Professional investors have slammed an “embarrassing” technical glitch for the ASX, which saw price-sensitive announcements unable to be published for several hours this morning, resulting in about 50 companies being placed in trading halts for much of the day.

The ASX apologised for the disruption to trading, and said on its website that: “All company announcements post 11:22am AEDT have been published. ASX is working with listed companies to publish impacted announcements submitted before 11:22am AEDT.”

Grocery and hardware wholesaler Metcash was one of the companies put in a trading halt, ultimately falling 9.2 per cent when its shares resumed trade in the afternoon, following a poorly received interim result.

Professional investors like Wilson Asset Management lead portfolio manager Matthew Haupt said the outage was frustrating.

“We were there waiting, especially with companies like Metcash coming out with their results, obviously a big day for them and unfortunately unable to trade, and it happened to quite a few holdings today,” he told The Business.

“So very embarrassing for the ASX and something that’s been plaguing them for a while now.”

However, he said it was unlikely to have caused losses for most investors.

“If it was material information, they’ve been in a trading halt,” he observed.

“But, obviously, you want to trade on all the available information. So not having information out is incredibly frustrating.

“So it is a big deal, but as far as materiality goes, unlikely to be big misses there, but it’s just more of a nuisance than anything else.”

It was more than a nuisance for the ASX, which itself finished down 2.8 per cent to $56.58, hovering just above what would be its lowest levels in seven-and-a-half years.

Australia’s major stock exchange has been plagued by a raft of technical problems, with the greatest being a settlement platform, CHESS, that is many decades old and long overdue for replacement.

Its previous proposed successor, based on blockchain technology, was beset with problems, delayed by years and ultimately shelved, taking the ASX back to the drawing board.

The exchange is also now under intense scrutiny from its main regulators, ASIC and the Reserve Bank, who are becoming increasingly worried about its aging, and at times failing, technology.

ASX closes lower as AUB shares dive

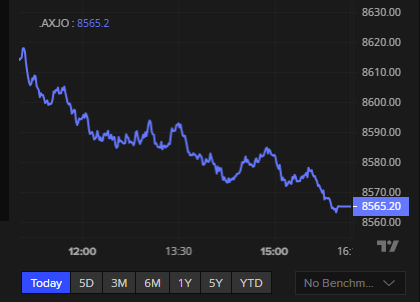

Overall, the benchmark ASX 200 index completed its day-long trudge downhill to close the session 0.6 per cent lower at 8,565 points.

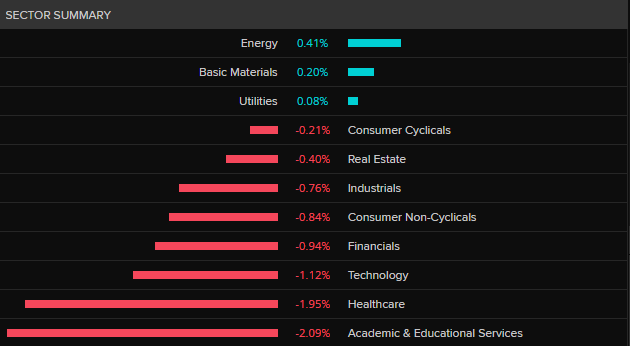

Energy, buoyed by higher oil prices, basic materials and utilities were the only sectors to make any headway, while health care was dragged down by selling in the sector’s heavyweight CSL (-1.4 per cent) along with a steep fall for Resmed (-4.6 per cent).

The big loser was insurance broker AUB, crashing 17.8 per cent after a private equity consortium bailed out on a takeover bid.

Treasury Wine Estates fell moderately after announcing a big impairment charge against its US business, but its share price is already at its lowest levels since 2018.

