Remote Monitoring and Control System Market Size and Forecast 2025 to 2034

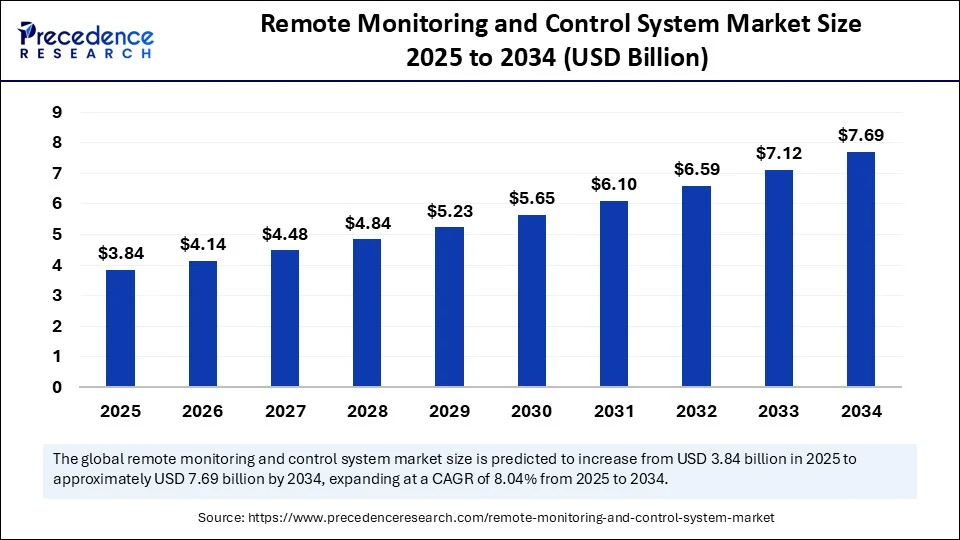

The global remote monitoring and control system market size accounted for USD 3.55 billion in 2024 and is predicted to increase from USD 3.84 billion in 2025 to approximately USD 7.69 billion by 2034, expanding at a CAGR of 8.04% from 2025 to 2034. The market growth is attributed to the increasing reliance on real-time data analytics and automation to enhance operational efficiency and enhance decision-making capabilities across various industries.

Remote Monitoring and Control System Market Key Takeaways

In terms of revenue, the global remote monitoring and control system market was valued at USD 3.55 billion in 2024.

It is projected to reach USD 7.69 billion by 2034.

The market is expected to grow at a CAGR of 8.04% from 2025 to 2034.

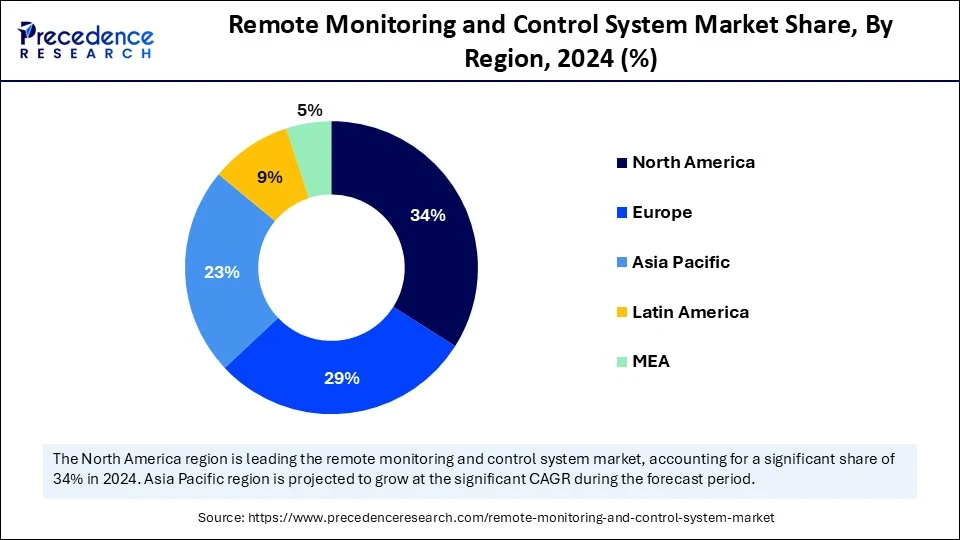

North America dominated the global market with the largest share of 34% in 2024.

Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

By component, the hardware segment held the major market share of 42% in 2024.

By component, the software segment is projected to grow at a significant CAGR between 2025 and 2034.

By application, the industrial automation segment captured the biggest market share of 27% in 2024.

By application, the smart infrastructure segment is expected to expand at a significant CAGR between 2025 and 2034.

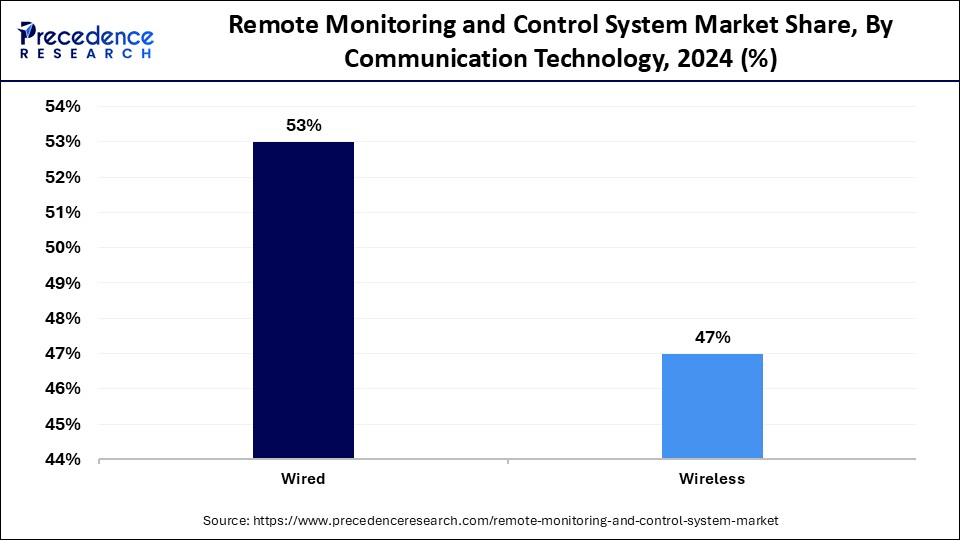

By communication technology, the wired segment contributed the highest market share of 53% in 2024.

By communication, the wireless segment is expected to grow at the fastest CAGR over the projected period.

By deployment mode, the on-premises segment generated the major market share of 60% in 2024.

By deployment mode, the cloud-based segment is expected to grow at the fastest CAGR from 2025 to 2034.

By end use industry, the energy & utilities segment accounted for significant market share 24% in 2024.

By end use industry, the healthcare segment is expected to grow at the fastest CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Remote Monitoring and Control System Market

Artificial intelligence (AI) significantly enhances the functionality of remote monitoring and control systems by making their processes faster, smarter, and more autonomous. This enables systems to identify anomalies, set performance variables at optimal levels, and implement remedial measures without human input. Furthermore, AI offers remote fault detection and minimizes downtime to ensure predictive maintenance plans. AI algorithms analyze data from the sensors of remote monitoring and control systems to predict potential failures and reduce downtime. AI also enables automated control systems, reducing the need for manual intervention.

