19m agoWed 29 Oct 2025 at 1:11amMarket snapshotASX 200: -0.7% to 8,951 points (live values below)Australian dollar: +0.2% at 65.96 US cents S&P 500: +0.2% to 6,890 pointsNasdaq: +0.8% to 23,827 pointsFTSE: +0.4% to 9,696 points EuroStoxx: -0.2% to 575 points Spot gold: +0.7% to $US3,977/ounce Brent crude: .1% to $US64.48/barrel Iron ore: -0.1% to $US105.70/tonne Bitcoin: -0.5% to $US112,332

Prices current from 12:10pm AEDT

Live updates from key ASX indices:

1m agoWed 29 Oct 2025 at 1:29amMarket only sees one more RBA rate cut, next year

A quick check in on market pricing for further interest rate cuts.

According to Bloomberg data, the chance of a cut next week is now down to around 8% — yesterday, it was seen around 40%.

There is one more 0.25 percentage point cut priced in by May, but not much beyond that.

11m agoWed 29 Oct 2025 at 1:20am

Deloitte still expecting December rate cut

Deloitte Access Economics partner Stephen Smith is going against the grain with a forecast of an interest rate cut in December.

“As electricity price rebates roll off, headline inflation was always expected to bounce in the September quarter,” he wrote.

“Another bounce is expected in the March quarter of 2026.

“Neither of those moves should influence interest rate deliberations with this data unlikely to sway the next decision.”

He notes that market pricing for a November cut has “see-sawed over recent weeks” after monthly inflation data surprised to the upside, while unemployment came in higher than expected.

“Those moves have been over-reactions in both directions given the volatility of those data releases and the Reserve Bank’s own messaging,” he said.

“Looking ahead, September quarter economic growth data is expected to be soft, underscoring the continued cost-of-living pressure facing many households and the need for additional interest rate relief to further propel a nascent economic recovery.”

The RBA had forecast the pick up in headline inflation, as Mr Smith notes, but earlier this week Michele Bullock put a number on what she would consider a “material miss” for underlying inflation, and today’s figures blew past that.

With two more RBA meetings left this year, including next Tuesday’s, which comes with updated forecasts, we’ll know soon enough how the central bank is viewing this.

