Companion Animal Genetics Market Summary

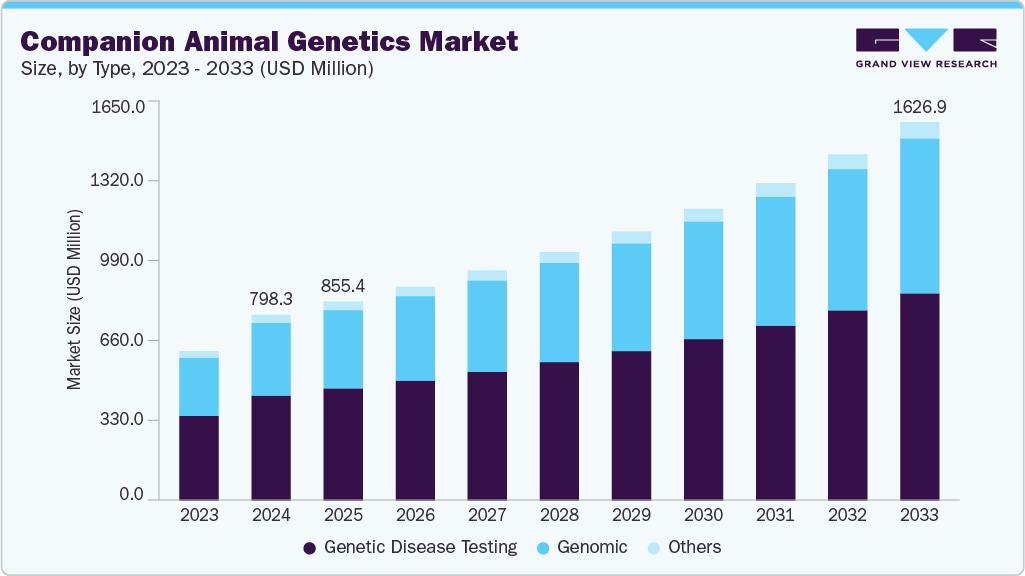

The global companion animal genetics market size was estimated at USD 798.3 million in 2024 and is projected to reach USD 1,626.9 million by 2033, growing at a CAGR of 8.37% from 2025 to 2033. The market is significantly growing, driven by rising pet humanization and preventive care trends, expansion of direct-to-consumer (DTC) models, andrising incidence of hereditary and breed-specific disorders.

Key Market Trends & Insights

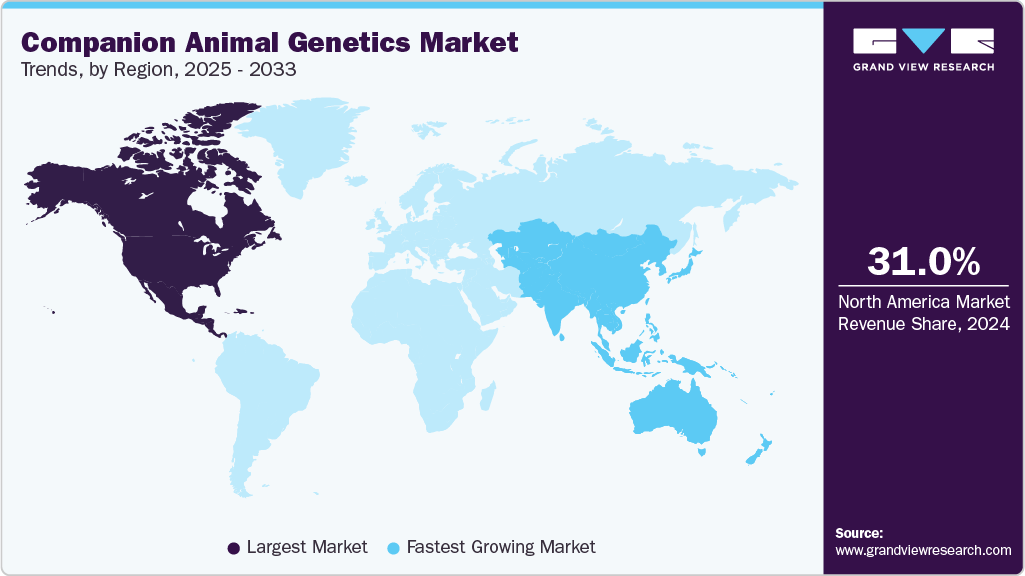

The North America companion animal genetics market held the largest revenue share of 31.03% in 2024.