U.S. Remote Monitoring and Control System Market Size and Growth 2025 to 2034

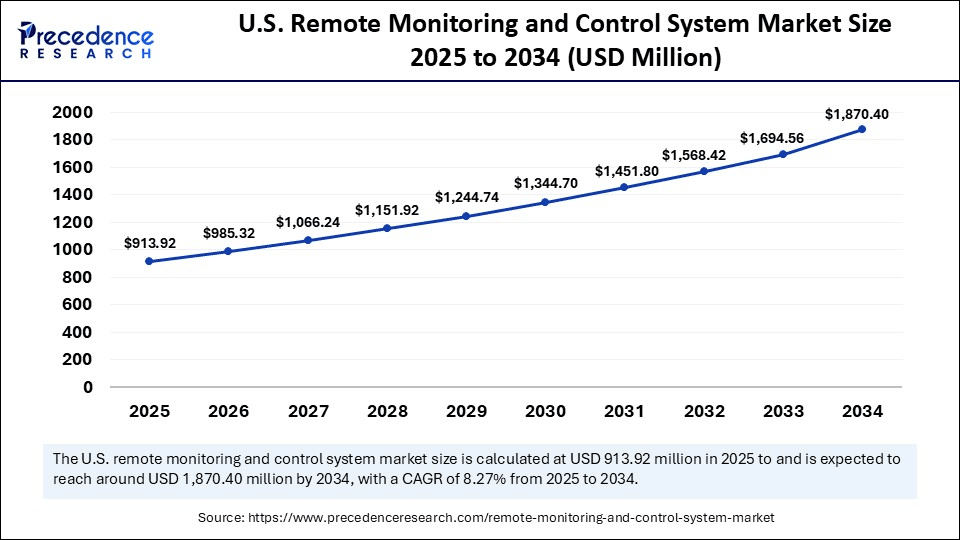

The U.S. remote monitoring and control system market size was exhibited at USD 844.90 million in 2024 and is projected to be worth around USD 1,870.40 million by 2034, growing at a CAGR of 8.27% from 2025 to 2034.

What Made North America the Dominant Region in the Global Remote Monitoring and Control System Market in 2024?

North America registered dominance in the remote monitoring and control system market, capturing the largest revenue share of 34% in 2024. This is mainly due to its robust infrastructure and high adoption of monitoring and control systems in the industrial sector. Operators at manufacturing facilities, utilities, and oil and gas operators in the U.S. and Canada were interested in fast-acting solutions to monitor their assets, to increase uptime, achieve regulatory compliance, and lower operational costs. In 2024, the U.S. Department of Energy (DOE) increased its investments in grid modernization, as well as high-level automation of substations, and encouraged the use of next-generation SCADA systems.

The region is at the forefront of technological innovations, along with the presence of leading market players. A supportive regulatory environment encourages the adoption of advanced technologies, further supporting regional market growth. In 2024, the National Institute of Standards and Technology (NIST) published cybersecurity guidelines that facilitated the security of industrial control systems, leading to a surge in on-premise and edge-based monitoring frameworks. Large organizations, such as Rockwell Automation, Emerson Electric, and Honeywell, were already expanding their industrial automation offerings by integrating predictive analytics solutions into the control platforms of their North American plants. Furthermore, state agencies and the National Renewable Energy Laboratory (NREL) collaborated to test AI-enabled remote sensing platforms in renewable projects, which further fuels the market in this region.

(Source: https://www.morganlewis.com)

What Makes Asia Pacific the Fastest-Growing Area?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, driven by rapid industrialization, infrastructure modernization, and the adoption of intelligent technologies across various sectors. The International Electrotechnical Commission (IEC) and Japan Electrical Manufacturers Association (JEMA) showed considerable growth in automation implementation in Japan, South Korea, and China in 2024. There is a rising investment in remote asset monitoring solutions by power distribution and water management facilities. Additionally, the Indian government implemented its Digital India and Smart Cities Mission, facilitating the expansion of connected control platforms in the water supply services. The rising focus on industrial automation further supports regional market growth.

Market Overview

The remote monitoring and control system market refers to the set of integrated hardware and software solutions designed to monitor, collect, and control operations, assets, and systems from remote locations. These systems facilitate real-time data acquisition, automated alerts, predictive analytics, and remote-control capabilities, enabling enhanced operational efficiency, safety, and asset management across diverse industries. Applications span industrial automation, utilities, oil & gas, water & wastewater management, smart infrastructure, healthcare, and agriculture.