See how the trading day unfolded on the ABC’s business news blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

11h ago11 hours agoMon 1 Dec 2025 at 5:40am

11h ago11 hours agoMon 1 Dec 2025 at 5:05am

12h ago12 hours agoMon 1 Dec 2025 at 4:55am

Show all key events11h agoMon 1 Dec 2025 at 5:18amMarket snapshotASX 200: -0.6% to 8,565 points (live values below)Australian dollar: -0.1% to 65.40 US centsAsia: Nikkei -1.9%, Hang Seng +0.8%, Shanghai +0.8%Wall Street (Friday): S&P500 +0.5%, Dow +0.6%, Nasdaq +0.7%Europe (Friday): Dax -0.3%, FTSE +0.3%, Eurostoxx +0.3%Spot gold: flat at $US4,231/ounceBrent crude: +1.7% at $US63.44/barrelIron ore (Friday): -0.9% to $US102.50/tonneBitcoin: -5.9% at $US85,790

Prices current at around 4:15pm AEDT

Live updates on the major ASX indices:

10h agoMon 1 Dec 2025 at 6:28am

Goodbye

That’s it for another day on the blog, thanks for your company.

Looking ahead things don’t look great on Wall Street with all the key futures markets in the red.

S&P 500 futures: -0.7%Dow futures: -0.5%Nasdaq futures: -0.9%

We’ll be back bright and early tomorrow morning with the wash up and all the markets and economics news and analysis across the day.

Missing you already, until next time …

Loading11h agoMon 1 Dec 2025 at 5:40amASX falls 0.6%, AUB and Metcash tumble

The ASX 200 completed its day long trudge downhill to close the session 0.6% lower at 8,565 points.

ASX 200 today (LSEG, ASX)

ASX 200 today (LSEG, ASX)

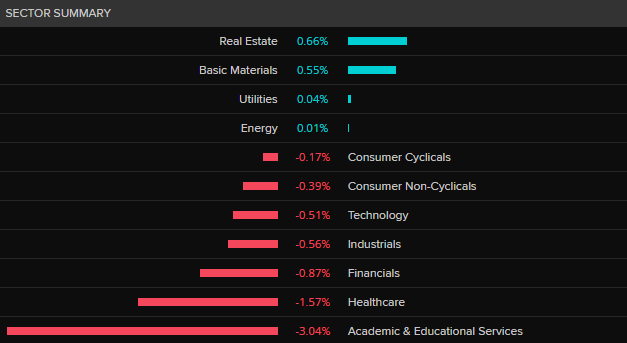

Energy, buoyed by higher oil prices, basic materials and utilities were the only sectors to make any headway while healthcare was dragged down selling in the sector’s heavyweight CSL (-1.4%).

ASX 200 by sector (LSEG, ASX)

ASX 200 by sector (LSEG, ASX)

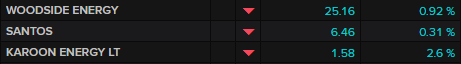

The OPEC+ decision not to increase production until at least March next year saw oil prices rise today, giving a leg up to the likes of Woodside (+0.9%) and Karoon (2.6%).

ASX major oil & gas producers (LSEG, ASX)

ASX major oil & gas producers (LSEG, ASX)

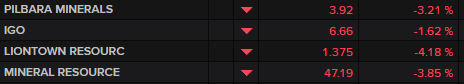

Despite another batch of soft Chinese economic data, the big miners were generally stronger, with the exception of Mineral Resources which fell 3.9%.

ASX major miners (LSEG, ASX)

ASX major miners (LSEG, ASX)

Mineral Resources’ stumble was in line with falls in other major lithium miners.

The banks started brightly enough but by the end of the session all were in the red, with ANZ down 1.3%,

ASX banks (LSEG, ASX)

ASX banks (LSEG, ASX)

The ASX 200’s top mover was copper and gold miner Greatland Resources after posting some positive commentary in a production update.

