1h agoWed 27 Aug 2025 at 9:50pmMarket snapshotASX 200 futures: Flat at 8,938 pointsAustralian dollar: -0.1% to 65.00 US centsS&P 500: +0.2% to 6,481 pointsNasdaq: +0.1% to 21,590 pointsFTSE: -0.1% to 9,256 pointsEuroStoxx: +0.1% to 555 pointsSpot gold: +0.1% to $US3,397/ounceBrent crude: +0.9% to $US67.80/barrelIron ore: Flat at $US101.75/tonneBitcoin: -0.7% to $US111,692

Live updates on the major ASX indices:

4m agoWed 27 Aug 2025 at 10:47pmQantas posts 28% jump in profit to $1.61 billion

Qantas has just released its results to the ASX and is reporting a 27.9% surge in statutory net profit after tax to $1,605 million.

I’ll have more as I delve into the details of the announcement.

7m agoWed 27 Aug 2025 at 10:44pm

Nvidia earnings ‘solid but not spectacular’

Some more commentary on Nvidia’s latest earnings results, released just after US markets closed, from Samy Sriram, market analyst at online share brokerage Stake.

“Nvidia’s Q2 earnings can best be described as solid but not spectacular,” she wrote.

“They’ve by and large hit analyst expectations but the market has dipped.

“This is probably less of a reaction to the results and more a case of profit taking as there was a lot of buying of stock before the earnings were released.

“NVDA was the most traded stock on Stake in the last seven days, with 73% of volume in buy orders alone. However, trading volumes were more subdued compared to previous earnings reports from the chip giant suggesting that investors are more cautious amid mixed signals about future demand.”

She said the company’s financials actually generally exceeded expectations.

“With earnings per share at US$1.05 versus expectations of US$1.01 and revenue at US$46.74b versus expectations of US$46.06b, the world’s most valuable company is continuing to grow and is up 56% year-on-year, which is consistent with previous quarters.”

However, when you are priced for perfection, “spectacular” results are what the market is looking for.

Nvidia stock was down around 3% in after hours trade, hovering about $US176 a share.

15m agoWed 27 Aug 2025 at 10:36pm

Wesfarmers outlines board leadership succession

Aside from its profit result, Wesfarmers had some other big news out today:

“Wesfarmers today announced that its board has resolved to appoint Mr Ken MacKenzie as chairman to succeed Michael Chaney from the conclusion of Wesfarmers’ 2026 Annual General Meeting (AGM), expected to be held on 29 October 2026.

“Mr MacKenzie will join the Board of Wesfarmers on 1 June 2026 and will stand for election as a director by shareholders, as required under Wesfarmers’ Constitution, at the 2026 AGM.”

Mr Chaney has had a lengthy history with the company, but had already flagged his retirement.

“At the 2023 AGM, Mr Chaney announced he would retire at the end of his current three-year term.

“Mr Chaney’s retirement will mark the end of a long and successful career at Wesfarmers, including separate periods in which he has served as chairman and as managing director.

“He joined Wesfarmers in 1983 as company secretary and administration manager and became finance director in 1984.

“Mr Chaney was appointed managing director in July 1992 and retired from that position in July 2005.

“He re-joined the board as a non-executive director in June 2015, becoming chairman in November 2015.”

Mr MacKenzie also comes to Wesfarmers with a pretty impressive corporate CV.

“Most recently Mr MacKenzie was the chair of BHP Group Limited, from September 2017 to March 2025.

“Before that, from 2005 to 2015, he served as managing director and chief executive officer of Amcor Limited, a global packaging company.

“Mr MacKenzie is currently the chair of Melbourne Business School Limited (since June 2023), a member of the advisory board of American Securities Capital Partners LLC (since January 2016) and is a part-time adviser at Barrenjoey (since April 2021).”

22m agoWed 27 Aug 2025 at 10:30pm

Global travel upheaval

The global travel sector is being reshaped by Middle East tensions and occasional airspace closures, along with increasing hesitance among many to travel to, or even through, the US.

Meanwhile, destinations a bit closer to home continue to be popular with Australian tourists.

Flight Centre’s CEO Graham Turner spoke to The Business last night.

Loading…24m agoWed 27 Aug 2025 at 10:27pmWesfarmers profit surges to more than $2.9 billion

While Woolworths, and particularly its long troubled Big W discount department store, struggled with falling earnings, there’s no such problem at Wesfarmers.

The Perth-based conglomerate, which owns a slew of Australia’s biggest retail brands — most notably Bunnings, Officeworks and Kmart — as well as interests in mining, industrial and safety, and health, posted a 14.4% jump in full-year profit to $2.93 billion.

That came from a mere 3.4% growth in revenue to $45.7 billion.

“In a year when many retail and business customers faced cost of living and cost of doing business pressures, the group’s divisions delivered even greater value, service and convenience for customers,” said managing director Rob Scott in a statement.