The increasing interest in automation across various industries is expected to boost the adoption of remote monitoring and control systems worldwide. In FY 2024, the U.S. Department of Energy (DOE) announced major federal investments in grid modernization and industrial automation to enhance the reliability of energy and asset control. Remote monitoring technologies enable activities to be managed in a centralized manner, which is extremely important in the oil and gas sector, manufacturing, power generation, and other industries. Furthermore, the International Energy Agency (IEA) also affirmed in its 2024 Smart Grid Progress Report that more than 70 countries have increased their application of digital controls and remote diagnostics of energy distribution systems.

(Source: https://www.energy.gov)

Remote Monitoring and Control System Market Growth Factors

Accelerating Digital Twin Integration: The adoption of digital twin technologies is fueling real-time equipment modeling and remote system diagnostics across industrial environments.

Growing Emphasis on Operational Resilience: Rising demand for disaster recovery and business continuity strategies is driving interest in decentralized, remotely managed systems.

Rising Dependence on Remote Workforce Models: The expansion of off-site operations is driving the deployment of cloud-linked control and monitoring solutions.

Growing Use of AI in System Optimization: Implementation of AI for anomaly detection and autonomous response is driving smarter, more adaptive monitoring networks.

Market Scope

Report Coverage

Details

Market Size by 2034

USD 7.69 Billion

Market Size in 2025

USD 3.84 Billion

Market Size in 2024

USD 3.55 Billion

Market Growth Rate from 2025 to 2034

CAGR of 8.04%

Dominating Region

North America

Fastest Growing Region

Asia Pacific

Base Year

2024

Forecast Period

2025 to 2034

Segments Covered

Component, Application, Communication Technology, Deployment Mode, Industry End Use, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Drivers

Increasing Industrial Automation

The increasing need for efficient industrial automation is a major factor boosting the growth of the remote monitoring and control systems market. Manufacturing businesses utilize advanced control structures to streamline operations, minimize human intervention, and ensure consistent quality production. Industries such as automotive, electronics, and food processing are keen on automation to remain competitive and meet strict regulatory requirements. Hybridization of programmable logic controllers (PLCs), distributed control systems (DCS), and human-machine interfaces (HMIs) is also progressing rapidly. This forms a powerful foundation on which intelligent surveillance and automated control could be built.

In 2024, the U.S. Department of Energy (DOE) reported that a significant number of American industries focused on energy efficiency had implemented automated remote monitoring systems in their efforts to enhance efficiency and reduce emissions. The most notable increase in usage occurred in 2024, when standard protocols used in real-time industrial controls gained broader adoption overall, particularly in the European and East Asian regions of the world. Furthermore, Siemens, ABB, and Rockwell Automation have released next-generation industrial controllers to assist in faster decision-making and remote diagnostics, thus further fueling the market.

Restraint

High Initial Investment

High initial implementation costs are expected to hamper the adoption of remote monitoring and control systems. These systems are expensive to set up and require specialized hardware, licensed software, customized integration, and skilled staff for proper operation. A complicated setup in the legacy infrastructure raises labor and configuration costs. Furthermore, these systems are vulnerable to cyberattacks, posing security risks. The expense of cybersecurity protection and edge-computing infrastructure is also a deterrent, further hampering the market.

Opportunity

Rising Smart Infrastructure Projects

Rising investments in smart infrastructure projects are projected to create immense opportunities in the remote monitoring and control system market. Smart infrastructure projects require intelligent monitoring and control systems to identify potential failures and mitigate them effectively. Intelligent transportation systems and smart grids are other concepts dependent on remote sensing and control provisions.

The need to digitally transform other parts of the urban areas is one of the most prioritized by governments and other business-related sectors working in areas such as North America, Europe, and the Asia-Pacific, which directly impacts the market. In 2024, the European Commission (EC) awarded new funds as part of its Horizon Europe program to more than 90 smart city pilot projects that incorporate AI-based remote monitoring systems to control energy and water systems, thus further fuelling the market in the coming years.

