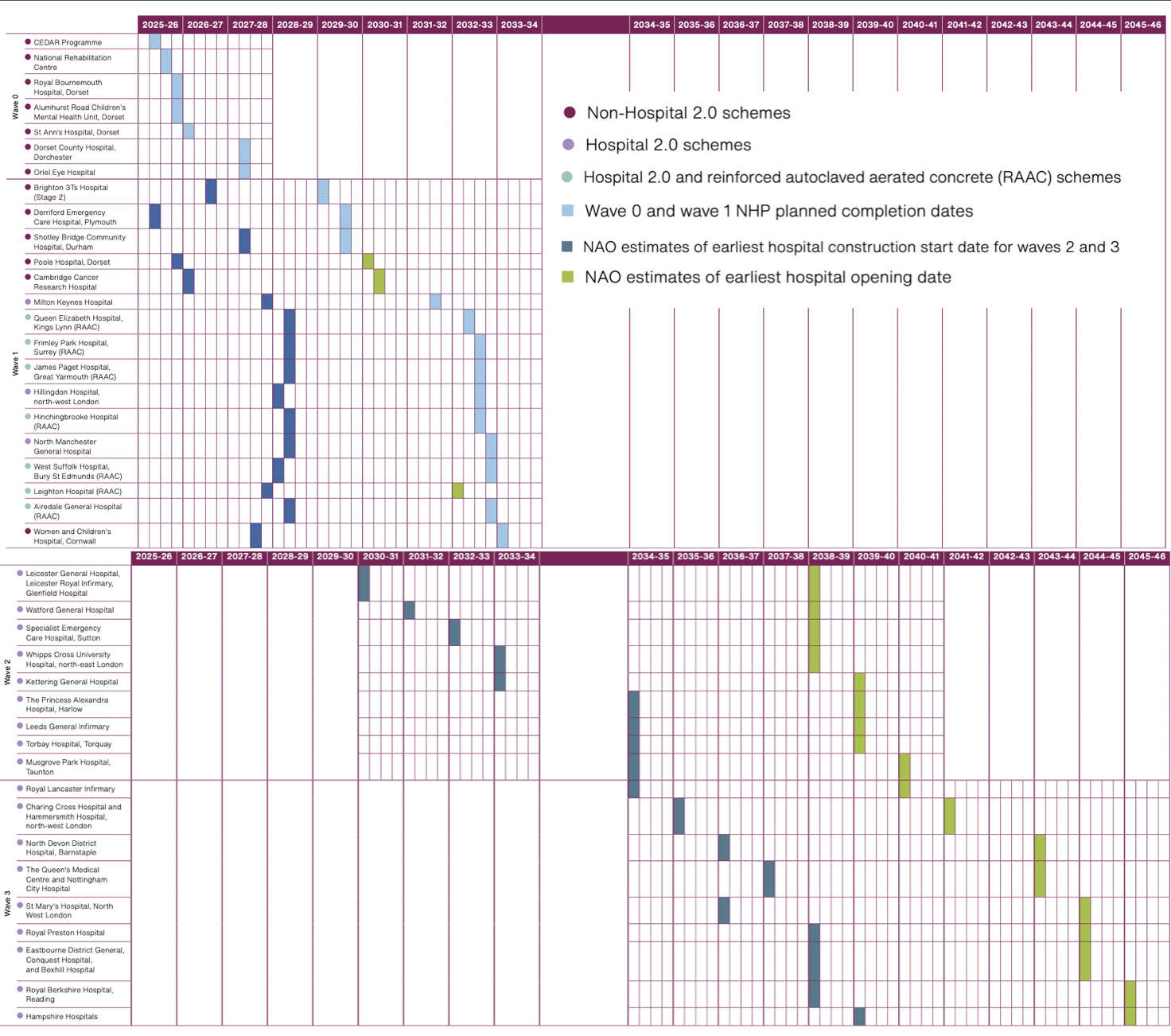

A new update from the National Audit Office says the reset has put the programme on a more credible footing, with final hospitals now expected to complete in 2045-46.

However, seven hospitals built predominantly using Reinforced Aerated Autoclaved Concrete are not expected to open until 2032-33, despite being prioritised.

For contractors, the reset brings long-term certainty and a stronger forward pipeline, but the NAO warns that the next five years will be critical, with a tight construction schedule and limited contingency leaving little room for early slippage or cost overruns.

Key milestones are approaching. The Hospital 2.0 alliance contract was due to be awarded at the end of the year but has now slipped into early 2026. Critical work to draw up standard design will now be completed by April 2026.

Market interest has been strong, with more than 20 contractors expressing interest and 16 firms shortlisted for competitive dialogue.

Alliance shortlist

Bam Construction

McLaren Construction

Bovis Construction (Europe)

Morgan Sindall

Bouygues UK

Multiplex Construction Europe

Dragados

Sacyr UK

FCC Construcción

Skanska Construction UK

Integrated Health Projects

Willmott Dixon Construction

John Graham Construction

Laing O’Rourke

John Sisk & Son

Kier Construction

Wave 1 schemes are due to start on site by 2028-29, including Milton Keynes Hospital and Leighton Hospital.

But capacity risks remain in key public sector client delivery roles. As of November 2025, the programme had a 39% vacancy rate with gaps in digital, commercial and technical skills flagged as a red risk.

The reset, announced last year by the Department of Health & Social Care, follows a review triggered by the watchdog’s 2023 finding that the programme was not deliverable as originally planned.

It now covers 41 hospital schemes delivered across four waves over the next 20 years. Five schemes were already complete when the programme was reset in January 2025.

Total funding to deliver all 46 schemes now stands at £60bn, including £56bn of capital spend – a £33.8bn increase on 2023 assumptions – with a £12bn contingency built in to reflect inflation, market pressure, engineering complexity and environmental requirements.

Capital funding of £8.9bn has been allocated between 2025-26 and 2029-30, with spending rising to around £3bn a year from 2030-31 onwards. Almost 90% of funding before 2030 is earmarked for wave 1 schemes, concentrating work in the late 2020s and early 2030s.

RAAC remains the biggest immediate risk. An independent 2022 review recommended replacing seven RAAC hospitals by 2030, but the NAO says this deadline will be missed. By 2025, more than £500m had already been spent preventing structural failure, while trusts face £100m–£140m a year in extra maintenance costs as replacements are delayed.

The reset leans heavily on the Hospital 2.0 model, designed to standardise layouts, improve buildability and create a more predictable market for contractors. Features include single-patient rooms, shorter staff travel distances, digital patient records and new monitoring technology.

Across 28 Hospital 2.0 schemes, DHSC expects overnight bed numbers to rise by an average of 6%.

NAO head Gareth Davies said the reset had created a firmer platform but warned delivery discipline would be critical.

“The reset of the New Hospital Programme gives the Department a firmer platform to deliver long-term improvements, and its ambition to transform hospital infrastructure has real potential provided designs are rigorously tested and programme delivery is well managed,” he said.

Sir Geoffrey Clifton-Brown, chair of the Committee of Public Accounts, said delays in tackling RAAC posed “significant clinical and cost risks” and warned that rigorous oversight was essential to stop patients and clinicians waiting even longer for new hospitals.

New Hospital Programme – project starts and completions