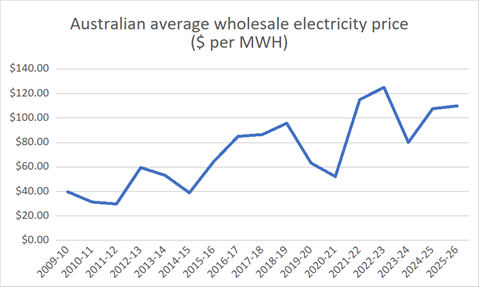

Average electricity wholesale prices rose from less than $40 per MWh in 2009 (actually less than $30 in 2011) to their present $110.

Almost continuously over the past 20 years, governments and the political establishment generally have chanted the mantra that renewables are the cheapest form of energy and predicted the dawn of lower prices from the ‘energy transition’ away from fossil fuels.

Given the data, this is astonishing – and all the more so in view of the continued need of renewables for subsidies and evidence of low electricity prices in countries where the wind/solar penetration (and subsidy level) is low.

The increase in Australian wholesale electricity prices is only part of the story. For households, the wholesale energy component represents about a third of total costs; for industry, it is higher and up to 70 per cent in the case of smelters.

Other components include the subsidies themselves, which directly add about 8 per cent to prices as well as indirectly being responsible for all the wholesale price increase. Energy subsidies are increasingly opaque as the Albanese government is shifting its main instruments to the Capacity Investment Scheme (CIS) and the Safeguard Mechanism.

The former is for direct purchases of wind/solar/batteries and following this year’s election, its capitalisation was increased to $85 billion, which is to be spent between now and 2030. Because the government refuses to reveal the prices it pays for the power projects it selects, the subsidy equivalent is unclear but based on outcomes of the similar UK scheme, is likely to be over $7 billion a year.

For its part the Safeguard Mechanism requires the top 226 businesses to reduce their emissions by 30 per cent by 2030 or alternatively buy greenhouse credits. It costs business about $1 billion a year and although it is already causing business closures, government affiliates are preparing the ground for it to be expanded.

Transmission has traditionally comprised around 10 per cent of total costs. But this was when the cost was based on a network that shipped electricity produced in relatively compact areas, especially the Latrobe Valley, Bowen-Surat Basin in Queensland, the Sydney Basin, and Snowy. The forced replacement of concentrated forms of energy – coal, gas, and hydro – by wind and solar requires a totally different network.

Until recently, the total value of the transmission system on which costs were based was $23 billion. The renewables ‘transition’ is billed to increase that cost to $100 billion as a result of the need to gather the electricity from highly diffuse areas and send it along less intensively used transmission lines. And that $100 billion cost is likely to be a serious underestimate – VNI West, the spine linking projected renewable projects in Victoria, was first estimated to cost $3.4 billion and is now proceeding with a cost estimate of $11.4 billion.

Hence transmission costs will increase at least five-fold, an amount amplified by the additional facilitatory equipment like inverters and capacitors required by an intermittent energy-dominated grid.

The cost of distribution is also increased by the subsidies because the network is not designed for both importing electricity to users and exporting surplus electricity from rooftop facilities generated during the peak sunlight periods.

Roof-top solar accounts for 12.4 per cent of total supply, large-scale solar 7.2 per cent and wind 13.4 per cent. Roof top solar is supported by a subsidy of about 30 per cent. Grid solar and wind continue to benefit from Large-scale Generation Certificates (LGCs) though this is now, at about $12 per MWh, not as important as the CIS.

Wind in particular faces community pushback from groups that are attempting to prevent developments that impact on farmland and bring visual intrusion. One of the key initiatives of the government’s recent Productivity Roundtable was to prevent appeals to new planned renewable energy zones, an initiative which, if successful, would of course detract from improving productivity.

Battery installations are the real story of 2025. Residential battery uptake at 185,798 units installed by the end of 2024, is up from 121,551 earlier in the year. By late 2024, 28.4 per cent of new rooftop solar systems included batteries, a sharp rise from 7 per cent in 2023. In July 2025 alone, 19,592 batteries were added under the Small-scale Renewable Energy Scheme, with a total capacity of 356.6 MWh. This has been spurred by the federal battery rebate program, launched in July 2025, which offers ~30 per cent off installation costs. In addition, there are state schemes like Queensland’s Battery Booster and the ACT’s zero-interest loans.

Vast sums are also being spent on grid large-scale Battery Energy Storage Systems (BESS). Q1 2025 saw $2.4 billion invested in six projects, adding 1.5 GW/5 GWh of capacity.

Batteries offer a smoothing out the peaks and troughs of solar and wind generation and will offset daytime gluts that cause extreme price volatility with negative levels during the early afternoon.

Most Australians with their own roof can for, an outlay of under $50,000 in panels and batteries (with over $10,000 of this being a subsidy), be self-sufficient in electricity except for relatively rare occasions when there is little sun. To the household, a $40,000 outlay represents about $2,200 a year. This, at least in the unlikely event that current prices do not rise, is not much more than their present bills, though a market driven system would see much lower grid supplied electricity prices.

However, unless a very high fixed grid connection price is in place those households, as well as being directly subsidised by others, will be free-loading on the grid as a back-up. And there are limits to which a high connection cost can be set, limits that for many households are the cost of a diesel generator.

All this said, batteries, while able to even out normal daily use of sunlight, are never going to offer the insurance against windless and sunless days that a reliable grid requires. A highly diffused renewable based system would likely require a near duplication of its capacity in fast gas reserve generation as well as the massive increase in network costs.

On current policy settings a higher cost and less reliable electricity supply is assured. But the system’s collapse is not inevitable. At present, 16 per cent of electricity demand is directed to the aluminium smelters, facilities that have been made internationally uncompetitive by government energy policies. A truly cynical government would be tempted to time the closure of these facilities – inevitable under current policies – to coincide with a convenient stage in the electoral cycle as this would be followed by a collapse in the market price before the next coal station closes and the price bounces back up. Naturally such an approach would accelerate the de-industrialisation set in train by current energy strategies.

Without a rethink of market design – prioritising reliability over ideology – Australia risks a grid that’s neither cheap nor stable. Policymakers must let markets, not mandates, meet demand.

The US Republicans have now abandoned the absurdity of a low-cost renewable energy future, as have the Reform and Conservative Party Oppositions in the UK. Most of Australia’s Coalition parties’ leadership remains heavily focused opposing coal and gas. At a grassroots level, led by Matt Canavan and Barnaby Joyce, there is much opposition to a shift from coal but even the opposition to Net Zero is only tiptoeing in that direction with resolutions seeking a ‘flexible’ approach to emissions reduction.