16m agoWed 29 Oct 2025 at 1:15am

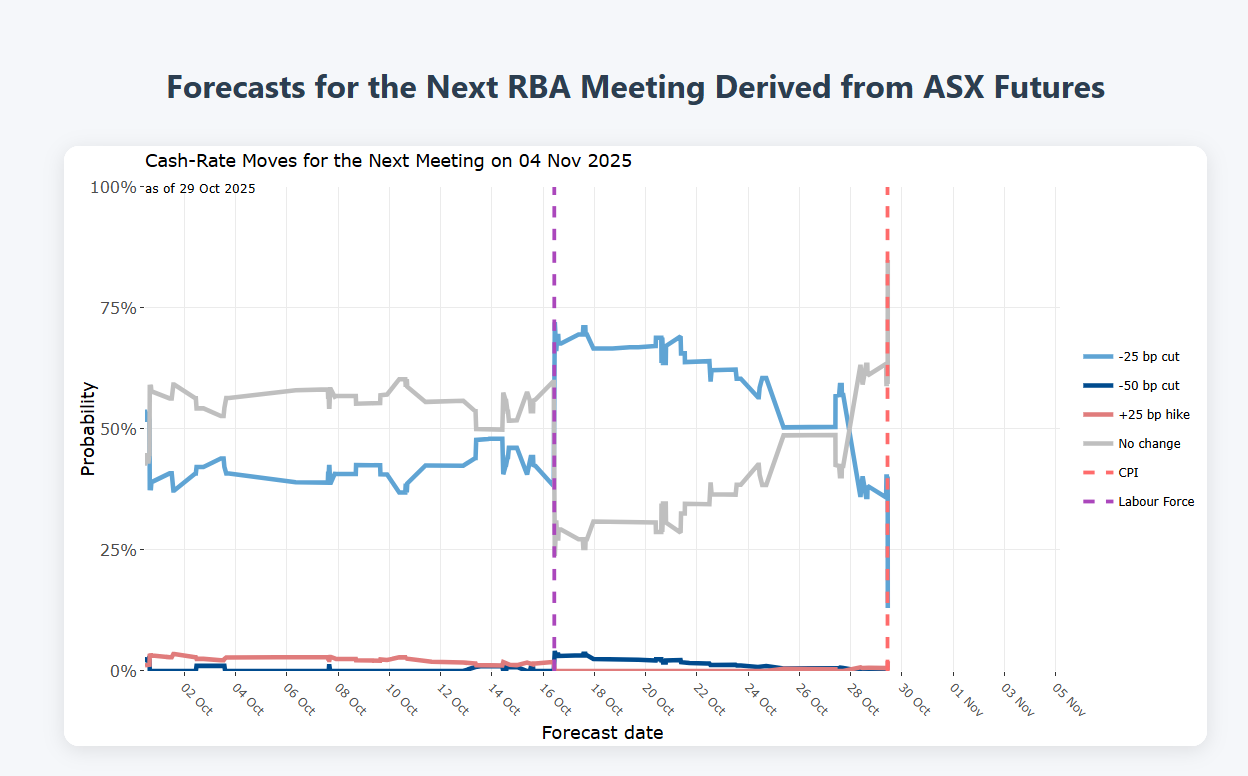

Forecasts for next RBA meeting

Take a look at this chart by economist Isaac Gross, from Monash University.

It shows the probability of different cash rate outcomes at the next RBA meeting, tracking how expectations have evolved over time based on market futures pricing.

It shows how the forecasts move on a daily basis.

Since the inflation data came out at 11.30am AEDT, there is an 85% probability of ‘no change’ to the cash rate on Tuesday.

There is a 13% chance of a 0.25 percentage point cut.

Forecasts for next RBA meeting (Isaac Gross)

Forecasts for next RBA meeting (Isaac Gross)

23m agoWed 29 Oct 2025 at 1:08am

Electricity costs the biggest contributor to CPI

Electricity costs were up 9% in this quarter.

The two main reasons were:

The annual power price increases came into effect from July, which led to higher prices across all capital citiesThe timing of when some households received government rebates also had a large impact. The federal rebates were extended for 6 months from July, however some households did not receive rebates that month (and will receive them later in the year).

You can read more on this story here:

28m agoWed 29 Oct 2025 at 1:03amTrimmed mean lifts to top of RBA’s target band

Some more from Capital Economics’ Marcel Thieliant — he says “crucially” it was not just headline inflation surging in the third quarter, with the trimmed mean also rising 1% in the quarter, its largest increase since the first quarter of 2024.

“That in turn lifted [annual] trimmed mean inflation to 3.0% — the top end of the RBA’s 2-3% target band,” he wrote.

The RBA’s August forecasts had pencilled in just an 0.6% increase in the trimmed mean for the quarter.

“To be sure, the unemployment rate rose sharply in September as well,” Mr Thieliant said.

“However, Governor Bullock earlier this week downplayed that increase and indicated that an increase in the trimmed mean of at least 0.9% q/q would constitute a ‘material’ upside surprise.”

A surprise that was delivered.

“The upshot is that the Bank will almost certainly leave its policy rate unchanged at its meeting next week. And with economic activity now rebounding, the risks are clearly tilted towards less easing than the two 25bp cuts we’ve currently pencilled in,” Mr Thieliant concluded his note.

32m agoWed 29 Oct 2025 at 12:59am

Strength in underlying inflation reduces rate cut chances: Capital Economics

Some of the early takes from economists are rolling in, and the team at Capital Economics is taking the opportunity to pour more cold water on interest rate cut expectations — not just for next month, but for the rest of this cycle.

