The average UK house price increased by a below-inflation 2.8 per cent in the 12 months to July, slowing from 3.6 per cent in the year to June, the Office for National Statistics said.

Across the UK, the average house price in July was £270,000.

Average house prices increased to £292,000 (up 2.7 per cent) in England, £209,000 (2 per cent) in Wales, and £192,000 (3.3 per cent) in Scotland. In Northern Ireland, it was £185,000, up by 5.5 per cent annually.

The ONS figures typically lag more timely updates from lenders such as the Nationwide and Halifax as they are based on Land Registry data for actual completed sales, rather than mortgage approvals.

In its latest data Rightmove, the online estate agent, said house price growth turned negative in the year to September, with prices down 0.1 per cent in the first annual drop since January 2024.

Elliott Jordan-Doak, economist at Pantheon Macroeconomics, said: “Speculation over further property tax rises in November is already hitting sentiment in the housing market according to agents, and the budget being held later than usual in the year means uncertainty will continue to swirl over the next two months.”

Gold to hit $4,000 next year, says Deutsche Bank

The price of gold is set to hit $4,000 an ounce next year, according to the latest projections from Deutsche Bank, as the Federal Reserve is expected to resume interest rate cuts later today.

The investment bank raised its forecast for gold and silver from a previous forecast of $3,700 an ounce, anticipating a further rally in precious metals prices on the back of lower interest rates, questions over the Fed’s independence and ongoing demand from China.

Higher interest rates typically dim the appeal of gold for investors since it does not offer a yield.

The spot price of gold, which hit a new high of $3,702.95 an ounce yesterday, dipped $21.40, or 0.6 per cent, to $3,668.98 an ounce this morning on a weaker dollar ahead of the Fed decision and profit-taking after a strong run.

Centaur Media losses deepen

Centaur Media announced the sale of The Lawyer last week

Losses have deepened at Centaur Media as the board pressed ahead with a break-up of the publishing group.

Pre-tax losses rose to £1.8 million over the six months to the end of June, from £0.2 million a year earlier, as revenue from its ongoing businesses fell 7 per cent to £11.1 million.

Last week the company, which is listed on London’s junior Aim market, announced the sale of The Lawyer for £43 million, the second major disposal from Centaur under Martin Rowland, 53, who was appointed at the end of last year as executive chairman to lead a strategic review of the company in an effort to revive its valuation.

The shares, which have risen 74 per cent since the start of this year, were 0.9p, or 2.3 per cent, higher at 39.9p in morning trading.

Big Tech invests billions in Britain

Several big US technology companies have announced investments in Britain to coincide with President Trump’s state visit.

President Trump and his wife, Melania, arriving at London Stansted airport for a state visit

ANNA MONEYMAKER/GETTY IMAGES

Microsoft: The technology company has made its biggest ever investment in the UK, pledging $30 billion (£22 billion) over four years to help build Britain’s largest AI supercomputer at British data centre company Nscale’s AI campus in Loughton and expand its network of data centres.

Nvidia: The AI chipmaker is working with Nscale and CoreWeave on new facilities that will deploy 120,000 AI accelerator chips by 2026. It is also working with Nscale and OpenAI on Stargate UK, a regional version of the Stargate infrastructure project.

CoreWeave: The cloud platform has announced the next £1.5 billion phase of its investment in AI data centre capacity and operations in the UK, bringing the total investment in the country to £2.5 billion.

Salesforce: The cloud-based customer relationship management company will spend an extra $2 billion in the UK through 2030.

Google: The company will invest an extra £5 billion in the UK over the next two years, in areas ranging from data centre infrastructure to research and engineering.

BlackRock: The world’s largest asset manager will invest £500 million in UK data centres.

Hot summer boosts sales at Young’s

Simon Dodd, Young’s chief executive

CHRISTOPHER PROCTOR FOR THE TIMES

The pub group Young’s has reported strong trading as warm weather helped drive sales growth over the summer.

Like-for-like sales rose 5.6 per cent in the 24 weeks to September 15, while total sales climbed 5.3 per cent. The group saw demand for its gardens, riverside pubs and outdoor spaces.

The company said it was on track to deliver first-half results in line with expectations despite external pressures such as last week’s strike action by London Underground staff.

Simon Dodd, the chief executive, said: “We enter the autumn in a strong position and expect to maintain the momentum into the all-important Christmas trading period.”

Young’s shares rose 3.9 per cent, or 31p, to 820p.

PZ Cussons edges back into profit

Jonathan Myers, the PZ Cussons chief executive

ROB PINNEY FOR THE TIMES

The consumer goods company has reported a return to full-year profit, helped by growth in Africa.