By type, the genetic disease segment held the largest market share of 56.54% in 2024.

By animal, the dogs segment held the largest revenue share of 49.46% in 2024.

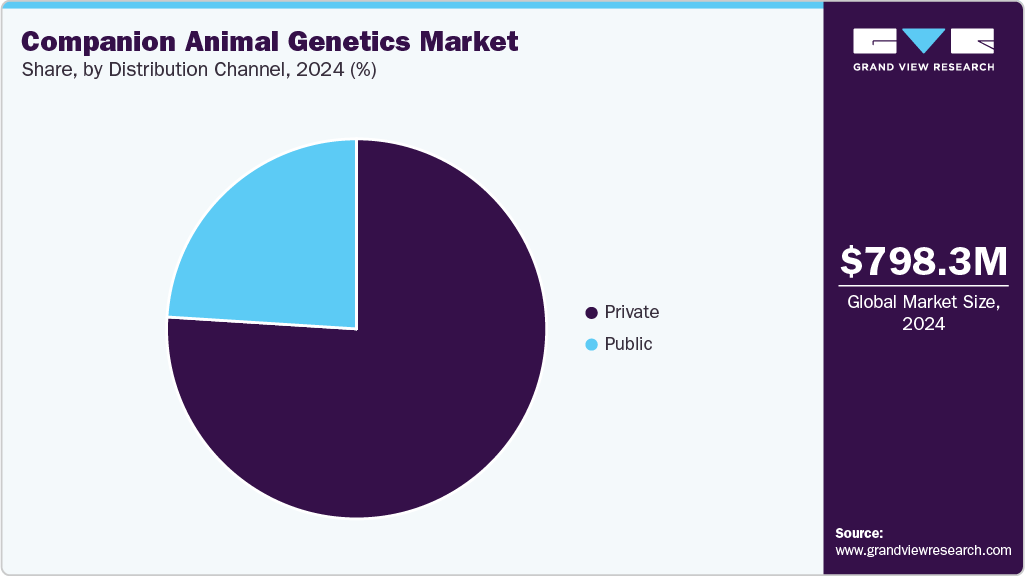

By distribution channel, the private segment held the largest market share in 2024.

Market Size & Forecast

2024 Market Size: USD 798.3 Million

2033 Projected Market Size: USD 1,626.9 Million

CAGR (2025-2033): 8.37%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

The growing prevalence of hereditary and breed-specific conditions in dogs and cats is a major driver for companion animal genetics. Popular purebred breeds often carry genetic predispositions to disorders such as hip dysplasia, cardiomyopathies, and inherited cancers. As of December 2020, the Online Mendelian Inheritance in Animals (OMIA) database documented 784 single-locus diseases or traits in dogs and 361 in cats that had been genetically explained.

Pet owners and breeders are increasingly using genetic testing to identify carriers, reduce the risk of passing on defective genes, and improve long-term health outcomes. This proactive approach not only enhances animal welfare but also reduces veterinary costs associated with treating chronic conditions. The heightened awareness of genetic disorders is fueling the adoption of companion animal genetics across global markets.

The growth of direct-to-consumer genetic testing kits has transformed the accessibility of companion animal genetics. Companies like Embark and Wisdom Panel offer easy-to-use at-home kits that provide insights into breed composition, ancestry, and health risks without requiring a veterinary visit. Rising e-commerce penetration and digital marketing have amplified consumer awareness and adoption. Subscription models and integrated wellness recommendations are further enhancing customer engagement and retention. By democratizing access to genetic information and linking it to preventive healthcare, the DTC approach significantly widens market reach and drives consistent growth within the companion animal genetics industry.

