Listen to this article

Estimated 4 minutes

The audio version of this article is generated by AI-based technology. Mispronunciations can occur. We are working with our partners to continually review and improve the results.

China has lifted its years-long ban on Canadian beef exports — a move industry officials hope will contribute to the sector’s growth and support future market diversification.

Federal Agriculture Minister Heath MacDonald announced the ban’s removal Tuesday, following a recent trip to Beijing, adding he’s aware of a Canadian company shipping its first load of beef to China next week.

Dennis Laycraft, executive vice-president of the Canadian Cattle Association, said the ban’s removal was a long time coming, and beef producers and processors are eager to get back into the Chinese market.

“Now that we have access again, we look forward to seeing our sales grow like they were growing prior to the suspension,” he said.

China has blocked beef shipments from Canadian processing plants since December 2021, following an atypical case of bovine spongiform encephalopathy (BSE) on an Alberta farm.

At the time, South Korea and the Philippines also implemented bans, but lifted them two months later. China — which in 2021 was Canada’s fourth-largest beef export market — was the only country to maintain a ban.

The removal of the ban comes after Canada reached what Prime Minister Mark Carney called a “landmark” trade deal with China, allowing Chinese-made electric vehicles into the country in exchange for a break on tariffs for Canadian agricultural products, like canola seeds.

While beef exports were not specified in the deal, one expert says improving the political and economic relationship between the two countries can have a positive trickle-down effect for other industries.

“The beef producers should be enthusiastic,” said Gordon Houlden, director emeritus of The China Institute at the University of Alberta.

“If we can lever an improved political relationship to help the beef industry, that’s a good thing,” Houlden added.

Market diversification

Although the ban was a blow for the industry in Canada, Laycraft said it also provided an opportunity for producers to look elsewhere.

He pointed to stronger relationships with Japan, South Korea, Taiwan, Mexico and the U.S., as examples of how the beef market has diversified since the ban.

The U.S. remains the beef industry’s largest and most significant importer. Laycraft said last year Canada exported $7 billion worth of beef and cattle, with $6 billion of that heading south of the border.

