Thousands of homes are set to be revalued

21:37, 27 Nov 2025Updated 21:39, 27 Nov 2025

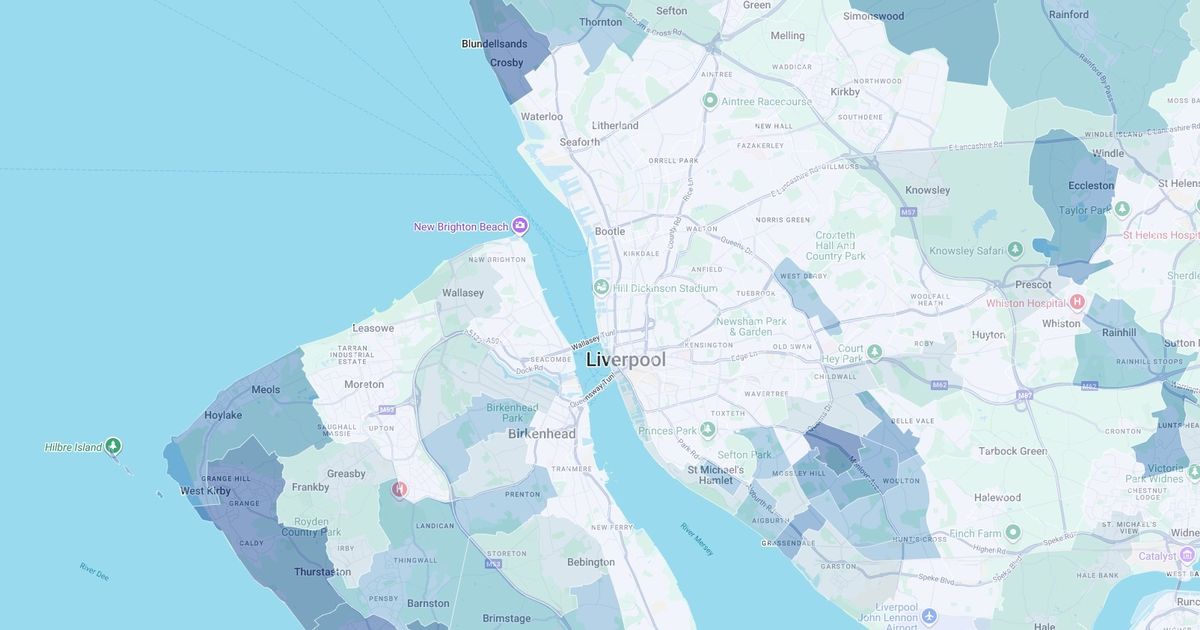

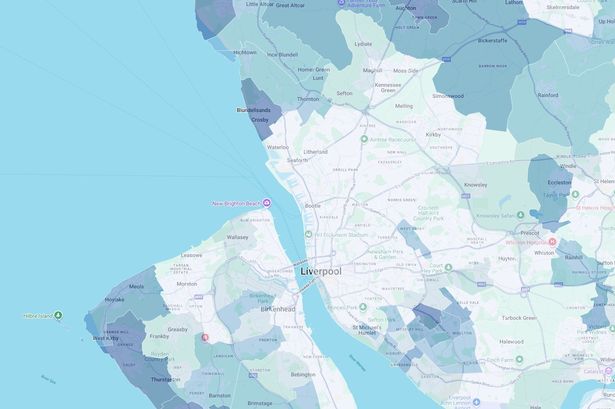

Areas with the highest percentage of properties in Council Tax Band G(Image: Wirral Intelligence Service/Wirral Council)

Areas with the highest percentage of properties in Council Tax Band G(Image: Wirral Intelligence Service/Wirral Council)

A map shows where homes could soon be hit by a new yearly charge that’s been dubbed the “mansion tax”. The money will be collected by councils who will then pass it onto the UK government who promises to use it to fund local services.

The High Value Council Tax Surcharge was announced in the UK Government’s Autumn Budget on November 26 which will affect properties that have been valued at over £2m. The charge will come in from April 2028, with Chancellor Rachel Reeves telling the House of Commons she “will take further steps to deal with a long standing source of wealth inequality in our country”.

Owners of those properties will be liable for an annual charge every year, which will be added to any existing Council Tax and increase with inflation from 2029. This tax will raise £400m by 2029 with the money used to support funding local services.

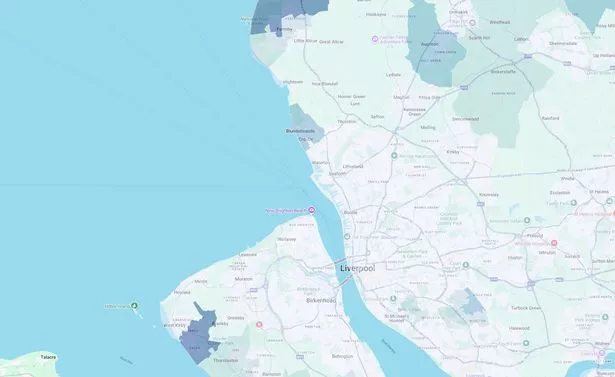

Areas with the highest percentage of properties in Council Tax Band H, the highest band(Image: Wirral Intelligence Service/Wirral Council)

Areas with the highest percentage of properties in Council Tax Band H, the highest band(Image: Wirral Intelligence Service/Wirral Council)

The change is only expected to affect 1% of properties in England and a support scheme is planned for those who may struggle to pay. To work out which homes are over £2m, it has been reported properties in Council Tax bands F, G, and H are set to be revalued.

On its website, the government said: “Under the current system, the average band D charge for a typical family home across England is £2,280.

“That is £250 more per year than a £10 million property in Mayfair, based on the band H charge in the City of Westminster, currently pays.

“This surcharge will change that, implementing a significant reform to improve fairness within England’s property tax system.”

For a house valued at between £2m and £2.5m, people will have to pay £2,500. For homes up to £3.5m, the charge will be another £3,500.

Homes between £3.5m and £5m will have to pay an extra £5,000 while homes over £5m will pay another £7,500. This means a Wirral home valued over £5m that is in Band H could end up paying more than £12,000 in tax.

Across Merseyside’s 14 Parliamentary constituencies, more than 22,000 homes could be eligible for the new tax. The areas with the highest numbers of homes are Wirral West, Sefton Central, Southport, and Liverpool Garston.

Wirral West, which covers the western side of the borough, would see 14.1% of its properties revalued under the scheme with 5,710 homes affected. Sefton Central and Southport would see 4,420 and 3,330 homes revalued respectively.

However the new tax has been criticised. The Institute for Fiscal Studies said: “When it comes to property, we now have a council tax system based on 1991 values, with a new complicated bolt-on for high-value houses based on what the house is worth today. There’s a reasonable case for levying more on high-value homes, but the design of this tax leaves much to be desired.”

Cllr Pete Marland, resources committee chair at the Local Government Association which represents councils, said the government needed to address practical concerns of local authorities.

He added: “Any additional funding raised through the council tax system must be available to support local authorities, particularly in the context of the current financial pressures they face, and we wait to see how government intends to use this funding to specifically support local services.

“Council tax needs comprehensive, fair reform and local government is ready to work with government on this. This surcharge should not create confusion over accountability, with councils likely to be blamed for a charge that is not theirs.”