ASX 200 top movers (LSEG, ASX)

ASX 200 top movers (LSEG, ASX)

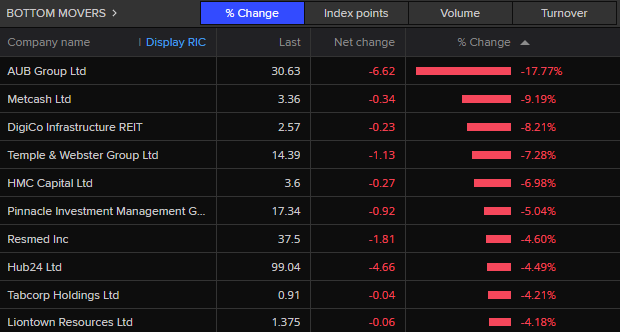

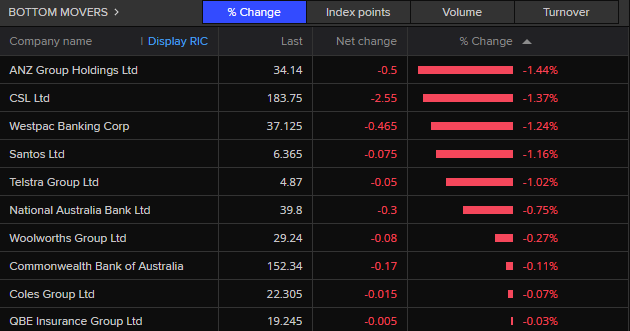

The big loser was insurance broker AUB crashing 17.8% after a private equity consortium bailed out on a takeover bid.

Metcash fell 9.2% on a poorly received interim result.

ASX 200 bottom movers (LSEG, ASX)

ASX 200 bottom movers (LSEG, ASX)

11h agoMon 1 Dec 2025 at 5:39am

Colour coded

The graph of house price rises is almost impossible to read. Using so many similar shades of blue is really crazy.

– Martin

Thanks for the feedback Martin, have updated the colours as per our style guide, so enjoy this easier-to-read version.

You can also hover over the line you’re interested in to get a clearer view or click the label:

Will take the comment on my sanity on notice.

11h agoMon 1 Dec 2025 at 5:05amASX revises down number of halted companies

Dozens of companies that were placed in trading halts after the ASX was unable to publish price-sensitive announcements are now progressively returning to trade, as the stock exchange operator works through the backlog.

An ASX spokesperson earlier told ABC News that around 80 companies had been affected by not having their price-sensitive announcements published, but it has now revised that down to around 50, as some were duplicates.

The exchange operator is now working with listed companies that submitted price-sensitive announcements between when the outage began around 9am AEDT and 11:22am AEDT to publish the announcements and return them to trade.

The ASX would not confirm the full number of announcements or companies affected by the interruption in publication, as not all company announcements are considered price sensitive, so some stocks were able to continue trading despite the publication delay.

ASX Ltd shares were down 3% heading into the close, and are down around 13% since January.

This is the latest technical issue to hit the ASX, adding to a litany of problems in recent years.

In August, the company’s shares slumped after an embarrassing bungle involving TPG Telecom, where the ASX confused it with a similarly-named foreign owned private equity group — you can read chief business correspondent Ian Verrender’s take from the time:

12h agoMon 1 Dec 2025 at 4:55amCryptos crash

It’s been a tough day in crypto-land with yet another wave of selling pushing recent buyers deeper underwater.

Bitcoin has shed almost 6% to be trading at $US85,980 while Ethereum is down 6.8% $US2,815.

And we haven’t checked in on it for a while, but the Trump Coin is also down 5.7% today to $US5.73, a fair way shy of its record high above $US45.

12h agoMon 1 Dec 2025 at 4:24amMetcash tumbles 9.5% after trading delay

Metcash finally got the go ahead for its shares to start trading after an ASX glitch put the company in a halt, but the supermarket chain probably wishes it could have remained suspended a while longer.

At 2:18pm when the suspension was lifted, a backlog of frustrated sell orders came flooding in and Metcash plummeted close to 10%.

The share price has recovered a bit from its intraday low of $3.28 to be sitting at $3.34 with an hour’s trading to go.

The market was well aware of Metcash’s flat interim profit and disappointing performance in its hardware and liquor divisions having seen the results before the ASX announcements page froze at 9am.

With the Metcash investor presentation still caught up in the glitch and not released, the ASX put Metcash and around 80 other companies into trading halts until it sorted things out in the back office.

