Benchmark regression results

The baseline regression results show the following sequential changes (Shown in Table 2): First, without the inclusion of control variables or double fixed effects, the effect of ESG on industrial robot applications in manufacturing firms is 0.248 and statistically significant (p < 0.01). After adding control variables, the regression coefficient remains at 0.248, indicating that the effect of ESG on adoption remains stable when accounting for other factors. Finally, when both control variables and double fixed effects are included, the regression coefficient decreases to 0.100, but it remains significant (p < 0.01). These findings suggest a positive correlation between ESG and industrial robot applications in manufacturing firms.

Table 2 Benchmark regression results.Parallel trend test

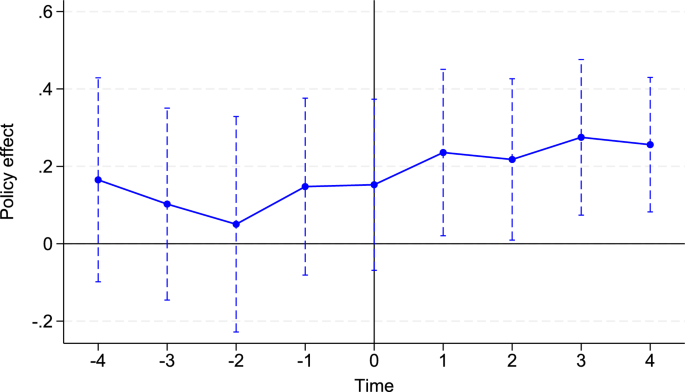

To ensure the validity of the Difference-in-Differences (DID) approach, this study conducts a parallel trend test to verify the key identifying assumption that, in the absence of ESG disclosures, the treatment and control groups would have followed similar trends over time. Specifically, we construct an event study framework by including a series of leads and lags of the treatment variable. Considering the data for the first four years prior to policy implementation, we define four pre-treatment periods, while the post-treatment period extends up to six years given the sample window from 2009 to 2022 and the widespread emergence of ESG disclosures in 2015. The year of ESG disclosure is treated as the baseline (omitted) period. Figure 2 presents the estimated dynamic treatment effects. The coefficients for all pre-treatment periods are statistically insignificant, suggesting that prior to ESG disclosure, the treatment and control groups did not exhibit systematic differences in trends related to industrial robot adoption. This supports the validity of the parallel trend assumption. The significant and increasingly positive coefficients in the post-treatment periods further reinforce the robustness of the estimated treatment effect.

Fig. 2 Placebo testTime-placebo test

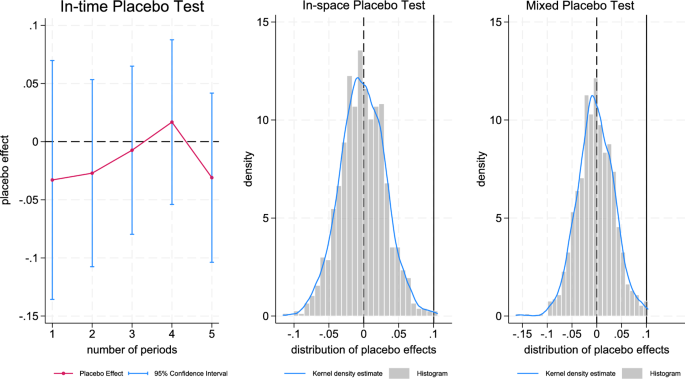

Placebo testTime-placebo test

To ensure that the observed difference in industrial robot applications between the treatment and control groups is not driven by time, this study adjusts the policy implementation timeline by 1 to 5 years, based on the parallel trends test results. A virtual policy shock is then created, and regression analysis is performed using Eq. (1). The results, shown in Fig. 3, indicate that the time-placebo test reveals no significant average treatment effect, suggesting that there is no notable difference in the time trends of ESG report releases between the treatment and control groups.

This study employs individual placebo tests to assess the robustness of the effect of ESG release on manufacturing firms. Specifically, we examine the significance of ESG by applying a placebo intervention to a sample of firms in years when ESG reports were not released. The results from the individual placebo test show that the effect of ESG on industrial robot applications is not significant in years when ESG reports were absent, as depicted in Fig. 3. This finding suggests that the observed ESG effect is not driven by unobserved factors or time trends, but rather by the actual release of ESG reports. Therefore, the individual placebo test supports our interpretation of the empirical results.

Mixed placebo test

Mixed placebo tests involve the random assignment of time and individual factors. As shown in Fig. 3, the mixed placebo test displays the kernel density distribution of the coefficients after 1,000 random groupings. The distribution approximates a normal distribution centered around 0, with most coefficients falling to the left of the baseline regression coefficients. This suggests a lack of statistically significant correlation between the coefficients of the randomized groupings, thereby confirming the robustness of the conclusions drawn from the baseline regression.