Pre-tax profits at PZ Cussons rose to £6.5 million in the year to the end of May, up from a £95.9 million loss the previous year.

Revenue slid 2.7 per cent to £513.8 million, but like-for-like revenue growth was 8 per cent, driven by pricing in Africa and strong brand activity in the UK and Indonesia.

Jonathan Myers, the chief executive, said: “We have delivered good momentum across most of our portfolio, driven by our renewed focus on more competitive brand activation, strengthened innovation and successful commercial partnerships. At the same time, we have taken action to address our cost base, as we embed our new operating model.”

PZ Cussons shares rose 8 per cent to 72p.

FTSE 100 flat after inflation data

London’s leading share index edged higher this morning as inflation remained unchanged in August.

The FTSE 100 added 5 points, or 0.06 per cent, to 9,201.06 after closing a fraction lower yesterday.

The British Gas owner Centrica was the biggest riser, helped by UK government plans to fast-track a new generation of small nuclear power stations and its agreement with the US nuclear company X-energy to build a fleet of 12 advanced modular reactors in Hartlepool. The housebuilder Barratt Redrow also rose despite a gloomy outlook after it increased its dividend.

The gold miners Fresnillo and Endeavour Mining were among the fallers after the bullion price slipped from record highs due to a slight rise in the dollar and profit-taking. The miners Anglo American, Antofagasta and Rio Tinto were also down.

The pound was down 0.07 per cent against the dollar at $1.3637. The yield on the benchmark UK ten-year government bond was down 1 basis point at 4.63 per cent after the inflation data left the market betting the Bank of England will leave interest rates unchanged tomorrow.

Moonpig buoyed by AI stickers

Nickyl Raithatha, Moonpig’s chief executive

JEFF GILBERT/SHUTTERSTOCK

The online greetings cards business said trading momentum has continued through the start of the year and it remained on track to deliver its full-year guidance.

Nickyl Raithatha, the outgoing chief executive, said: “We continue to use technology, AI and data to enable our customers to connect with their loved ones in new and creative ways.”

He added the AI-generated stickers had quickly become the company’s most widely adopted innovation, allowing customers to create personalised stickers such as a llama in sunglasses or a sloth on a skateboard.

Moonpig shares rose 6 per cent, or 12p, to 210½p in early trading.

PwC partners’ share of profits averages £865,000

PwC plans to focus growth around technology, data, AI, and multidisciplinary services

ANDY RAIN/EPA

The 987 UK partners at the Big Four accountancy firm received a share of profits averaging £865,000 for the year to the end of June, up from £862,000 last year.

Profit across the group, which includes the UK, Middle East and Channel Island businesses, rose to £1.37 billion, up from £1.14 billion in 2024.

Marco Amitrano, PwC senior partner, said: “While headwinds remain, improving market sentiment is creating a stronger pipeline across our multidisciplinary portfolio.”

The firm plans to focus growth around technology, data, AI, and multidisciplinary services. Amitrano added: “The UK government’s industrial strategy should build vital market momentum, providing growth is prioritised across wider policy.”

Barratt Redrow sees limited growth next year

Barratt Redrow’s chief executive cited fragile homebuyer confidence as part of the reasons for limited growth

CHRIS RATCLIFFE/GETTY IMAGES

The FTSE 100 housebuilder has warned alongside full-year results that the “housing market remains challenging” and cautioned that it anticipates “limited growth in 2026”.

David Thomas, the chief executive, said: “Private homebuyer confidence remains fragile given the continuing affordability challenges they face, particularly around deposit requirements, and general concerns on employment, future taxation policy and mortgage rates.”

The numbers were in line with the company’s full-year trading update in July. Headline profit rose 26.8 per cent to £488.3 million in the 12 months to the end of June, up from £385 million. Revenue rose 33 per cent to £5.58 billion as the group built 16,565 homes.

Air fares drove down inflation, says ONS

The ONS chief economist said air fares rose less than they did a year ago

JASON ALDEN/GETTY IMAGES

Transport, particularly air fares, made the largest upward contribution to the monthly change in CPI inflation, data from the Office for National Statistics showed.

Grant Fitzner, the ONS’s chief economist, said air fares rose less than they did a year ago, after the large increase in July linked to the timing of the summer holidays.

He added: “This was offset by a rise in prices at the pump and the cost of hotel accommodation falling less than this time last year.”

Food price inflation climbed for the fifth consecutive month, with small increases seen across a range of vegetables, cheese and fish items, he said.