Metcash share price today (LSEG, ASX)

Metcash share price today (LSEG, ASX)

12h agoMon 1 Dec 2025 at 4:14am

How Australia’s home prices have tracked over last 25 years

As we’ve been reporting today, Cotality’s latest data shows national dwelling values up 1% last month — taking the median value to $888,941.11.

To zoom out just a few decades — here’s what the price growth looks like over the past 25 years:

12h agoMon 1 Dec 2025 at 4:03amRising home prices could lead to “early” and more rate hikes: UBS

The big investment bank UBS says the on-going rise in home prices could lead to the RBA going “early” in hiking interest rates next year.

UBS had already changed its rates outlook to project the ‘next move is up’, with first rate hike in Q4, 2026.

It also expects another hike in Q1, 2027 which would take the official cash rate to 4.1%.

National home prices, as surveyed by Cotality, rose 1% over November to be almost 7% higher year-on-year.

“(The) housing boom already saw macro-pru tightening; but could also see RBA hike rates ‘early’,” UBS economist George Tharenou wrote in a note to clients.

Mr Tharenou also pointed our rising house prices generally lead to higher construction inflation, often nine months down the track.

“This spike in home prices is lifting overall household wealth; as well resulting in a leveraging cycle,” Mr Tharenou said.

“Hence, the risks to our RBA view have already shifted to an earlier rate hike by ~mid-26; as well as the risk of more hikes than our forecast of a 50bps cycle by Q1 2027.”

13h agoMon 1 Dec 2025 at 3:40amBusiness Indicators have mixed messages for GDP

A weaker than expected private non-farm inventories figure will be a significant drag on the Q3 GDP result to be released on Thursday.

The unexpected 0.9% drawdown on inventories is likely to carve 0.3 percentage points off GDP over the quarter, however with still two more GDP partials – government finances and balance of payments – to be released tomorrow, most market economists are unwilling to change their forecasts just yet.

One the wage front, business wages increased by a strong 1.5% across the quarter to be 6.3% higher over the year.

Company profits were flat, or down 1.7% adjusting for inventories – largely due to a large drawdown in mining inventories.

For the record, the consensus pick is for GDP growth to come in at 0.7% over the quarter and 2.2% year-on-year.

Here’s some commentary on today’s figures.

Adelaide Trimball (ANZ): The Q3 Business Indicators report has offset the upside risk to our GDP forecast following the release of capex and construction work done data last week. This weakness is not uniform though; some components of the BI release were softer than expected, while others came in strongerAshwin Clarke (CBA): Today’s partial updates on company profits, businesses’ wages bill, and private non farm inventories have not materially shifted the dial for our Q3 25 GDP forecast. At this stage we continue to look for real GDP growth in Q3 25 of 0.7%/qtr and 2.2%/yr.Taylor Nugent (NAB): Private inventories fell 0.9% qoq against NAB and consensus expectations for little change. That implies a 0.3ppt subtraction from Q3 growth. While at face value that skews the risk to the downside of our 0.7% qoq expectation for Q3 GDP growth, swings in inventories are often offset elsewhere in the accounts.Tom Ryan (J.P. Morgan): Weaker-than-forecast inventories present a headwind for GDP accounting, but the concentration in mining suggests real export growth is likely stronger than we had penciled in. Accordingly, we view inventory/net trade dynamics as broadly offsetting and maintain our 0.5%q/q 3Q real GDP forecast pending tomorrow’s trade and government spending data.13h agoMon 1 Dec 2025 at 3:05amChina’s manufacturing activity contracts further

China’s manufacturing activity has gone into reverse, dragged down by slower new orders and a stalling output.

The private sector PMI, compiled by RatingDog and S&P Global, dropped below 50 points, the breakeven point between expansion and contraction, in November.

The result backs up the “official” NBS PMI survey which recorded an even sharper slide in activity, its eighth consecutive month of contraction.

“On the demand side, although new export orders picked up in November, this trend failed to reverse the sluggish state of the manufacturing sector,” RatingDog founder Yao Yu said.