Robustness testPropensity score matching

In this study, the propensity score matching (PSM) method is used to construct the sample. After matching, the distribution of variables becomes more balanced between the treatment and control groups, with the deviation proportion below 10%. The mean values of the variables do not show significant differences between the two groups. As shown in Table 3, the empirical results derived from the Propensity Score Matching Double Difference Method (PSM-DID), using kernel matching, caliper matching, and nearest neighbor matching techniques, indicate that ESG enhances industrial robot applications in manufacturing firms. These results demonstrate the effectiveness of ESG and confirm the robustness of the DID method.

Lag processing

To ensure the robustness of the results, lag processing was applied to the industrial robot applications data of manufacturing firms. The regression results show that the effect of ESG on industrial robot applications is 0.061, which is statistically significant (p < 0.05). This suggests that ESG continues to positively impact robot adoption, even after accounting for the lagged effects. However, the effect is somewhat attenuated compared to the higher coefficient observed in the baseline regression.

Sample exclusion

To further verify the robustness of the results, the sample was restricted by excluding municipalities. After excluding the municipal sample, the regression results show that the effect of ESG on industrial robot applications in manufacturing firms is 0.120, and the coefficient remains statistically significant (p < 0.01). This indicates that even after excluding municipal enterprises, ESG continues to have a positive and significant impact on industrial robot applications in manufacturing firms.

Replace explanatory variables

To address the concern that the binary ESG disclosure dummy may oversimplify firms’ ESG performance and ignore heterogeneity in ESG quality, we conduct a robustness check by replacing the binary treatment variable with continuous ESG scores provided by Huazheng Index Information Service. Compared to simple disclosure indicators, the Huazheng ESG rating reflects the relative quality of firms’ ESG performance based on a standardized scoring system widely used in China’s capital market. This allows us to capture not only whether a firm discloses ESG information, but also the intensity and credibility of its ESG practices. The results (see Table 3) remain consistent with our main findings: the effect of ESG on industrial robot applications in manufacturing firms is 0.106, and the coefficient remains statistically significant (p < 0.05). This robustness check mitigates the concern of potential measurement error arising from the binary specification, and confirms that our findings are not sensitive to alternative measurements of ESG practices.

Endogenous testing

This study employs the shareholding proportion of pan-ESG funds as an instrumental variable (IV) to address potential endogenous self-selection biases in firms’ voluntary ESG disclosure decisions10. ESG funds operate under stringent green investment mandates, wherein their portfolio allocations inherently depend on firms’ compliance with standardized ESG certification requirements. This institutional characteristic creates exogenous pressure for invested firms to participate in ESG rating disclosures, as fund managers systematically prioritize issuers with verifiable sustainability credentials. Empirical evidence indicates that a one-percentage-point increase in pan-ESG fund ownership raises the probability of manufacturing firms initiating ESG rating procedures by 4.2 percentage points in the subsequent year, demonstrating the IV’s strong relevance. Furthermore, Hausman test results confirm that fluctuations in fund holdings lose explanatory power for stock price volatility after controlling for ESG disclosure status, thereby supporting the exclusion restriction. The regression results show in Table 3, line 6, and the coefficient remains statistically significant.

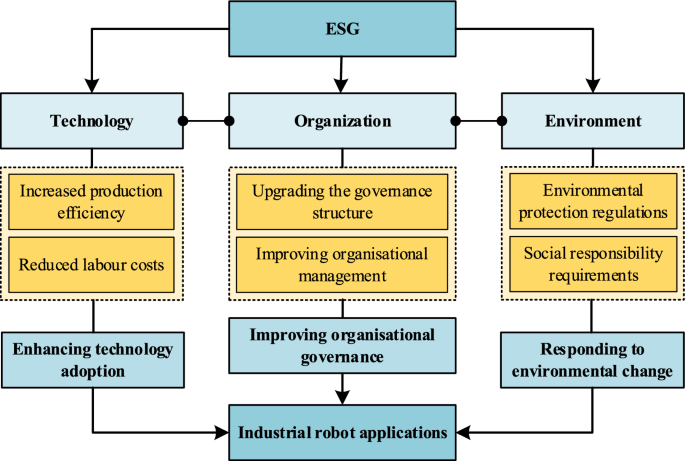

Mechanism testing

Given the ongoing debates surrounding traditional approaches to mechanism testing in existing literature, this study adopts a hybrid causal inference framework following the methodology of32, employing the Difference-in-Differences (DID) model for benchmark regression and double machine learning models as the tool for mechanism analysis. The results of this study demonstrate that the release of ESG has significantly contributed to industrial robot applications in manufacturing firms. This section, guided by the TOE framework, explores the mechanisms through which ESG influences industrial robot applications in manufacturing firms, focusing on three key dimensions: technology, organization, and environment. This study employs the research methodology of10, which uses a dual machine learning model to reveal the complex mechanisms through which ESG affects industrial robot applications. Table 4 presents the detailed results of this analysis, highlighting the specific ways in which each dimension contributes to the observed impacts.

