Russian crude imports in September.”

Slowing US summer demand

Crude oil and gasoline demand in the United States rises significantly during the summer driving season, which begins with Memorial Day (May 25), encompasses Independence Day on July 4, and continues through September. Travel volumes typically increase during this period, influencing wholesale and retail fuel prices, as energy demand is highly price-sensitive. The season concludes with Labour Day, which this year falls on Monday, September 1. This period represents the peak in U.S. crude oil and gasoline demand.

The end of the season, marked by the Labour Day holiday, typically signals a decline in U.S. demand. This often puts downward pressure on global oil prices as consumption eases and refiners shift to winter-grade fuels. Traders now expect U.S. summer driving demand to gradually slow starting next week. The close of the summer driving season also ushers in a phase of gradual supply increases that extends into the winter months.

Seasonal US demand indicators

According to the weekly report by the U.S. Energy Information Administration (EIA), commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) declined sharply during this summer driving season. Total U.S. crude oil inventories fell by 22.1 million barrels so far this season, dropping to 418.3 million barrels for the week ending August 22 from 440.4 million barrels for the week ending May 23, 2025. This drawdown was attributed to strong domestic demand and the highest Nigerian crude imports in nearly six years.

For the week ending August 22, crude oil inventories decreased by 2.4 million barrels to 418.3 million barrels, marking the second consecutive weekly decline. In the previous week ending August 15, inventories had fallen by 6 million barrels. The latest draw was steeper than analysts’ expectations of a 1.8 million-barrel decline. At 418.3 million barrels, U.S. crude oil inventories stand about 6 percent below the five-year average for this time of year.

Total motor gasoline inventories decreased by 1.2 million barrels from the previous week and are currently in line with the five-year average. Within this category, finished gasoline inventories increased, while blending component inventories declined. Distillate fuel inventories fell by 1.8 million barrels and remain about 15 percent below the five-year average. Overall, total commercial petroleum inventories declined by 4.4 million barrels during the week, the EIA reported. U.S. crude oil imports averaged 6.2 million barrels per day (bpd) last week, down by 263,000 bpd from the prior week.

Oversupply amid OPEC+ output hikes

The Paris-based International Energy Agency (IEA) has revised global oil supply growth upward by 370,000 barrels per day (bpd) to 2.5 million bpd for the current year, and by 620,000 bpd to 1.9 million bpd in 2026. The revision follows OPEC+’s August 3 decision to raise production by an additional 547,000 bpd in September. This move could complete the first phase of unwinding 2.2 million bpd of output cuts by the end of September. Notably, the eight OPEC+ members that had implemented voluntary output cuts have now decided to fully roll back their reductions in a bid to regain market share. OPEC+ has also signaled its intention to raise output further at its next meeting.

Energy research and analytics firm Kpler has forecast that global crude oil demand will remain subdued in 2025 and 2026, weighed down by the growing adoption of electric vehicles and sluggish economic growth. Kpler expects global fuel demand to increase by about 840,000 bpd in 2025, edging up slightly to 880,000 bpd in 2026 amid weak consumer confidence. Consumption in emerging and developing economies has also been softer than expected, with downward revisions for China, Brazil, Egypt, and India.

Geopolitical conflicts

U.S. President Donald Trump has been pushing hard to broker a peace deal between Russia and Ukraine to end the 3½-year war that began on February 26, 2022. Reports indicate that both Trump and Ukrainian President Volodymyr Zelenskyy support a negotiated resolution to the conflict. However, past peace efforts have repeatedly collapsed due to the Kremlin’s ultimatums and rigid demands, as well as Kyiv’s refusal to accept them. Now, investors eye on the outcome of the Shanghai Cooperation Organisation (SCO) August 31-September 1 meeting before building their position.

According to reports, Russian President Vladimir Putin has demanded that Ukraine relinquish the entire eastern Donbas region, abandon its ambitions to join the North Atlantic Treaty Organization (NATO)—a military alliance of developed nations founded on the principle of collective defense, “an attack on one is an attack on all”—and prohibit Western troops from entering the country.

Following Trump’s meeting with Putin in Alaska on August 15, Zelenskyy told Trump at a subsequent summit in Washington that he would not cede any territory to Russia. Meanwhile, Trump assured Zelenskyy of U.S. security guarantees to deter any future Russian reinvasion but ruled out immediate military intervention. NATO leaders and Ukraine’s European partners are also awaiting clarity on Washington’s stance in the Russia-Ukraine conflict.

Outlook

Crude oil prices are likely to remain under pressure amid expectations of weaker U.S. fuel demand following the end of the summer driving season, coupled with the resumption of Russian crude flows to Hungary and Slovakia through the Druzhba pipeline after a temporary outage. With the impact of the U.S. 50 percent tariff on India’s purchases of Russian oil expected to remain limited, the crude oil market is likely to stay oversupplied in the medium term. However, ongoing military strikes on energy infrastructure by both Russia and Ukraine are providing some support, keeping supply risks in focus.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com