Capital Economics China economist Zichun Huang, said averaging the PMIs the headline reading declined from 49.8 to a four-month low of 49.5.

“The PMIs suggest that construction activity recovered somewhat, probably due to an easing of weather-related disruptions,” Mr Huang said.

“But the surveys point to a continued loss of momentum in the wider economy, with slower growth across both manufacturing and services.”

Mr Huang said he expects Chinese growth to stay subdued next year.

“Fiscal support looks set to offer less of a lift to growth, and the recent appreciation of the trade-weighted renminbi is likely to offset much of the boost from the US-China trade truce,” he noted.

14h agoMon 1 Dec 2025 at 2:24amBusinesses now need to register to send branded texts

If your phone is anything like mine at the moment, you’re receiving an onslaught of texts from every retailer you’ve ever purchased something from, promoting their Cyber Monday sales — many delivered from a brand name, rather than a number.

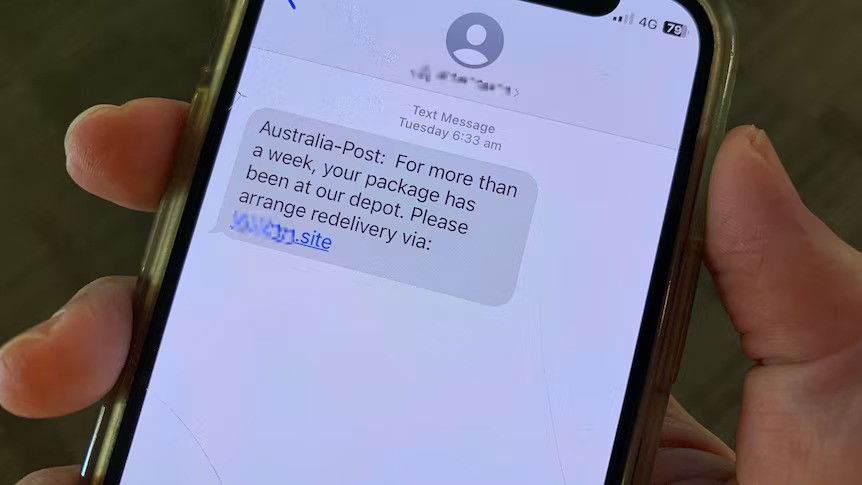

Soon, however, organisations will need to register for the privilege of texting under their name, in new measures from the communications regulator, as part of efforts to crackdown on scams.

The Australian Communications and Media Authority (ACMA) says organisations that use so-called “branded identifiers” in their SMS messages (for example, myGov or AusPost) will need to register their sender IDs with their telco provider ahead of the launch of the SMS Sender ID Register on July 1 next year.

ACMA says it won’t just protect consumers receiving the texts, but also brands from being impersonated.

Organisations that don’t register in by July 1 2026 will have their sender IDs replaced by the word “unverified”, and grouped together in a message thread with other unverified texts.

Impersonation texts will soon be identified as ‘unverified’ (ABC News: Nicholas McElroy)

Impersonation texts will soon be identified as ‘unverified’ (ABC News: Nicholas McElroy)

“This will alert recipients that the text is a potential scam,” ACMA said in a release.

“Anyone using sender IDs must act now to prepare for these changes and get their sender ID registered to take advantage of the new protections,” said ACMA chair Nerida O’Loughlin, noting banks, medical and dental surgeries, retailers, utility providers and not-for-profits were among those that could be affected.

“If a legitimate organisation does not register their sender ID, their messages could be mistaken for a scam, disrupting customer communications and affecting brand reputation.”

14h agoMon 1 Dec 2025 at 2:04am

ASX continues to slide, down 0.3%

The ASX 200 has continued its slow slide downhill, down 0.3% at 1:00pm AEDT.

ASX 200 today (LSEG, ASX)

ASX 200 today (LSEG, ASX)

Real estate and the big miners in the materials sector have made gains, but not enough to offset losses across the likes of healthcare, financials and industrials.

