By Editorial Dept – Aug 15, 2025, 9:00 AM CDT

Numbers Report – August 15, 2025

In the latest edition of the Numbers Report, we will take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

‘Bloated’ Markets Are Finally Coming, Warns the IEA The International Energy Agency has sought to squash hopes for an oil market recovery with a scathingly bearish monthly report, cutting 2025-2026 demand growth for the third month in a row. The IEA now expects oil demand growth to average 680,000 b/d and 700,000 b/d, respectively in 2025 and 2026.The Paris-based organization also believes that ‘observed’ oil inventories reached a 46-month high of 7.8 billion barrels in June, even if OECD stocks were nearing decade-low levels of just 2.8 billion barrels. Largely contradicting market consensus, the IEA has also increased non-OPEC+ supply growth for 2026 by 60,000 b/d, tacking in at 1 million b/d (after an increase of 1.3 million b/d this year). The IEA pointed out jet fuel as the refined product seeing the most robust demand growth, expected to be up by 2.1% from 2024 at 7.7 million b/d, even if remaining below 2019 pre-COVID levels. US Natural Gas Prices Collapse on OversupplyA surprisingly timid summer combined with a booming natural gas supply have teamed up to send US natural gas futures to their lowest level since November 2024, trading…

Numbers Report – August 15, 2025

In the latest edition of the Numbers Report, we will take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

‘Bloated’ Markets Are Finally Coming, Warns the IEA

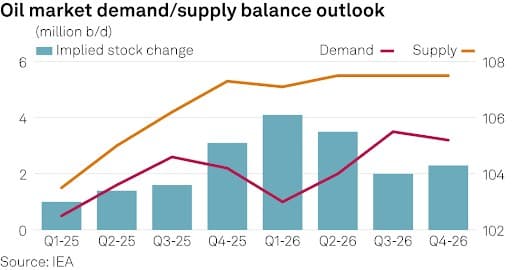

The International Energy Agency has sought to squash hopes for an oil market recovery with a scathingly bearish monthly report, cutting 2025-2026 demand growth for the third month in a row. The IEA now expects oil demand growth to average 680,000 b/d and 700,000 b/d, respectively in 2025 and 2026.The Paris-based organization also believes that ‘observed’ oil inventories reached a 46-month high of 7.8 billion barrels in June, even if OECD stocks were nearing decade-low levels of just 2.8 billion barrels. Largely contradicting market consensus, the IEA has also increased non-OPEC+ supply growth for 2026 by 60,000 b/d, tacking in at 1 million b/d (after an increase of 1.3 million b/d this year). The IEA pointed out jet fuel as the refined product seeing the most robust demand growth, expected to be up by 2.1% from 2024 at 7.7 million b/d, even if remaining below 2019 pre-COVID levels. US Natural Gas Prices Collapse on Oversupply

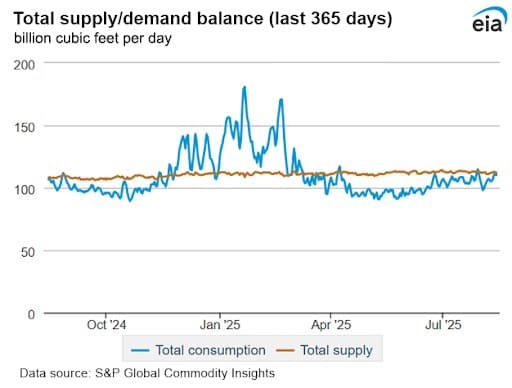

A surprisingly timid summer combined with a booming natural gas supply have teamed up to send US natural gas futures to their lowest level since November 2024, trading below $2.8 per MMBtu. In the second half of August, temperatures across the Lower 48 states are expected to average 77 degrees, pushing US gas burn to 43.7 BCf/day, which is roughly 4% lower than the past three years’ average. In its most recent weekly report, the EIA reported a relatively small inventory build of 21 BCf in the week ending August 8, however a year ago, August saw net withdrawals rather than continuous builds, adding to the pricing pressures. Henry Hub strengthened slightly towards the end of the week on news of Tropical Storm Erin strengthening into a major hurricane next week; however, gas output in Texas and Louisiana is unlikely to be impacted. US natural gas supply in the Lower 48 states has been trending around 108.2 BCf/day in August to date, slightly higher than July’s record print of 107.9 BCf/day. Heatwaves Don’t Bode Well with Europe’s Nuclear Renaissance

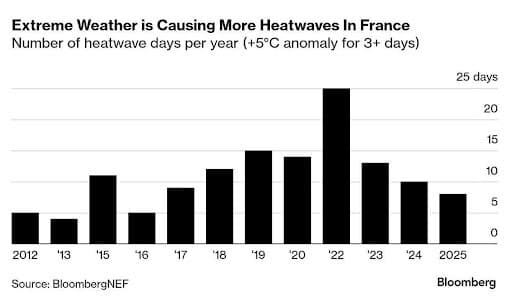

Extreme heatwaves are complicating the operation of Europe’s nuclear industry as the boiling waters of the continent’s rivers and seas make it difficult to condense steam back into water to cool the plants. Every single year since 2010, the length of Europe’s heatwaves has been extending by approximately 1 day per year, with weather-related nuclear outages tripling compared to the 2000s. France in particular, has been plagued by heatwave-triggered force majeure events, with the country’s nuclear operator EDF having to shut down four 0.9 GW nuclear reactors at the Gravelines site this week due to a rapid proliferation of jellyfish in its cooling systems. Introducing closed-cycle cooling systems that don’t rely on outside water sources to cool nuclear plants could be a way out; however, retrofitting such systems would cost about $500 million per reactor. Hence, it is more likely that France’s nuclear regulator, ASN, will relax environmental limits on river temperatures, allowing for generation even when temperatures move out of historical bounds. Outages, Leaks and Fires Ratchet Up Gasoline Cracks

