My wife and I suffered under interest rates of 17%. We had three kids, worked hard and paid the house off. 3.6% is nothing and like getting out of jail free. PROBLEM, most want too much too soon. They over commit to get it. Stupidity.

– Clive Nicholson

Hi Clive,

We didn’t get to this comment yesterday, amid the rush of news following the RBA’s decision to keep the cash rate at 3.6%, but it’s worth returning to.

It’s worth having a read of yesterday’s article from Hal Pawson, who is one of Australia’s leading housing experts.

I’ve attached a link to his piece below.

I’ve heard that “17% interest rates” argument for decades now, and it’s lost its moral power. There are major differences between the early 1990s and today, such as the average size of loans, household debt-to-income ratios, and the relative size of mortgage repayments, which means the two eras aren’t comparable.

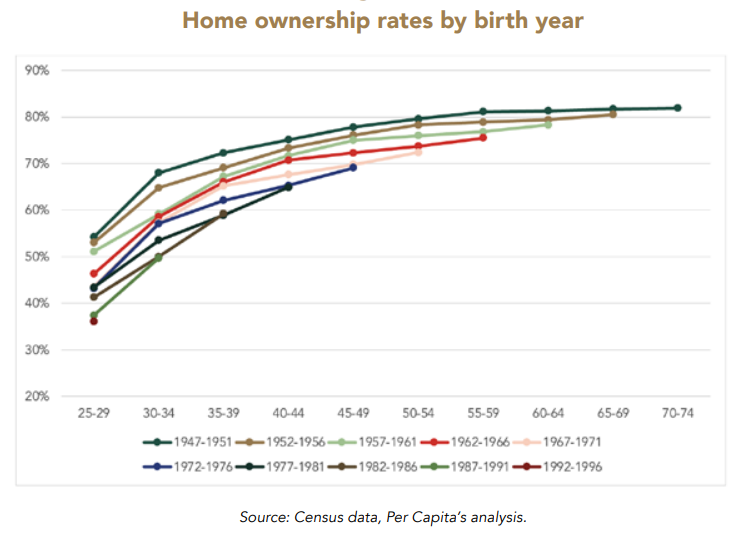

In yesterday’s piece, Professor Pawson pointed out that relative to incomes, Australia’s housing system has deteriorated markedly in recent years:

Back in 2019 a typical property equated to six times the average annual household income.

Even by 2024, that ratio had risen to eight– effectively, houses had become more than 30% less affordable in just five years.

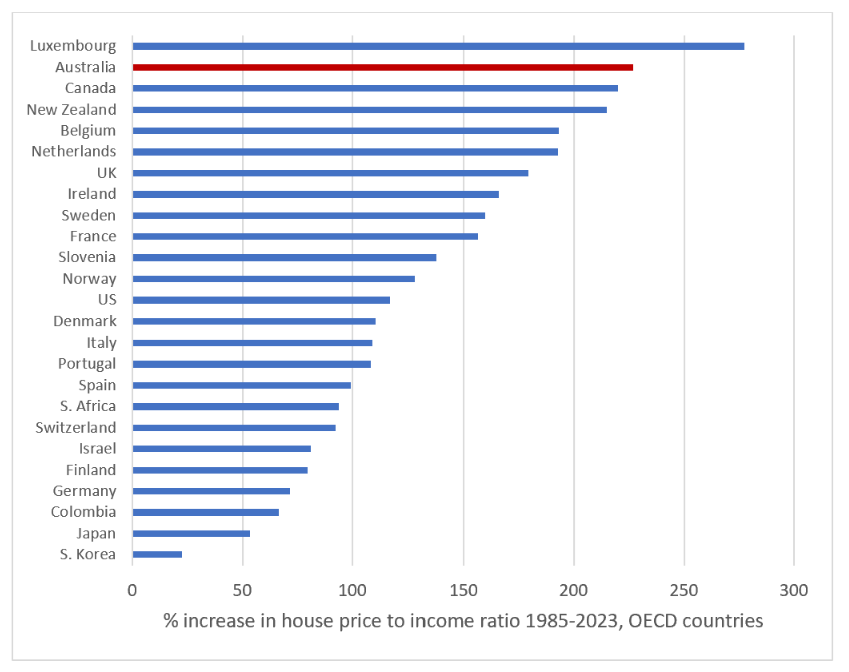

And then, he said, when we step back and take a longer view, you’ll see that Australia’s housing system has been “on the slide for decades”, and it’s been worse in Australia than in many comparable countries:

“Although hardly unique to this country, powerful statistical evidence demonstrates that, over the long term, the situation has worsened more markedly here than in any major comparator country.

“Since 1985, Australia’s house price to income ratio has grown by 226%; ahead of Canada (220%), the UK (180%) and the USA (117%).

See his graphic below:

We’ve written about this phenomenon a lot.

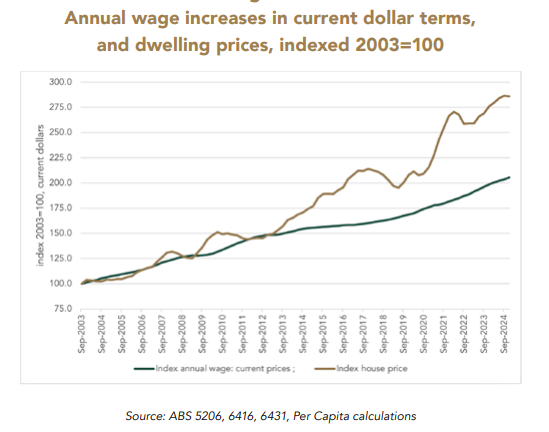

You can see it illustrated in a different way in this graph from the Per Capita think-tank, which shows how quickly property prices increased, relative to incomes, between 2003 and 2024:

It’s very easy to find consumer-friendly articles on the internet that explain why comparisons between the 1990s “17% interest rates” and today’s interest rates are not a like-for-like comparison.

In recent years the ABC, AFR, News.com, and Yahoo Finance, have all had a crack at it.

As Martin North explained in that Yahoo Finance article, in the 1990s debt levels were a lot lower relative to income, house prices were much more affordable relative to income, and tighter lending rules kept a lid on how much people were able to borrow, among many other things.

It’s a different world today.