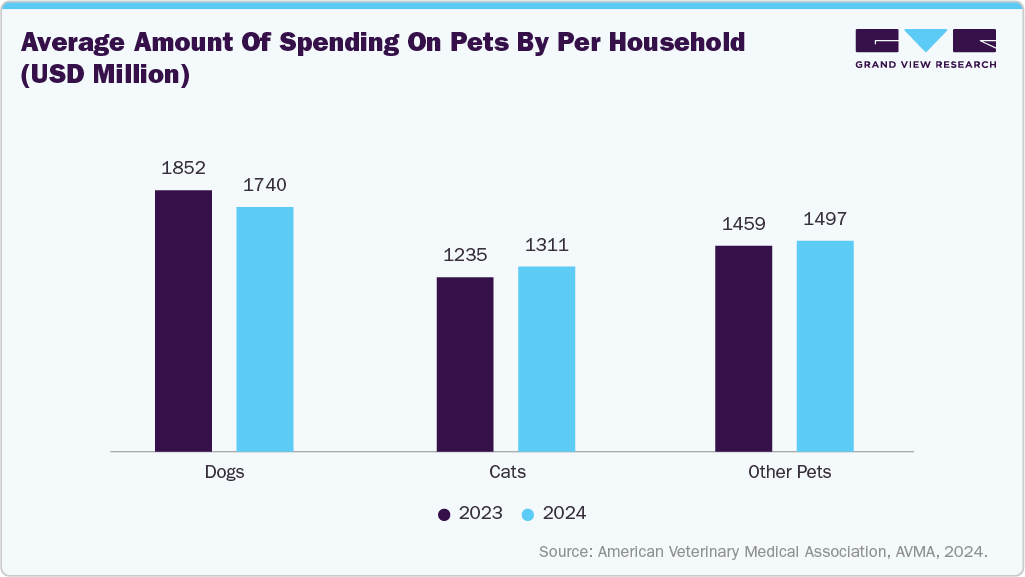

Pet owners increasingly view companion animals as family members, driving demand for personalized healthcare. This shift has boosted the adoption of genetic testing to detect hereditary conditions, predict disease risks, and ensure long-term well-being. Preventive healthcare is gaining traction, with pet parents opting for DNA tests to make informed decisions about nutrition, breeding, and lifestyle management. Moreover, increasing awareness of breed-specific disorders in dogs and cats has accelerated early adoption of genetic solutions. This trend, coupled with higher spending on veterinary services, continues to be a strong growth driver for the companion animal genetics market.