“With inflation vastly overshooting the RBA’s forecasts, the [Reserve] Bank won’t cut interest rates at its November meeting and the chances that it won’t loosen policy any further are rising,” head of Asia-Pacific Marcel Thieliant wrote in a note.

He did note, however, that some of the lift in headline inflation was due to volatile items.

“But while the ABS flagged the 9.0% q/q rise in electricity prices as the largest contributor, the key point is that electricity prices rose by nearly as much in Q2,” he wrote

“Indeed, the strength in price pressures was broad based.

“Governor Bullock had flagged potential upside surprises in new dwellings purchases and market services and that indeed happened.”

43m agoWed 29 Oct 2025 at 12:48am

This chart shows inflation over the years

Take a look at this chart, which shows annual inflation for the last 10 years.

You can see the peak in December 2022, when inflation reached 7.8%.

And how it’s risen since March this year.

47m agoWed 29 Oct 2025 at 12:44am

RBA will be looking at this number

The Reserve Bank will be looking closely at today’s inflation figures before making their interest rate decision next Tuesday.

The RBA prefers the ‘trimmed mean’ measure of inflation.

It also rose, from 2.7% to 3%.

The RBA’s target range for underlying inflation is from 2-3%.

53m agoWed 29 Oct 2025 at 12:37amAussie dollar rallying, ASX dropping

The market reaction to the big upside surprise on inflation has been swift —the Aussie dollar is up a quarter of a per cent to just shy of 66 US cents and the ASX 200 is down 0.6%.

53m agoWed 29 Oct 2025 at 12:37amInflation surges in September quarter

The Consumer Price Index rose 1.3% in the September quarter, much higher than analyst expectations.

It takes the annual figure to 3.2%, up from 2.1% in the June quarter, according to the Australian Bureau of Statistics.

“The CPI rose 1.3 per cent in the September 2025 quarter, which is the highest quarterly rise since March 2023. The largest contributor to this quarterly movement was Electricity costs, which rose by 9.0 per cent,” said Michelle Marquardt, ABS head of prices statistics.

It’s the highest annual inflation since the June 2024 quarter, when annual inflation was 3.8%.

58m agoWed 29 Oct 2025 at 12:33amBreaking: Inflation hotter than expected

The headline inflation rate rose 1.3% in the third quarter, according to ABS data.

More to come

1h agoWed 29 Oct 2025 at 12:23amMarket sees 43% chance of November rate cut

Not too long now until the Bureau of Statistics releases its third quarter Consumer Price Index, the most closely watched inflation indicator ahead of next Tuesday’s RBA meeting.

According to LSEG data, market pricing puts an around 43% chance of an 0.25 percentage point cut next week, with ‘on hold’ priced as the more likely option for the cash rate.

Earlier this week, RBA governor Michelle Bullock said an 0.9% quarterly core inflation read would be a “material miss” compared to the central bank’s 0.6% projection.

There’s a wide range of economist forecasts, with a Reuters poll putting consensus for the quarterly trimmed mean at 0.8% and headline CPI at 1.1%.

1h agoWed 29 Oct 2025 at 12:20am

Woolworths sales growth ‘well below consensus’

Woolworths’ sales growth in their major ‘food’ category were ‘well below consensus’, according to RBC Capital Markets analyst Michael Toner.

Comparable sales growth in Australian food was up 1.6%, while consensus was 2.2%.

“Despite heavy price investment (-30bps change in average prices ex. tobacco), AU food volumes are still decelerating,” Mr Toner said in an analyst note.

He says lower inflation was primarily due to fruit and vegetables moving into deflation in the quarter driven by increased supply of berries and avocados.

This was partially offset by higher meat prices.

1h agoTue 28 Oct 2025 at 11:59pmWoolworths boss urges patience from investors after lacklustre results

Woolworths’ has posted slower-than-expected sales results in the first three months of the financial year.

Australian supermarket sales rose 2.1 per cent. Woolworths also owns stores in New Zealand and Big W. Total sales were up 2.7 per cent to $18.5 billion.

However, Woolworths CEO Amanda Bardwell conceded sale results were below expectations.