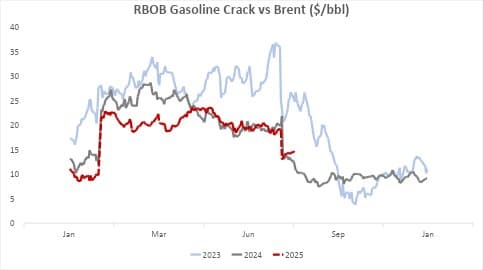

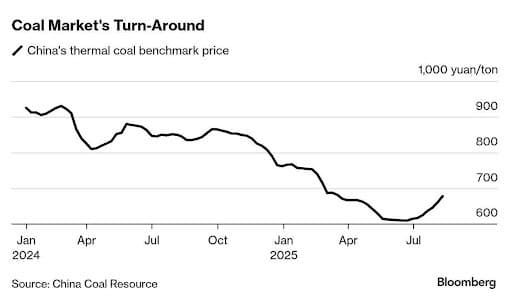

Gasoline cracks have been the star performers of this week, as the Atlantic Basin saw refinery after refinery halt production of gasoline due to unplanned outages and fires, lifting European gasoline cracks back to $15 per barrel. US gasoline demand has been largely disappointing throughout the 2025 summer driving season, with 12 out of the past 13 weeks posting year-over-year declines despite lower prices. However, the rise in US gasoline prices will be supply-driven, with Shell’s Norco reporting a boiler leak this week that forced it to shut its giant 112,000 b/d RCC unit, used to produce gasoline. Simultaneously, Nigeria’s 650,000 b/d Dangote refinery, arguably the main reason why this year’s cracks have been lower than 2024, added to the bullish sentiment due to an unplanned outage at its fluid catalytic cracking (FCC) unit. The last nail in the coffin was Phillips 66 reporting a fire at its 240,000 b/d Bayway refinery in New Jersey on August 14, prompting the US refiner to cut rates at its gasoline-producing FCC unit. Beijing’s Regulatory Crackdown Helps Coal Price Recovery

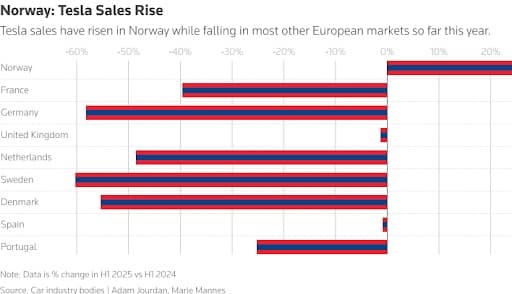

Chinese coal prices halted a year-long trend of continuous declines, with spot prices in the country’s main Qinhuangdao benchmark rising to ¥680 per metric tonne ($95/mt) this week. Whilst lacking supply was the main driving factor behind the price rally, higher air conditioning demand across coastal cities has also helped with thermal coal consumption in the powergen sector rising to a post-COVID high in early August. Last month, China posted the lowest coal production figures since April 2024 amidst mine safety inspections and heavy rain-driven disruptions, producing ‘just’ 381 million tonnes of coal. Total Chinese coal production is still up 4% from a year ago, totalling 2.78 billion metric tonnes in January-July, with most of growth coming from metallurgical coal. Norway Remains the Last Bastion of Tesla’s European Appeal

Elon Musk’s foray into global politics seems to have backfired commercially as Tesla sales across European countries have been falling dramatically, with Norway being the only nation to see demand rise. The Austin-headquartered carmaker saw its appeal collapse in Germany, with H1 sales plunging 60% year-over-year to just 8,890 units, with a concurrent 40% fall in France. Continental Europe is increasingly drifting towards Chinese EVs as Chinese brands rose 91% from a year ago in the first half of 2025, selling 347,135 units, with BYD registering the most prominent increase, at 311% vs H1 2024. Norway remains the only European market to see a notable increase in Tesla sales, up 24% from a year ago to 13,039 units, as consumers latched on to promotional offers such as free supercharging in May and zero-interest financing. Lithium Price Rally Offers Much-Sought Relief to Miners

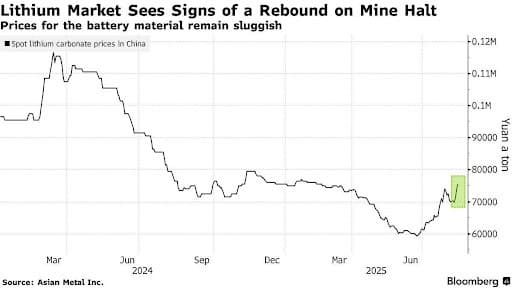

Lithium producers globally are finally enjoying much-anticipated supply disruptions across the metal’s upstream segment, sending lithium carbonate prices as high as ¥88,840 per metric tonne ($12,370/mt) this week. The rally was started off by Beijing forcing CATL to suspend operations at its Yichun mine in Jiangxi province, and then further boosted by Chile opening an investigation into Albemarle’s La Negra plant. Chinese authorities seem to have forced mine suspensions after launching probes into previously granted mining licences, raising the risk of further closures in Jiangxi by September 30. Chile could also see lower supply as Albemarle’s 80,000 mt/year output could be jeopardized by the partial halt of production at the La Negra processing facility, following an acid leak from a pipeline. Even though lithium futures soared to their highest in a year, physical trading was relatively slim as the availability of the metal still exceeds current demand.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.