Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 1 September.

With Nvidia’s earnings behind us – and the associated market jitters dying down – US stock indices are likely to start moving more freely again. In the coming week, the focus will again be on key data from the US, including ISM services and manufacturing updates, and the latest labour market figures (in the form of the JOLTS report, ADP private payrolls, and the closely watched non-farm payrolls print). On the corporate earnings front, semiconductor company Broadcom – which has overtaken Tesla to become the seventh largest US company by market capitalisation – is due to report third-quarter results on Thursday.

US August ISM data

Tuesday 2 September (manufacturing), Thursday 4 September (services)

The week ahead brings two monthly economic reports on the manufacturing and services industries in the US. Published by the Institute for Supply Management (ISM), these purchasing managers’ index (PMI) readings indicate expansion (above 50) or contraction (below 50) in the relevant sectors. The manufacturing print, due out Tuesday, is expected to show a mild improvement for August, with analysts forecasting a rise to 48.6, up from 48 in July, though still in contraction territory. The services report, set for release on Thursday, is expected to have increased to 50.5 from 50.1.

The market will, however, focus on the employment and prices paid sub-indexes, as traders seek to gain an edge ahead of upcoming jobs and inflation data. Sensitivities to these figures are likely to weigh heavily on the dollar, with USD/JPY potentially seeing the greatest volatility, especially given the convergence of market interest rates between the US and Japan. In the short term, USD/JPY has formed what appears to be a bear flag, as shown on the chart below. If confirmed, this pattern could suggest near-term yen strength against the dollar, with the pair potentially falling towards ¥143.25 per dollar.

USD/JPY, March 2025 – present

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

Broadcom Q3 earnings

Thursday 4 September

Analysts are forecasting that Broadcom’s earnings grew 32.9% in its fiscal third quarter to $1.65 a share, as revenue increased 21% to $15.8bn. Gross margins are expected to fall to 77.0% from 79.4% sequentially. Looking ahead to the fiscal fourth quarter, analysts expect revenue to increase to $17.0bn, with gross margins tightening to 76.4%, resulting in earnings of $1.79 a share. The Nasdaq-listed chip company’s shares, up by a third this year at roughly $309, could rise or fall within a range of about 7% following the Q3 results announcement, based on options market positioning.

As has often been the case, the options market is positioned bullishly going into the results. Traders are betting on the shares to rise, with a significant level of resistance pinned at $320. However, as our chart shows, the stock has broken below a major uptrend and faces technical resistance around $316. Additionally, the relative strength index has been trending lower since June, creating a bearish divergence from the rising stock price. In other words, momentum in Broadcom has waned over the last couple of months despite the stock’s gains, suggesting that a price reversal may be imminent.

Should the Q3 results fail to exceed the market’s bullish expectations, the shares could slide towards a major level of options and technical support around $270.

Broadcom share price, February 2025 – present

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

US August jobs report

Friday 5 September

The non-farm payrolls print is set to be a major market event as it is likely to play a key role in determining whether the Federal Reserve cuts interest rates in September. The odds of a September rate cut are around 85% at the time of writing.

Analysts expect just 78,000 jobs to have been created in August, up from 73,000 in July. The monthly report is also expected to show that unemployment rose to 4.3% from 4.2%, with growth in average hourly earnings thought to be unchanged at 0.3% month-on-month. As always, traders will be paying close attention to any data revisions for previous months.