ASX 200 by sector (LSEG, ASX)

ASX 200 by sector (LSEG, ASX)

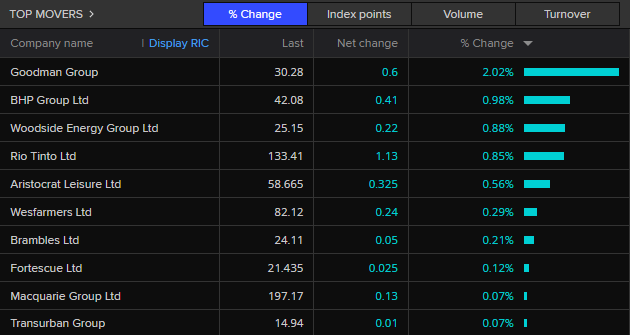

The big end of town in the ASX top 20 is outperforming the broader market, down just 0.1%.

There’s an even split in performance with 10 stocks up and 10 down.

Goodman Group (+2.0%) is the best of the blue chips, while BHP (+1%) and Rio Tinto (+0.9%) are also higher.

Woodside (+0.9%) has gained on higher oil prices today.

ASX top 20 top movers (LSEG, ASX)

ASX top 20 top movers (LSEG, ASX)

The laggards include the big banks ANZ (-14%) and Westpac (-1.2%), while healthcare heavyweight CSL’s decline (-1.4%) is a big part of its sub-index decline.

ASX top 20 bottom movers (LSEG, ASX)14h agoMon 1 Dec 2025 at 1:59amAbout 80 companies affected: ASX

ASX top 20 bottom movers (LSEG, ASX)14h agoMon 1 Dec 2025 at 1:59amAbout 80 companies affected: ASX

In response to questions from the ABC, the ASX has confirmed it “urgently investigating” the issue that has been affecting the publication of company announcements since just before 9am AEDT — with about 80 companies affected.

The stock exchange operator says its trading platform remains open and commenced as normal, and clearing and settlement processes are not affected.

“ASX apologises for the disruption from this event and we are seeking to resolve this as soon as possible,” a spokesperson said.

An initial fix means some announcements lodged from 11:22am AEDT have now been published but earlier announcements are still not out.

“Companies that lodged price sensitive announcements were placed into a trading halt and were contacted directly by ASX,” the spokesperson said.

“As at midday, we understand approximately 80 companies had price sensitive announcements.

“Halted securities will only resume trading once the associated announcement has been published…

“Based on available information, ASX does not believe this technical issue with the announcements platform is cyber-related.”

It is publishing updates on its website.

15h agoMon 1 Dec 2025 at 1:44amASX issues ongoing, according to error message

Here’s what the ASX website has to say on the publishing outage, as we’ve seen a couple of dozen announcements published after a three hour gap.

“ASX has implemented an initial remediation and commenced processing company announcements received since 11:22 AEDT,” its website message reads.

“Earlier announcements remain impacted. We apologise for the disruption from this event and we are seeking to resolve this as soon as possible.”

So that’s a more than two-hour period that investors relying on ASX announcements remain in the dark about.

We’ve put questions to the stock exchange operator and will keep you updated.

15h agoMon 1 Dec 2025 at 1:44am

Market snapshotASX 200: -0.3% to 8,586 points (live values below)Australian dollar: +0.1% to 65.52 US centsWall Street (Friday): S&P500 +0.5%, Dow +0.6%, Nasdaq +0.7%Europe (Friday): Dax -0.3%, FTSE +0.3%, Eurostoxx +0.3%Spot gold: +0.3% to $US4,242/ounceBrent crude: +1.1% at $US63.09/barrelIron ore (Friday): -0.9% to $US102.50/tonneBitcoin: -4.1% at $US87,436

Prices current at around 12:40pm AEDT

Live updates on the major ASX indices:

15h agoMon 1 Dec 2025 at 1:38amCompany profits flat in Q3, wages up 1.5%

The ABS business indicators show company profits were relatively flat over the third quarter and up only 1.1% over the year.

Wages and salaries rose 1.5% over the quarter, while inventories dropped 0.9% which is likely to lop around 0.35 percentage points off Q3 GDP which will be released on Wednesday.