“While the Q1 sales performance was below our aspirations and there remains more to do, the changes we are making to improve value, convenience and availability are being recognised by our customers,” Ms Bardwell said in a statement.

Ms Bardwell said fresh food and groceries were solid in Q1, while pet and baby products continued to underperform in store.

Tobacco sales declined by 51%.

Online sales grew by 12.9% and she said ‘on demand’ growth remained a highlight.

“Australian B2B sales increased by 6.2% with sales growth driven by PFD. In New Zealand Food, sales growth improved towards the end of the quarter with total sales growth of 3.2%1 and eCommerce growth of 15.8%,” she said.

Woolworths said sales at BIG W increased by 1%.

Ms Bardwell, who is facing pressure to increase sales as competition against rivals Coles and ALDI intensifies, talked up a positive second quarter.

“Looking ahead, we are cautiously optimistic about our key trading quarter and we have strong plans in place for our customers for the festive season including a refreshed seasonal range.

“Woolworths Food Retail sales in Q2 to date have increased by 3.2% (5.0% ex. Tobacco) as we continue our focus on rebuilding momentum.

Ms Bardwell also urged investors to be patient.

“It will take some time for the full benefits of our strategic actions to be realised but we remain confident the steps we are taking will lead to meaningful improvements for our customers and our shareholders.”

Rival Coles is due to post its results on Thursday.

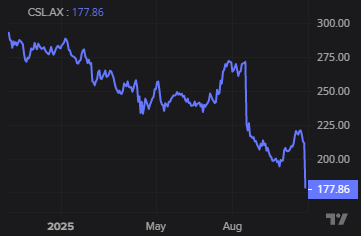

1h agoTue 28 Oct 2025 at 11:50pmCSL drops 3% in early trade

Shares in biotech giant CSL are down around 3% in early trade, adding to yesterday’s near-16% slump, on top of three prior sessions of more modest falls.

It means the stock has now lost just shy of 40% since January.

CSL shares before Wednesday’s fall (LSEG Refinitiv)

CSL shares before Wednesday’s fall (LSEG Refinitiv)

This morning, brokers including Morgan Stanley, Morgans, Citi and Bell Potter cut their price targets on the stock.

CSL shares hit a near seven-year low yesterday after it delayed the US spin-off of its vaccine unit, downgraded guidance and was hit with a second strike against its remuneration report at its annual general meeting.

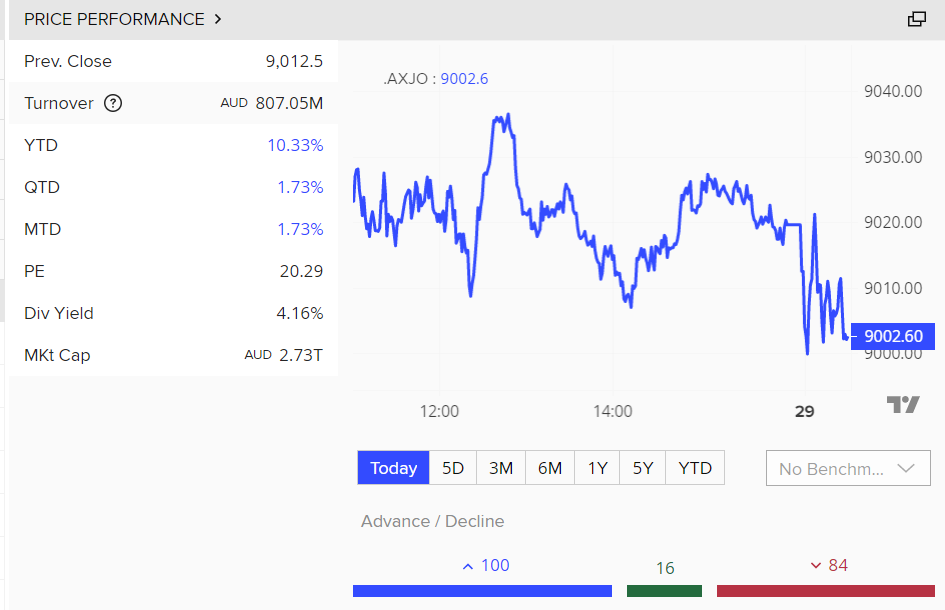

1h agoTue 28 Oct 2025 at 11:33pmASX turns, down 0.1%

Okay, the ASX is now trading lower. It’s down about 0.1% to sit at 9,003 points.