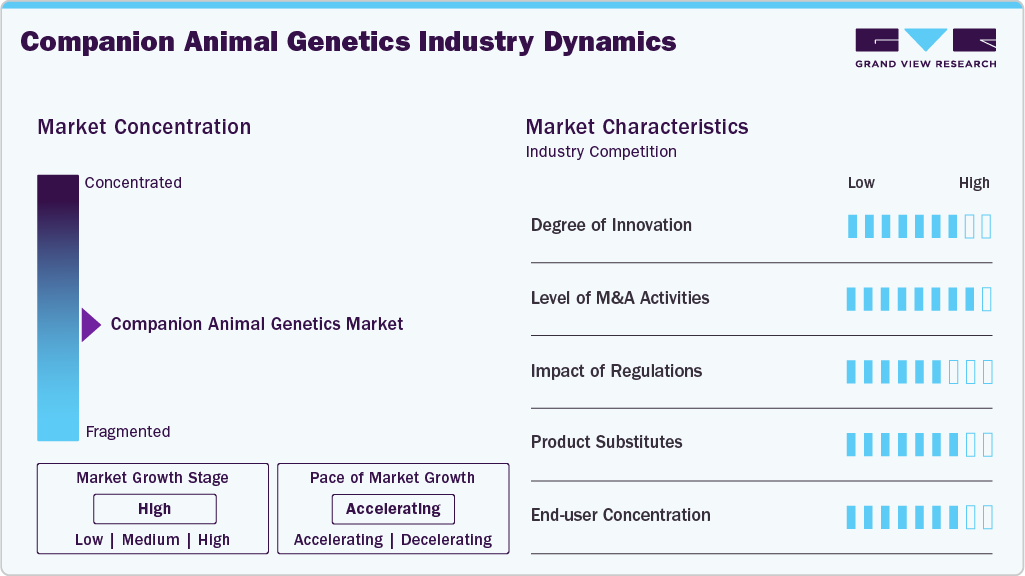

Market Concentration & Characteristics

The companion animal genetics market is highly concentrated, with a mix of global leaders and specialized niche players. Large companies such as Zoetis, Antech Diagnostics (Mars Inc.), and Embark Veterinary hold strong market positions due to broad product portfolios, advanced genomic technologies, and established distribution networks. Their dominance is reinforced by strategic partnerships with veterinary clinics and hospital chains, integrating genetic testing into standard care. However, the market also includes emerging and regional players offering breed-specific, cost-effective tests, creating competitive fragmentation. Thus, the industry concentration leans toward a few dominant players, but innovation keeps the space dynamic.

The companion animal genetics industry’s growth is driven by high innovation, with companies investing in next-generation sequencing, genomic screening panels, and AI-driven data interpretation. Innovations focus on predictive health testing, breed identification, and personalized veterinary care, creating differentiation and competitive advantage. In October 2023, Basepaws launched an extensive dog DNA test, Breed + Health, enabling early detection of over 280 genetic conditions, detailed breed insights, and trait markers, promoting proactive care and improved pet health outcomes.

M&A activity is moderate to high, acquiring genetic testing companies to strengthen portfolios. For instance, in April 2023, Mars, Incorporated announced the acquisition of Heska Corporation, strengthening Mars Petcare’s Science & Diagnostics division, expanding veterinary diagnostic offerings, accelerating innovation, and enhancing global access to advanced point-of-care solutions for pets and veterinary professionals. Consolidation aims at expanding service offerings, accelerating innovation, and gaining broader market access.

Regulation is evolving, varying across regions. While most markets treat companion animal genetic testing as a service with limited oversight, growing scrutiny on data privacy, diagnostic claims, and veterinary involvement may shape compliance frameworks and slow market entry.

Substitution risk is low to moderate. While traditional veterinary diagnostics (e.g., imaging, blood tests) can detect diseases, they lack predictive and hereditary insights. Owners increasingly value genetic testing for early risk detection and personalized pet healthcare.

End users include veterinary hospitals, clinics, and direct-to-consumer (D2C) pet owners. While veterinary clinics increasingly integrate testing, D2C kits drive market democratization. Concentration remains fragmented, with no single end-user segment overwhelmingly dominant, ensuring balanced demand.

Animal Insights

Dogs represented the largest segment in the companion animal genetics market with a revenue share of 49.46% in 2024, driven by their high global adoption rates and the growing demand for advanced genetic testing. Pet owners increasingly seek insights into breed identification, inherited disorders, and predispositions to chronic diseases, fueling the adoption of DNA-based services. Veterinary practices and genetic testing companies offer tailored solutions that improve healthcare outcomes, breeding decisions, and personalized nutrition for dogs. In March 2023,Mars Petcare, in partnership with the Broad Institute, is sequencing 20,000 dog and cat genomes through its BIOBANK initiative, creating an open-access database to advance individualized pet healthcare and scientific breakthroughs. The segment’s dominance is further supported by rising awareness, strong emotional attachment to pets, and growing expenditure on canine health.