The big rundown inventories came in the mining sector, which as IFM chief economist Alex Joiner points out, could be paid back to GDP growth via higher exports.

15h agoMon 1 Dec 2025 at 1:31amASX announcements filtering through after three-hour outage

Our blog master Stephen Letts has been keeping an eye on the ASX announcement page and from about 10 minutes ago, it seems company announcements are coming through again.

By a quick count, there are just shy of 30 announcements published so far, after the more than three hour gap.

The error message remains at the top of the ASX website, however. And no ASX announcement from the exchange operator. Its shares are down about 2.4%, while the broader index is off 0.3%.

Steve says the biggest surprise from the earlier ‘test page’ publication was the ASX’s font choice of ClassGarmnd … he was expecting Comic Sans.

Loading15h agoMon 1 Dec 2025 at 1:17amJob ads continue to slide

The number of job ads fell 0.8% in November, marking the fifth consecutive monthly decline.

ANZ-Indeed Job Advertisements series in now 6.3% lower than a year ago.

“Labour market conditions continue to soften,” Indeed economist Callam Pickering said.

“There is a risk of higher unemployment in the coming months.”

Job advertisements are regarded as a forward-looking measure of labour demand.

“The ongoing fall in the ANZ-Indeed measure, along with the recent slowdown in employment growth, raises the possibility of a higher unemployment rate in the near-term,” Mr Pickering said

“Seasonal hiring in retail began to unwind in November, but in food preparation & service roles opportunities continued to grow. Job Ads for both sectors normally fall sharply in December.”

Job Ads fell across most states and territories in November, with the largest decline in Victoria.

“Over the past year, the fall in Job Ads has been concentrated in Queensland and Victoria, with New South Wales also underperforming,” Mr Pickering said.

“Western Australia continues to outperform national trends.”

“Seasonal hiring in retail began to unwind in November, but in food preparation & service roles opportunities continued to grow. Job Ads for both sectors normally fall sharply in December.”

Despite softer labour market conditions, Mr Pickering said it will have few, if any immediate implications for monetary policy and interest rates.

“While softer labour market figures are concerning, rate cuts won’t be given any consideration when the RBA meets next week.”

“The latest inflation figures were nasty and the RBA should give serious consideration to hiking rates at their next meeting.

“It’s not the Christmas present anyone wants, but it is undeniable that inflation has picked up faster and higher than the RBA expected.

“Waiting until February seems ill-advised in the current inflation climate.”

15h agoMon 1 Dec 2025 at 1:12amASX Ltd shares down 2.2% as announcement outage rolls on

ASX shares have fallen more than 2 per cent.

I just checked in to see if the outage in publishing company announcements has been resolved… in short, no.

Here’s a ‘test’ announcement at 11:46am AEDT:

ASX test pageShow more posts

ASX test pageShow more posts

ASX 200: -0.6% to 8,565 points (live values below)Australian dollar: -0.1% to 65.40 US centsAsia: Nikkei -1.9%, Hang Seng +0.8%, Shanghai +0.8%Wall Street (Friday): S&P500 +0.5%, Dow +0.6%, Nasdaq +0.7%Europe (Friday): Dax -0.3%, FTSE +0.3%, Eurostoxx +0.3%Spot gold: flat at $US4,231/ounceBrent crude: +1.7% at $US63.44/barrelIron ore (Friday): -0.9% to $US102.50/tonneBitcoin: -5.9% at $US85,790

ASX 200: -0.6% to 8,565 points (live values below)Australian dollar: -0.1% to 65.40 US centsAsia: Nikkei -1.9%, Hang Seng +0.8%, Shanghai +0.8%Wall Street (Friday): S&P500 +0.5%, Dow +0.6%, Nasdaq +0.7%Europe (Friday): Dax -0.3%, FTSE +0.3%, Eurostoxx +0.3%Spot gold: flat at $US4,231/ounceBrent crude: +1.7% at $US63.44/barrelIron ore (Friday): -0.9% to $US102.50/tonneBitcoin: -5.9% at $US85,790