Short-term Bitcoin investors have generated a rare signal that previously indicated a local market bottom. This was reported by Frank Fetter, an analyst at Vibes Capital Management.

Officially got the Oversold print on the short-term holder MVRV bollinger bands. Last three instances of this:

1. Yen Carry Unwind — $49k

2. Tariff Tantrum — $74k

3. Today — $108k $BTC pic.twitter.com/AqcYXLwbzw

— Frank (@FrankAFetter) September 1, 2025

The purchase price of coins held by short-term holders has equaled the current market price of the leading cryptocurrency. This level often acts as support during corrections in a bull market, but its loss could lead to a prolonged decline.

The MVRV indicator for this category of holders has reached a breakeven point. Its deviation from the lower Bollinger band is extremely rare. Over the past year, this has occurred only twice:

in August 2024 amid the unwinding of the yen carry trade;

in April 2025, when digital gold fell below $75,000 due to U.S. tariffs.

Currently, a bullish divergence is forming on the BTC/USD chart on the four-hour RSI indicator. According to Fetter, this indicates a potential trend reversal.

A “Fragile” Market

On September 2, Bitcoin’s price briefly recovered to $110,000 after falling to $107,000 at the end of August. However, analysts at Glassnode noted a decline in investor interest. They stated that the market structure remains unstable.

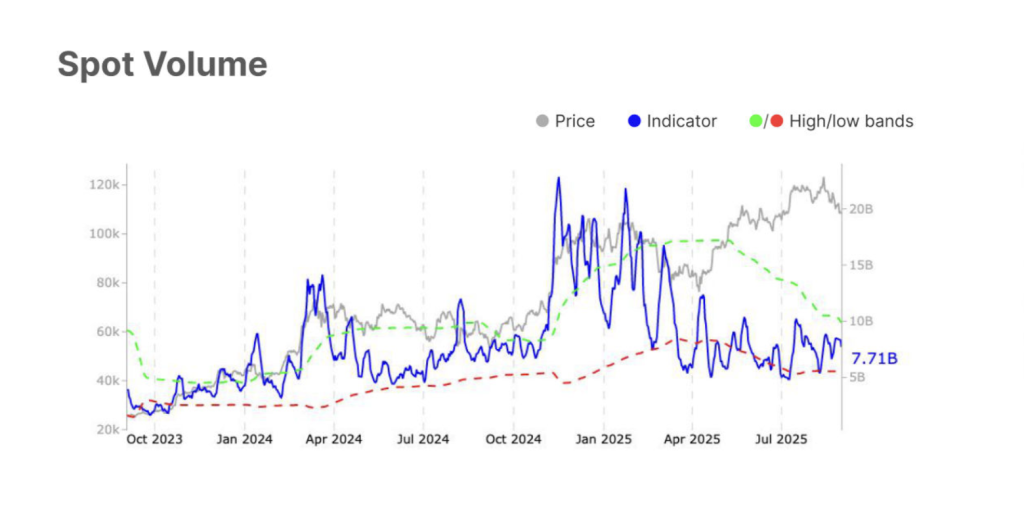

Last week, demand in the spot market for digital gold was weak. Trading volume fell by 9% — from $8.5 billion to $7.7 billion. Experts emphasized that investors and traders are losing confidence in Bitcoin’s recovery.

The CVD indicator rose slightly, indicating a decrease in sales. Nevertheless, “spot metrics indicate fragile demand,” added Glassnode.

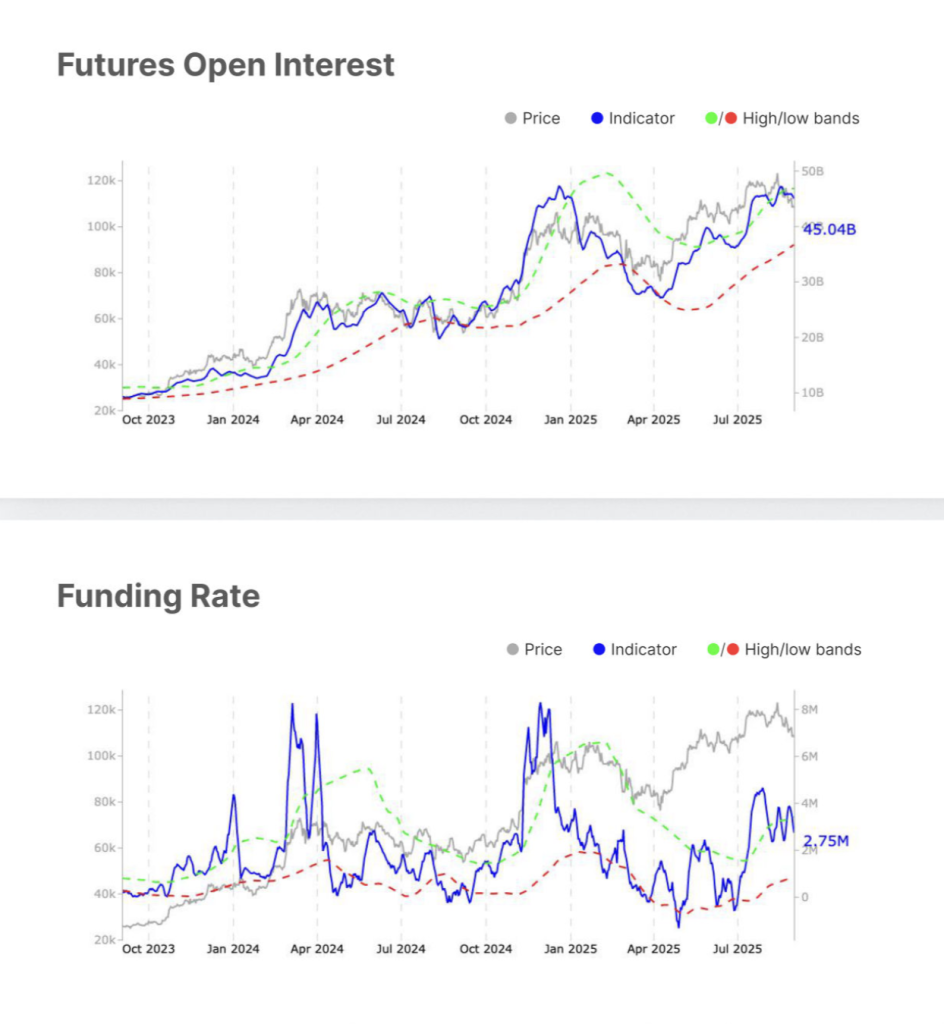

The situation in the futures market also points to player caution. Open interest decreased from $45.8 billion to $45 billion, and funding volume fell from $3.8 billion to $2.8 billion.

Key Levels to Watch

The key resistance level has become $110,500 — the upper boundary of the descending channel. Closing above this could open the path to the liquidity zone of $110,000-117,000.

The nearest support levels, according to experts, are $108,000 and $107,300.

MN Capital founder Michaël van de Poppe believes that for Bitcoin to reach a new all-time high, it must consolidate above $112,000. Otherwise, the cryptocurrency faces a pullback to $103,000.

The area remains the same for $BTC.

If we can clearly break $112K, we’ll be onto a new ATH.

Otherwise, I’d be looking at $103Kish for a great opportunity.

Interestingly enough, Gold is yet to make a new ATH.

When Bitcoin? pic.twitter.com/JDruy5ba8O

— Michaël van de Poppe (@CryptoMichNL) September 2, 2025

The liquidity map shows significant clusters of buy orders in the range of $105,500-107,000 and sell orders in the $110,000-111,000 zone. Analyst AlphaBTC suggested that the market is “hunting for money” and may first test the short area before returning to check the lows.

📈 #Bitcoin liquidity hunt 🎯

Looks like they are coming for that big cluster of shorts 110K-111k, then likely back to run the Monday low and the longs from the weekend.#Crypto #BTC pic.twitter.com/crRwauoOyq

— AlphaBTC (@mark_cullen) September 2, 2025

Earlier in September, the CEO of Bitcoin Magazine accused two whales of “stalling” Bitcoin.

Подписывайтесь на ForkLog в социальных сетях

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!