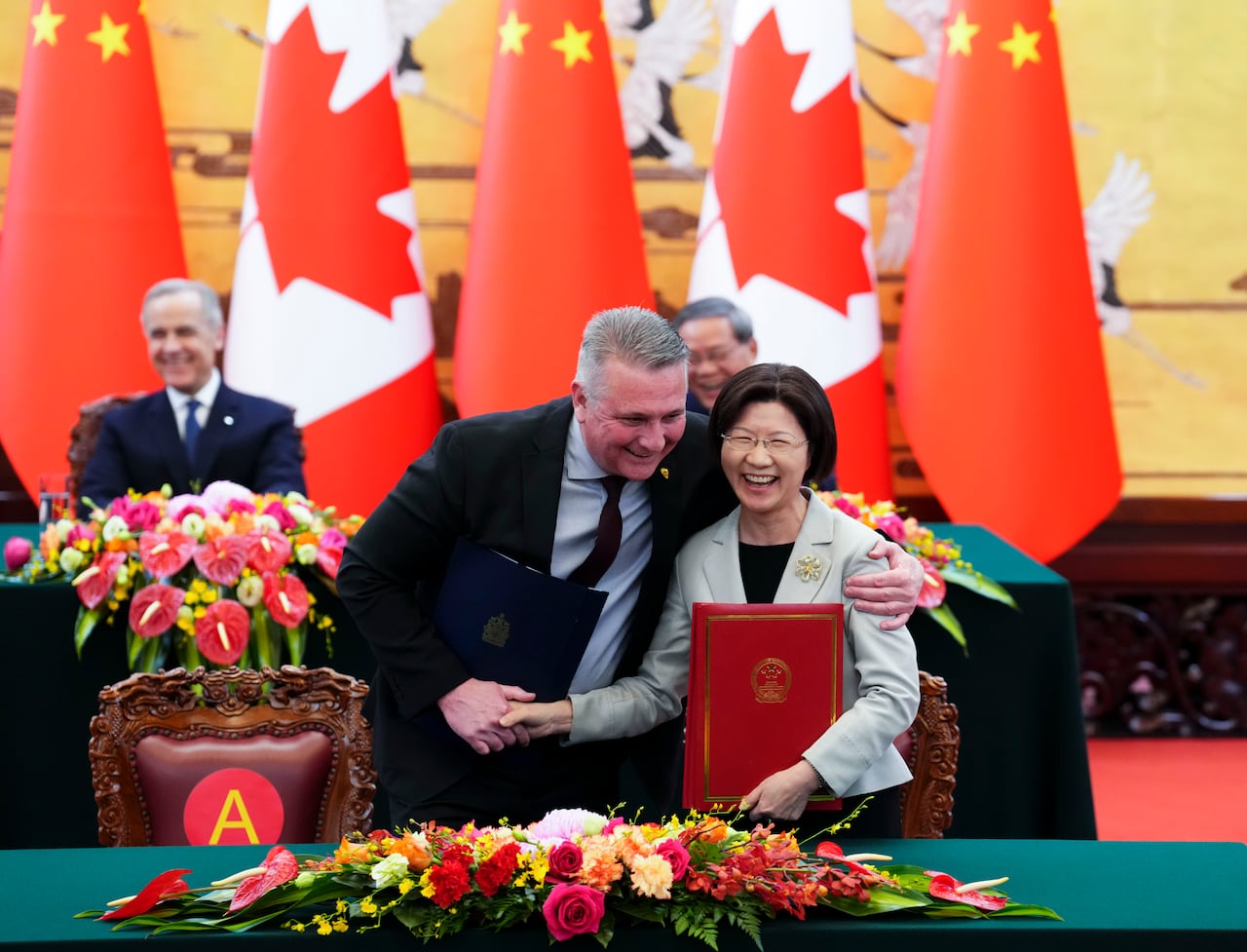

Canadian Prime Minister Mark Carney, back left, and Premier of China Li Qiang, back right, look on as Minister of Agriculture and Agri-Food Heath MacDonald, front left, and Sun Meijun, Minister of the General Administration of Customs in China take part in a signing ceremony at the Great Hall of the People in Beijing, China on Thursday, Jan. 15, 2026. (Sean Kilpatrick/The Canadian Press)

Canadian Prime Minister Mark Carney, back left, and Premier of China Li Qiang, back right, look on as Minister of Agriculture and Agri-Food Heath MacDonald, front left, and Sun Meijun, Minister of the General Administration of Customs in China take part in a signing ceremony at the Great Hall of the People in Beijing, China on Thursday, Jan. 15, 2026. (Sean Kilpatrick/The Canadian Press)

China lifting its ban, means the industry can continue to expand its market outside of those traditional partners, Laycraft said.

“Ultimately our goal is to diversify above the U.S., not instead of the United States,” he said.

Diversification, Laycraft said, can also help keep prices stable, for both producers and consumers. While he said he doesn’t expect beef prices to go down anytime soon, he also doesn’t expect them to rise drastically either.

Beef not immediately entering Chinese markets

Despite the encouraging message sent by lifting the ban, Laycraft said it doesn’t mean Canadian beef will be able to enter the Chinese market right away.

Last year, in a move to protect its domestic cattle industry, China implemented a 55 per cent tariff on beef imports that exceed a predetermined quota.

There are country-specific quotas for China’s major suppliers, such as Brazil and Argentina, along with a general quota for countries who are not major exporters. In 2026, the quota for other countries or regions is around 156,000 tonnes.

Laycraft said, because of the ban, Canada was not assigned a country-specific quota, and will instead have to compete to export its product under the general quota.

WATCH | Why beef is so expensive right now:

Why beef prices keep going up

High beef prices are expected to continue to climb in 2026. For The National, CBC’s Paula Duhatschek breaks down what’s making meat so expensive and what it will take to stabilize the Canadian market.

“You just don’t set up and start exporting to a country, they have some specific requirements like most countries,” Laycraft said.

Still, he said Canadian processors and producers are looking into the requirements, and are “gearing up” to hopefully start shipping their product to China in the next few weeks.

The quota safeguards will increase annually for the next three years, after which time Laycraft hopes the industry can return to normal growth in the market.

“Just looking at the demand that’s growing [in China] and the high quality of our grain-fed beef products, we see the opportunity for fairly quick growth in that market,” he said.