The rebound of the US dollar after the FOMC meeting last Wednesday looks to be losing steam already and the strength of the dollar always looked to be more a case of positioning in a market that had become a little over-extended on the Fed dovish side that means the FOMC communication was always likely to disappoint. Trading yesterday was relatively quiet and fixed income in particular with only marginal moves in yields. With close to two further rate cuts fully priced for the Fed the immediate outlook for risk remains positive. Declining volatility is fuelling renewed appetite for risk that is being helped by a macro backdrop that is improving. The TikTok deal and the positive news of a constructive call between Presidents Trump and Xi is easing concerns over any renewed escalation in trade tensions.

If global sentiment is improving that will make it difficult for the dollar to sustain this rebound from here. For sure, against the lowest yielding G10 currencies the dollar can outperform but against wider G10 and emerging market currencies gains will be difficult to maintain.

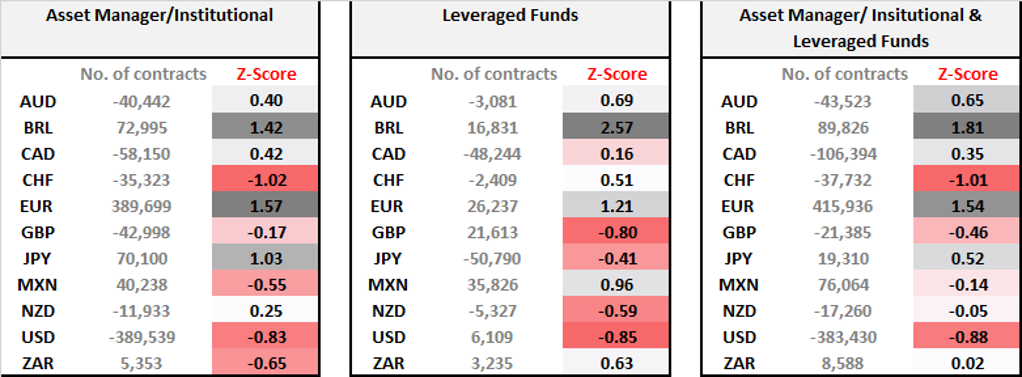

A look at positioning data released at the end of last week shows the strong appetite for carry. The positioning data measured by our own z-score metric indicates the most extreme positioning for the Brazilian real in the latest data relative to data over a two-year period, underlining the strong appetite for carry. The Mexican peso is also in demand although based on our z-score measure not as extreme as for the real. The carry attractiveness for the real in particular stands out. The key policy rate stands at 15.00% and last week the central bank left the key rate unchanged despite the latest inflation reading of 4.95% – implying a very attractive real policy rate of around 10%. BRL volatility continues to slide with the 3mth implied vol falling to below 12% to a level not seen since June last year.

Positioning is now entirely fuelled by carry of course and when Leveraged Funds and Asset Manager/Institutional Investor positions are combined, long positioning in euro is the next largest after the Brazilian real. That’s not yield driven and as is usually the case, the euro simply benefits as the ‘anti-dollar’ whenever US dollar sentiment is poor.

Growth optimism did certainly help the euro earlier in its rally after Germany announced its EUR 1 trillion defence and infrastructure spending plans and Bund yields surged. In that context today’s advance PMIs will be important for the euro. The euro-zone composite PMI, currently at 51.0, is the highest since August 2024 underlining improved business sentiment helped in part by a better outlook in Germany and some reduced concerns over the impact of US tariffs. Still, the tariff relief could well prove temporary and with French politics an added uncertainty we may well see some modest retracement in sentiment. EUR/USD clearly rejected the upside levels visited after the FOMC last week and that could well curtail EUR buying appetite ensuring relatively narrow trading ranges until there is clear direction from the US or some disruption to the low-vol positive risk trading environment.

CFTC IMM WEEKLY POSITIONING DATA HIGHLIGHTS STRONG BRL & MXN BUYING BY LEVERAGED FUNDS

Source: Bloomberg, Macrobond & MUFG GMR