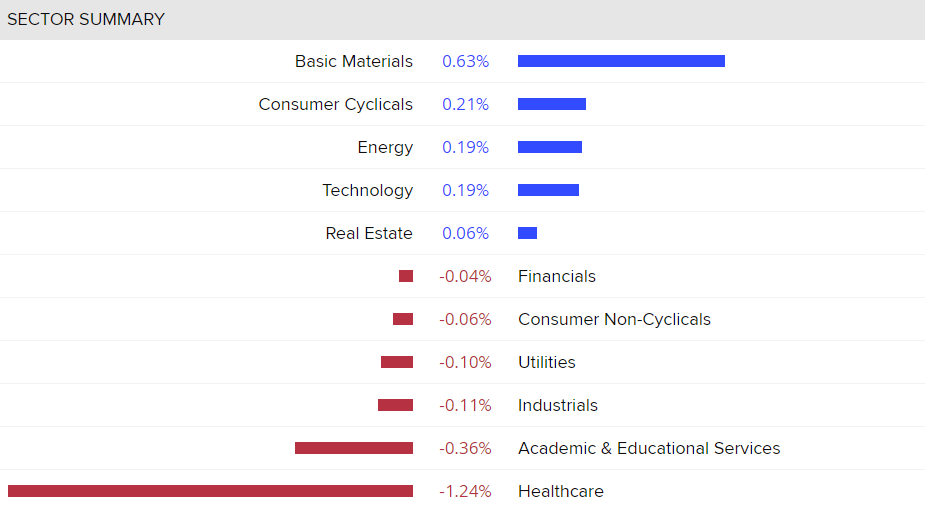

Here’s a look at how the sectors are performing in early trade:

