Thousands of Australians have been locked out of their bank accounts after a major outage crippled ANZ’s mobile app and internet banking system on Tuesday.

Both the ANZ App and online banking portal are down, leaving customers unable to log in, transfer money or check their balances.

When users try to access the app, they are met with the following message: ‘ANZ App unavailable. We are working to have the ANZ App available again as soon as possible. We apologise for the inconvenience.’

ANZ’s Digital Service Status page reports an issue affecting ‘Payment Processing and Intra-Day Reporting’, which is causing delays to payments and transaction balance updates.

‘We are currently experiencing an issue impacting Payment processing and Intra-Day reporting. Technology teams are currently investigating the issue and will provide further updates when available.’ the website reads.

‘We apologise for the inconvenience. Please refer back to Status Page for further updates.’

It is understood the outage began at around 12.30pm on Tuesday afternoon.

In a statement to Daily Mail, ANZ confirmed the issue has since been resolved.

‘For a short period this afternoon customers may have experienced issues with some services including ANZ App and Internet Banking. This has now been resolved. We apologise for any inconvenience,’ a spokesperson said.

Thousands have been locked out of their ANZ banking app and online site, due to an outage

The ANZ outage comes just a day after a major web blackout that took down popular apps, payment platforms and games including Snapchat, Afterpay and Fortnite.

That disruption was caused by a problem with Amazon Web Services, affecting millions of users around the world.

While the AWS issue has since been resolved, many Australians said the latest ANZ crash underscores the risks of an increasingly cashless society.

‘Happening so often and they say digital and cashless is the way forward,’ one said.

‘This is why we don’t want to become cashless,’ another added.

The outage comes as the Albanese government’s long-awaited plan to ‘protect Australians’ right to pay with cash’ is being slammed as a sham, with consumer advocates warning it could actually speed up the country’s shift toward a cashless economy.

The draft legislation, quietly released at 4pm last Friday, appears to require only large supermarkets and major petrol chains to accept cash, and even then only for purchases under $500.

Smaller businesses, government agencies, and most retailers would be completely exempt from the so-called ‘cash mandate’, meaning they can continue refusing cash payments without penalty.

‘This is a mandate so full of loopholes it’s ridiculous,’ said Jason Bryce, leader of the Cash Welcome campaign told 2GB’s Ben Fordham.

The draft regulations draft regulations will require fuel and grocery retailers to accept cash for in-person transactions up to $500

‘It doesn’t apply to small businesses, or even most big ones – just large supermarkets and petrol stations. Everyone else is exempt.’

Under the draft regulations, supermarkets would only be required to maintain at least one cash terminal and could potentially claim small business status to avoid the requirement altogether.

The rules allow businesses to claim exemptions if handling cash is deemed ‘too costly or too difficult’, effectively giving retailers a legal excuse to reject it.

‘Any retailers, including supermarkets and servos, can refuse cash by claiming it’s too difficult to accept cash,’ Mr Bryce said.

‘If retailers can claim it’s too hard to accept cash, banks will make sure it’s hard and cash will disappear.’

The draft legislation was meant to honour earlier promises by Treasurer Jim Chalmers that consumers would always have the option to pay with cash.

‘The current proposal leaves out medicines, housing, utility bills and many other essential items we need to live,’ Mr Bryce said.

Financial Services Minister Daniel Mulino said the draft regulations will require fuel and grocery retailers to accept cash for in-person transactions up to $500, with exemptions for small businesses earning under $10million annually or franchises where the total turnover is under $10million.

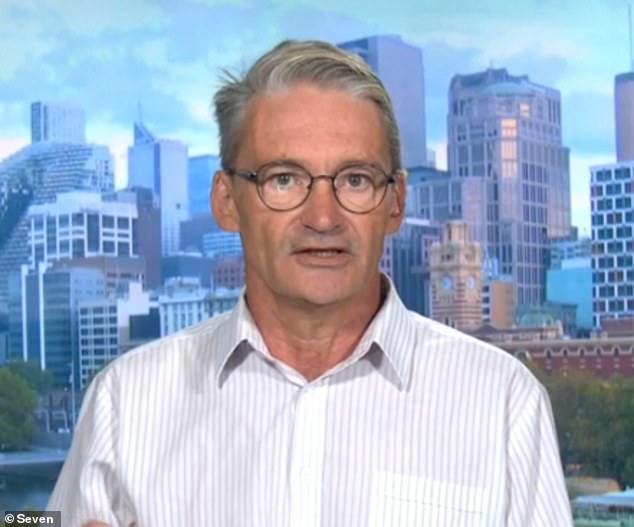

Pro-cash campaigner Jason Bryce (pictured) says the draft regulations have been watered down

‘We recognise that Australians are increasingly using digital payment methods, but there will be an ongoing place for cash in our society,’ he said.

‘This is a balanced, practical, and sensible step to support cash users and give consideration to businesses.’

Mr Mulino said people already have the option to pay their bills, including utilities, phone bills and council rates, in cash at their local Australia Post outlet.

Nearly 5,000 ATMs across Australia have been removed by banks in just five years, as they claim the cost of paying to have the machines restocked was too much.

Meanwhile, the number of bank branches nationwide fell by 155 over the past financial year, and by 1,564 over five years.