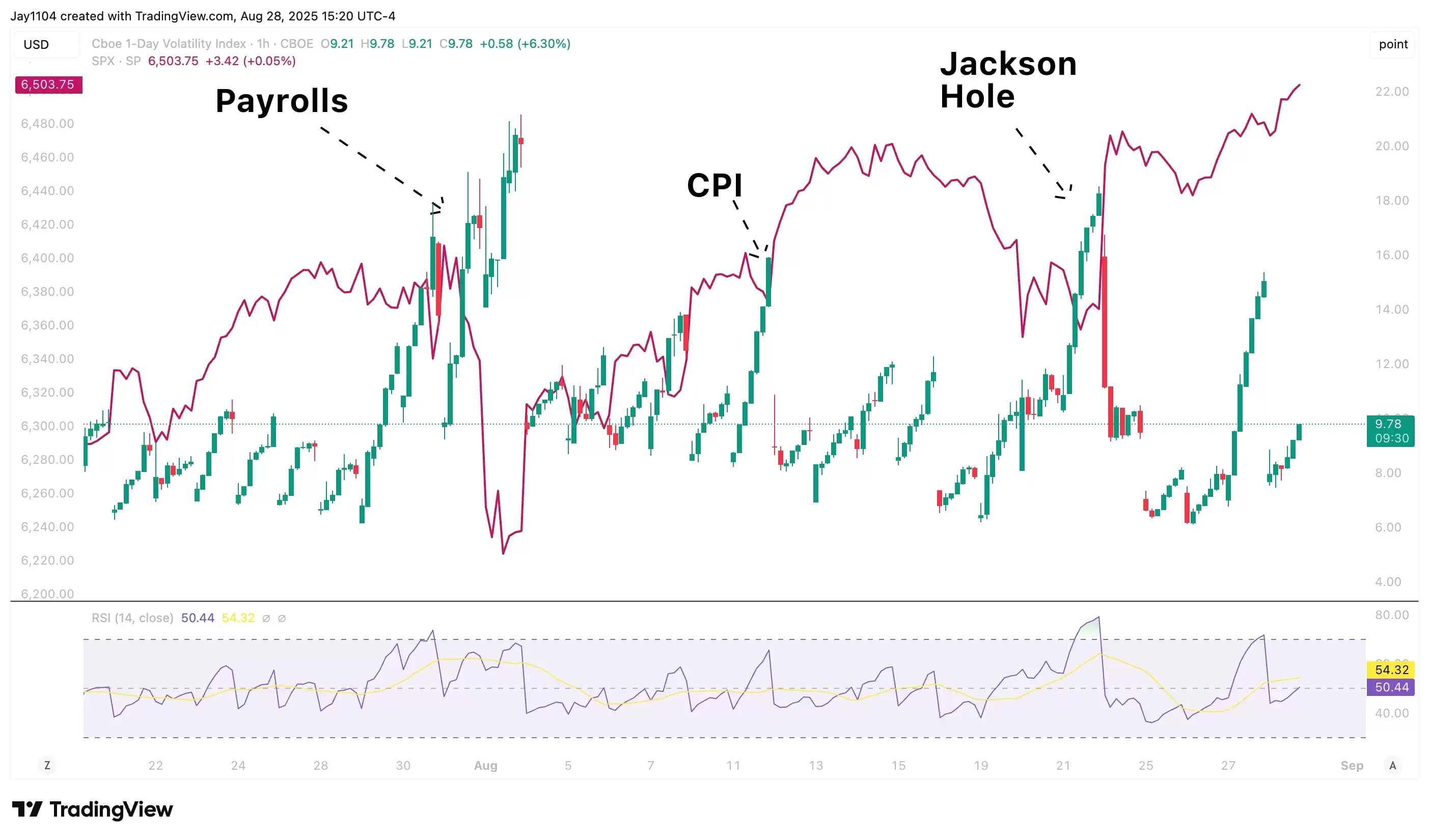

With much riding on the jobs figures, implied volatility heading into the data release could reach elevated levels. Volatility, as measured by the Vix 1-day index, has spiked ahead of recent events including the previous US jobs report, the consumer price index update around mid-August, and the gathering of central bankers at Jackson Hole. The steep rise in implied volatility before such events often leads to a sharp drop afterwards, and that implied volatility crush can spark a significant rally in the S&P 500.

The caveat is that, because the last jobs report surprised to the downside, the volatility crush was delayed until the following Monday – a risk that makes trading around these events tricky. Still, the higher implied volatility climbs in the run-up to the jobs report, the greater the chance that the stock market rallies afterwards – provided that the payroll and other data points are mostly in line with estimates.

Vix 1-Day Volatility Index, 22 July 2025 – present

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

Major upcoming economic announcements and scheduled US and UK company reports include:

Sunday 31 August

• China: August National Bureau of Statistics (NBS) manufacturing purchasing managers’ index (PMI), August NBS services and construction PMI

Monday 1 September

• China: August Caixin manufacturing PMI

• US: Labor Day (markets closed)

Tuesday 2 September

• Eurozone: August harmonised consumer price index (CPI)

• US: August Institute for Supply Management (ISM) manufacturing PMI

• Results: Nio (Q2), Oxford Nanopore Technologies (HY), Zscaler (Q4)

Wednesday 3 September

• Australia: Q2 gross domestic product (GDP)

• China: August Caixin services PMI

• US: July Job Openings and Labor Turnover Survey (JOLTS) job openings

• Results: American Eagle Outfitters (Q2), Ashtead (Q1), Campbell’s (Q4), Credo Technology (Q1), Dollar Tree (Q2), Figma (Q2), Gitlab (Q2), Hewlett Packard Enterprise (Q3), M&G (HY), Salesforce (Q2)

Thursday 4 September

• Australia: July trade balance

• Eurozone: July retail sales

• Switzerland: August CPI

• US: August ADP employment change, August ISM services PMI, weekly initial jobless claims

• Results: Braze (Q2), Broadcom (Q3), Ciena (Q3), Copart (Q4), DocuSign (Q2), Guidewire Software (Q4), Lululemon Athletica (Q2), Samsara (Q2), ServiceTitan (Q2),Toro (Q3)

Friday 5 September

• Canada: August unemployment rate, August net change in employment

• Eurozone: Q2 GDP

• UK: July retail sales

• US: August jobs report, including non-farm payrolls and average hourly earnings

• Results: ABM Industries (Q3), Ashmore (FY)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets Singapore may provide or make available research analysis or reports prepared or issued by entities within the CMC Markets group of companies, located and regulated under the laws in a foreign jurisdictions, in accordance with regulation 32C of the Financial Advisers Regulations. Where such information is issued or promulgated to a person who is not an accredited investor, expert investor or institutional investor, CMC Markets Singapore accepts legal responsibility for the contents of the analysis or report, to the extent required by law. Recipients of such information who are resident in Singapore may contact CMC Markets Singapore on 1800 559 6000 for any matters arising from or in connection with the information.