Investors concerned about signs that the bull market is approaching unsustainable levels will soon face new worries.

According to Zhitong Finance APP, as the calendar turns to next week, U.S. stocks will enter the historically weakest month—institutional investors adjusting their positions, retail traders slowing their purchases, increased volatility, and corporate buybacks entering a silent period.

Although macro events typically have a more decisive impact on market direction, seasonal factors may amplify fluctuations triggered by economic data or monetary policy. Next month, before the highly anticipated policy decision by the Federal Reserve, investors must contend with the latest government employment report and two inflation data releases.

Although macro events typically have a more decisive impact on market direction, seasonal factors may amplify fluctuations triggered by economic data or monetary policy. Next month, before the highly anticipated policy decision by the Federal Reserve, investors must contend with the latest government employment report and two inflation data releases.

In this context, President Trump continues to criticize the independence of the central bank while calling for significant interest rate cuts.

Bullish investors face particularly precarious circumstances entering September, as the S&P 500 has surged 17% since early May. Valuations have reached 22 times expected earnings, comparable to levels at the end of the dot-com bubble. Computer-driven traders’ allocation to U.S. stocks is nearing its maximum, with strategies that disregard fundamentals and focus on trends.

Barclays strategist Emmanuel Cau and others point out that hedge funds’ equity risk exposure recently reached the 80th percentile, with positions at elevated levels.

Brandon Yarckin, Chief Operating Officer of Universa Investments, stated: “We are in a very dangerous position. Navigating this market with diversified assets such as bonds or hedge funds, rather than being fully invested in stocks, is a challenging task.”

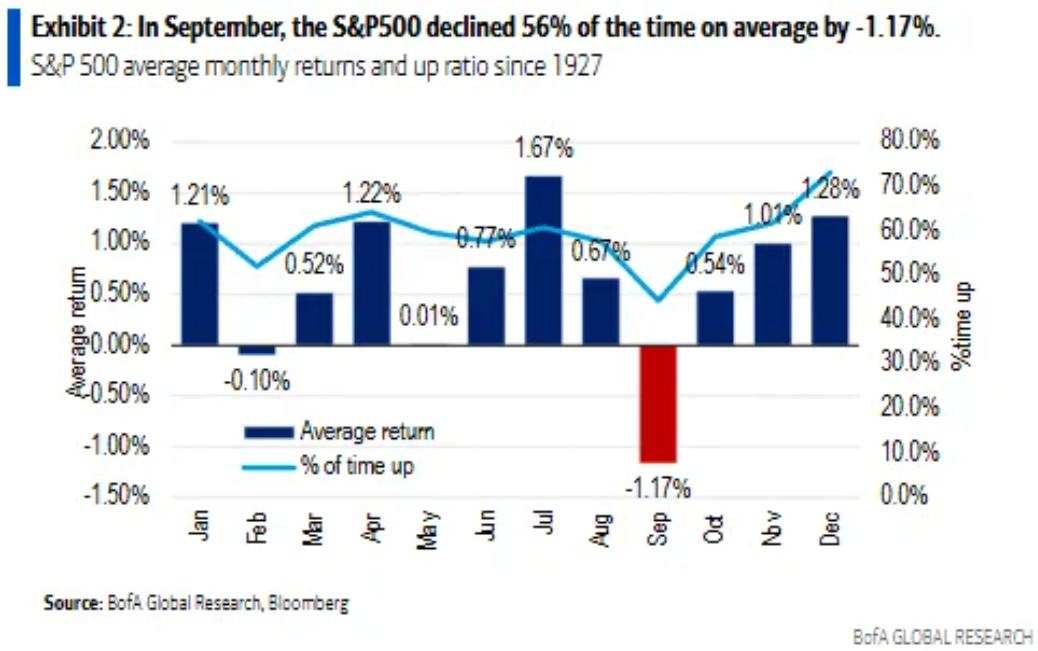

Paul Chana of Bank of America cited data dating back to 1927, indicating that the S&P 500 Index has a 56% probability of decline in September, with an average drop of 1.17%. In the first year of a presidential term, the likelihood of a decline in September rises to 58%, with an average decrease of 1.62%.