(Source: https://digital-strategy.ec.europa.eu)

Component Insights

Why Did the Hardware Segment Dominate the Remote Monitoring and Control System Market in 2024?

The hardware segment dominated the market, holding a 42% share in 2024. This is mainly due to the increased demand for RTUs and PLCs as they support industrial automation. The operation of industry and utility operators equally depended on hardware elements to facilitate real-time data gathering, device-level control, and the smooth communication of distributed resources. RTUs are widely used to provide remote access to field locations, particularly in oil pipelines, power automation grids, and wastewater treatment facilities. Furthermore, companies such as Siemens, ABB, and Rockwell Automation have launched updated hardware platforms, further solidifying the segment’s leading position in the industry.

The software segment is expected to grow at the fastest CAGR in the coming years. The growth of the segment is attributed to the increasing demand for efficient data analysis solutions. Since remote monitoring and control systems generate a huge amount of data, they require reliable software to analyze and process this data, which in turn helps inform decision-making. Organizations in various sectors are investing heavily in specialized software to obtain enhanced visualization, predictive maintenance, and remote diagnostics. Furthermore, the shift from legacy interfaces to intelligent dashboards, which are user-configurable, enables their long-term involvement in software development, particularly in energy, water, and smart infrastructure applications.

Application Insights

How Does the Industrial Automation Segment Dominate the Remote Monitoring and Control System Market?

The industrial automation segment dominated the market while holding a 27% share in 2024 due to the critical role of remote monitoring and control systems in industrial automation. These systems help reduce manufacturing costs, minimize human control, and maintain a clear picture of ongoing processes. Growing attention to quality control, asset availability, and cost reduction has stimulated the implementation of integrated solutions based on PLCs, RTUs, SCADA, and edge-based analytics. According to the International Society of Automation (ISA), significant growth in investments in industrial automation solutions was observed in 2024. A large number of businesses in North America and the Asia Pacific are focusing on modernizing their existing plants and reducing labor dependency, thereby boosting demand for industrial automation solutions.

Key market players worldwide, such as Honeywell, Mitsubishi Electric, and Bosch Rexroth, have been developing high-speed control systems with in-built remote monitoring features to meet the burgeoning demand for industrial automation. Furthermore, rising government initiatives to promote industrial automation are encouraging businesses to invest in factory automation solutions, further facilitating the long-term growth of the segment.

The smart infrastructure segment is expected to grow at the fastest CAGR in the upcoming period, owing to the high rate of urbanization, increasing focus on energy efficiency, and ample investment in public utilities. Municipalities and cities are now utilizing intelligent systems to manage the flow of traffic, energy, public transportation, and their buildings in real-time. Furthermore, the integration of IoT sensors and AI analytics on a remote monitoring platform facilitates autonomous decision-making in smart buildings, further propelling the segment in the years to come. The rising smart city projects further contribute to segmental growth.

Communication Technology Insights

What Made Wired the Dominant Segment in the Remote Monitoring and Control System Market?

The wired segment dominated the remote monitoring and control system market, accounting for a 53% market share, as wired systems are more reliable and capable of transferring large amounts of data through SCADA networks and distributed control systems at faster, higher speeds, and with lower latencies. Wired systems are generally more secure than wireless systems, as they are less vulnerable to hacking. They provide a stable and reliable connection, ensuring consistent data sharing. Manufacturing and transportation businesses often prefer Ethernet-based networks to establish connectivity between sensors, PLCs, RTUs, and centralized control platforms. The increased need for faster data transmission of large amounts of data encouraged businesses to invest in wired systems, thereby bolstering the segment.

The wireless segment is expected to grow at the fastest CAGR over the forecast period. Industry operators are interested in flexible, cost-effective, and scalable means of connectivity to enable remote operations in geographically distributed and inaccessible locations. In 2024, the International Telecommunication Union (ITU) and the European Commission (EC) outlined roadmaps for the accelerated industrial implementation of 5G and NB-IoT technologies. A wireless system enhances remote monitoring capabilities, increasing asset visibility and enabling real-time control in energy grids, smart structures, and mining operations. Additionally, companies are introducing end-to-end wireless services that include secure cloud analytics with edge-based monitoring, facilitating large-scale industrial implementations. The growing digitization across industries further boosts the segment’s growth.