The cats segment is expected to grow the fastest over the forecast period, driven by rising pet ownership, increasing awareness of feline health, and technological advancements. Innovations like Neogen’s My CatScan 2.0, launched in June 2023, covering 120+ genetic conditions through a simple cheek swab, are revolutionizing feline healthcare. Cat owners and breeders increasingly seek insights into hereditary diseases, traits, and overall well-being, fueling demand for genetic testing. With greater focus on preventive care, early disease detection, and personalized healthcare solutions, cats are emerging as a key growth driver within the global companion animal genetics industry.

Type Insights

Genetic disease testing is among the largest segments in the companion animal genetics industry, with a revenue share of 56.54% in 2024, driven by rising demand for early disease detection and preventive healthcare. Pet owners, breeders, and veterinarians increasingly rely on advanced DNA tests to identify hereditary disorders, improve breeding practices, and ensure healthier pets. Expanding availability of affordable, non-invasive testing methods, such as cheek swabs, has further accelerated adoption. With growing awareness of genetic predispositions in dogs and cats, this segment continues to dominate the market, offering critical insights that enhance animal welfare and long-term health outcomes.

Genomics, encompassing breed identification, parentage testing, genomic screening, health risk profiling, and trait/phenotype testing, is the fastest-growing segment in the market over the forecast period. Rising pet ownership, demand for precision healthcare, and growing interest in genetic insights to manage hereditary diseases are driving adoption. Pet owners and veterinarians increasingly rely on genomic tools to ensure accurate breed identification, assess predisposition to conditions, and personalize care. Advances in sequencing technology and wider affordability are accelerating growth, positioning genomics as a transformative force in advancing companion animal health and welfare worldwide.

Distribution Channel Insights

The private segment stands as both the largest and fastest-growing category in the companion animal genetics market, driven by rising consumer awareness and increasing demand for personalized pet care. Pet owners are showing greater willingness to invest in advanced genetic testing services to ensure the health, longevity, and well-being of their dogs and cats. Collaborations are becoming a defining feature of the market, driving innovation, accessibility, and global reach. In May 2025, PooPrints partnered with Ancestry to integrate dog DNA testing into its waste management program, enabling multifamily residents to access detailed breed and health insights through a seamless cheek swab and online process.

Companies catering directly to pet parents offer easy-to-use kits, such as cheek swabs, enabling convenient and affordable access to breed identification, ancestry, trait analysis, and disease screening. This direct-to-consumer model is expanding rapidly, supported by online platforms and e-commerce, which enhance accessibility and awareness. Growing pet humanization trends, coupled with the willingness of owners to pay for preventive healthcare, are further accelerating this segment’s dominance. Additionally, private players are at the forefront of innovation, frequently updating their offerings with more comprehensive tests, fueling both market expansion and leadership of the private segment in companion animal genetics.

Regional Insights

The North America companion animal genetics market held the largest revenue share of 31.03% in 2024. The market is competitive, with its growth driven by rising pet humanization, demand for preventive care, and advances in genomic technologies. Some of the players, such as Zoetis, Embark Veterinary, and Mars’ Antech Diagnostics, lead with broad portfolios and D2C offerings. Innovations in next-generation sequencing, breed-specific disease panels, and clinic-integrated testing strengthen market growth and accessibility.

U.S. Companion Animal Genetics Market Trends

The U.S. companion animal genetics industry is dominating, fueled by increasing pet ownership, awareness of hereditary diseases, and demand for personalized veterinary care. In August 2023, Neogen launched over 100 new canine genetic tests via Paw Print Genetics and Canine HealthCheck, enhancing disease detection, trait analysis, and coat color insights, empowering veterinarians, breeders, and pet owners with informed health decisions. Ongoing innovations in breed identification, disease risk detection, and preventive health strategies drive strong market competitiveness.