“This was achieved through the delivery of productivity initiatives, which supported investment in customer value propositions and helped mitigate higher costs.”

The company is paying a fully franked final dividend of $1.11 per share.

Additionally, the firm’s directors have also recommended a capital management initiative under which shareholders will receive a distribution of $1.50 per share.

Wesfarmers says the form of the distribution is subject to a final ruling from the Australian Taxation Office (ATO), but is expected to comprise a capital component of $1.10 per share and a fully franked special dividend component of $0.40 per share.

The recommended return of capital is subject to shareholder approval at the 2025 Annual General Meeting on October 30, 2025.

35m agoWed 27 Aug 2025 at 10:17pm

Inflation is up, but at least one supermarket isn’t profiting

My colleague Emilia Terzon wrapped both the monthly inflation figures (surprisingly higher) with the Woolworths profits (surprisingly low) and Coles profits (surprisingly high).

You can watch the result:

Loading…

44m agoWed 27 Aug 2025 at 10:07pm

Wesfarmers profit results out today

The other massive corporate result out on the ASX today is Wesfarmers, the conglomerate that owns Bunnings, Kmart, Officeworks, and much more.

Its managing director, Rob Scott, will be speaking with the ABC’s chief business correspondent Ian Verrender this afternoon in an interview that will air on PM.

46m agoWed 27 Aug 2025 at 10:05pm

Finance with Alan Kohler

Need to get up to speed on what happened with the markets yesterday?

As usual, Alan Kohler has you covered with his 7pm News Finance Report.

Loading…

48m agoWed 27 Aug 2025 at 10:03pm

Bally’s may be Star’s saviour, but who is going to save it?

Casino operator Star Entertainment has delayed releasing its latest profit results to tomorrow and, even then, those results will be unaudited.

It’s the latest chapter in the company’s struggle to stay alive after revelations that its casinos had previously been regularly used by organised crime to launder money.

US casino giant Bally’s stepped in earlier this year with a deal to save Star, but the American company’s own finances don’t look great.

Its most recent accounts show a company with more than $US7 billion ($11 billion) in liabilities, half of which is listed as long-term debt alongside a large chunk of lease liabilities.

The debt burden is around 10 times the market value of Bally’s Corporation.

Liquidity is also tight for the US company. Almost $US1 billion in short-term debt must be repaid within the next 12 months, covered by just $US490 million in easily saleable assets.

In February, these strains were enough to prompt ratings agency Fitch to downgrade Bally’s debt to B-.

The ABC’s chief business correspondent Ian Verrender discussed the issues on The Business last night.

Loading…

You can read more in his analysis, published this morning.

56m agoWed 27 Aug 2025 at 9:55pm

Waiting on Qantas results

The most watched result on the ASX today is likely to be Qantas, which should drop any minute.

The airline is holding a press conference at 9am AEST, and ABC’s The Business will be there.

1h agoWed 27 Aug 2025 at 9:36pmNvidia profit slightly beats expectations, but shares fall in after-hours trade

Nvidia has beaten revenue estimates, but not enough to stop its share pricing falling moderately in after-market trade.

The world’s leading AI chipmaker reported revenue of $US46.74 billion for the second quarter, beating consensus analyst estimates of $US46.06 billion, according to LSEG data.

In an unprecedented deal with US President Donald Trump, Nvidia has agreed to pay the government 15% of some of its revenue in China in exchange for a reversal of restrictions that curbed sales of its H20 chips to China. But Beijing has cautioned domestic companies about imports, and sources said that Nvidia has halted production of H20 chips.

Nvidia had in May expected the curbs to shave off $8 billion in sales from the July quarter.

The AI market bellwether expects revenue of $US54 billion, plus or minus 2%, in the third quarter, compared with analysts’ average estimate of $US53.14 billion, according to data compiled by LSEG. The company said it has not assumed any shipments of its H20 chips to China in the outlook.

Shares of the world’s most valuable firm fell 2.5% in extended trading. Nvidia shares have gained more than a third so far in 2025, outpacing the benchmark S&P 500 Index’s year-to-date rise of nearly 10%.

“In the very short-term, the stock is seeing some downside testing, as they did not drastically exceed the consensus forecasts,” said Larry Tentarelli, the chief technical strategist with the Blue Chip Daily Trend Report.

“Beyond the short-term volatility, Nvidia remains the benchmark artificial intelligence stock and the most direct way to invest in the theme.

“The AI trade has been the major driver of this bull market over the past 30 months, and we expect that both AI and Nvidia will continue to lead.”

Chuck Carlson, the CEO of Horizon Investment Services, agreed that the results were “okay”.

“They weren’t blow-the-doors-off, but nor were they bad,” he told Reuters.

“And I think the stock price movement is going to depend a lot on what they say on the earnings call, especially if they give colour on China.

“I think people were a little disappointed in the data center number, which looks like the sequential growth was about 5% … and I think people might have been looking for a little bit more on that side.