(Source: https://www.itu.int)

Deployment Mode Insights

Why Did the On-Premises Segment Led the Remote Monitoring and Control System Market in 2024?

The on-premises segment led the market with a 60% share in 2024. Direct control, low-latency processing of data, and data sovereignty are the key aspects of on-premises deployment offered, which is why industrial operators favored it. Industries, such as oil & gas, energy generation, and manufacturing, often prioritize on-site infrastructure due to the growing concerns over cyberattacks. On-premises deployment enables businesses to have greater control over their data, thereby reducing the risk of data breaches. As part of the compliance requirement and the ability to work 24/7 in remote or high-security locations, businesses prefer on-premises deployment of remote monitoring and control systems.

As of 2024, there is a significant dependency on on-premise systems in the U.S. critical infrastructure, as mandated by the National Institute of Standards and Technology (NIST) for cybersecurity risk management requirements. The International Electrotechnical Commission (IEC) also noted that industrial consumers in Asia and Europe continue to utilize traditional deployment models for remote monitoring and control systems. Furthermore, the advanced on-premise control system, with its launchable modules and scalable products, enables the integration of edge processing and AI-based diagnostics without requiring cloud connectivity, further fueling the segment.

The cloud-based segment is expected to grow at the fastest CAGR during the projection period due to the increasing need for flexible, scalable, and centralized operations. Cloud-based systems are more cost-effective, as they eliminate the need for additional infrastructure, resulting in reduced operational costs. Thus, businesses in various sectors are moving to cloud systems to centralize on-demand monitoring of distributed systems. Cloud-based remote management deployments are gaining traction in the smart infrastructure and renewable energy sectors. Moreover, Cisco Systems and Schneider Electric have actively responded with cloud-integrated collaborative platforms that include dynamic control capabilities, thus facilitating the growing demand for this type of advanced technology.

End Use Industry Insights

How Does the Energy & Utilities Segment Dominate the Remote Monitoring and Control System Market in 2024?

The energy & utilities segment dominated the remote monitoring and control system market, holding a 24% share in 2024. This is mainly due to the increased grid modernization. Power generation firms, transmission system operators, and water treatment plants are increasingly opting for remote control solutions to monitor their valuable assets in real-time, thereby optimizing operational efficiency.

According to the International Energy Agency (IEA), in 2024, there was a significant increase in digital automation of grid and substation monitoring tools in North America and Europe. Energy generation businesses are increasingly implementing these tools to modernize their ageing infrastructure and increase distributed renewable energy sources. Additionally, the growing need to monitor carbon neutrality requirements and meet carbon-zero targets further propels the demand for advanced remote monitoring and control systems.

The healthcare segment is expected to grow at the fastest CAGR in the coming years. The growth of the segment is attributed to the rising need for remote patient monitoring to optimize patient outcomes and satisfaction. Remote monitoring and control systems enable continuous monitoring of patients’ vital signs, allowing for early detection of potential health issues and timely intervention. The rising focus on patient-centric care approaches further contributes to segmental growth. There is a high adoption of real-time monitoring solutions in hospitals and diagnostic laboratories to monitor critical systems, supporting segmental growth.

Remote Monitoring and Control System Market Companies

ABB Ltd.

Advantech Co., Ltd.

AVEVA Group plc

Cisco Systems, Inc.

Emerson Electric Co.

Endress+Hauser Group

General Electric Company (GE Digital)

Hitachi, Ltd.

Honeywell International Inc.

Iconics, Inc.

L&T Technology Services

Mitsubishi Electric Corporation

Omron Corporation

Panasonic Corporation

Red Lion Controls (a division of Spectris plc)

Rockwell Automation Inc.