Europe Companion Animal Genetics Market Trends

Europe’s companion animal genetics industry is expanding, fueled by rising pet healthcare awareness, preventive diagnostics, and demand for breed-specific testing. Leading players such as Neogen, Zoetis, and Basepaws are advancing innovative genomic screening technologies. In February 2025, Ceva Animal Health launched Biogenovac, a genomics research laboratory in France, strengthening its One Health strategy. The facility focuses on creating advanced vaccine solutions to tackle emerging animal diseases and adapt to shifting viral challenges.

The UK companion animal genetics market is expanding, driven by rising demand for preventive healthcare, pet wellness awareness, and breed-specific diagnostics. Key players like Neogen, Zoetis, and Embark are advancing with innovative genetic screening solutions, partnerships with veterinary practices, and technological advancements that enhance early disease detection and personalized treatment planning.

Asia Pacific Companion Animal Genetics Market Trends

The Asia Pacific companion animal genetics industry is expected to grow the fastest over the forecast period, fueled by rising pet ownership, increasing awareness of preventive care, and growing veterinary infrastructure. Key players like Zoetis, Neogen, and Embark are expanding through partnerships, localized services, and advanced genetic testing solutions, driving the adoption of breed identification, health risk screening, and personalized pet healthcare.

India’s companion animal genetics market is emerging, driven by rising pet adoption, growing awareness of genetic diseases, and increasing demand for preventive veterinary care. Companies such as Neogen, Zoetis, and Embark are introducing advanced DNA testing and breed-specific health screening solutions, fostering personalized care, and strengthening veterinary support across urban markets.

Latin America Companion Animal Genetics Market Trends

The Latin America companion animal genetics industry is expanding, fueled by increasing pet ownership, rising awareness of hereditary conditions, and demand for preventive care. Companies like Neogen, Zoetis, and Basepaws are advancing DNA testing solutions, while local collaborations strengthen breed-specific diagnostics and genetic screening adoption, enhancing veterinary care across the region.

The Brazil companion animal genetics market is witnessing strong growth, driven by rising pet ownership, demand for breed identification, and preventive healthcare. Key players such as Neogen, Zoetis, and Embark Veterinary are expanding DNA testing solutions. Advancements in genomic screening and collaborations with veterinary practices are enhancing early disease detection, supporting personalized treatment, and strengthening Brazil’s role in Latin America’s animal genetics landscape.

Middle East & Africa Companion Animal Genetics Market Trends

The Middle East companion animal genetics industry is expanding, fueled by growing pet adoption, rising awareness of hereditary diseases, and increasing demand for preventive veterinary care. Some of the players like Zoetis, Neogen, and Mars-owned Antech are entering the region with advanced DNA testing and diagnostic solutions. Innovations in breed-specific testing and partnerships with veterinary clinics are enhancing precision healthcare and strengthening market presence.

South Africa’s companion animal genetics market is gradually advancing, driven by rising urban pet ownership, increasing awareness of hereditary disorders, and demand for early disease detection. In December 2022, Prenetics launched CirclePaw, an advanced canine DNA test delivering 200+ insights into breed, health risks, and traits, enabling proactive care, early disease detection, and personalized pet health management for happier, healthier dogs.

The companion animal genetics market in Saudi Arabia is emerging, fueled by rising pet ownership, growing awareness of preventive healthcare, and demand for advanced diagnostics. Some of the players, like Neogen, Zoetis, and local veterinary labs, are expanding their presence. Advancements in genetic screening, breed-specific testing, and disease risk detection are strengthening the market, supported by increasing investments in veterinary infrastructure and pet healthcare innovation.

Key Companion Animal Genetics Company Insights

The market is dominated by key players such as Mars Petcare, Neogen Corporation, Embark Veterinary, and Ancestry. These companies hold significant market share through advanced genetic testing solutions, collaborations, and expanding product portfolios, driving innovation, accessibility, and growth across global pet health and diagnostics.

Key Companion Animal Genetics Companies:

The following are the leading companies in the companion animal genetics market. These companies collectively hold the largest market share and dictate industry trends.