Selling pressure may stem from pension funds and mutual funds as they adjust their portfolios at the end of the quarter. The largest exchange-traded fund tracking the S&P 500 has risen nearly 5% since the end of June, while a broad bond ETF has declined by nearly 2%. This strong performance in equities may compel funds to liquidate positions later this month.

David Cohne, a mutual fund analyst at Bloomberg Industry Research, indicated that mutual funds may also rebalance before the start of the new fiscal year, selling underperforming assets or simply locking in profits. He noted that large funds tend to unwind positions slowly to avoid disrupting the market, with such actions likely commencing next month.

Retail traders may also slow their fervent stock buying pace in September. Data from Castle Securities dating back to 2017 shows that after strong activity in June and July, retail buying began to decelerate in August, while September typically marks a low point for retail participation throughout the year.

In addition, one of the largest buying groups in the market, American corporations, will be compelled to reduce purchases ahead of the third-quarter earnings reports.

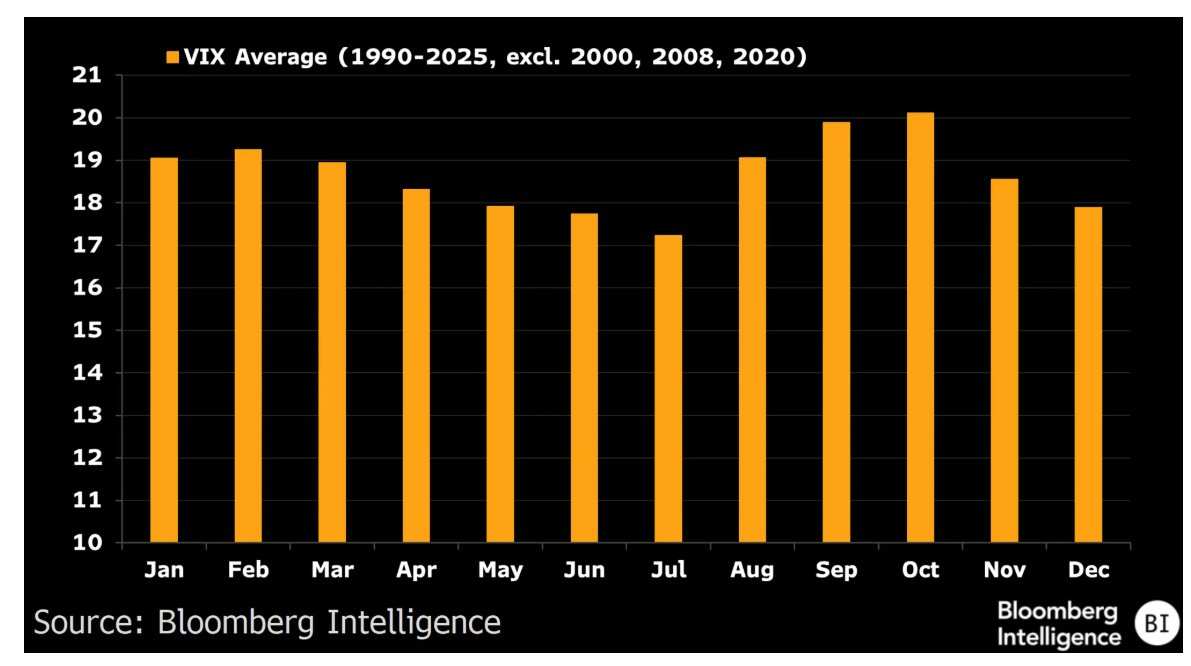

According to data from Bloomberg Industry Research dating back to the 1990s, another investor concern is that September and October are typically the two months when volatility reaches its peak, with the Cboe Volatility Index (VIX) trading around 20. The index closed at 14.43 on Thursday.

In the options market, the positioning indicates that traders have become more cautious regarding short-term trends. The cost ratio of 10-delta put options to 40-delta put options (which reflects the cost comparison for hedging against significant sell-offs versus moderate declines) has surged to its highest level this year.

Chris Murphy, co-head of derivative strategies at Susquehanna International Group, stated: “We continue to see significant hedging activity in September and October, which underscores a cautious attitude toward short-term downside risks.”