UK inflation steady at 3.8% in August

UK inflation held steady over the last month at a 19-month high, underscoring expectations that the Bank of England will leave interest rates unchanged at 4 per cent tomorrow.

Figures from the Office for National Statistics (ONS) showed that inflation was unchanged at 3.8 per cent in August, in line with analysts’ and the Bank of England’s forecasts. Inflation stayed at the highest level since January 2024.

Although the pace of price rises in the UK did not accelerate over the past month, the rate remained nearly double the Bank of England’s 2 per cent target and is well above levels seen in Europe and the US.

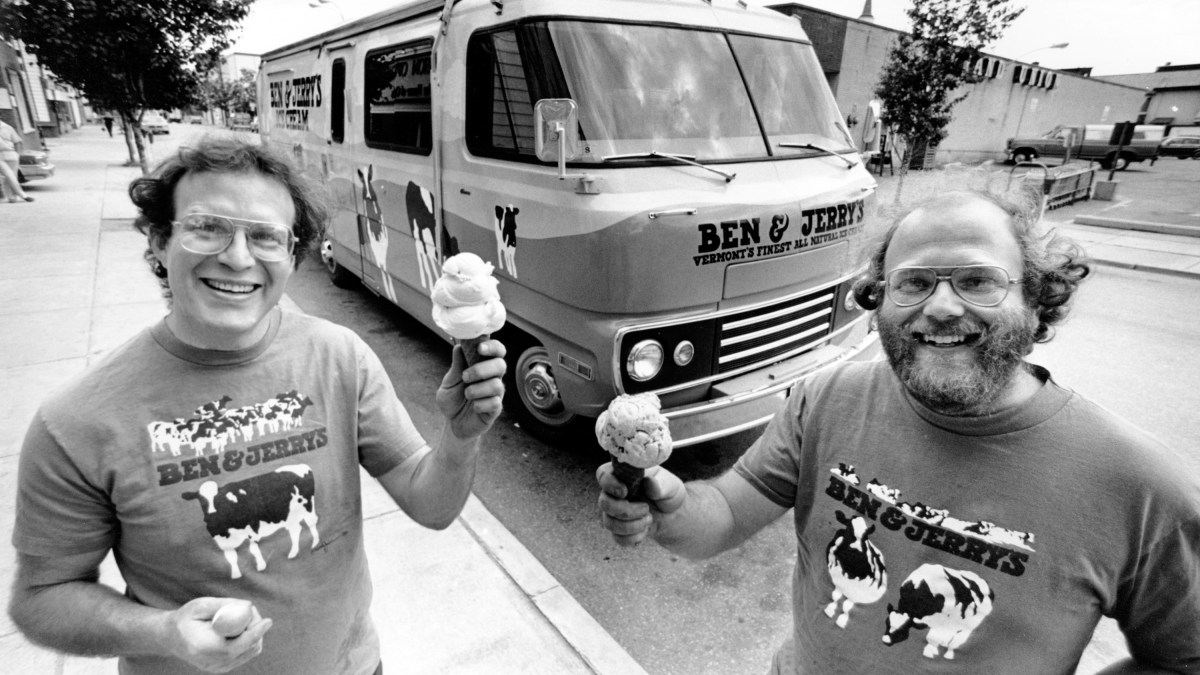

Jerry Greenfield quits Ben and Jerry’s

Jerry Greenfield, second right, and Ben Cohen, centre, in front of the White House protesting climate change in 2019

CHIP SOMODEVILLA/GETTY IMAGES

The Ben & Jerry’s co-founder Jerry Greenfield has left the ice cream company he helped establish nearly half a century ago after he said it had lost the independence it was given under its “unique merger agreement” with Unilever.

In a letter posted on X by the co-founder Ben Cohen, Greenfield said: “It’s with a broken heart that I’ve decided I can no longer, in good conscience, and after 47 years, remain an employee of Ben & Jerry’s. I am resigning from the company.”

He added it was a painful decision, but that the company had lost its independence to pursue its social mission to support peace, justice and human rights, which was part of its deal with Unilever when the consumer goods company bought it for $326 million in 2000.

The co-founders had recently written to the board of Unilever’s soon-to-be-spun-off ice cream division, The Magnum Ice Cream Company, calling for the brand to be “released” before its initial public offering. The proposal was rejected.

The relationship between the founders and Unilever has soured in recent years due to the ice cream company’s stance on social and political issues. Tensions first erupted in 2021 after Ben & Jerry’s refused to sell products in the Israeli-occupied West Bank, leading to several lawsuits.

Please enable cookies and other technologies to view this content. You can update your cookies preferences any time using privacy manager.

Enable cookiesAllow cookies once