Neogen Corporation

Antech Diagnostics, Inc.

Embark Veterinary, Inc.

Basepaws

UC Davis Veterinary Genetics Laboratory (VGL)

ZOOGEN

Orivet Genetic Pet Care

Animal Genetics Inc.

Generatio GmbH

Zoetis Services LLC

Recent Developments

In August 2025, POP launched a 90-day canine health study with Innovative Pet Lab and Embark Veterinary, offering nutrition, biomarker, and DNA insights. Participants get $600 in tools and personalized reports to advance preventative pet wellness.

In June 2025, Wisdom Panel scientists identified a SLAMF1 gene variant strongly linked to canine atopic dermatitis in French Bulldogs and Boxers, advancing breeding insights and enabling more targeted solutions for skin health management.

In February 2025, Ceva Animal Health inaugurated Biogenovac, a genomics research laboratory in France, equipped with advanced sequencing and bioinformatics tools to design rapid, next-generation vaccines against emerging infectious diseases, reinforcing its One Health commitment.

Companion Animal Genetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 855.4 million

Revenue forecast in 2033

USD 1,626.9 million

Growth rate

CAGR of 8.37% from 2025 to 2033

Historical period

2021 – 2023

Actual data

2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, type, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Neogen Corporation; Antech Diagnostics, Inc.; Generatio GmbH; Zoetis Services LLC; Embark Veterinary, Inc.; Basepaws; UC Davis Veterinary Genetics Laboratory (VGL); Animal Genetics, Inc.;ZOOGEN; Orivet Genetic Pet Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Genetics Market Report Segmentation

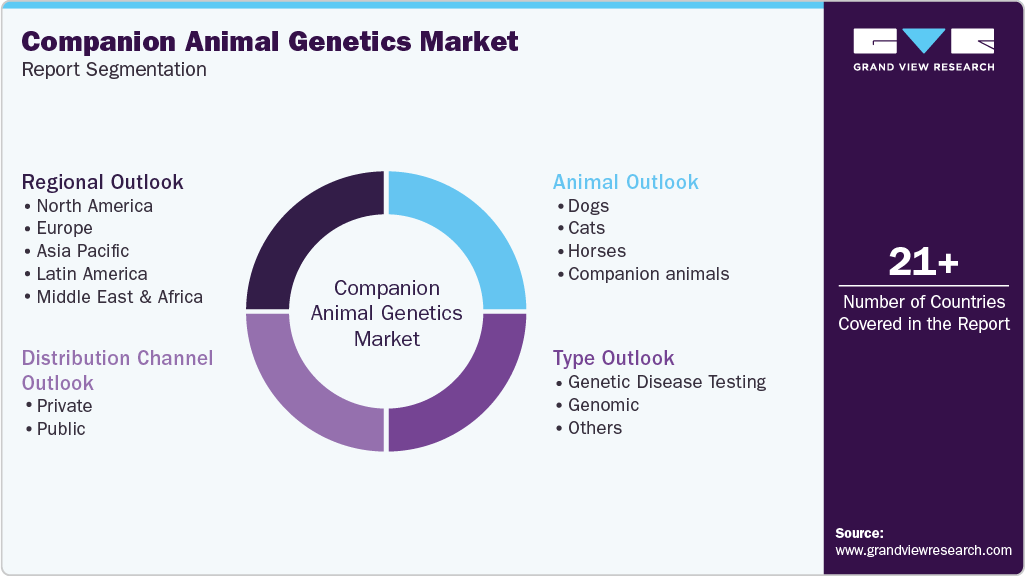

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the companion animal genetics market report based on animal, type, distribution channel, and region:

Animal Outlook (Revenue, USD Million, 2021 – 2033)

Dogs

Cats

Horses

Companion animals

Type Outlook (Revenue, USD Million, 2021 – 2033)

Genetic Disease Testing

Genomic

Others

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021- 2033)