Table 4 Mechanism test results.Enhancing technology adoption

The technology dimension, including green technology innovation and firm R&D investment, shows significant positive direct effects. These findings indicate that ESG positively influences industrial robot applications in manufacturing firms through technological factors. The positive effects of green technology innovation and R&D investment suggest that ESG encourages firms to prioritize sustainable and advanced technologies. This emphasis likely stems from regulatory incentives and stakeholder expectations for reduced environmental impact and improved efficiency. Moreover, R&D investment enhances firms’ capacity to integrate industrial robots by fostering technological readiness and innovation. ESG policies may act as a catalyst, aligning long-term sustainability goals with technological progress, thereby reducing operational risks and opening pathways for competitive advantage in manufacturing.

Improving organizational governance

The organizational dimension, encompassing corporate green awareness and financing constraints, demonstrates significant positive direct and indirect effects. These results suggest that ESG positively impacts industrial robot applications in manufacturing firms by improving organizational governance. The significant positive direct and indirect effects of corporate green awareness and financing constraints indicate that ESG can enhance organizational governance, which in turn facilitates the adoption of industrial robots. Corporate green awareness, driven by ESG factors, encourages a culture of sustainability within the firm, fostering long-term strategic planning and decision-making that aligns with green transformation. This heightened awareness may lead to more effective management of resources, better integration of sustainable practices, and prioritization of environmentally friendly technologies such as industrial robots. Moreover, addressing financing constraints through ESG initiatives, such as access to green financing or incentives for adopting sustainable technologies, provides firms with the financial flexibility needed to invest in industrial robots. Enhanced organizational governance, strengthened by ESG, also promotes better decision-making processes, improved transparency, and a stronger commitment to long-term sustainability goals. This combination of factors creates an environment where the adoption of industrial robots becomes a strategic priority for manufacturing firms.

Responding to changes in the external environment

The environmental dimension, which includes environmental regulations and environmental subsidies, shows significant positive direct and indirect effects. These findings suggest that ESG positively influences industrial robot applications in manufacturing firms by responding to external environmental factors. The positive direct and indirect effects of environmental regulations and environmental subsidies highlight the importance of the external environment in driving the adoption of industrial robots in manufacturing firms. Environmental regulations, as part of ESG, create a compliance-driven imperative for firms to adopt cleaner and more efficient technologies, such as industrial robots, to meet regulatory standards and reduce their environmental impact. These regulations not only encourage technological upgrades but also push firms to innovate and explore alternative solutions that align with sustainable practices. Furthermore, environmental subsidies, which are often provided to firms that adopt green technologies, offer financial incentives to ease the initial costs of integrating industrial robots. These subsidies can lower the financial barriers to technology adoption, making it more attractive for firms to invest in robotics for improved operational efficiency and sustainability. By responding to these external pressures—regulations and subsidies—firms can better align their strategies with national and international sustainability goals, thus accelerating the adoption of industrial robots as part of their green transformation.

Heterogeneity testTechnological heterogeneity

The sample is divided into high-tech and non-high-tech firms to analyze the effects of technological heterogeneity. Regression analysis reveals that in high-tech firms, the release of ESG does not significantly impact industrial robot applications. However, in non-high-tech firms, the release of ESG has a positive effect on industrial robot applications (Shown in Table 5). The contrasting effects of ESG on industrial robot applications in high-tech versus non-high-tech firms highlight the role of technological readiness in the adoption of new technologies. In high-tech firms, the lack of a significant impact from ESG suggests that these firms may already possess the technological capabilities and infrastructure to integrate industrial robots, regardless of their ESG performance. High-tech firms are likely to be more advanced in their innovation and digitalization processes, with a strong focus on R&D and technology adoption. As a result, their decision to adopt industrial robots may be driven more by technological necessity and strategic priorities rather than ESG pressures or incentives.

Table 5 Heterogeneity test.Environmental heterogeneity

To examine environmental heterogeneity, the sample is split into high-pollution and non-high-pollution enterprises. Regression results indicate that the release of ESG positively impacts industrial robot applications in high-pollution enterprises. Conversely, in non-high-pollution enterprises, ESG release does not significantly influence industrial robot applications (Shown in Table 5). The contrasting effects of ESG on industrial robot applications in high-pollution versus non-high-pollution firms highlight the role of external environmental pressures in shaping technology adoption. For high-pollution enterprises, the positive impact of ESG suggests that these firms are more likely to respond to ESG-driven incentives, such as stricter environmental regulations, emissions reduction targets, and sustainability mandates. In highly polluting industries, ESG considerations, particularly those related to environmental performance, can create significant external pressure for firms to adopt greener and more efficient technologies, such as industrial robots, in order to meet regulatory standards and reduce their environmental footprint. These firms are likely to view industrial robots as a tool for improving operational efficiency, reducing waste, and complying with environmental regulations, thereby enhancing their overall sustainability. On the other hand, non-high-pollution firms are already less exposed to stringent environmental regulations and, as a result, may not feel the same level of urgency to adopt industrial robots due to ESG considerations. These firms may prioritize other factors, such as cost reduction, productivity improvements, or technological innovation, over environmental performance, making ESG pressures less impactful in driving robot adoption. As a result, ESG’s influence on industrial robot applications is more pronounced in high-pollution firms, where the need to comply with environmental regulations and reduce pollution acts as a key driver of technological transformation.