Weather: More of the same with rainfall building right across the Australian cropping belt. Some concern over BOM’s prediction of a wet harvest.

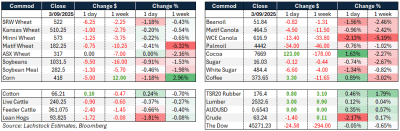

Markets: The long-debated impact of Russia returning to the export market seems to be validated. Aug Russian exports look to come in around 4 million tonnes (Mt) – still requires some heavy lifting into the northern hemisphere winter but solves some problems all the same. Australia has been one of the main benefactors, tightening old crop stocks meaningfully. Meanwhile, Chicago wheat is solving for zero.

Australian Day Ahead: Rain on the way and a softer global market will keep bids on the defensive. Canola will be have the push/pull between China import talk and lower futures.

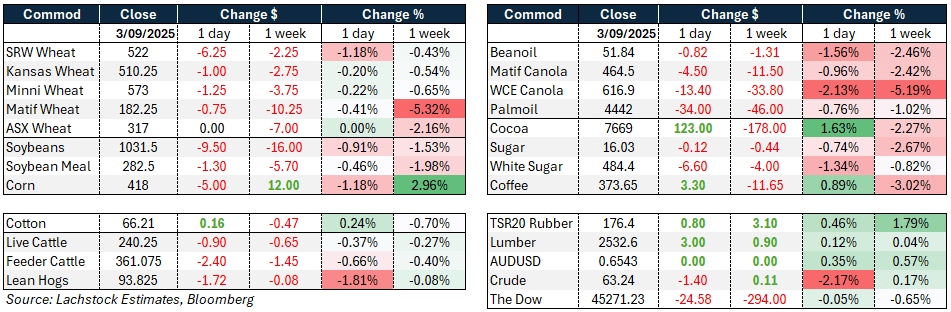

US wheat futures sank across all contracts, with spreads flat to firm and implied volatility in Chicago at 21.83 percent.

Open interest rose sharply, indicating additional short positions being added. Chicago spreads look vulnerable, and US wheat is no longer the cheapest into key destinations like Nigeria, undermining competitiveness.

Russian cash was steady at $230, while Paris Matif gained slightly.

Jordan issued a new tender for up to 120kt milling wheat, adding to international demand flow.

Overall, global production expectations remain firm, demand is uncertain, and speculative shorts are weighing on sentiment.

Chicago wheat fell further on Tuesday, down as much as 2.3pc, the steepest intraday drop since July, on improving supply prospects worldwide.

Other grains and oilseeds

Corn weakened with December futures sliding toward the US$4/bu level, reversing the recent gap-fill narrative.

Argentina remains the cheapest into Asia, with spreads against Brazil narrowing, and Ukraine expected to re-enter the mix soon.

US growers remain undersold while production debate builds amid disease concerns.

Ethanol output is forecast at 1,067k barrels with stocks at 22.4m.

Soybeans and products drifted lower, with SX off nearly 10c/bu and Oct crush narrowing slightly.

Demand worries focus squarely on China’s absence from the US market, with Brazil filling November import slots.

Production concerns persist as US crop conditions deteriorated, but Allendale’s yield estimates remain higher than some condition-based models. FC Stone updates are due shortly.

Malaysian palm oil slipped nearly 1% after a sharp rally, pressured by seasonal output gains and profit taking, though India’s purchases surged to their highest since mid-2024.

Australia is close to finalizing a framework to restart canola exports to China, offering potential relief for trade flows.

Brazilian fertilizer demand is forecast to rise steeply to 73Mt by 2036 on pastureland conversion and greater uptake by small farmers.

Farmer sentiment in the US deteriorated according to the Purdue/CME Ag Economy Barometer, with incomes expected to weaken as crop prices sit below breakeven for many operations.

Macro

US JOLTS job openings fell to 7.18 million in July, dropping the vacancies-to-unemployment ratio below 1:1 for the first time since early 2021, reinforcing a softer labour market.

Fed Governor Waller argued for imminent rate cuts to pre-empt further weakness, anticipating multiple cuts in coming months.

US Treasury yields continue to climb, with the 30-year approaching 5pc, part of a global bond sell-off driven by inflation and fiscal concerns.

Australia’s GDP rose 0.6pc q/q in Q2, boosted by stronger household consumption, evidence of a private-sector recovery that may temper the RBA’s rate cut path.

Broader geopolitical risks remain elevated, highlighted by Xi, Putin, and Kim Jong Un’s joint parade in China and Trump’s pointed response, as well as legal manouevring over US emergency tariffs.

Meanwhile, Shell scrapped a Rotterdam biofuels facility on competitiveness grounds, highlighting challenges in renewable investments.

Strong cold front is sweeping across the US Midwest and Great Lakes, dropping temperatures well below seasonal norms.

Australia

Bids in the west were steady yesterday with canola A$830 FIS Albany, wheat $348 and barley stronger +$5 to $320.

Through the east of the country new crop canola bids were around $805 track Port Kembla, with wheat $335 and barley $306.

Pulse bids have softened further this week with domestic buyers hesitant to take on position amid weak global demand. Faba bids are around $450 Geelong/Melbourne and $440 PAD, while new crop lentils are $650 delivered Vic and SA.

Australian beef exports continue to surge, with August shipments at 135,570t – the second-highest month ever and only just behind July’s record. Year-to-date exports are up 16pc at nearly 1Mt, and the trade is on track to smash through 1.5Mt in 2025 as Australia capitalises on record-low US cattle numbers, Trump tariffs sidelining Brazil, and China’s curbs on US access.