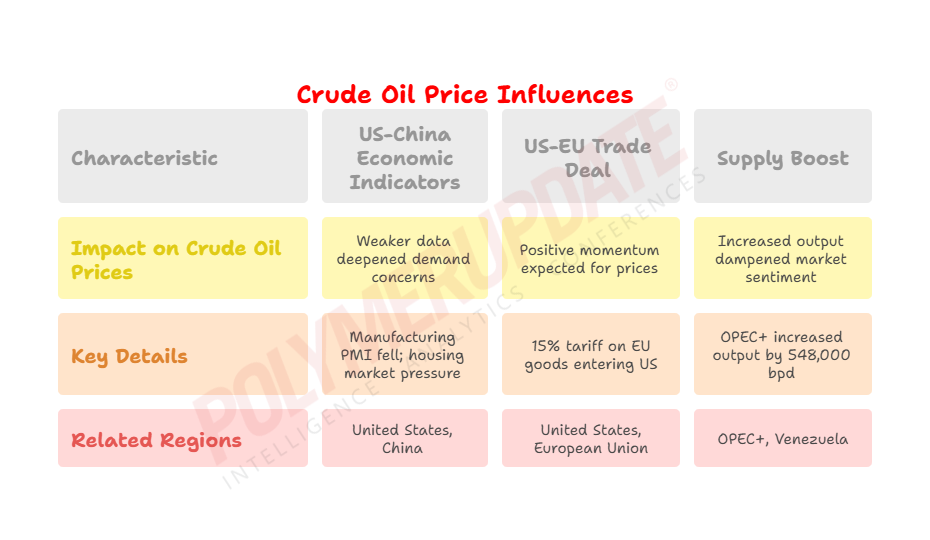

Crude oil prices declined last week, hitting their lowest levels in July, as demand concerns deepened following weak economic data from the United States and China. A prolonged delay in US-China and US-India tariff agreements, coupled with increased output from major producers, further dampened market sentiment. However, the decline was partially capped by hopes of a trade breakthrough between the United States and the European Union, which was announced on Sunday with a 15 percent tariff on EU goods entering the US.

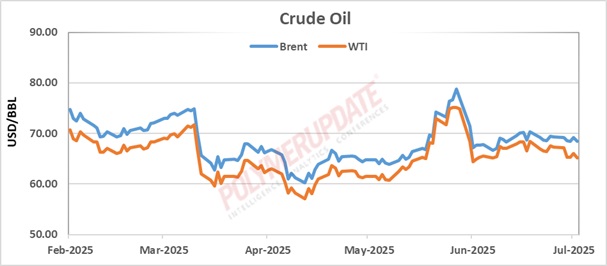

According to data compiled by Polymerupdate Research, benchmark Brent crude futures started the week steady, with the near-month delivery contract trading at US$ 69.21 a barrel on Monday, down from US$ 69.28 the previous day. However, profit-booking soon took hold, dragging Brent prices down to US$ 68.59 a barrel on Tuesday. After stabilizing at US$ 68.51 on Wednesday, the contract edged up to US$ 69.18 on Thursday before falling again on Friday to US$ 68.44 a barrel—the lowest level in July. Overall, Brent futures recorded a weekly decline of 1.21 percent, or US$ 0.84 a barrel.

According to data compiled by Polymerupdate Research, benchmark Brent crude futures started the week steady, with the near-month delivery contract trading at US$ 69.21 a barrel on Monday, down from US$ 69.28 the previous day. However, profit-booking soon took hold, dragging Brent prices down to US$ 68.59 a barrel on Tuesday. After stabilizing at US$ 68.51 on Wednesday, the contract edged up to US$ 69.18 on Thursday before falling again on Friday to US$ 68.44 a barrel—the lowest level in July. Overall, Brent futures recorded a weekly decline of 1.21 percent, or US$ 0.84 a barrel.

The decline was more pronounced in West Texas Intermediate (WTI) Cushing futures. The near-month WTI contract began the week with a marginal dip to US$ 67.20 a barrel on Monday, down from US$ 67.34 on Sunday. On Tuesday, extended profit-booking pushed prices sharply lower to US$ 65.31 a barrel, followed by a narrow move to US$ 65.25 on Wednesday. Prices rose to US$ 66.03 a barrel on Thursday due to short-covering but fell again on Friday to close the week at US$ 65.16 a barrel—the lowest for WTI in July. This marked a weekly decline of 3.24 percent, or US$ 2.18 a barrel.

In its commentary, Kedia Stocks and Commodities Research noted, “Crude oil prices edged lower last week, weighed by persistent concerns over weakening economic signals from both the US and China. Market sentiment remained cautious as the US prepares to allow Chevron and other firms to resume limited operations in Venezuela, potentially adding over 200,000 barrels per day to global supply. However, both OPEC and IEA forecasts remain conservative, especially when compared to last year’s overly optimistic projections during a period of falling Asian crude imports.”