Schneider Electric SE

Siemens AG

Telit Communications PLC

Yokogawa Electric Corporation

Recent Developments

In January 2023, Fuji Electric Co., Ltd. announced the launch of the MICREX-VieW FOCUS Evolution, a new addition to its MICREX-VieW FOCUS Series of automation monitoring and control systems for plants, designed to support flexible system configurations tailored to customer challenges. (Source: https://www.fujielectric.com)

In June 2024, the Indian Army unveiled ‘Vidyut Rakshak’, an integrated generator monitoring, protection, and control system developed by the Army Design Bureau (ADB). This tech-driven innovation was launched by the Army’s Vice Chief Lt Gen Upendra Dwivedi to modernize generator management capabilities.(Source: https://economictimes.indiatimes.com)

In March 2024, global pest control manufacturer and distributor Pelsis Group introduced EverSmart Rodent, a remote monitoring product for rodent control, created by Philadelphia-based tech firm Microshare. It sends real-time alerts to phones, tablets, or computers when rodent activity is detected, enhancing operational and response efficiency. (Source: https://www.pelsis.com)

On February 15, 2024, Yokogawa Electric Corporation revealed that its subsidiary Yokogawa Solution Service Corporation completed the supply and commissioning of a remote operation and monitoring system using OpreX™ Collaborative Information Server for the Ishikari Bay New Port Offshore Wind Farm. The company will also provide ongoing maintenance services for the facility. (Source: https://www.yokogawa.com)

On February 4, 2025, Crestron Electronics, a global home automation leader, announced new product updates, features, and integrations at Integrated Systems Europe (ISE) 2025. These innovations aim to enhance smart living by offering unified, intuitive smart home experiences for homeowners. (Source: https://www.crestron.com)

Latest Announcement by Industry Leader

In April 2025, Samsung, India’s leading consumer electronics brand, has introduced its Home Appliances Remote Management (HRM) tool, a next-gen remote diagnostics and troubleshooting solution that drastically cuts service wait times while improving the overall customer experience. “Samsung Service leads the way in home appliance diagnostics by using advanced tools to detect issues with precision. Through its smart diagnostics service, customers receive proactive solutions by remotely troubleshooting and resolving problems, reducing the need for technician visits. This innovation shortens wait times, enables quicker resolutions, and delivers timely updates on product upkeep, ultimately elevating the customer experience,” said Sunil Cutinha, VP, Customer Satisfaction, Samsung India. (Source: https://news.samsung.com)

Segments Covered in the Report

By Component

Hardware

Remote Terminal Units (RTUs)

Programmable Logic Controllers (PLCs)

Sensors

Actuators

Communication Devices (Gateways, Modems)

Software

SCADA Systems

Asset Management Software

HMI (Human Machine Interface)

Analytics & Visualization Tools

Services

Installation & Integration

Maintenance & Support

Managed Services

Consulting & Training

By Application

Industrial Automation

Manufacturing

Chemical & Petrochemical

Pharmaceuticals

Utilities

Water & Wastewater

Power Generation & Distribution

Renewable Energy

Oil & Gas

Upstream Monitoring

Midstream (Pipelines, Terminals)

Downstream (Refineries)

Smart Infrastructure

Smart Buildings

Smart Cities

Healthcare

Patient Remote Monitoring

Equipment Telemetry

Agriculture

Precision Farming

Livestock Monitoring

Transportation & Logistics

Fleet Monitoring

Asset Tracking

By Communication Technology

Wired

Ethernet

Serial Communication

Wireless

Cellular (3G, 4G, 5G)

Wi-Fi

Satellite

LPWAN (LoRa, NB-IoT)

Zigbee/Bluetooth

By Deployment Mode

On-Premises

Cloud-Based

Hybrid

By Industry End Use

Manufacturing

Energy & Utilities

Oil & Gas

Healthcare

Agriculture

Transportation

Water & Wastewater

Mining

Aerospace & Defense

Others

By Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa