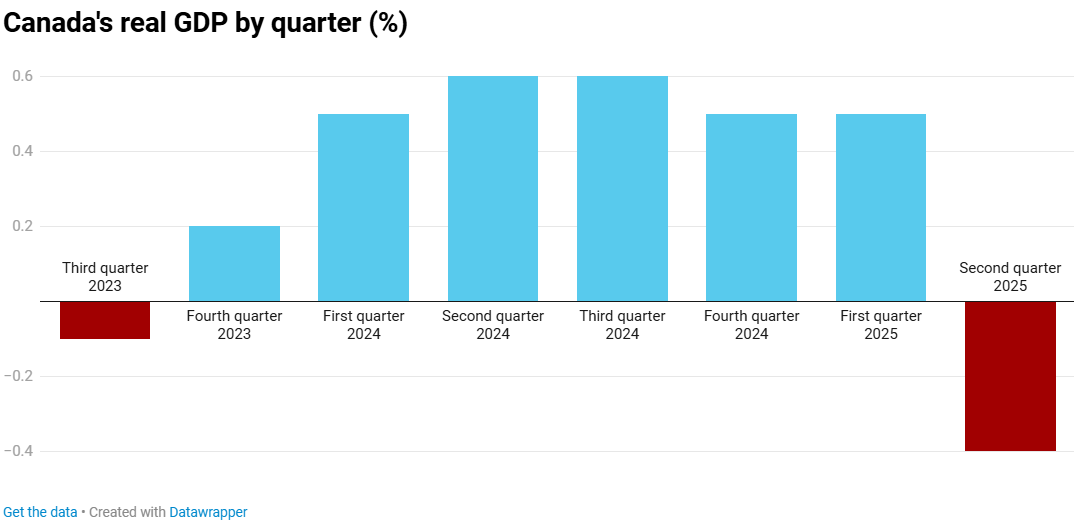

With the release of Canada’s second quarter GDP figures, it was revealed that the economy had fallen back into contraction in headline terms for the first time since the third quarter of 2023, with quarterly GDP falling by 0.5%.

In the words of Pedro Antunes, Conference Board of Canada’s Chief Economist:

Canada is in “recession territory”.

“Business confidence is down at rock-bottom level still, and this just doesn’t bode well for that private investment in that productive capacity,”

Advertisement

“That’s so important in terms of driving our future production, our future employment, our future growth. And of course, the same thing is happening with consumers.” Antunes said

Examining the chart of Canadian quarterly GDP growth, it’s clear that the economy is struggling under the weight of a dramatic slowdown in population growth and the impact of President Trump’s tariffs, whether it be the direct effects or the uncertainty they have generated within the Canadian economy.

Source: CTV News

Advertisement

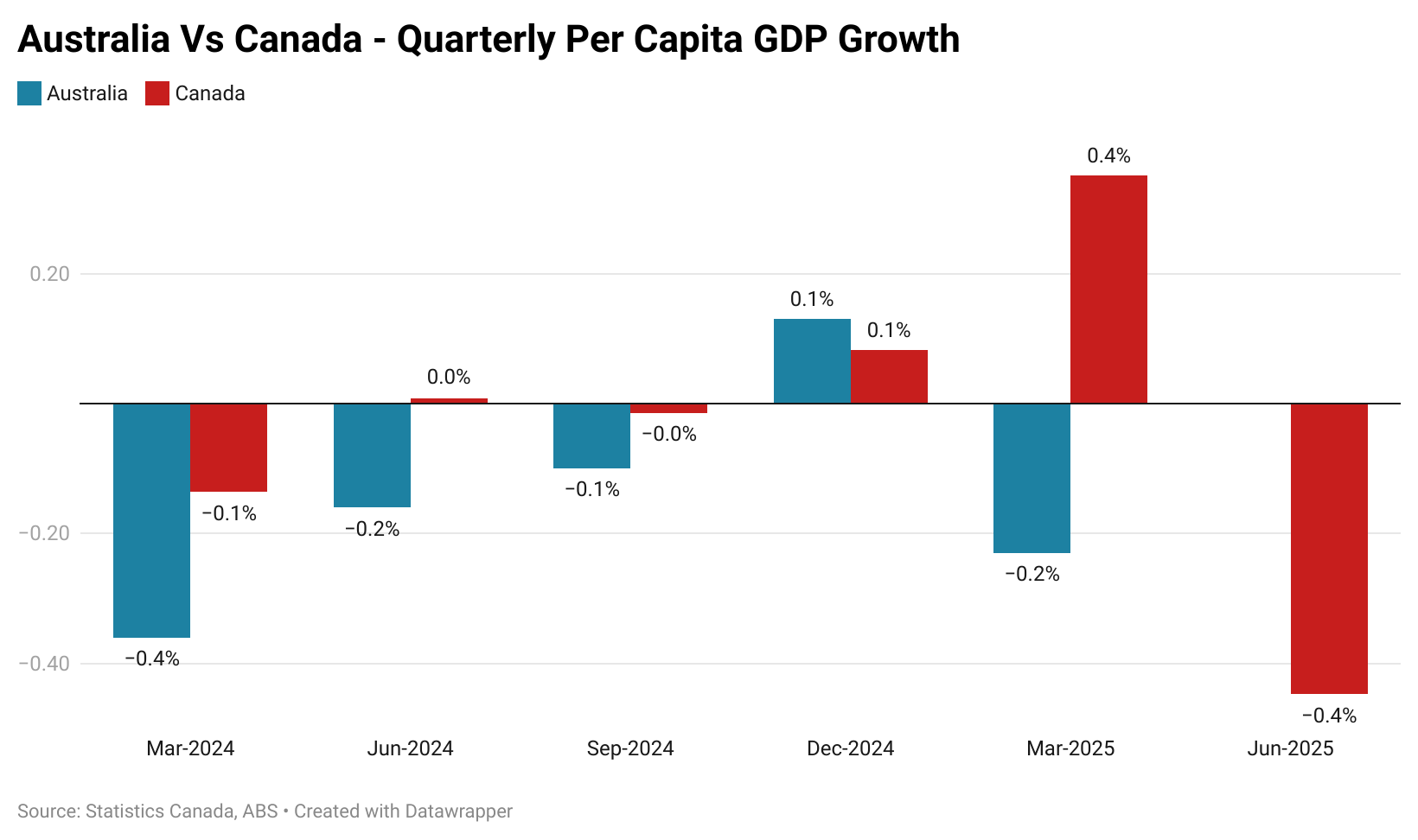

Yet despite the challenges that the Canadian economy faces, on a per capita basis over the last 6 months’ worth of available data, it’s actually performing slightly better than Australia’s.

Over the last two quarters of data, Canada’s GDP per capita has been flat, while Australia’s has contracted.

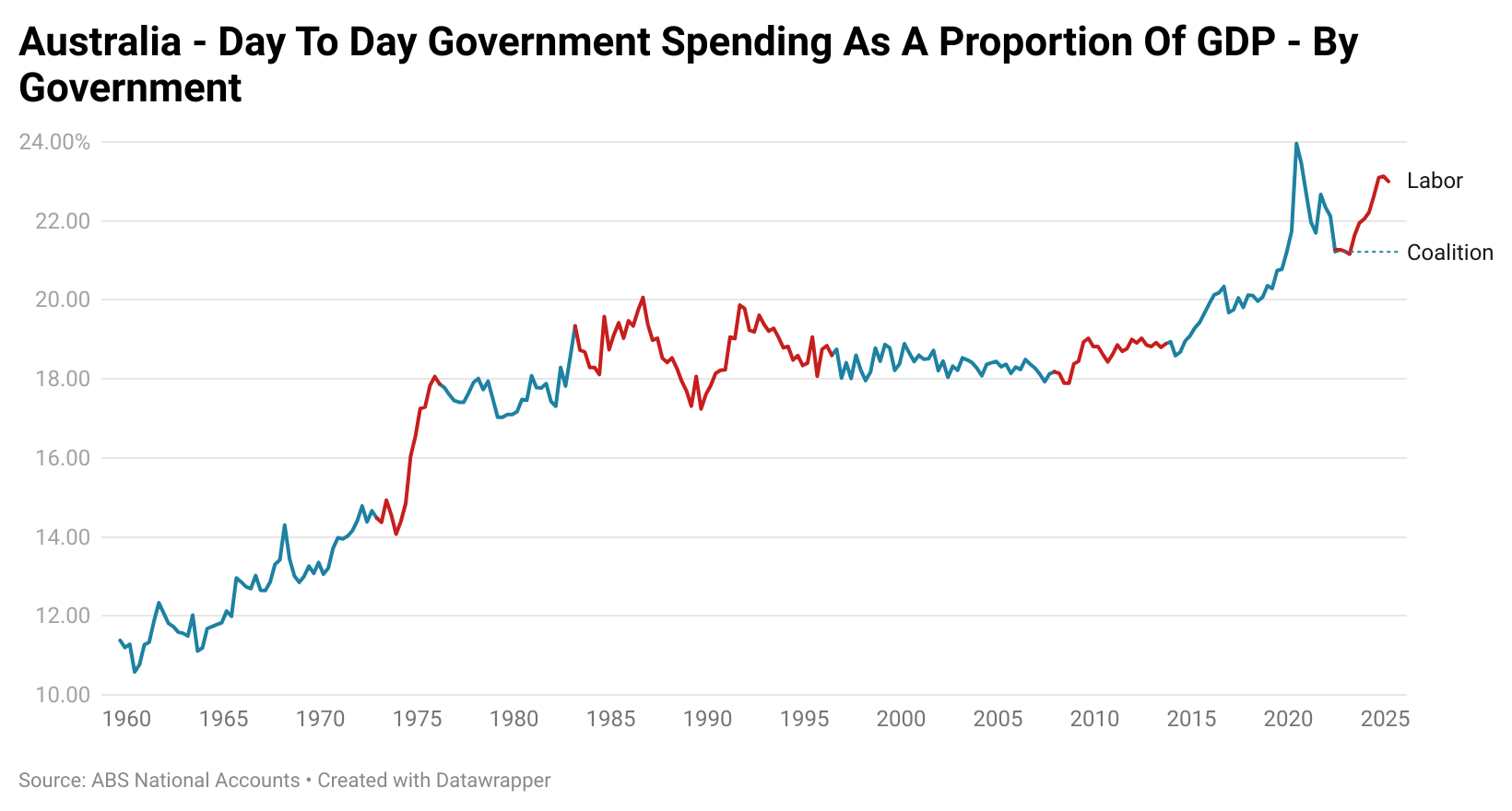

This comes in spite of the fact that the Australian economy has had significantly more backing from the government than its Canadian counterpart.

Advertisement

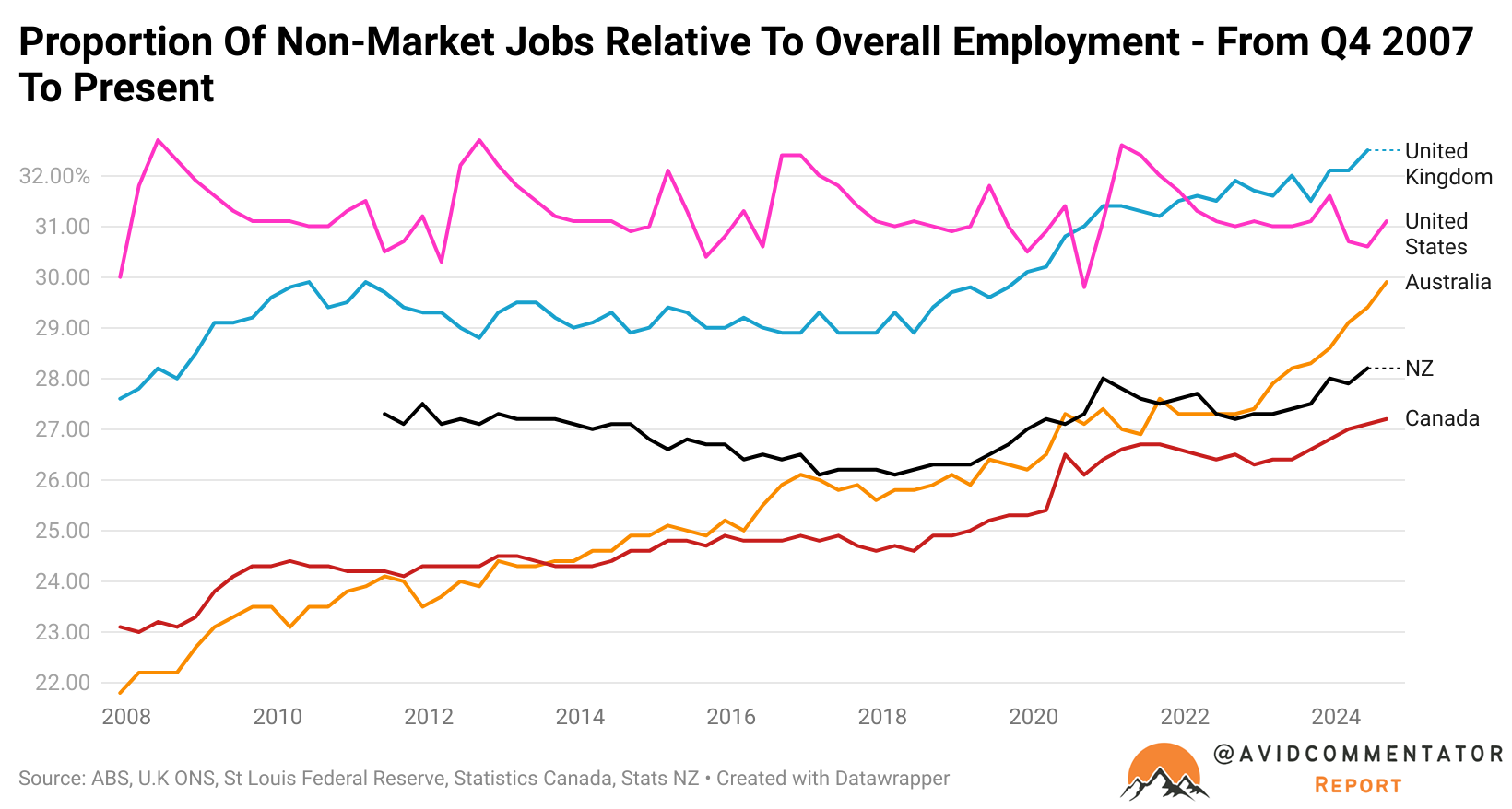

Late last year I put together an analysis of Anglosphere nations by the proportion of the overall labour force employed in non-market roles.

The ABS defines non-market jobs as those in Public administration and safety, Education, Healthcare and social assistance.

As you can see from the chart below, since the pandemic-driven peak in n0n-market jobs, the proportion of Canadians in this type of employment has risen significantly, but it’s far from the meteoric rise seen in Australia in recent years.

Advertisement

Meanwhile, the years since the conclusion of the positive impulse from the mining boom have seen the size of government as a proportion of economic activity continue to grow larger and larger.

This has played a large and heavily underappreciated role in Australia avoiding a more serious economic downside to the roll-off of pandemic-era stimulus and the tightening of monetary policy by the Reserve Bank.

Advertisement

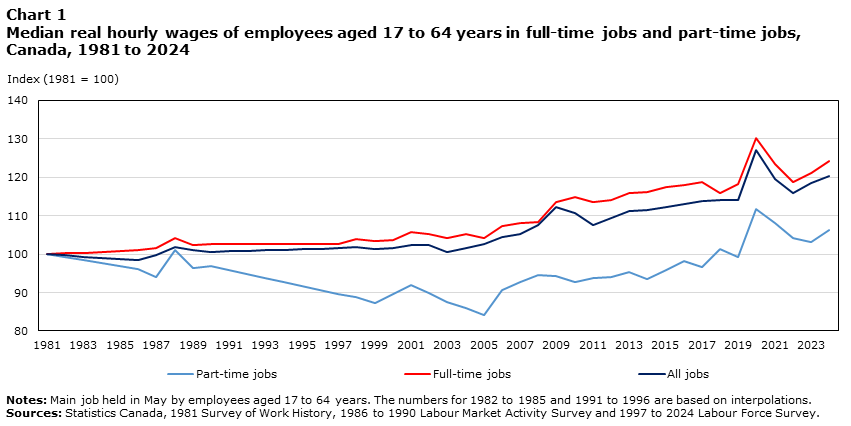

In terms of wages, data from Statistics Canada reveals that in inflation-adjusted terms, wages are significantly higher than they were prior to the pandemic, whether it be for full-time workers, part-time workers, or overall.

This is in stark contrast to Australia, where real wages are not projected to recover to pre-pandemic levels until the early to mid-2030s.

Advertisement

Despite the Albanese government and various states playing a major role in supporting the economy through growing the size of government and expanding taxpayer-funded employment, Canada is still edging out the narrowest of leads with its economy in per capita terms, despite the headwinds that it faces, at least for now.

For Canada, it was always going to get challenging as net migration was reduced to significantly below pre-Covid levels.

Advertisement

For Australia, it appears that the progress in cutting migration back to pre-Covid levels may have stalled out above pre-Covid record highs, but our challenge will come nonetheless in the form of the government pulling back on taxpayer-funded employment growth, at least for as long as they believe the economy and the electorate can weather it.