US-EU trade deal

US-EU trade deal

The United States and the European Union have agreed to resolve a US$ 1.3 trillion transatlantic tariff dispute with US President Donald Trump describing as the ‘biggest-ever’ deal. The breakthrough came during a high-level meeting between European Commission President Ursula von der Leyen and President Trump at his golf resort in Scotland, aimed at resolving differences over a proposed 15 percent tariff on EU goods entering the United States.

The deal was finalized well ahead of the August 1 deadline threatening to implement a 30 percent tariff. Announcing the agreement, President Trump said, “We’ve reached a deal. It’s a good deal for everybody. This is probably the biggest deal ever reached in any capacity. The 15 percent tariff will apply across the board, including to Europe’s critical automobile sector, pharmaceuticals, and semiconductors. As part of the agreement, the 27-nation EU bloc has committed to purchasing US$ 750 billion worth of energy from the United States and making an additional US$ 600 billion in investments.”

Following the announcement, von der Leyen stated, “The ‘significant’ purchases of US liquefied natural gas, oil, and nuclear fuels will be made over three years, as part of the bloc’s efforts to diversify away from Russian sources. It is a good deal. It will bring stability and predictability, which remain important for our businesses on both sides of the Atlantic.” She added that bilateral tariff exemptions had been agreed upon for several “strategic products,” notably aircraft, certain chemicals, some agricultural goods, and critical raw materials. The EU also hopes to finalize further “zero-for-zero” agreements—such as on alcoholic beverages—in the coming days.

Commenting on the agreement, Carsten Brzeski, Global Head of Macro at ING Economics, said, “The US and the EU appear to have reached a principal agreement on a 15 percent tariff on nearly all European exports to the US, with exceptions for steel, aluminium, and pharmaceuticals. There must be something magical about golf. Over the weekend, a golf course in Scotland brought relief to the global economy. President Donald Trump and European Commission President Ursula von der Leyen held their first high-level meeting in the current round of US-EU trade talks and agreed on a 15 percent tariff on EU goods entering the United States.”

US-China economic indicators

The S&P Global U.S. Manufacturing PMI fell to 49.5 in July 2025, down from June’s 37-month high and well below market expectations of 52.6, according to a preliminary estimate. The reading marked the first deterioration in factory business conditions since December, as production growth slowed and new orders declined for the first time this year. Additionally, both employment and inventories of purchases fell for the first time since April.

The data also point to continued pressure on the housing market, with high mortgage rates and economic uncertainty prompting many prospective buyers to delay purchasing decisions. Sales of new single-family homes in the United States rose by 0.6 percent in June 2025 to a seasonally adjusted annualized rate of 627,000 units—slightly above May’s seven-month low of 623,000 but still well below market expectations of 650,000. Meanwhile, the recent trend of lower-than-expected jobless claims has reinforced expectations that the Federal Reserve (Fed) may keep interest rates elevated. This has supported U.S. Treasury yields and the U.S. dollar—both typically bearish for non-yielding assets.

China’s economy, meanwhile, grew more strongly than expected in the second quarter, demonstrating resilience in the face of President Trump’s trade war. Gross domestic product (GDP) expanded by 5.2 percent year-on-year (yoy) in the April–June quarter, down slightly from 5.4 percent in the previous quarter but above analysts’ expectations of 5.1 percent. The world’s second-largest economy has so far avoided a sharp slowdown, but investors remain cautious heading into the second half of the year as export momentum weakens, prices continue to decline, and consumer confidence remains subdued.

Supply boost

The OPEC+ coalition (including Russia) is scheduled to increase output again in September by the same volume, following its decision to raise production by 548,000 barrels per day (bpd) in August—completing the rollback of 2.2 million bpd in voluntary output cuts. On July 5, OPEC+ agreed to boost output by 548,000 bpd in August, marking the fourth consecutive monthly increase and exceeding analysts’ expectations. In total, the OPEC+ group has implemented approximately 5.5 million bpd in phased output cuts since Russia’s invasion of Ukraine in February 2022.

In sharp contrast to President Trump’s earlier policy on Venezuela, the U.S. administration is now preparing to grant new authorizations to oil companies with assets in the South American country. Venezuela holds the world’s largest proven oil reserves, estimated at around 304 billion barrels—or approximately 18 percent of global reserves. The Trump administration has now authorized Chevron to resume drilling for Venezuelan oil in partnership with the country’s state-owned oil company, PDVSA.

Outlook

The US-EU ‘best-ever’ deal is expected to provide positive momentum for crude oil prices. Meanwhile, investors will be closely watching this week’s release of the first survey-based estimates for OPEC+ production in July, which will offer insights into the extent to which the five OPEC+ members participating in voluntary output cuts have increased their production levels.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com