“I’m not surprised that the stock in the after-market is down a bit, but it is not down a ton, especially given the strength that the stock is showing so far this year.”

Reuters

1h agoWed 27 Aug 2025 at 9:29pmS&P edged cautiously higher ahead of Nvidia results

The S&P 500 climbed 0.2% to end the session at 6,481 points, exceeding its previous record high close on August 14.

The Nasdaq gained 0.2% to 21,590 points, while the Dow Jones Industrial Average rose 0.3% to 45,565 points, as US markets traded cautiously ahead of Nvidia’s second-quarter profit results.

Volume on US exchanges was relatively light, with 14.0 billion shares traded, compared to an average of 16.9 billion shares over the previous 20 sessions.

Eight of the 11 S&P 500 sector indexes rose, led by energy (up 1.2%), followed by a 0.5% gain in information technology.

Shares in tech and AI heavyweights were mixed, with Microsoft gaining nearly 1% and Meta Platforms dipping almost 1%. They, along with Alphabet and Amazon, are among Nvidia’s biggest customers.

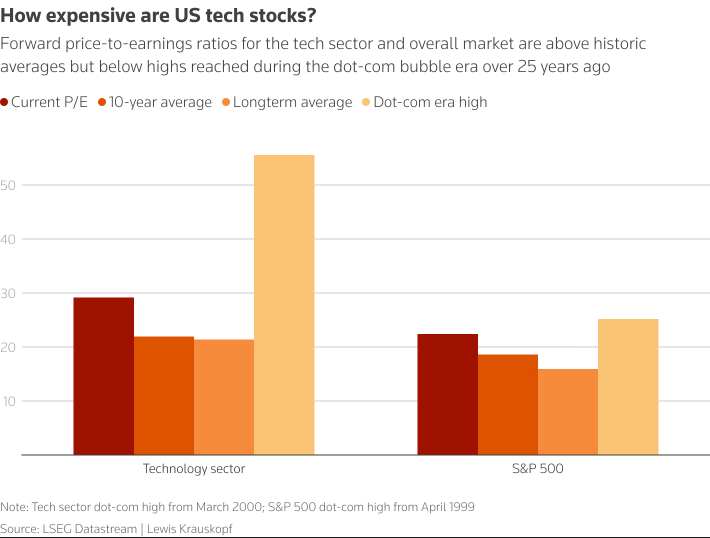

Enthusiasm for companies related to AI has fueled big gains in technology stocks. The S&P 500 now trades at over 22 times expected earnings, its highest price-to-earnings ratio in four years, according to LSEG.

Concerns about the pace of the AI rally increased last week after OpenAI CEO Sam Altman warned of a potential AI bubble.

US tech stocks are above average valuations but not yet at the Dot-com era peak (LSEG)

US tech stocks are above average valuations but not yet at the Dot-com era peak (LSEG)

Investors were also watching for developments related to US President Donald Trump’s attempt to fire Federal Reserve governor Lisa Cook, a move likely to face legal challenges.

If Trump succeeds, he would nominate a replacement to the central bank’s board who could be expected to back his policy preferences, challenging the central bank’s independence.

Investors are pricing in a 25-basis-point interest-rate cut in September, according to data compiled by LSEG, with most big brokerages also leaning in that direction.

New York Federal Reserve Bank president John Williams said on CNBC it is likely interest rates can fall at some point, but policymakers need to see upcoming economic data to decide if a rate cut is appropriate at the Fed’s September meeting.

Reuters

1h agoWed 27 Aug 2025 at 9:29pm

Welcome to another day on the markets

Good morning, and welcome to another trading day.

We’ll bring you all the latest from the markets, as well as any other major economic, financial and business news.

Locally, the key result to watch out for today is Qantas, while Nvidia’s profit results were released shortly after US trade closed.

Stay with us.

Loading

ASX 200 futures: Flat at 8,938 pointsAustralian dollar: -0.1% to 65.00 US centsS&P 500: +0.2% to 6,481 pointsNasdaq: +0.1% to 21,590 pointsFTSE: -0.1% to 9,256 pointsEuroStoxx: +0.1% to 555 pointsSpot gold: +0.1% to $US3,397/ounceBrent crude: +0.9% to $US67.80/barrelIron ore: Flat at $US101.75/tonneBitcoin: -0.7% to $US111,692

ASX 200 futures: Flat at 8,938 pointsAustralian dollar: -0.1% to 65.00 US centsS&P 500: +0.2% to 6,481 pointsNasdaq: +0.1% to 21,590 pointsFTSE: -0.1% to 9,256 pointsEuroStoxx: +0.1% to 555 pointsSpot gold: +0.1% to $US3,397/ounceBrent crude: +0.9% to $US67.80/barrelIron ore: Flat at $US101.75/tonneBitcoin: -0.7% to $US111,692