One of Australia’s largest superannuation funds HESTA has been hit with regulatory action, after a “severe, prolonged disruption” that left 1.1 million Australians unable to access their funds for weeks.

The Australian Prudential Regulation Authority (APRA) has imposed additional licence conditions on HESTA, raising concerns about the fund’s risk management and board governance during its transition from one outsourced administration provider to another earlier this year.

APRA said the transition, which led to a seven-week planned outage and ongoing problems for some members even after full services were restored, “resulted in a severe, prolonged disruption to member services and caused direct harm to members”.

“While some disruption is unavoidable when changing service providers, APRA expects that any transitions are well managed and do not result in any unnecessary impact on members’ ability to access their accounts,” APRA deputy chair Margaret Cole said.

In a damning assessment of HESTA, the regulator said it had identified deficiencies in the fund’s board governance and management of risks which rendered it inadequately prepared to effectively oversee and manage the transition.

“APRA’s imposition of licence conditions mean that HESTA is required to take prompt action to address deficiencies. APRA will utilise its powers to hold trustees accountable to meet their obligations to members,” Ms Cole said.

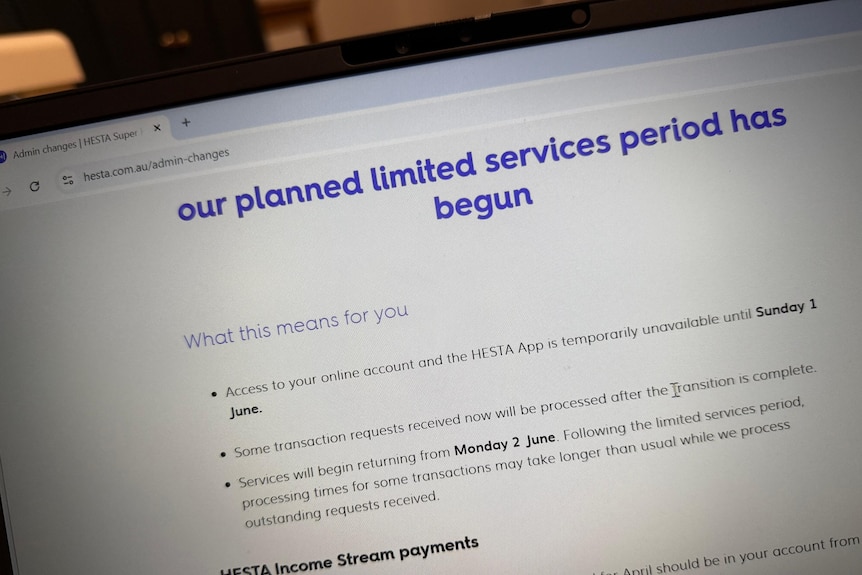

HESTA customers are unable to log in to their accounts until June. (ABC News: Stephanie Chalmers)

In a statement, HESTA chief executive Debby Blakey said the fund took the matters raised by APRA “very seriously and are cooperating fully with the regulator to resolve them”.

“We apologise to members who experienced delays during our transition to a new administration provider.

“Since the transition we have worked closely with our administration provider to seek to deliver the level of service our members expect and deserve.

“We are committed to implementing any potential improvements identified so we can better support our members now and into the future.”

The superannuation fund will now be required to conduct separate independent reviews of its risk management framework and board effectiveness, to comply with its extra licence conditions.

Members faced financial fallout from fund freeze

In April this year, HESTA underwent a planned outage that affected its more than 1 million members, as it transitioned its administration services over to a new platform, GROW.

Members were unable to access most services, including online accounts.

Super contributions and investment switches were unable to be processed until after the outage, as well as withdrawals and insurance claims.

‘Just gobsmacked’: HESTA super outage

The planned outage was announced in February, with HESTA’s chief executive Debby Blakey describing it as “the largest technology project in HESTA’s 38-year history”.

Despite the fund’s communications, dozens of members who contacted the ABC said they were not aware of the outage until it had begun, with some only finding out about it in reporting.

One HESTA member came close to losing his home deposit after struggling to access his super during the planned outage, while another woman said she had to cancel surgery because she couldn’t draw down on her superannuation fund.

In another case, Victorian Glynn Lewis was concerned wife Mandy, a HESTA member, would lose her place at a nursing home because he could not access super to pay the deposit.

Glynn Lewis faced difficulty dealing with his wife Mandy’s super fund, HESTA. (ABC News: Sarah Lawrence)

“We were so unsure about what we could do, there was a real risk — potential risk — that we’d have to take her out of the home and looking after her is a bit of an issue. She needs care,” Mr Lewis told ABC News.

“It was quite stressful for a long time. Not knowing how I’d get the money was a real issue.”

After the ABC contacted HESTA about Mandy’s case in June, Mr Lewis said the money “magically appeared”.

“We apologise to the member and her husband who have not received the service they should expect from us,” a HESTA spokesperson said at the time.

Mr Lewis said HESTA deserved the consequences it was facing: “They certainly need to pick up their game.”

‘Should be a lesson for all funds’

Consumer advocates were scathing of HESTA’s communications with members and conduction during the period of disruption.

On Thursday, Super Consumers Australia welcomed the imposition of licence conditions by APRA.

Why is a seven-week super outage acceptable?

“This raises serious concerns about the HESTA board and executive’s ability to look after their members. HESTA caused serious harm by failing to deliver basic services, with many unable to contact their fund for months,” the group’s chief executive Xavier O’Halloran said.

“People lost access to their money, faced extreme uncertainty and wasted time because of these failures.

“We heard from one grandmother who was forced to pick up her grandchildren on a bike after she was unable to access her money at HESTA to pay for urgent costs after her car broke down.”

Mr O’Halloran said it should be “a lesson to all funds going through similar transitions, they need to put members’ interests first and properly resource their customer service”.

Super Consumers called on the federal government to implement mandatory customer service standards in super, “to send a clear message to funds that they need to lift their standards or face serious repercussions”.

APRA said the independent reviews HESTA will be required to carry out will be comprehensive in scope and will consider the fund’s management of the transition.