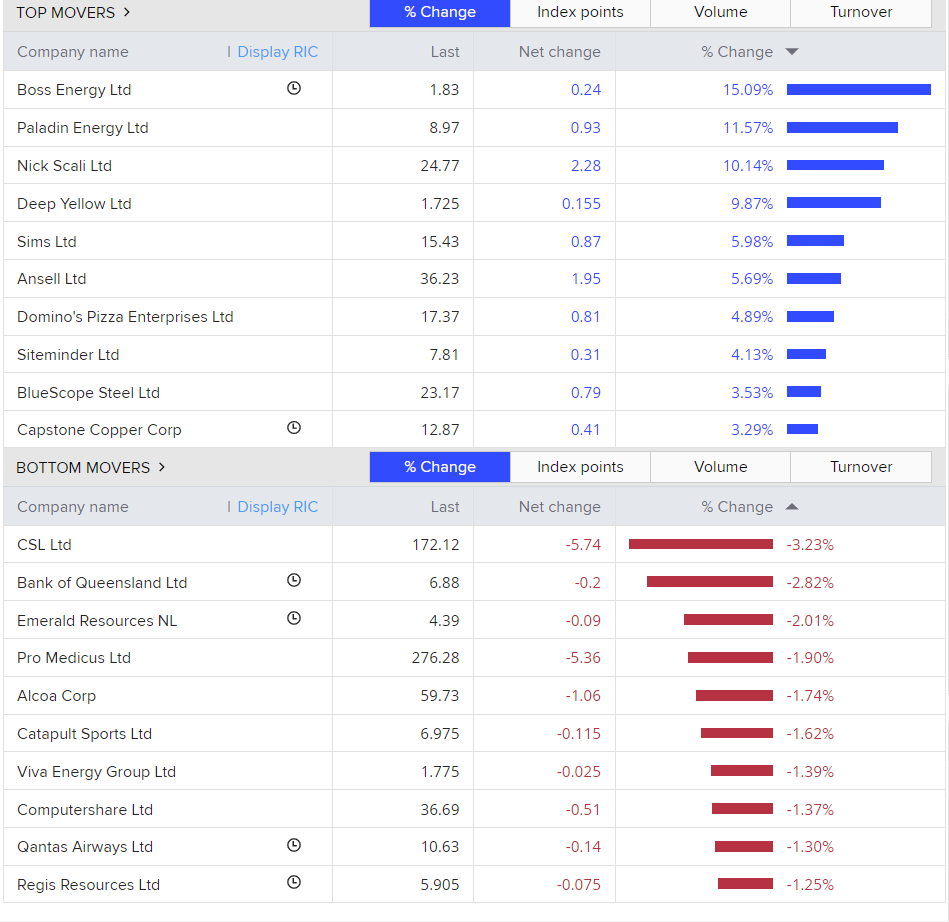

And the top and bottom movers so far:

2h agoTue 28 Oct 2025 at 11:22pmVIDEO: Are we in another dot-com bubble with AI?

2h agoTue 28 Oct 2025 at 11:22pmVIDEO: Are we in another dot-com bubble with AI?

There was a big tech stock push on Wall Street overnight. AI was a big reason why. Microsoft’s deal with Chat GPT owner Open AI buoyed investors.

But some are asking if all this positivity is masking an AI bubble.

Chief investment officer at Forager Funds, Steve Johnson says the AI boom seen in markets at the moment is reminiscent of the dot-com bubble.

Johnson spoke to host of The Business Kirsten Aiken last night:

Loading…2h agoTue 28 Oct 2025 at 11:14pmCrypto industry leader welcomes update from ASIC

Industry leaders have welcomed ASIC’s move to clarify how existing financial laws apply to digital assets, calling it a pivotal step towards restoring confidence in Australia’s crypto sector.

Nick Abrahams, crypto law expert, said the guidance marked a turning point for the industry.

“This is an important moment for Australia’s digital asset ecosystem. ASIC’s updated guidance finally provides a reasonable degree of regulatory certainty. This will help to give innovators confidence to build and investors confidence to fund.”

He said the move to recognise key products as financial services was crucial to separating legitimate operators from bad actors.

“By recognising that stablecoins, wrapped tokens, tokenised securities and digital asset wallets are financial products, ASIC has created regulatory clarity and this provides a clear pathway for legitimate digital asset businesses to operate.”

Mr Abrahams also welcomed ASIC’s plan to allow a transitional period so businesses have time to comply.

“The sector-wide no-action position until June 2026 gives crypto businesses the breathing room they need to transition responsibly.”

2h agoTue 28 Oct 2025 at 11:08pmASX up 0.1% as trading opens for Wednesday

The ASX 200 has gained about 0.1% as trading begins.

I’ll bring you more on that when the number settle.

ASX 200: -0.7% to 8,951 points (live values below)Australian dollar: +0.2% at 65.96 US cents S&P 500: +0.2% to 6,890 pointsNasdaq: +0.8% to 23,827 pointsFTSE: +0.4% to 9,696 points EuroStoxx: -0.2% to 575 points Spot gold: +0.7% to $US3,977/ounce Brent crude: .1% to $US64.48/barrel Iron ore: -0.1% to $US105.70/tonne Bitcoin: -0.5% to $US112,332

ASX 200: -0.7% to 8,951 points (live values below)Australian dollar: +0.2% at 65.96 US cents S&P 500: +0.2% to 6,890 pointsNasdaq: +0.8% to 23,827 pointsFTSE: +0.4% to 9,696 points EuroStoxx: -0.2% to 575 points Spot gold: +0.7% to $US3,977/ounce Brent crude: .1% to $US64.48/barrel Iron ore: -0.1% to $US105.70/tonne Bitcoin: -0.5% to $US112,332